Your Home insurance quotes indiana images are available. Home insurance quotes indiana are a topic that is being searched for and liked by netizens now. You can Download the Home insurance quotes indiana files here. Download all royalty-free images.

If you’re searching for home insurance quotes indiana images information related to the home insurance quotes indiana topic, you have visit the right blog. Our website frequently provides you with hints for downloading the highest quality video and picture content, please kindly search and find more enlightening video content and graphics that fit your interests.

Home Insurance Quotes Indiana. 93 rows compare quotes from top providers and save now! In the united states, the national average cost of car insurance is $1,312 per year. Your deductible is the amount you pay for a home insurance claim before your insurer covers the remainder, up to your policy limits. It is always best to get quotes from multiple providers in order to find the lowest home insurance rates in indiana!

Home Insurance Indianapolis St Joseph Agency Home Auto From mandas-hotspot.blogspot.com

Home Insurance Indianapolis St Joseph Agency Home Auto From mandas-hotspot.blogspot.com

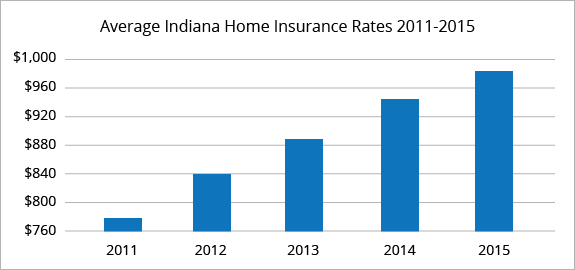

How much is home insurance in indiana? This is $94 over the average yearly indiana home insurance policy price of $955. Indiana homeowners insurance rates in december 2013 stood at an average of $820 as compared to $830 in november 2013. As an indianapolis resident, you can expect to pay about $1,300 a year for $200,000 in home insurance coverage. However, home insurance premiums are highly individualized. Indiana home insurance is 54.6% less than the u.s.

Protect your home, property and family with great coverage and policy features like guaranteed replacement cost from erie insurance.

Liberty mutual offers free quotes online. It is always best to get quotes from multiple providers in order to find the lowest home insurance rates in indiana! Your actual home insurance costs will be higher or lower. Indiana home insurance is 54.6% less than the u.s. Indianapolis homeowners insurance rates average out at about $1,049 a year. One can buy or renew an existing policy through our viable platform.

Subject to terms, conditions and availability. Home insurance quotes in indiana below are home insurance providers that offer home insurance quotes in indiana. Average cost of homeowners insurance in indiana. Average cost of indiana home insurance quotes. Associated insurance group of indiana provides custom tailored home insurance policies to fit the needs of every homeowner in indiana.

It also covers any liability claims that you may face. Cincinnati insurance provides the most affordable home insurance in indiana, at only $932 annually. Simply click on the get quote buttons below to get a home insurance rate quote from each of the providers listed. The average cost of home insurance in indiana is $1,150 per year for $250,000 in dwelling coverage, which is well below the national average of $1,312 per year. This compares favorably to the state�s average cost of $1,395, providing a $463 price break on average policy costs statewide.

Source: dwinsuranceqswa.blogspot.com

One can buy or renew an existing policy through our viable platform. Indiana homeowners pay an average $1,587 per year, or $132 a month, for home insurance. The average cost of home insurance in indiana is $1,150 per year for $250,000 in dwelling coverage, which is well below the national average of $1,312 per year. Associated insurance group of indiana provides custom tailored home insurance policies to fit the needs of every homeowner in indiana. The average cost of homeowners insurance in indiana is around $954 for a $100,000 dwelling coverage baseline.

Source: dependetuperspectiva.blogspot.com

Source: dependetuperspectiva.blogspot.com

Average homeowners insurance in indiana: Your actual home insurance costs will be higher or lower. The average cost of home insurance in indiana is $1,150 per year for $250,000 in dwelling coverage, which is well below the national average of $1,312 per year. Median home price in indiana: 33rd most expensive premium in the us.

Source: vhomeinsurance.com

Source: vhomeinsurance.com

A standard home insurance protects your home and personal belongings from risks such as fire, theft, vandalism, and much more. Do you need homeowners insurance in indiana? Home insurance coverage options in indiana: See how to save on home insurance in indiana. With erie’s guaranteed replacement cost coverage, you get the highest level.

Source: insuredasap.com

Source: insuredasap.com

Indiana homeowners insurance rates in december 2013 stood at an average of $820 as compared to $830 in november 2013. Home insurance coverage options in indiana: From free home insurance policy quotes to compare among best home insurance providers in india, we at policybazaar are here to secure your home from all damages/losses. As an indianapolis resident, you can expect to pay about $1,300 a year for $200,000 in home insurance coverage. It is always best to get quotes from multiple providers in order to find the lowest home insurance rates in indiana!

Source: valuepenguin.com

Source: valuepenguin.com

Information, options, rates, and free quotes for indiana home insurance within minutes online now using our free tool. Cincinnati insurance provides the most affordable home insurance in indiana, at only $932 annually. Average cost of homeowners insurance in indiana. 1 features are optional and a part of the enhanced package. 33rd most expensive premium in the us.

Source: landlordinsurance-mi-in.com

Source: landlordinsurance-mi-in.com

Your actual home insurance costs will be higher or lower. This is slightly above the national average of $1,083. Many homeowners don’t realize that actual cash value policies subtract for wear and tear and depreciation. Declining deductibles ® — earn $50 toward your deductible each year.; In the united states, the national average cost of car insurance is $1,312 per year.

Source: quotewizard.com

Source: quotewizard.com

The average cost of homeowners insurance in indiana is around $954 for a $100,000 dwelling coverage baseline. Home insurance quotes in indiana below are home insurance providers that offer home insurance quotes in indiana. 1 features are optional and a part of the enhanced package. Indiana homeowners pay an average $1,587 per year, or $132 a month, for home insurance. Finding indiana insurance quotes for health, business, home, auto or life insurance isn�t hard, but how you find insurance quotes can have a huge impact on the ease and reliability of choosing the right company and policy for you.

Source: vhomeinsurance.com

Source: vhomeinsurance.com

Cincinnati insurance provides the most affordable home insurance in indiana, at only $932 annually. The average cost of homeowners insurance in indiana is around $954 for a $100,000 dwelling coverage baseline. 33rd most expensive premium in the us. Indiana homeowners pay an average $1,587 per year, or $132 a month, for home insurance. While price is an important factor.

Source: mandas-hotspot.blogspot.com

Source: mandas-hotspot.blogspot.com

Homeowners insurance rates in indiana will vary based on the insurance company you choose. Your premium may vary due to a number of factors, one of which is your deductible amount. With us, insuring your valuable possession, ‘home’ is now a matter of a few clicks. Homeowners insurance rates in indiana will vary based on the insurance company you choose. Median home price in indiana:

Source: agents.allstate.com

Source: agents.allstate.com

Your deductible is the amount you pay for a home insurance claim before your insurer covers the remainder, up to your policy limits. In addition to higher crime rates, other factors that contribute to higher homeowners insurance rates include risk for hurricanes, tornadoes, windstorms and hail. Associated insurance group of indiana provides custom tailored home insurance policies to fit the needs of every homeowner in indiana. 93 rows compare quotes from top providers and save now! Subject to terms, conditions and availability.

Source: youngalfred.com

Source: youngalfred.com

One can buy or renew an existing policy through our viable platform. Subject to terms, conditions and availability. Indianapolis homeowners insurance rates average out at about $1,049 a year. The average cost of homeowners insurance in indiana is around $954 for a $100,000 dwelling coverage baseline. Finding indiana insurance quotes for health, business, home, auto or life insurance isn�t hard, but how you find insurance quotes can have a huge impact on the ease and reliability of choosing the right company and policy for you.

Source: agents.allstate.com

Source: agents.allstate.com

93 rows compare quotes from top providers and save now! As an indianapolis resident, you can expect to pay about $1,300 a year for $200,000 in home insurance coverage. One can buy or renew an existing policy through our viable platform. 33rd most expensive premium in the us. Finding indiana insurance quotes for health, business, home, auto or life insurance isn�t hard, but how you find insurance quotes can have a huge impact on the ease and reliability of choosing the right company and policy for you.

Source: pinterest.com

Source: pinterest.com

How much is home insurance in indiana? The following graph shows how home insurance rates compare across different companies in indianapolis: Average homeowners insurance in indiana: A standard home insurance protects your home and personal belongings from risks such as fire, theft, vandalism, and much more. 33rd most expensive premium in the us.

Source: agents.allstate.com

Source: agents.allstate.com

The following graph shows how home insurance rates compare across different companies in indianapolis: Finding indiana insurance quotes for health, business, home, auto or life insurance isn�t hard, but how you find insurance quotes can have a huge impact on the ease and reliability of choosing the right company and policy for you. Your deductible is the amount you pay for a home insurance claim before your insurer covers the remainder, up to your policy limits. 1 features are optional and a part of the enhanced package. It is always best to get quotes from multiple providers in order to find the lowest home insurance rates in indiana!

Source: simplyinsurance.com

Source: simplyinsurance.com

33rd most expensive premium in the us. The following graph shows how home insurance rates compare across different companies in indianapolis: Average homeowners insurance in indiana: The average cost of homeowners insurance in indiana is around $954 for a $100,000 dwelling coverage baseline. Many homeowners don’t realize that actual cash value policies subtract for wear and tear and depreciation.

Source: agents.allstate.com

Source: agents.allstate.com

From free home insurance policy quotes to compare among best home insurance providers in india, we at policybazaar are here to secure your home from all damages/losses. Since your house is one of the most valuable possessions you have, you want to make sure that it and all the contents inside are protected. This is $94 over the average yearly indiana home insurance policy price of $955. 1 features are optional and a part of the enhanced package. Average cost of indiana home insurance quotes.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title home insurance quotes indiana by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.