Your Home insurance factors images are ready. Home insurance factors are a topic that is being searched for and liked by netizens today. You can Download the Home insurance factors files here. Find and Download all royalty-free photos and vectors.

If you’re searching for home insurance factors pictures information linked to the home insurance factors topic, you have come to the ideal blog. Our website always provides you with hints for seeing the highest quality video and image content, please kindly search and find more informative video content and images that fit your interests.

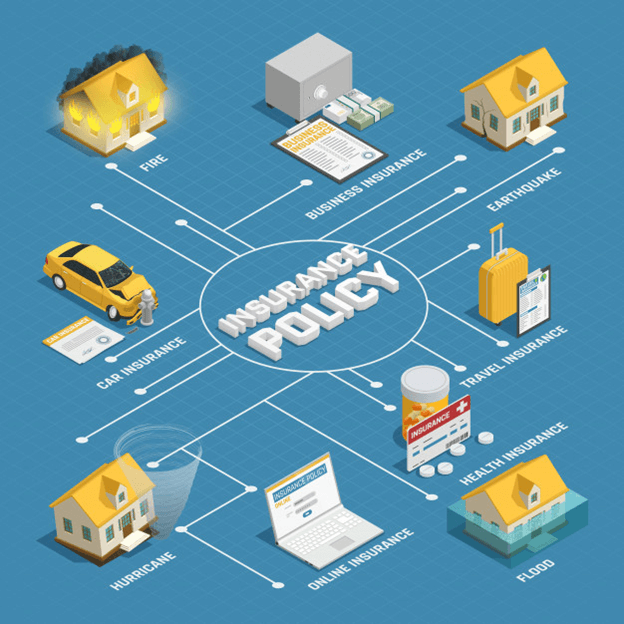

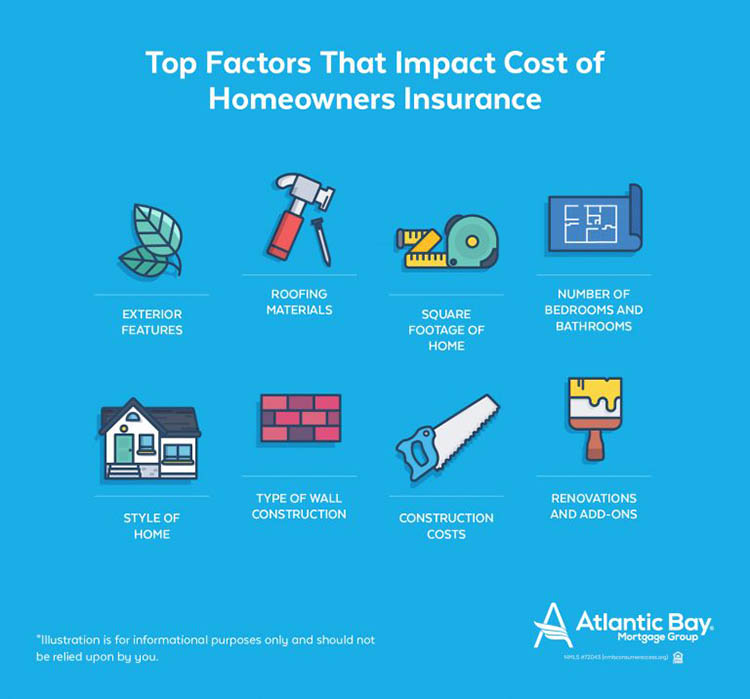

Home Insurance Factors. Below is really a description of the most essential factors to look at when reading reviews on home insurance corporations. Lowering the amount of coverage within your policy is one of the factors that affect home insurance costs. It is true that once you opt for a suitable home insurance package, the necessary paper work and associated paradigms will be executed swiftly. Many different factors determine the cost of your home insurance, as each insurance provider calculates it differently.

Home Insurance Factors to Consider if you are a First Time From knowito.com

Home Insurance Factors to Consider if you are a First Time From knowito.com

Lowering the amount of coverage within your policy is one of the factors that affect home insurance costs. Choose the right home insurance cover; An insurance policy deductible is an amount the policyholder will pay before insurance covers repairs or reparations. There are many factors that determine the cost of homeowners insurance. The location of your home. Roof shape and recent roof updates a significant factor driving your home insurance premium is your roof shape and age.

How much homeowners insurance coverage you need

Your credit score and insurance claim history play a part. Flat roofs are more expensive to insure. The ideal company should balance good customer service with lower premiums and abundant coverage. Home insurance must never be thought over as a delicate issue. Commercial insurance is our specialty and as an independent agency, we have relationships with every domestic insurance company in the state of hawaii. Being aware of how each factor is reflected in your overall home insurance rate is one of the best ways to make sure you get the best coverage at a low cost.

Source: allaroundmoving.com

Source: allaroundmoving.com

Your credit score and insurance claim history play a part. Home characteristics, such as building age and materials, affect pricing. 9 major factors that determine the cost of home insurance. The closer you are to a large body of water (like an ocean), the more likely you are to sustain damage from an. One of the most commonly known factors that can affect insurance premium prices is the deductible.

Source: blog.abcautoinsurance.com

Source: blog.abcautoinsurance.com

Home characteristics, such as building age and materials, affect pricing. Home characteristics, such as building age and materials, affect pricing. Home insurance is an essential part of buying a house. Being aware of how each factor is reflected in your overall home insurance rate is one of the best ways to make sure you get the best coverage at a low cost. However, many homebuyers end up feeling so overwhelmed by the buying and closing process that they simply how to read a home insurance quote:

Source: schwabagency.com

Source: schwabagency.com

If you live in an area where a higher number of claims are filed, your home will likely. While your rates could be lower, it. They include the following issues: The closer you are to a large body of water (like an ocean), the more likely you are to sustain damage from an. Factors to consider before buying a home insurance policy.

Source: insurewithkevin.com

Source: insurewithkevin.com

Compare insurance before you buy; It is true that once you opt for a suitable home insurance package, the necessary paper work and associated paradigms will be executed swiftly. Compare insurance before you buy; In all states except california, maryland and massachusetts, insurance companies can use your credit history when determining home insurance rates. But you could pay significantly more or less in premiums depending on details about your home, your policy, and your lifestyle.

Source: atlanticbay.com

Source: atlanticbay.com

Founded in 1931, insurance factors is one of hawaii’s leading commercial insurance agencies. An insurance policy deductible is an amount the policyholder will pay before insurance covers repairs or reparations. How much homeowners insurance coverage you need Locally owned and operated, our headquarters are located in downtown honolulu. Factor in the deductible and worth of the home in addition.

Source: mbsinsurance.com

Source: mbsinsurance.com

The likelihood of your home being caught up in a flood will also play a part in the pricing of your home insurance: 9 major factors that determine the cost of home insurance. Choose the right home insurance cover; Company�s history on claim denial: The replacement cost cost of.

Source: douglascostguide.com

Source: douglascostguide.com

Compare insurance before you buy; The closer you are to a large body of water (like an ocean), the more likely you are to sustain damage from an. Here are 10 factors that could be affecting your home insurance costs. Homeowners insurance state guides help you learn about the homeowners insurance factors, rates, requirements and regulations by state. Many different factors determine the cost of your home insurance, as each insurance provider calculates it differently.

Source: financiallygenius.com

Source: financiallygenius.com

Here are some key factors that determine how insurance companies calculate your homeowners insurance premium: Various other factors also affect the price of the insurance premium, such as how old or new your plumbing is (with new plumbing being less expensive), an electrical system that doesn’t overload, the size of the house (larger homes are more expensive to insure), your credit score (which insurers use to gauge the likelihood of filing claims, so the lower the score, the. Compare insurance before you buy; Structure and age of the house; There are many factors that determine the cost of homeowners insurance.

Source: insurezero.wordpress.com

Source: insurezero.wordpress.com

Here are some key factors that determine how insurance companies calculate your homeowners insurance premium: An insurance policy deductible is an amount the policyholder will pay before insurance covers repairs or reparations. They include the following issues: Even the neighborhood you live in could impact home insurance costs. This is not a way for insurance companies to save money but rather a risk.

Source: knowito.com

Source: knowito.com

When browsing for a home insurance policy, keep in mind the following 11 factors that affect homeowners insurance premiums. Company�s history on claim denial: They include the following issues: Here are some key factors that determine how insurance companies calculate your homeowners insurance premium: Commercial insurance is our specialty and as an independent agency, we have relationships with every domestic insurance company in the state of hawaii.

Source: homeinsured.org

Source: homeinsured.org

Below is really a description of the most essential factors to look at when reading reviews on home insurance corporations. Lowering the amount of coverage within your policy is one of the factors that affect home insurance costs. It is so because the other factors such as location and the coverage. Property area while the area of your house is an important factor that determines the premium of your home insurance policy, it is possible that two houses having similar area might have different insurance rates. One of the most commonly known factors that can affect insurance premium prices is the deductible.

Source: bydesignmusic.blogspot.com

Source: bydesignmusic.blogspot.com

The closer you are to a large body of water (like an ocean), the more likely you are to sustain damage from an. If your home is located in. An insurance policy deductible is an amount the policyholder will pay before insurance covers repairs or reparations. The location of your home. Many different factors determine the cost of your home insurance, as each insurance provider calculates it differently.

Source: thefastr.com

Source: thefastr.com

It is so because the other factors such as location and the coverage. Lowering the amount of coverage within your policy is one of the factors that affect home insurance costs. Please enter a valid 5 digit us zip code. Various other factors also affect the price of the insurance premium, such as how old or new your plumbing is (with new plumbing being less expensive), an electrical system that doesn’t overload, the size of the house (larger homes are more expensive to insure), your credit score (which insurers use to gauge the likelihood of filing claims, so the lower the score, the. Home location the location of your home plays an enormous role in determining the cost of your home insurance.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

When browsing for a home insurance policy, keep in mind the following 11 factors that affect homeowners insurance premiums. It is so because the other factors such as location and the coverage. Compare insurance before you buy; Here are a few factors that affect the premium of your home insurance policy. If your home is located in.

Source: insurify.com

Source: insurify.com

Flat roofs are more expensive to insure. How much homeowners insurance coverage you need If you live in an area where a higher number of claims are filed, your home will likely. Below is really a description of the most essential factors to look at when reading reviews on home insurance corporations. Even the neighborhood you live in could impact home insurance costs.

Source: homeinsurancesolutions.weebly.com

Source: homeinsurancesolutions.weebly.com

Commercial insurance is our specialty and as an independent agency, we have relationships with every domestic insurance company in the state of hawaii. Here are some key factors that determine how insurance companies calculate your homeowners insurance premium: Many different factors determine the cost of your home insurance, as each insurance provider calculates it differently. Lowering the amount of coverage within your policy is one of the factors that affect home insurance costs. The closer you are to a large body of water (like an ocean), the more likely you are to sustain damage from an.

Source: carlespen.com

Source: carlespen.com

Home location the location of your home plays an enormous role in determining the cost of your home insurance. Many different factors determine the cost of your home insurance, as each insurance provider calculates it differently. Here are a few factors that affect the premium of your home insurance policy. But you could pay significantly more or less in premiums depending on details about your home, your policy, and your lifestyle. One of the most commonly known factors that can affect insurance premium prices is the deductible.

Source: allnevadainsurance.com

Source: allnevadainsurance.com

Even the neighborhood you live in could impact home insurance costs. Flat roofs are more expensive to insure. Compare insurance before you buy; Being aware of how each factor is reflected in your overall home insurance rate is one of the best ways to make sure you get the best coverage at a low cost. However, many homebuyers end up feeling so overwhelmed by the buying and closing process that they simply how to read a home insurance quote:

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title home insurance factors by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.