Your Home insurance binder images are ready. Home insurance binder are a topic that is being searched for and liked by netizens now. You can Download the Home insurance binder files here. Download all free images.

If you’re looking for home insurance binder images information connected with to the home insurance binder interest, you have pay a visit to the right blog. Our website frequently provides you with hints for viewing the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that match your interests.

Home Insurance Binder. On a home insurance binder you should see limits listed for your dwelling coverage, personal property coverage, and any medical payments or loss of use limits purchased. It provides proof of coverage if there is no formal policy. The binder may be issued by the agent or the company. A lot of homeowners, especially those who just purchased a new home, are usually confused about the term insurance binder.

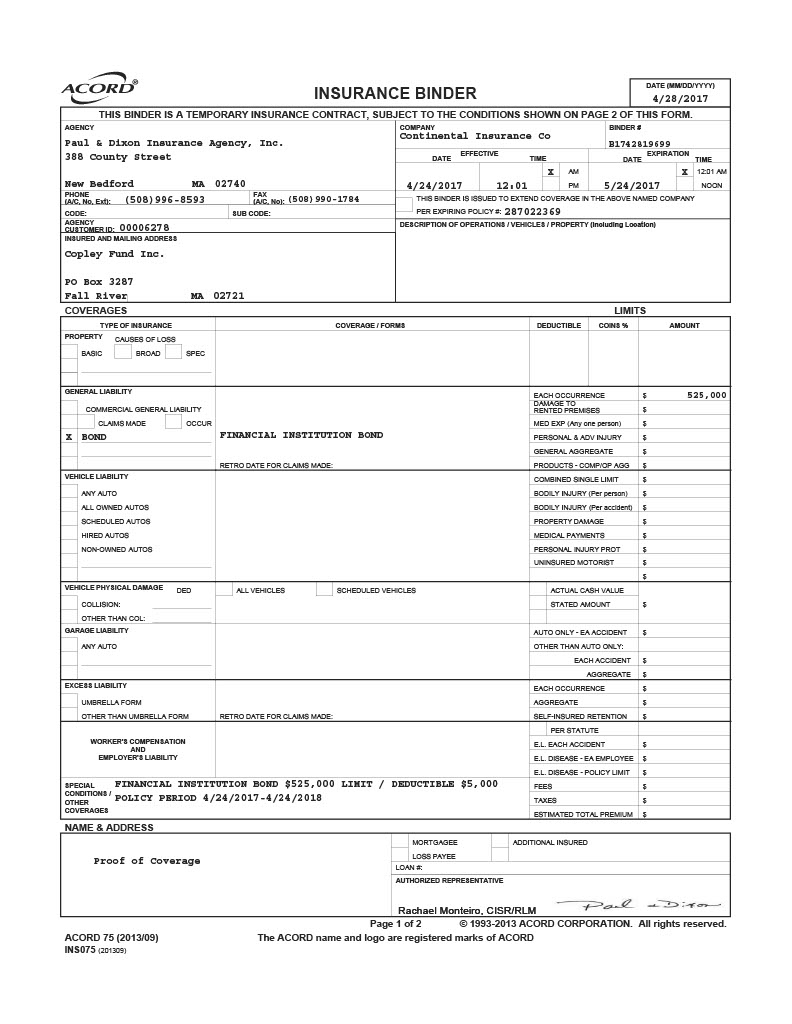

Acord Insurance Binder Pdf Fillable From insurance-info-center.blogspot.com

Acord Insurance Binder Pdf Fillable From insurance-info-center.blogspot.com

In other words it is a temporary proof of insurance that will cover or bind coverage until the formal policy is issued. Your binder will outline the basic terms, coverages, deductibles, and named insureds that will appear in your contract. Applicable in the virgin islands with respect to binders issued to renters of residential premises, home owners, condo unit owners and mobile home An insurance binder is temporary. Your home insurance binder needs to meet the requirements of your loan. Anyone who gets homeowners insurance should ask for a binder.

The binder will include information about your insurance such as policy coverage limits and covered perils.

A home insurance binder is a temporary proof of insurance that will have your back until your actual homeowners insurance documents are available. A home insurance binder, also known as bind coverage or bind coverage, is a set legal papers that establish the agreement between you (the insured) and your insurer. A homeowners insurance binder is a temporary document issued by an authorized insurance representative that can serve as proof of insurance for your home, car, or property. Issuing a new policy can sometimes take a few days or weeks, depending on the underwriting process. Binders are typically used to show evidence of things like property liability coverage to a lender, or when buying a new property. Your bank or mortgage company is requiring a binder because you have a mortgage on your home.

Source: thebalance.com

Source: thebalance.com

Anyone who gets homeowners insurance should ask for a binder. An insurance binder is a temporary policy that serves as a placeholder until your formal policy is issued. Binders for insurance typically last 30 to 90 days, and do not provide coverage once they expire. A homeowners insurance binder is a temporary legal insurance contract that furnishes coverage and evidence of insurance. Issuing a new policy can sometimes take a few days or weeks, depending on the underwriting process.

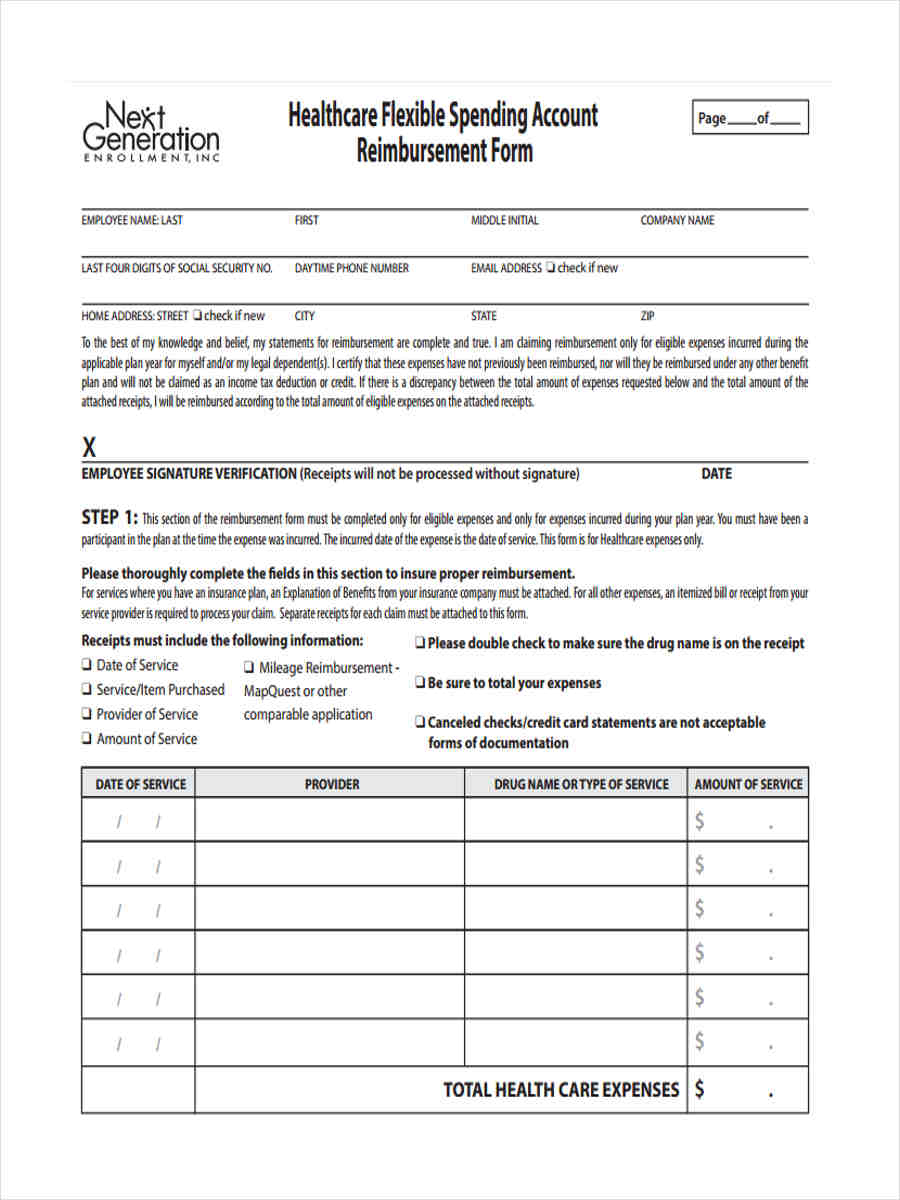

Source: formsbirds.com

Source: formsbirds.com

What is a home insurance binder? Many insurance providers can supply homeowners with a binder within 24 to 48 hours. First, the binder should clearly identify the name of the insurance company, type of coverage (home, property or auto), and the legal name of the agent who is authorizing the policy. This information typically includes the following: “will” is the operative word here though:

Source: pinterest.com

Source: pinterest.com

It is a single document that is usually one or two pages long, and it acts as temporary proof of insurance. An insurance binder is a temporary policy that serves as a placeholder until your formal policy is issued. Many insurance providers can supply homeowners with a binder within 24 to 48 hours. With respect to binders issued to renters of residential premises, home owners, condo unit owners and mobile home owners, the insurer has thirty (30) business days, commencing from the effective date of coverage, to evaluate the issuance of the insurance policy. An insurance binder contains a summary of the exact same terms of coverage as your pending contract.

Source: goodfairydesign.blogspot.com

Source: goodfairydesign.blogspot.com

It provides proof of coverage if there is no formal policy. The only way to get an insurance binder is through your home insurance provider. A homeowners insurance binder is a temporary legal insurance contract that furnishes coverage and evidence of insurance. A homeowners insurance binder is a temporary document issued by an authorized insurance representative that can serve as proof of insurance for your home, car, or property. It is a single document that is usually one or two pages long, and it acts as temporary proof of insurance.

Source: pinterest.com

Source: pinterest.com

Issuing a new policy can sometimes take a few days or weeks, depending on the underwriting process. A binder is typically used when closing on a new home to verify that the mortgage company or lender insures the house. The binder must prove that your bank is listed as a mortgagee on your insurance policy. You should use a homeowner insurance binder to prove that you have coverage on your home. Applicable in the virgin islands applicable in colorado with respect to binders issued to renters of residential premises, home owners, condo unit owners and mobile home

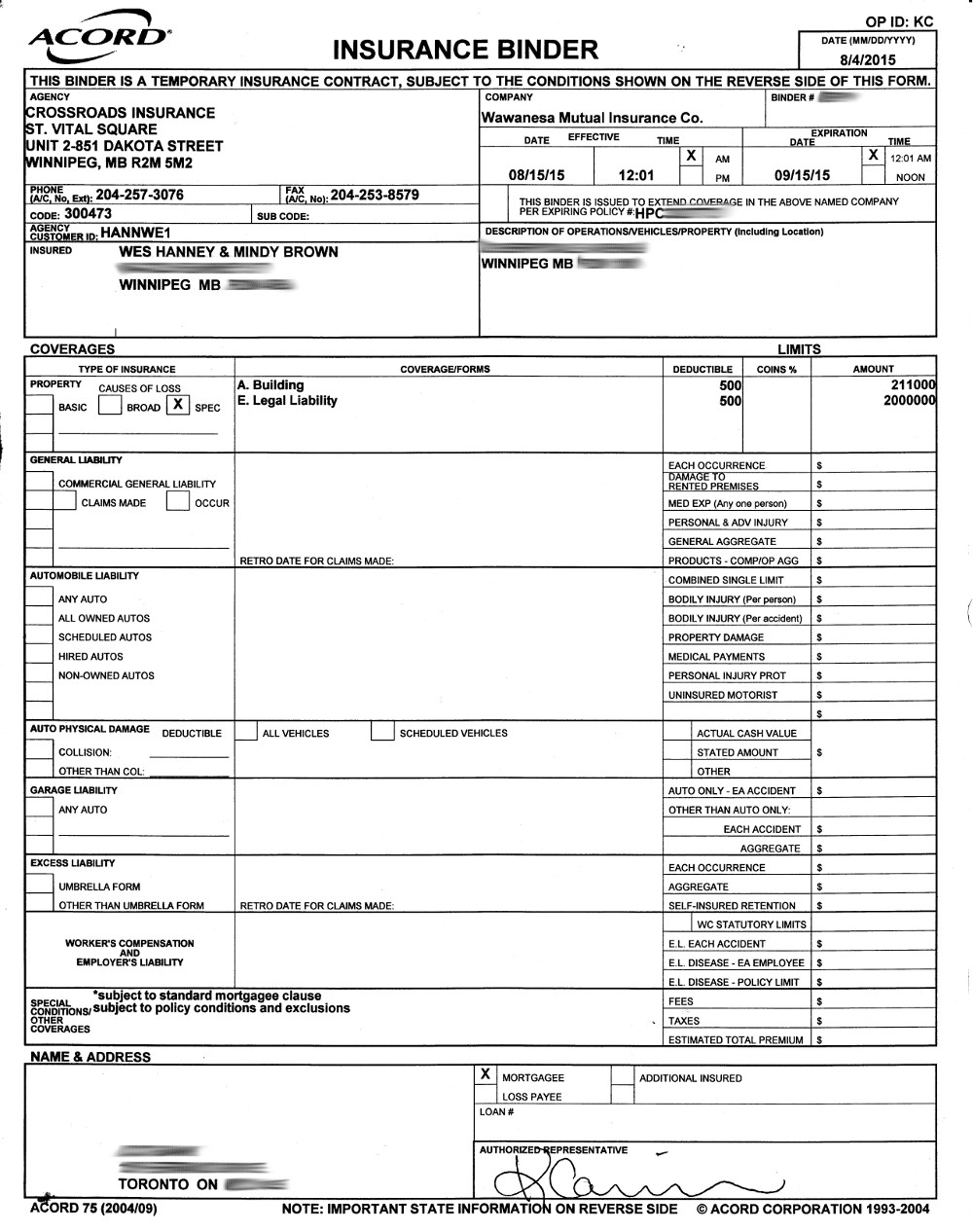

Source: insurance-info-center.blogspot.com

Source: insurance-info-center.blogspot.com

A home insurance binder is a temporary proof of insurance that will have your back until your actual homeowners insurance documents are available. Many insurance providers can supply homeowners with a binder within 24 to 48 hours. It provides proof of coverage if there is no formal policy. Your home insurance binder needs to meet the requirements of your loan. In other words it is a temporary proof of insurance that will cover or bind coverage until the formal policy is issued.

Source: reviewhome.co

Source: reviewhome.co

A home insurance binder, also known as bind coverage or bind coverage, is a set legal papers that establish the agreement between you (the insured) and your insurer. An insurance binder is a one page document showing the insurance company�s written confirmation to insure your newly purchased house. Here�s a breakdown of what to look for: It provides proof of coverage if there is no formal policy. An insurance binder provides temporary evidence of insurance coverage prior to the issuance of a formal insurance policy.

Source: youngalfred.com

Source: youngalfred.com

It serves as proof of insurance for your home , property, or car. A homeowners insurance binder is a temporary document issued by an authorized insurance representative that can serve as proof of insurance for your home, car, or property. A home insurance binder is a temporary proof of insurance that will have your back until your actual homeowners insurance documents are available. You should use a homeowner insurance binder to prove that you have coverage on your home. The address of the house being insured.

Source: reviewhome.co

Source: reviewhome.co

It should include key information about the insurance policy you just purchased. Of the form is changed from insurance binder to cover note. Your home insurance binder needs to meet the requirements of your loan. The most obvious example is the named insured, which simply. What is a home insurance binder?

Source: hominsurances.blogspot.com

Source: hominsurances.blogspot.com

The address of the house being insured. The address of the house being insured. That way, you’ll have proof of your homeowners policy in case your. An insurance binder is a one page document showing the insurance company�s written confirmation to insure your newly purchased house. To be very simple about it, a homeowners insurance binder is a temporary document which acts as your insurance policy while the actual policy has not yet been completed.

Source: alquilercastilloshinchables.info

Source: alquilercastilloshinchables.info

The insurance binder specifies all the protections for which you. As an enforceable contract, the binder must state who gets the benefits of the policy. Typically, a home insurance binder. First, the binder should clearly identify the name of the insurance company, type of coverage (home, property or auto), and the legal name of the agent who is authorizing the policy. Within thirty (30) days of receipt of this binder, you should request an insurance policy or certificate (if applicable) from your agent and/or insurance company.

Source: alquilercastilloshinchables.info

Source: alquilercastilloshinchables.info

That way, you’ll have proof of your homeowners policy in case your. Within thirty (30) days of receipt of this binder, you should request an insurance policy or certificate (if applicable) from your agent and/or insurance company. This information typically includes the following: Binders for insurance typically last 30 to 90 days, and do not provide coverage once they expire. As an enforceable contract, the binder must state who gets the benefits of the policy.

Source: lopriore.com

Source: lopriore.com

In other words it is a temporary proof of insurance that will cover or bind coverage until the formal policy is issued. A lot of homeowners, especially those who just purchased a new home, are usually confused about the term insurance binder. An insurance binder is a temporary policy that serves as a placeholder until your formal policy is issued. Technically, your homeowners insurance isn’t active yet. The binder may be issued by the agent or the company.

Source: staeti.blogspot.com

Typically, a home insurance binder. An insurance binder is a temporary policy that serves as a placeholder until your formal policy is issued. The binder must prove that your bank is listed as a mortgagee on your insurance policy. Home insurance binders are used to show proof of insurance coverage on a property. The binder may be issued by the agent or the company.

Source: reviewhome.co

Source: reviewhome.co

The address of the house being insured. A binder serves as temporary proof of insurance, since your. It serves as proof of insurance for your home , property, or car. Common coverages in a homeowner insurance binder include dwelling, liability, contents, and medical payments. However, some companies are able to finalize a binder in less than a day.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

It serves as proof of insurance for your home , property, or car. A lot of homeowners, especially those who just purchased a new home, are usually confused about the term insurance binder. People often need home and car insurance binders to provide proof of insurance coverage when purchasing a house with a mortgage or a new car with an auto loan. It should include key information about the insurance policy you just purchased. A binder serves as temporary proof of insurance, since your.

Source: reviewhome.co

Source: reviewhome.co

The only way to get an insurance binder is through your home insurance provider. Binders for insurance typically last 30 to 90 days, and do not provide coverage once they expire. Your home insurance binder needs to meet the requirements of your loan. An insurance binder contains a summary of the exact same terms of coverage as your pending contract. An insurance binder is a temporary policy that serves as a placeholder until your formal policy is issued.

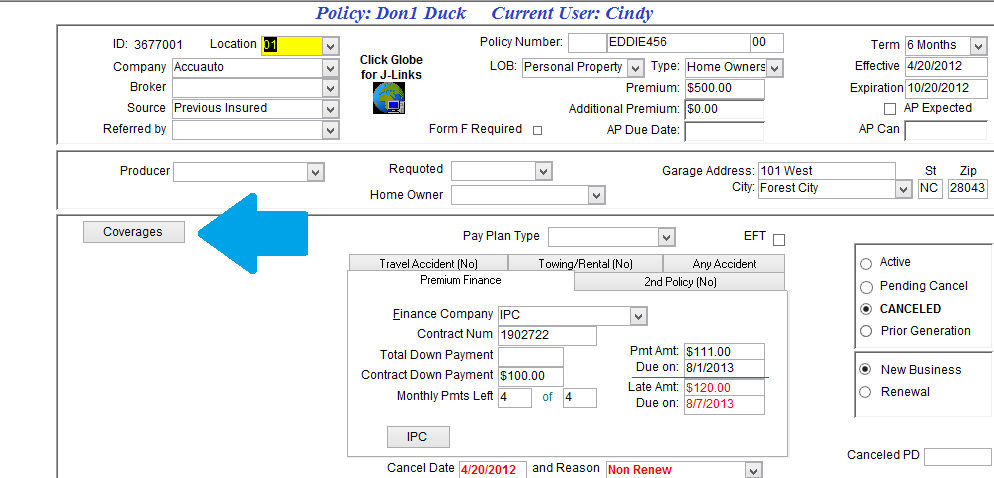

Source: jenesissoftware.com

Source: jenesissoftware.com

People often need home and car insurance binders to provide proof of insurance coverage when purchasing a house with a mortgage or a new car with an auto loan. Your binder will outline the basic terms, coverages, deductibles, and named insureds that will appear in your contract. When you buy a home, your lender will require proof of insurance. Issuing a new policy can sometimes take a few days or weeks, depending on the underwriting process. Anyone who gets homeowners insurance should ask for a binder.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title home insurance binder by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.