Your Home insurance against theft images are ready in this website. Home insurance against theft are a topic that is being searched for and liked by netizens today. You can Find and Download the Home insurance against theft files here. Find and Download all free photos and vectors.

If you’re looking for home insurance against theft images information related to the home insurance against theft keyword, you have come to the ideal site. Our website frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly surf and find more informative video articles and graphics that match your interests.

Home Insurance Against Theft. That can include fire, vandalism, falling tree limbs, civil unrest and more. Stay peaceful by insuring your possessions against theft/burglary. Audio equipment that is permanently installed in your car is also covered. A homeowner�s insurance is a form of property insurance that, in general terms, covers four different incidents to the property.

Home Insurance Against Theft / The Weirdest Insurance From friends-was-else.blogspot.com

Home Insurance Against Theft / The Weirdest Insurance From friends-was-else.blogspot.com

Not yet covered by john lewis? Any loss or damage that is caused to the premises during theft is also covered by the theft insurance policy. Does home title insurance protect me? Personal property coverage also extends to items in detached structures on your property, such as a shed. Homeowners insurance helps cover the cost of property damage and theft to your home, but that coverage may not extend to a house that has been vacant for lengthy periods of time. Home insurance on the contrary is considered as unnecessary by many especially indian households.

It covers damages to the interior or exterior to the home, it also covers the damage or loss of items that are found within the property, for example in case of a theft.

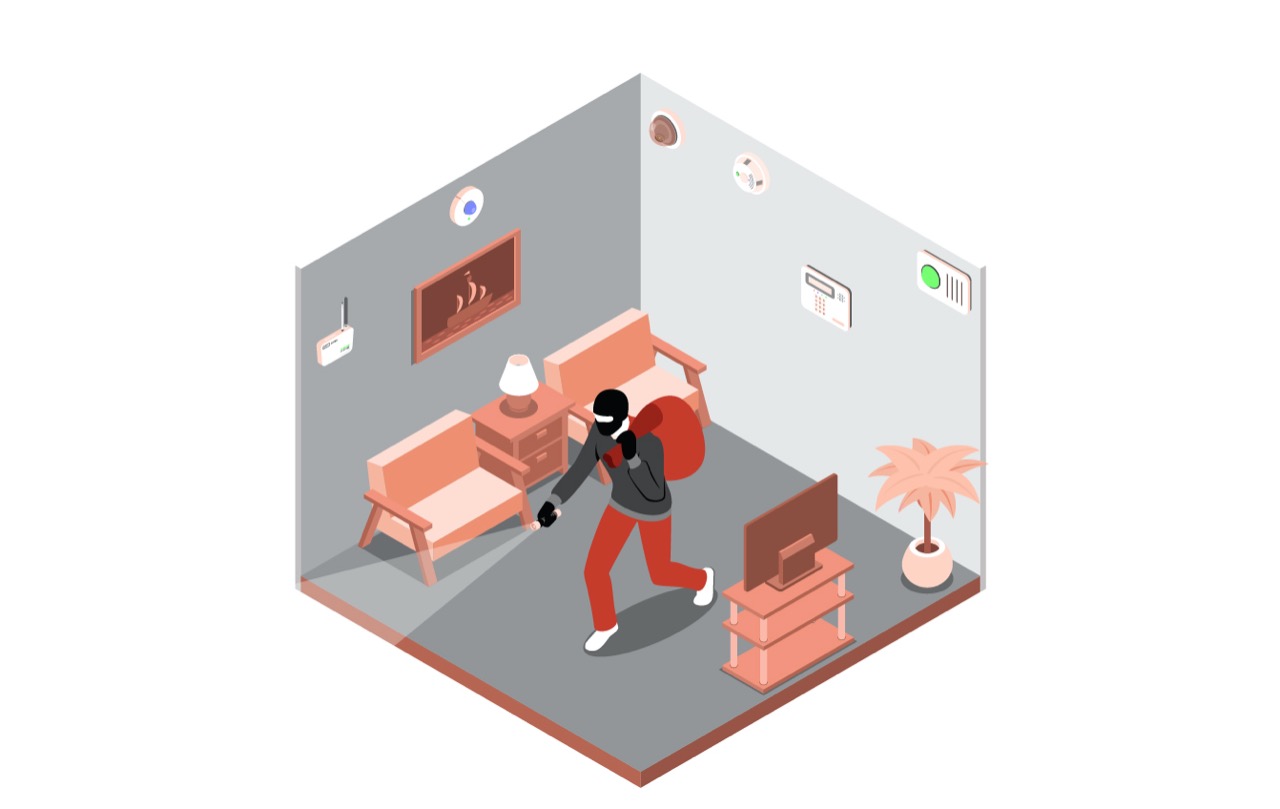

Any loss or damage that is caused to the premises during theft is also covered by the theft insurance policy. A homeowner�s insurance is a form of property insurance that, in general terms, covers four different incidents to the property. Dwelling coverage helps pay for repairs if your home is damaged by a covered peril. Many homeowners insurance providers offer the opportunity to purchase additional coverage (often called an endorsement or a rider) to provide relief should identity theft occur. Most home insurance policies cover theft of personal property such as clothing, computers, electronic equipment, and furniture. Although at the time of the theft gunn had renter�s insurance, since moving into a new home, she continues with homeowner�s insurance to help protect her valuables.

Source: is-logging.blogspot.com

Source: is-logging.blogspot.com

If something happens to destroy or damage your possessions, it can cost a lot of money to replace them items, some of which may be essential. Home title lock is one of the services that says it will monitor your home’s deed 24/7 to prevent title fraud; The cost of the items that are stolen from your premises will also be compensated by the insurer It costs $15 a month ($150 annually, two years for $298). While identity theft coverage will not cover direct loses — like unauthorized purchases or bank loans taken out in your name — it can help you get your finances back on track.

Source: comparemarketinsurance.blogspot.com

Source: comparemarketinsurance.blogspot.com

With up to ₹25 lakhs of coverage for home belongings, you can secure all your belongings with us. With up to ₹25 lakhs of coverage for home belongings, you can secure all your belongings with us. Because identity theft can have a negative impact on your credit and cause other financial problems, home insurance identity theft. Dwelling coverage, personal property coverage and other structures coverage. Although at the time of the theft gunn had renter�s insurance, since moving into a new home, she continues with homeowner�s insurance to help protect her valuables.

Source: is-logging.blogspot.com

Source: is-logging.blogspot.com

Does home title insurance protect me? Typically, homeowners insurance also provides coverage, with limitations, for personal items stolen from offsite. Your home contents policy can cover the cost of replacing any of your belongings that were stolen, though the specifics will depend on your policy. Personal property coverage also extends to items in detached structures on your property, such as a shed. That can include fire, vandalism, falling tree limbs, civil unrest and more.

Source: mypopulars.com

Source: mypopulars.com

That said, like most parts of your insurance policy, there are a few exceptions you should note. Any loss or damage that is caused to the premises during theft is also covered by the theft insurance policy. While identity theft coverage will not cover direct loses — like unauthorized purchases or bank loans taken out in your name — it can help you get your finances back on track. Dwelling coverage helps pay for repairs if your home is damaged by a covered peril. When you buy your home insurance policy, you get protection against the perils named in your policy.

Source: friends-was-else.blogspot.com

Source: friends-was-else.blogspot.com

Home insurance for theft is indeed very important. Any loss or damage that is caused to the premises during theft is also covered by the theft insurance policy. However, home insurance that covers earthquakes is a must, especially in regions that are prone to these natural calamities. A homeowner�s insurance is a form of property insurance that, in general terms, covers four different incidents to the property. It protects against accidents or injuries.

Source: is-logging.blogspot.com

Source: is-logging.blogspot.com

Any loss or damage that is caused to the premises during theft is also covered by the theft insurance policy. Loss or damage in the home by an extensive list of causes such as fire, flood, theft, earthquake and lightning, explosion, bursting or overflowing of water tanks or domestic appliances, riot strike or civil commotion and vehicle impact to home contents and/or any improvements or additions to your home (renovations). In fact, a standard home insurance policy explicitly states that residences are not covered against theft and vandalism if they’ve been vacant for more than 60 days. Typically, homeowners insurance also provides coverage, with limitations, for personal items stolen from offsite. Stay peaceful by insuring your possessions against theft/burglary.

Source: friends-was-else.blogspot.com

Source: friends-was-else.blogspot.com

Many homeowners insurance providers offer the opportunity to purchase additional coverage (often called an endorsement or a rider) to provide relief should identity theft occur. It costs $15 a month ($150 annually, two years for $298). The cost of the items that are stolen from your premises will also be compensated by the insurer This advice applies to england. If something happens to destroy or damage your possessions, it can cost a lot of money to replace them items, some of which may be essential.

Source: friends-was-else.blogspot.com

Source: friends-was-else.blogspot.com

The cost of the items that are stolen from your premises will also be compensated by the insurer Stay peaceful by insuring your possessions against theft/burglary. Audio equipment that is permanently installed in your car is also covered. When you buy your home insurance policy, you get protection against the perils named in your policy. Your home contents policy can cover the cost of replacing any of your belongings that were stolen, though the specifics will depend on your policy.

Source: is-logging.blogspot.com

Source: is-logging.blogspot.com

Be it your own house, a rented one, an apartment, or a luxury mansion this insurance policy will provide cover for any kind of loss or damage. Even in case of a theft incident, if you lose your precious belongings our home shield insurance covers the losses seamlessly. Typically, homeowners insurance also provides coverage, with limitations, for personal items stolen from offsite. Be it your own house, a rented one, an apartment, or a luxury mansion this insurance policy will provide cover for any kind of loss or damage. In fact, a standard home insurance policy explicitly states that residences are not covered against theft and vandalism if they’ve been vacant for more than 60 days.

Source: is-logging.blogspot.com

Source: is-logging.blogspot.com

Does homeowners insurance cover theft from a car? Home title lock is one of the services that says it will monitor your home’s deed 24/7 to prevent title fraud; However, in response to this emerging risk, many insurance providers offer policy endorsements specifically designed to protect against the losses associated with identity theft. That can include fire, vandalism, falling tree limbs, civil unrest and more. Audio equipment that is permanently installed in your car is also covered.

Source: harrylevineinsurance.com

Source: harrylevineinsurance.com

Homeowners insurance helps cover the cost of property damage and theft to your home, but that coverage may not extend to a house that has been vacant for lengthy periods of time. Specifically, theft is a standard covered peril. As we mentioned above, theft is a named peril (which also include other bad things that may happen to your stuff because of fire, vandalism, freezing, and more). It protects against accidents or injuries. The standard features of most home and home and contents policies include insurance for your tv, up to a certain value, against various insured events, including theft but not including accidental.

Source: friends-was-else.blogspot.com

Source: friends-was-else.blogspot.com

Typically, homeowners insurance also provides coverage, with limitations, for personal items stolen from offsite. Although at the time of the theft gunn had renter�s insurance, since moving into a new home, she continues with homeowner�s insurance to help protect her valuables. That said, like most parts of your insurance policy, there are a few exceptions you should note. Your home contents policy can cover the cost of replacing any of your belongings that were stolen, though the specifics will depend on your policy. Loss or damage in the home by an extensive list of causes such as fire, flood, theft, earthquake and lightning, explosion, bursting or overflowing of water tanks or domestic appliances, riot strike or civil commotion and vehicle impact to home contents and/or any improvements or additions to your home (renovations).

Source: toscaa.com

Source: toscaa.com

The standard features of most home and home and contents policies include insurance for your tv, up to a certain value, against various insured events, including theft but not including accidental. Stay peaceful by insuring your possessions against theft/burglary. Your home contents policy can cover the cost of replacing any of your belongings that were stolen, though the specifics will depend on your policy. It protects against accidents or injuries. Audio equipment that is permanently installed in your car is also covered.

Source: mindstick.com

Source: mindstick.com

A homeowner�s insurance is a form of property insurance that, in general terms, covers four different incidents to the property. A homeowner�s insurance is a form of property insurance that, in general terms, covers four different incidents to the property. Personal property coverage also extends to items in detached structures on your property, such as a shed. Not yet covered by john lewis? That can include fire, vandalism, falling tree limbs, civil unrest and more.

Source: friends-was-else.blogspot.com

Source: friends-was-else.blogspot.com

Does home title insurance protect me? Audio equipment that is permanently installed in your car is also covered. Stay peaceful by insuring your possessions against theft/burglary. It protects against accidents or injuries. Many homeowners insurance providers offer the opportunity to purchase additional coverage (often called an endorsement or a rider) to provide relief should identity theft occur.

Source: friends-was-else.blogspot.com

Source: friends-was-else.blogspot.com

Homeowners insurance helps cover the cost of property damage and theft to your home, but that coverage may not extend to a house that has been vacant for lengthy periods of time. Not yet covered by john lewis? The cost of the items that are stolen from your premises will also be compensated by the insurer Homeowners insurance helps cover the cost of property damage and theft to your home, but that coverage may not extend to a house that has been vacant for lengthy periods of time. Does home title insurance protect me?

Source: pinterest.com

Source: pinterest.com

With up to ₹25 lakhs of coverage for home belongings, you can secure all your belongings with us. It covers damages to the interior or exterior to the home, it also covers the damage or loss of items that are found within the property, for example in case of a theft. Specifically, theft is a standard covered peril. The standard features of most home and home and contents policies include insurance for your tv, up to a certain value, against various insured events, including theft but not including accidental. Several coverages in a homeowners policy help you recover from a burglary:

Source: freepik.com

Source: freepik.com

Home insurance for theft is indeed very important. Because identity theft can have a negative impact on your credit and cause other financial problems, home insurance identity theft. The cost of the items that are stolen from your premises will also be compensated by the insurer With up to ₹25 lakhs of coverage for home belongings, you can secure all your belongings with us. That can include fire, vandalism, falling tree limbs, civil unrest and more.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title home insurance against theft by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.