Your Ho5 insurance policy images are available in this site. Ho5 insurance policy are a topic that is being searched for and liked by netizens now. You can Find and Download the Ho5 insurance policy files here. Find and Download all royalty-free photos and vectors.

If you’re searching for ho5 insurance policy images information connected with to the ho5 insurance policy topic, you have visit the right site. Our website frequently gives you hints for seeking the highest quality video and picture content, please kindly hunt and locate more informative video content and graphics that fit your interests.

Ho5 Insurance Policy. This means that it covers anything and everything that could damage the physical structure you live in (called the dwelling) and all the stuff you own (called your personal property ), with a few exceptions. Ho5 policies protect you from your insurance company not reimbursing for certain types of personal property damage. The most common sort of homeowners insurance, an ho3 policy, regards all risk to the actual building structure of your home, meaning you’d be insured for any peril that could happen to the outside of your home. As you now know, ho5 home insurance is different than either the ho1 or ho3 since it lists all the dangers that aren’t covered.

HO3 Vs. HO5 Homeowners Insurance Policy What Are The From differencecamp.com

HO3 Vs. HO5 Homeowners Insurance Policy What Are The From differencecamp.com

An open perils policy is evidently a better choice than a named perils policy. The most common sort of homeowners insurance, an ho3 policy, regards all risk to the actual building structure of your home, meaning you’d be insured for any peril that could happen to the outside of your home. What is better ho3 or ho5? This policy is an “ open perils ” policy, which means that it insures your home and personal property against all types of damage and danger unless it specifically excludes. $1,500 for loss by theft, misplacing or losing It takes your basic homeowners insurance coverage and adds a number of significant perks.

An ho5 policy is also known as a comprehensive form policy and will have the most coverage options available.

An open perils policy like the h05 specifically lists all perils your policy does. An ho5 policy is also known as a comprehensive form policy and will have the most coverage options available. $1,500 on trailers or semitrailers not used with watercraft of all types. Page 4 of 22 copyright, insurance services office, inc., 1999 ho 00 05 10 00 c. This means your insurer covers damage to your home and personal property when it’s caused by an event, or peril, as long as it’s not listed as an exclusion in the policy. What is better ho3 or ho5?

Source: blog.thimmeschkastner.com

Source: blog.thimmeschkastner.com

What is an ho5 policy? It includes four components of. A premium insurance policy with high coverage limits an ho5 insurance policy is for times when you want to take your overall property protection up a notch. It can either be for keeping expensive heirlooms in your house, hanging a priceless painting you got from an auction, or simply feeling more secure in your own house. $1,500 on trailers or semitrailers not used with watercraft of all types.

Source: differencecamp.com

Source: differencecamp.com

This means that it covers anything and everything that could damage the physical structure you live in (called the dwelling) and all the stuff you own (called your personal property ), with a few exceptions. It includes four components of. Both ho3 and ho5 home insurance policies offer coverage for additional living expenses and liability. This type of policy gives you a bit more room when it comes to “acceptable perils.” we’ll discuss exactly what counts of a perils in the next section. Both ho3 and ho5 insurance offer open perils for the structure of your home.

Source: differencecamp.com

Source: differencecamp.com

$1,500 on watercraft of all types, including their trailers, furnishings, equipment and outboard engines or motors. $1,500 on trailers or semitrailers not used with watercraft of all types. In other words, it�s the premium version of homeowners insurance. In the insurance industry, ho5 policies are otherwise known as complete forms because they offer complete protection for a home. An open perils policy like the h05 specifically lists all perils your policy does.

Source: simplyinsurance.com

Source: simplyinsurance.com

An ho5 policy is also known as a comprehensive form policy and will have the most coverage options available. Both ho3 and ho5 home insurance policies offer coverage for additional living expenses and liability. An open perils policy is evidently a better choice than a named perils policy. This type of policy gives you a bit more room when it comes to “acceptable perils.” we’ll discuss exactly what counts of a perils in the next section. What is better ho3 or ho5?

Source: viaa4u.com

Source: viaa4u.com

It includes four components of. In other words, it�s the premium version of homeowners insurance. An ho5 insurance policy is a type of homeowners insurance policy that provides broader protection and higher coverage limits than the typical options. It provides more security for both your personal property and home than any residential policy on the market. Both ho3 and ho5 insurance offer open perils for the structure of your home.

Source: investingport.com

Source: investingport.com

It provides more security for both your personal property and home than any residential policy on the market. However, that also makes it the most expensive of all the home insurance policies. It can either be for keeping expensive heirlooms in your house, hanging a priceless painting you got from an auction, or simply feeling more secure in your own house. An open perils policy like the h05 specifically lists all perils your policy does. The ho5 is a superstar plan that gives homeowners a robust policy with coverage from soup to nuts.

Source: differencecamp.com

Source: differencecamp.com

What is better ho3 or ho5? This means that it covers anything and everything that could damage the physical structure you live in (called the dwelling) and all the stuff you own (called your personal property ), with a few exceptions. Ho5 policies protect you from your insurance company not reimbursing for certain types of personal property damage. It provides more security for both your personal property and home than any residential policy on the market. An ho5 insurance policy is a type of homeowners insurance policy that provides broader protection and higher coverage limits than the typical options.

Source: pinterest.com

Source: pinterest.com

The most distinctive aspect of an ho5 policy is that it covers all damages to your home and personal property within your home, that is not listed as an exception. Page 4 of 22 copyright, insurance services office, inc., 1999 ho 00 05 10 00 c. An ho5 policy is also known as a comprehensive form policy and will have the most coverage options available. It includes four components of. What is better ho3 or ho5?

Source: youngalfred.com

Source: youngalfred.com

An open perils policy is evidently a better choice than a named perils policy. The most common sort of homeowners insurance, an ho3 policy, regards all risk to the actual building structure of your home, meaning you’d be insured for any peril that could happen to the outside of your home. This policy is an “ open perils ” policy, which means that it insures your home and personal property against all types of damage and danger unless it specifically excludes. The most distinctive aspect of an ho5 policy is that it covers all damages to your home and personal property within your home, that is not listed as an exception. The ho5 is a superstar plan that gives homeowners a robust policy with coverage from soup to nuts.

Source: tgsinsurance.com

Source: tgsinsurance.com

Like an ho3 form, ho5 homeowners insurance includes both personal liability and medical payments coverage. This means that it covers anything and everything that could damage the physical structure you live in (called the dwelling) and all the stuff you own (called your personal property ), with a few exceptions. The ho5 is a superstar plan that gives homeowners a robust policy with coverage from soup to nuts. Page 4 of 22 copyright, insurance services office, inc., 1999 ho 00 05 10 00 c. Like an ho3 form, ho5 homeowners insurance includes both personal liability and medical payments coverage.

Source: tcsib.com

Source: tcsib.com

What is an ho5 policy? Both ho3 and ho5 insurance offer open perils for the structure of your home. It takes your basic homeowners insurance coverage and adds a number of significant perks. It includes four components of. A premium insurance policy with high coverage limits an ho5 insurance policy is for times when you want to take your overall property protection up a notch.

Source: youtube.com

Source: youtube.com

This policy is an “ open perils ” policy, which means that it insures your home and personal property against all types of damage and danger unless it specifically excludes. $1,500 on watercraft of all types, including their trailers, furnishings, equipment and outboard engines or motors. It is so, since the former ensures wider coverage for both the structure and the contents of the insured home. The ho5 is a superstar plan that gives homeowners a robust policy with coverage from soup to nuts. This means that it covers anything and everything that could damage the physical structure you live in (called the dwelling) and all the stuff you own (called your personal property ), with a few exceptions.

Source: tcsib.com

Source: tcsib.com

This term means that your policy covers your house for everything except situations listed explicitly as exclusions (more on that later). That includes your furniture, clothes, electronics, etc. In the insurance industry, ho5 policies are otherwise known as complete forms because they offer complete protection for a home. It includes four components of. This means your insurer covers damage to your home and personal property when it’s caused by an event, or peril, as long as it’s not listed as an exclusion in the policy.

Source: lemonade.com

Source: lemonade.com

The ho5 policy is designed to give you more freedom than the typical h03 and increase your personal items� limits, such as jewelry. However, that also makes it the most expensive of all the home insurance policies. An ho5 policy is also known as a comprehensive form policy and will have the most coverage options available. An open perils policy is evidently a better choice than a named perils policy. It can either be for keeping expensive heirlooms in your house, hanging a priceless painting you got from an auction, or simply feeling more secure in your own house.

Source: tgsinsurance.com

Source: tgsinsurance.com

This type of policy gives you a bit more room when it comes to “acceptable perils.” we’ll discuss exactly what counts of a perils in the next section. Think of an ho5 policy like the tesla model x of insurance policies. This means that it covers anything and everything that could damage the physical structure you live in (called the dwelling) and all the stuff you own (called your personal property ), with a few exceptions. This type of policy gives you a bit more room when it comes to “acceptable perils.” we’ll discuss exactly what counts of a perils in the next section. The ho5 insurance policy is an open perils insurance policy.this means that it covers anything and everything that could damage the physical structure you live in (called the dwelling) and all the stuff you own (called your personal property), with a few exceptions.

Source: differencecamp.com

Source: differencecamp.com

An ho5 insurance policy is a type of homeowners insurance policy that provides broader protection and higher coverage limits than the typical options. This term means that your policy covers your house for everything except situations listed explicitly as exclusions (more on that later). It includes four components of. Page 4 of 22 copyright, insurance services office, inc., 1999 ho 00 05 10 00 c. Meaning that all perils, or damages to your property, are covered by insurance.

Source: insuranceproaz.com

Source: insuranceproaz.com

Specific insurance policies cover certain types of disasters. Meaning that all perils, or damages to your property, are covered by insurance. This term means that your policy covers your house for everything except situations listed explicitly as exclusions (more on that later). What is an ho5 homeowners policy? An ho5 policy is also known as a comprehensive form policy and will have the most coverage options available.

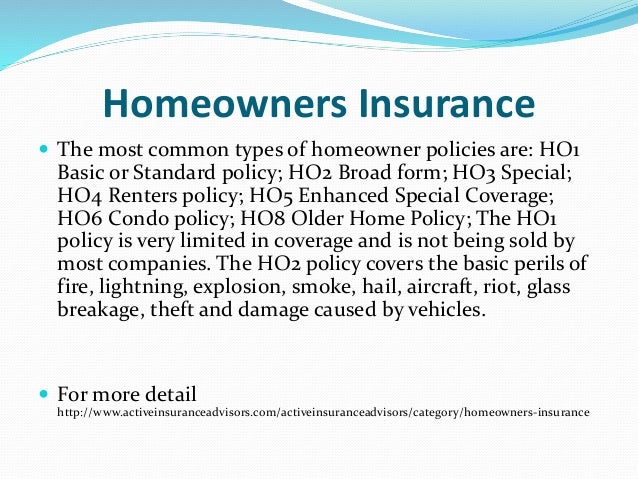

Source: slideshare.net

Source: slideshare.net

$1,500 for loss by theft, misplacing or losing It includes four components of. Until then, just know that ho5 policies give you “more peril coverage under an open peril policy. What is an ho5 policy? This term means that your policy covers your house for everything except situations listed explicitly as exclusions (more on that later).

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title ho5 insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.