Your Ho4 insurance images are ready. Ho4 insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Ho4 insurance files here. Download all royalty-free images.

If you’re looking for ho4 insurance images information related to the ho4 insurance topic, you have come to the right site. Our site always provides you with suggestions for seeking the maximum quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

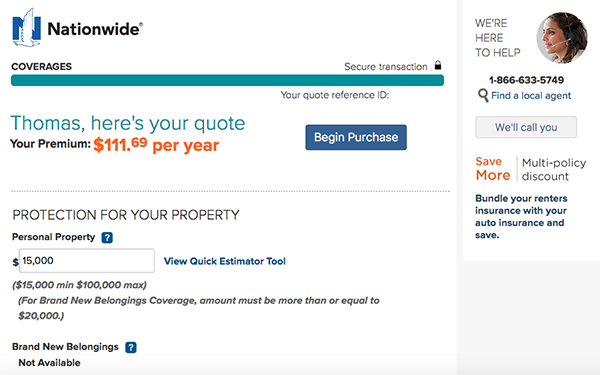

Ho4 Insurance. Anything that belongs to the tenant is covered under a renters insurance policy. Personal property limits from $5,000 to $250,000. Ho4 or renters insurance cover’s your personal property for named perils. An ho4 policy, also called renters insurance, protects a renter’s personal property and addresses their personal liability.

ePremium Renters Insurance Review for 2020 BLOGPAPI From blogpapi.com

ePremium Renters Insurance Review for 2020 BLOGPAPI From blogpapi.com

However, the ho6 policy will cover your interior walls that you own. You select the amount of coverage for your personal property. Medical payments when you’re responsible for a visitor’s injury. Renters insurance will cover damages or losses to your personal belongings and protect you from any liability if anyone is injuried while in your condo or home. The average condo insurance cost nationwide is $625, for $60,000 in personal property coverage, with a $1,000 deductible, and $300,000 in liability. With ho8 policies, ale is often 10% of the policy dwelling coverage limit.

What is the difference between an ho6 (condo) and ho4 (renters) insurance policy?

Similar to the ho3 policy, the ho4 was “created specifically for those who rent the home they live in.” in other words, it’s renter’s insurance. This covers you, the tenants, your belongings, and potential liabilities that may occur while you live in the property. You also have the choice between replacement cost or the actual cash value (acv) at. Instead, the owner of the house or building would have the policy to cover the property. Ho4 or renters insurance cover’s your personal property for named perils. What does an ho4 policy cover?

Source: fapriansyah.blogspot.com

Source: fapriansyah.blogspot.com

Both of these policies work under the named peril guidelines when it comes to filing a claim. The average condo insurance cost nationwide is $625, for $60,000 in personal property coverage, with a $1,000 deductible, and $300,000 in liability. There are two categories of insurance policies; Ale coverage usually is limited to 30% of ho2, ho3 and ho5 dwelling coverage limits. Industry standard ho4 policy form.

Source: lemonade.com

Source: lemonade.com

The ho4 is a named perils policy. There are two categories of insurance policies; Named perils and open perils. Ho4 insurance covers everyday household disasters, such as burglary, burst pipes, and fires. You select the amount of coverage for your personal property.

Source: aegiseasy.com

Source: aegiseasy.com

If you own the condo, you need the ho6. This covers you, the tenants, your belongings, and potential liabilities that may occur while you live in the property. Ho4 policies cost roughly $15 per month, but costs vary based on your coverage needs and policy choices. You also have the choice between replacement cost or the actual cash value (acv) at. The ho6 is similar to the ho3 but designed specifically for condo owners.

Source: slideshare.net

Source: slideshare.net

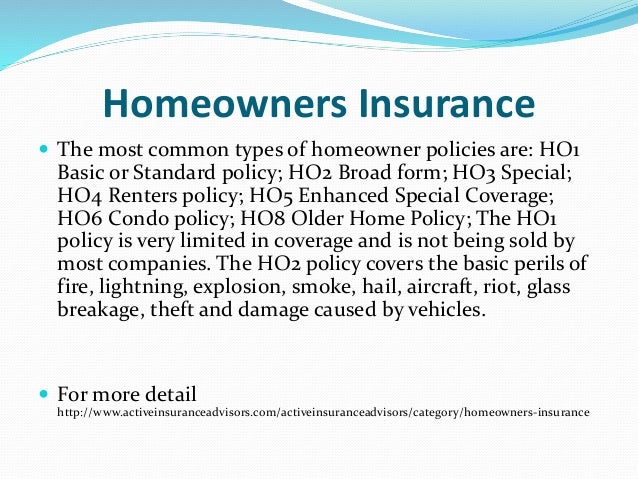

There are two categories of insurance policies; The exact coverage amounts can usually be finessed a little, but ho3 insurance is what most people are talking about when it comes having home insurance. Named perils and open perils. Ho4 insurance, or renters insurance, is financial coverage for 1) damages or losses to your stuff 2) legal fees if you’re sued 3) other’s medical bills if you’re at fault and 4) temp living expenses if your place becomes uninhabitable. However, the ho6 policy will cover your interior walls that you own.

Source: lemonade.com

Source: lemonade.com

The ho6 is similar to the ho3 but designed specifically for condo owners. What does an ho4 policy cover? Ho4 insurance, or renters insurance, is financial coverage for 1) damages or losses to your stuff 2) legal fees if you’re sued 3) other’s medical bills if you’re at fault and 4) temp living expenses if your place becomes uninhabitable. An ho4 will offer coverage for your belongings as well as some personal liability coverage. You select the amount of coverage for your personal property.

Source: reviews.com

Source: reviews.com

Instead, the owner of the house or building would have the policy to cover the property. If you rent a house or an apartment, the landlord’s insurance policy only provides coverage for the structure or property. Ho4 policies usually cover damage caused by these 16 named perils: Instead, the owner of the house or building would have the policy to cover the property. The additional coverage in the ho6 is essential.

Source: tempestadealmaletraseimagens.blogspot.com

Source: tempestadealmaletraseimagens.blogspot.com

Ho4 insurance covers everyday household disasters, such as burglary, burst pipes, and fires. Extreme weather conditions like hurricanes and strong storms are responsible for these high rates.” The ho6 and ho4 both cover your personal property and personal liability, but only the ho6 condo policy has additional coverage a for the interior finishing of the unit. This covers you, the tenants, your belongings, and potential liabilities that may occur while you live in the property. Ho4 insurance covers everyday household disasters, such as burglary, burst pipes, and fires.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Ho4 vs ho6 homeowners policy. Ho4 policies cost roughly $15 per month, but costs vary based on your coverage needs and policy choices. The additional coverage in the ho6 is essential. However, the ho6 policy will cover your interior walls that you own. Ho4 insurance is a named perils policy, which means the coverage steps in when the incidents listed in the policy damage your stuff.

Source: trustedchoice.com

Source: trustedchoice.com

With ho8 policies, ale is often 10% of the policy dwelling coverage limit. If you own the condo, you need the ho6. Ale coverage usually is limited to 30% of ho2, ho3 and ho5 dwelling coverage limits. The average condo insurance cost nationwide is $625, for $60,000 in personal property coverage, with a $1,000 deductible, and $300,000 in liability. The largest difference between the two policies is going to be that an ho4 policy is specifically for a rental and an ho6 policy was created for a condo.

Source: youtube.com

Source: youtube.com

The largest difference between the two policies is going to be that an ho4 policy is specifically for a rental and an ho6 policy was created for a condo. Medical payments when you’re responsible for a visitor’s injury. These numbers correspond to either home, renters, or condo insurance.here is a simple breakdown: You select the amount of coverage for your personal property. Ho4 vs ho6 homeowners policy.

Source: kin.com

Source: kin.com

Ho4 vs ho6 homeowners policy. There are two categories of insurance policies; However, the ho6 policy will cover your interior walls that you own. The largest difference between the two policies is going to be that an ho4 policy is specifically for a rental and an ho6 policy was created for a condo. An ho4 policy, also called renters insurance, protects a renter’s personal property and addresses their personal liability.

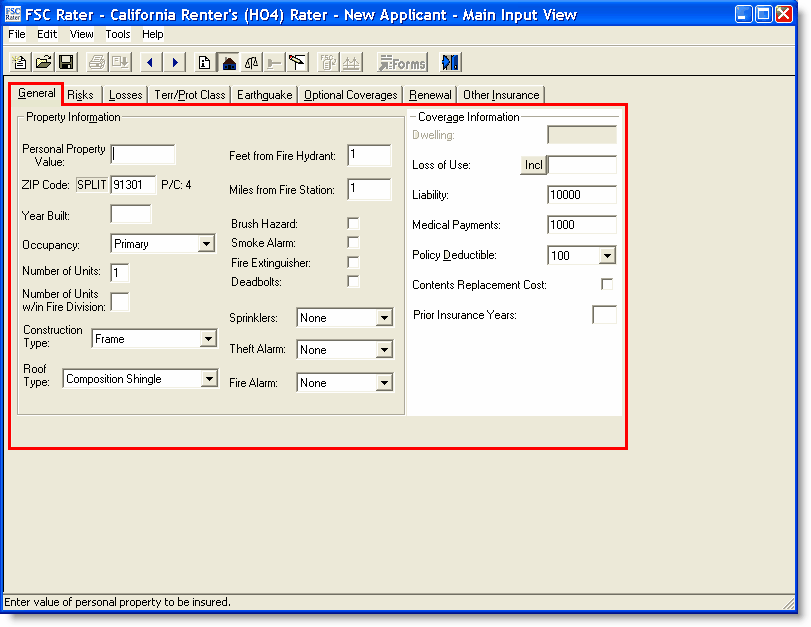

Source: help.vertafore.com

Source: help.vertafore.com

What does an ho4 policy cover? However, the ho6 policy will cover your interior walls that you own. The ho4 is a named perils policy. Deductibles from $500 to $10,000. Ho4 policies usually cover damage caused by these 16 named perils:

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

However, the ho6 policy will cover your interior walls that you own. The ho6 and ho4 both cover your personal property and personal liability, but only the ho6 condo policy has additional coverage a for the interior finishing of the unit. With ho4 coverage, renters can receive 30% of their personal property limit for ale. You also have the choice between replacement cost or the actual cash value (acv) at. Both of these policies work under the named peril guidelines when it comes to filing a claim.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The ho4 is a named perils policy. Instead, the owner of the house or building would have the policy to cover the property. An ho4 does not cover the building structure itself. The ho6 is similar to the ho3 but designed specifically for condo owners. Extreme weather conditions like hurricanes and strong storms are responsible for these high rates.”

Ho4 insurance is a named perils policy, which means the coverage steps in when the incidents listed in the policy damage your stuff. Ho4 vs ho6 homeowners policy. Ho4 insurance covers everyday household disasters, such as burglary, burst pipes, and fires. You also have the choice between replacement cost or the actual cash value (acv) at. However, the ho6 policy will cover your interior walls that you own.

Source: slideshare.net

Source: slideshare.net

Ho4 insurance covers everyday household disasters, such as burglary, burst pipes, and fires. Ho4 or renters insurance cover’s your personal property for named perils. With ho8 policies, ale is often 10% of the policy dwelling coverage limit. With ho4 coverage, renters can receive 30% of their personal property limit for ale. Ho4 policies cost roughly $15 per month, but costs vary based on your coverage needs and policy choices.

Source: blogpapi.com

Source: blogpapi.com

Ho4 insurance is more commonly known as renters insurance.renters insurance is important for the very same reason why homeowners insurance is important. Ho4 insurance is more commonly known as renters insurance.renters insurance is important for the very same reason why homeowners insurance is important. Renters insurance will cover damages or losses to your personal belongings and protect you from any liability if anyone is injuried while in your condo or home. Personal property limits from $5,000 to $250,000. The ho6 is similar to the ho3 but designed specifically for condo owners.

Source: univistainsurance.com

Source: univistainsurance.com

Ho4 insurance covers everyday household disasters, such as burglary, burst pipes, and fires. Ho4 or renters insurance cover’s your personal property for named perils. With ho8 policies, ale is often 10% of the policy dwelling coverage limit. An ho4 does not cover the building structure itself. Named perils and open perils.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title ho4 insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.