Your Ho3 insurance vs ho6 images are available. Ho3 insurance vs ho6 are a topic that is being searched for and liked by netizens today. You can Get the Ho3 insurance vs ho6 files here. Find and Download all royalty-free photos.

If you’re looking for ho3 insurance vs ho6 pictures information related to the ho3 insurance vs ho6 interest, you have visit the ideal site. Our website always provides you with hints for viewing the maximum quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

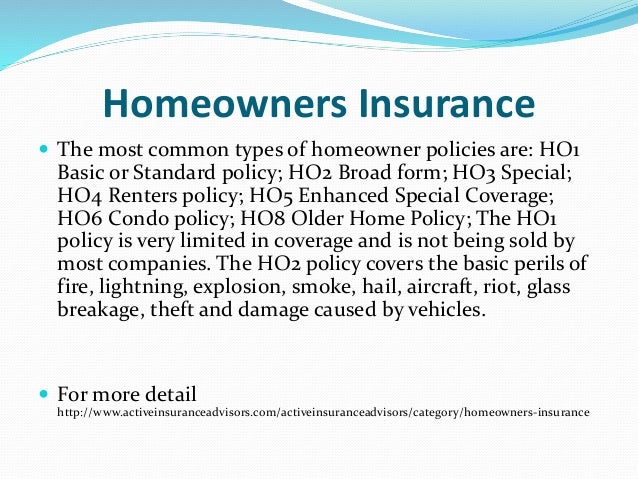

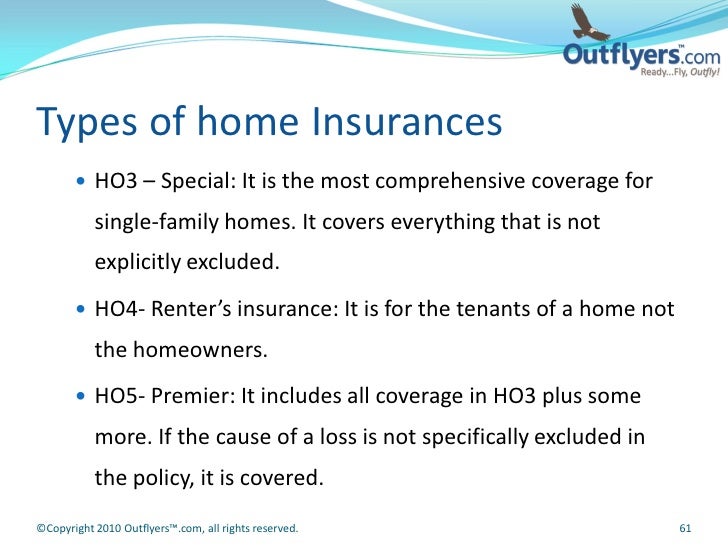

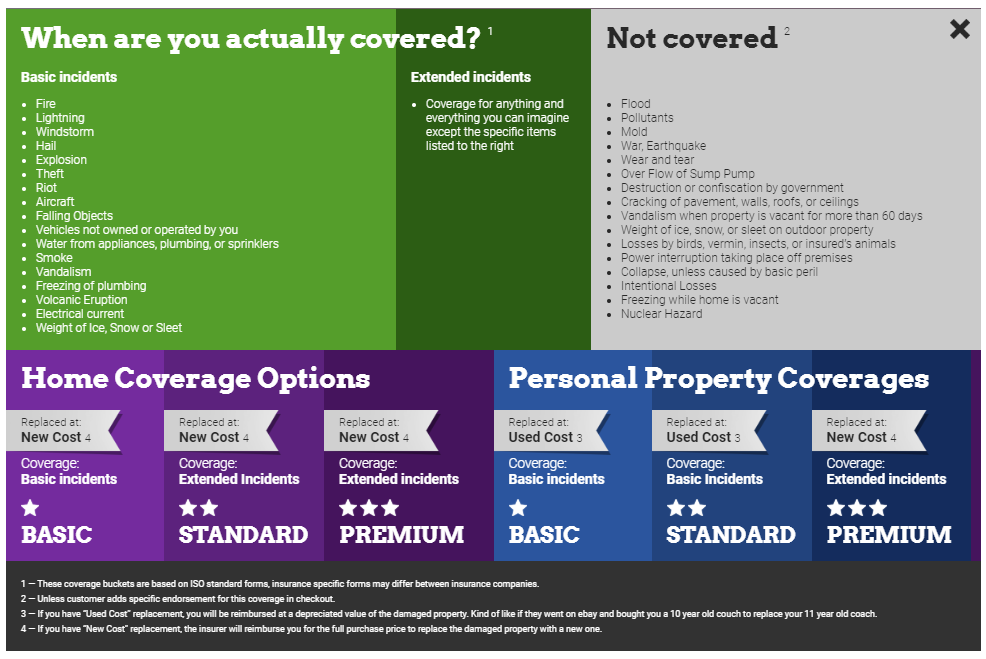

Ho3 Insurance Vs Ho6. The ho3 policy is a mixture of named perils and open perils coverage. That way all roofs could be replaced at once and costs could be split evenly amongst the community. There are eight homeowners insurance forms, starting with ho1 and ending with ho8. And while the ho3 policy is a mixture of a named peril and open peril policy, ho6 policies tend to be fully named peril policies.

What is the difference between a HO8 and HO3 home From youngalfred.com

What is the difference between a HO8 and HO3 home From youngalfred.com

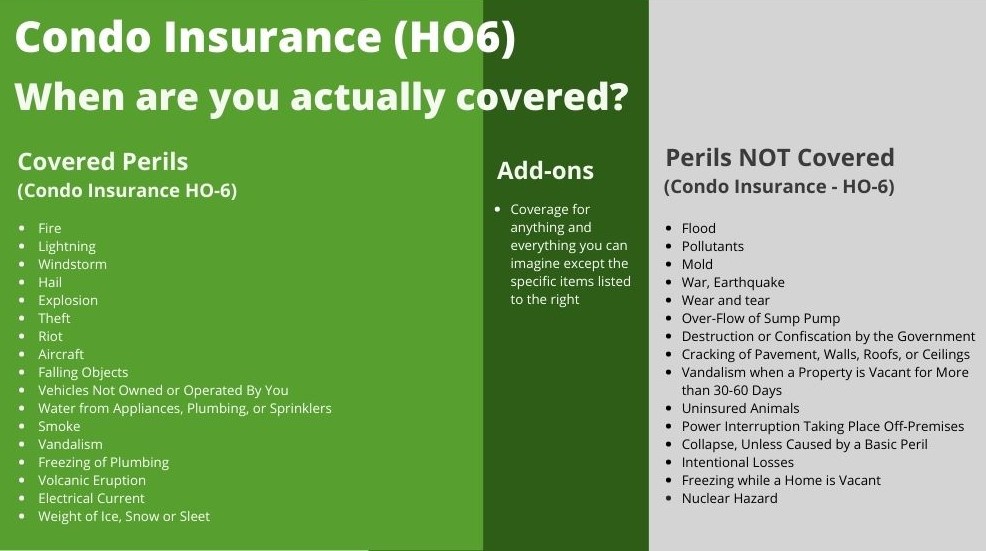

A couple of common forms of homeowners insurance are: And while the ho3 policy is a mixture of a named peril and open peril policy, ho6 policies tend to be fully named peril policies. Also known as condo insurance, this is the perfect choice if you want total protection for your unit. This type of policy traditionally will only cover your personal property, personal liability, your walls, floors, and your ceilings when you live in a condo. Another difference is what portions of the property each policy covers. It is comparable to the ho3 policy, although its coverage for property is less inclusive since it does not cover any of the building structure.

The largest difference between the two policies is going to be that an ho3 policy is specifically for a house and an ho6 policy was created for a condo.

On this publish at the moment, i’ll go over the variations between ho3 and ho6 householders insurance coverage, how they work and […] It is comparable to the ho3 policy, although its coverage for property is less inclusive since it does not cover any of the building structure. It covers the physical structure of your home that also includes attached areas such as garage, porch, parking lot Ho6, ho3, dp3, or dp1). An ho6 policy is just the technical name for condominium insurance and is going to be for a condo owner. A home that is currently being built doesn’t require the same insurance as a finished house, and a condominium requires different coverage than a single family home.

Source: eliquinnett.blogspot.com

Source: eliquinnett.blogspot.com

A couple of common forms of homeowners insurance are: An ho6 policy does not cover the structure or exterior. What is ho3 vs ho6 insurance? However, just like renters insurance, it doesn�t cover the actual structure of the. Ho6 is for owners of condominiums who need personal property and liability coverage.

Source: youngalfred.com

Source: youngalfred.com

That way all roofs could be replaced at once and costs could be split evenly amongst the community. It is comparable to the ho3 policy, although its coverage for property is less inclusive since it does not cover any of the building structure. On this publish at the moment, i’ll go over the variations between ho3 and ho6 householders insurance coverage, how they work and […] And whereas the ho3 coverage is a combination of a named peril and open peril coverage, ho6 insurance policies are typically totally named peril. And while the ho3 policy is a mixture of a named peril and open peril policy, ho6 policies tend to be fully named peril policies.

Source: slideshare.net

Source: slideshare.net

If for some reason, your hoa�s master policy excludes the source of damage and you are holding an ho6 property, you just lost your property. On this publish at the moment, i’ll go over the variations between ho3 and ho6 householders insurance coverage, how they work and […] A couple of common forms of homeowners insurance are: But, it doesn�t have to be because there are only a few types of policies that are actually for your What is ho3 vs ho6 insurance?

Source: slideshare.net

Source: slideshare.net

Insurance coverage for condominiums is typically not required by the government but many condo associations may need you to secure it. However, just like renters insurance, it doesn�t cover the actual structure of the. What is ho3 vs ho6 insurance? The hoa is proposing an amendment to the bylaws for the community, that would shift responsibility for insuring the roofs from the homeowners� private ho3 policy to a new hoa run ho6 policy. The largest difference between the two types of policies are that an ho3 policy is specifically for a house that is owner occupied and an ho6 policy was created for a condo unit owner.

Source: tcsib.com

Source: tcsib.com

An ho6 policy is just the technical name for condominium insurance and is going to be for a condo owner. Ho6, ho3, dp3, or dp1). However, it does not should be as a result of there are just a few varieties of insurance policies which can be truly on your house and studying how they work is not onerous. However, just like renters insurance, it doesn�t cover the actual structure of the. An ho6 policy is just the technical name for condominium insurance and is going to be for a condo owner.

Source: pinterest.com

Source: pinterest.com

Knowing the difference between ho3 and ho5 helps you shop for the ideal level of coverage. The largest difference between the two policies is going to be that an ho3 policy is specifically for a house and an ho6 policy was created for a condo. However, it does not should be as a result of there are just a few varieties of insurance policies which can be truly on your house and studying how they work is not onerous. Different types of homes or levels of completion require different types of homeowners insurance. And while the ho3 policy is a mixture of a named peril and open peril policy, ho6 policies tend to be fully named peril policies.

Source: eliscartaodevisita.blogspot.com

Source: eliscartaodevisita.blogspot.com

Ho3 vs ho6 householders coverage the biggest distinction between the 2 insurance policies goes to be that an ho3 coverage is particularly for a home and an ho6 coverage was created for a apartment. Ho3 vs ho6 householders coverage the biggest distinction between the 2 insurance policies goes to be that an ho3 coverage is particularly for a home and an ho6 coverage was created for a apartment. Ho6, ho3, dp3, or dp1). Second, locate your insurance policy and review the coverage limits for your condo, villa, or townhome and more specifically, the coverage form the policy is placed on (you should see either: Ho6 condo insurance protects your unit and everything it contains, provides.

Source: coverage.com

Source: coverage.com

If for some reason, your hoa�s master policy excludes the source of damage and you are holding an ho6 property, you just lost your property. Most are designed for homes, but ho4 is renters insurance, ho6 is for condos and ho7 is for mobile homes. The largest difference between the two policies is going to be that an ho3 policy is specifically for a house and an ho6 policy was created for a condo. The ho3 policy is a mixture of named perils and open perils coverage. But, it doesn�t have to be because there are only a few types of policies that are actually for your

Source: insurancenewshubb.com

Source: insurancenewshubb.com

Different types of homes or levels of completion require different types of homeowners insurance. Ho6, ho3, dp3, or dp1). As townhomes have many coverage gaps, it is usually in the best interest of the townhome or rowhome owner to get an ho3 policy instead of an ho6 policy. Ho3 vs ho6 homeowners policy. Most are designed for homes, but ho4 is renters insurance, ho6 is for condos and ho7 is for mobile homes.

Source: simplyinsurance.com

Source: simplyinsurance.com

A couple of common forms of homeowners insurance are: Also known as condo insurance, this is the perfect choice if you want total protection for your unit. What is ho3 vs ho6 insurance? The largest difference between the two policies is going to be that an ho3 policy is specifically for a house and an ho6 policy was created for a condo. The hoa is proposing an amendment to the bylaws for the community, that would shift responsibility for insuring the roofs from the homeowners� private ho3 policy to a new hoa run ho6 policy.

Source: investingport.com

Source: investingport.com

An ho6 policy does not cover the structure or exterior. It covers the physical structure of your home that also includes attached areas such as garage, porch, parking lot Different types of homes or levels of completion require different types of homeowners insurance. However, just like renters insurance, it doesn�t cover the actual structure of the. But, it doesn�t have to be because there are only a few types of policies that are actually for your

Source: insurance1health.com

Source: insurance1health.com

The main difference is the type of properties they cover. Dp3 vs ho3 vs ho6. Knowing the difference between ho3 and ho5 helps you shop for the ideal level of coverage. A home that is currently being built doesn’t require the same insurance as a finished house, and a condominium requires different coverage than a single family home. And while the ho3 policy is a mixture of a named peril and open peril policy, ho6 policies tend to be fully named peril policies.

Source: youngalfred.com

Source: youngalfred.com

Another difference is what portions of the property each policy covers. An ho6 policy is just the technical name for condominium insurance and is going to be for a condo owner. The hoa is proposing an amendment to the bylaws for the community, that would shift responsibility for insuring the roofs from the homeowners� private ho3 policy to a new hoa run ho6 policy. A home that is currently being built doesn’t require the same insurance as a finished house, and a condominium requires different coverage than a single family home. An ho6 policy does not cover the structure or exterior.

Source: tgsinsurance.com

Source: tgsinsurance.com

On this publish at the moment, i’ll go over the variations between ho3 and ho6 householders insurance coverage, how they work and […] It is comparable to the ho3 policy, although its coverage for property is less inclusive since it does not cover any of the building structure. Dp3 vs ho3 vs ho6. And whereas the ho3 coverage is a combination of a named peril and open peril coverage, ho6 insurance policies are typically totally named peril. The largest difference between the two types of policies are that an ho3 policy is specifically for a house that is owner occupied and an ho6 policy was created for a condo unit owner.

Source: simplyinsurance.com

Source: simplyinsurance.com

Ho6 is for owners of condominiums who need personal property and liability coverage. This type of policy traditionally will only cover your personal property, personal liability, your walls, floors, and your ceilings when you live in a condo. Also known as condo insurance, this is the perfect choice if you want total protection for your unit. It is comparable to the ho3 policy, although its coverage for property is less inclusive since it does not cover any of the building structure. The ho3 policy is a mixture of named perils and open perils coverage.

Source: tgsinsurance.com

Source: tgsinsurance.com

Most are designed for homes, but ho4 is renters insurance, ho6 is for condos and ho7 is for mobile homes. Ho3 vs ho6 homeowners policy. On this publish at the moment, i’ll go over the variations between ho3 and ho6 householders insurance coverage, how they work and […] And whereas the ho3 coverage is a combination of a named peril and open peril coverage, ho6 insurance policies are typically totally named peril. Insurance coverage for condominiums is typically not required by the government but many condo associations may need you to secure it.

Source: insurance1health.com

Source: insurance1health.com

Ho3 vs ho6 householders coverage the biggest distinction between the 2 insurance policies goes to be that an ho3 coverage is particularly for a home and an ho6 coverage was created for a apartment. Ho6 condo insurance protects your unit and everything it contains, provides. What is ho3 vs ho6 insurance? Second, locate your insurance policy and review the coverage limits for your condo, villa, or townhome and more specifically, the coverage form the policy is placed on (you should see either: Another difference is what portions of the property each policy covers.

Source: youngalfred.com

Source: youngalfred.com

Ho6 is for owners of condominiums who need personal property and liability coverage. It covers the physical structure of your home that also includes attached areas such as garage, porch, parking lot What is ho3 vs ho6 insurance? A couple of common forms of homeowners insurance are: And while the ho3 policy is a mixture of a named peril and open peril policy, ho6 policies tend to be fully named peril policies.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title ho3 insurance vs ho6 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.