Your Ho3 insurance form images are ready in this website. Ho3 insurance form are a topic that is being searched for and liked by netizens today. You can Download the Ho3 insurance form files here. Get all free photos and vectors.

If you’re looking for ho3 insurance form pictures information related to the ho3 insurance form keyword, you have come to the right blog. Our site frequently gives you hints for seeking the maximum quality video and image content, please kindly surf and find more informative video content and graphics that fit your interests.

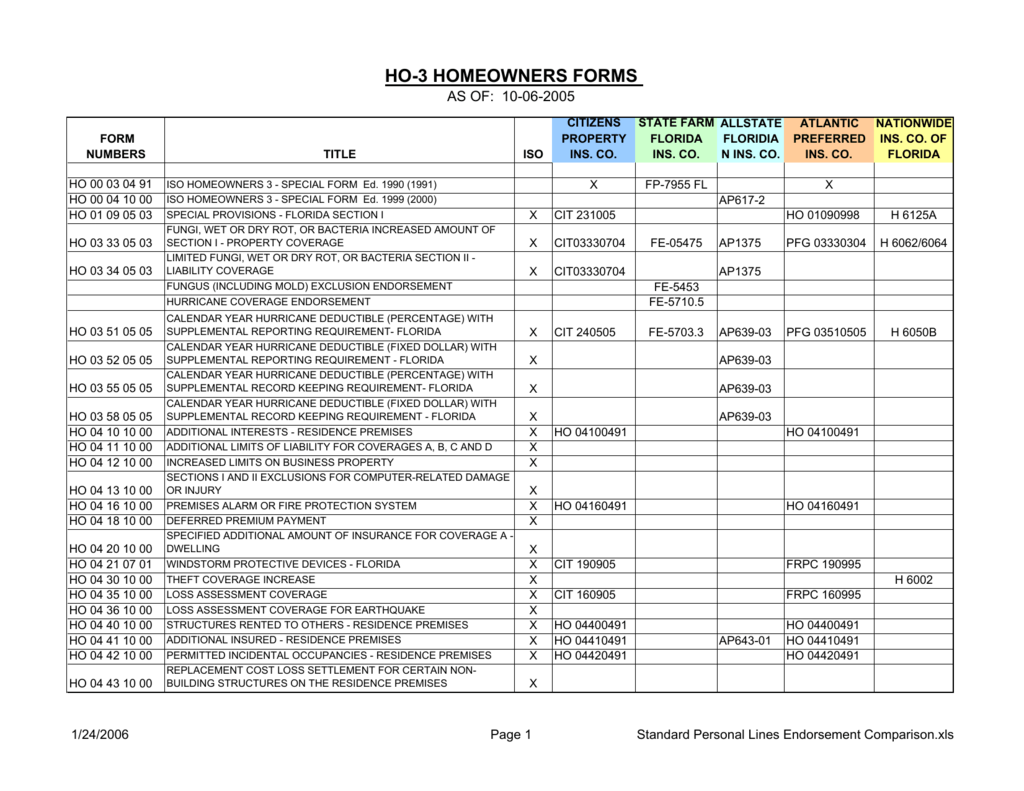

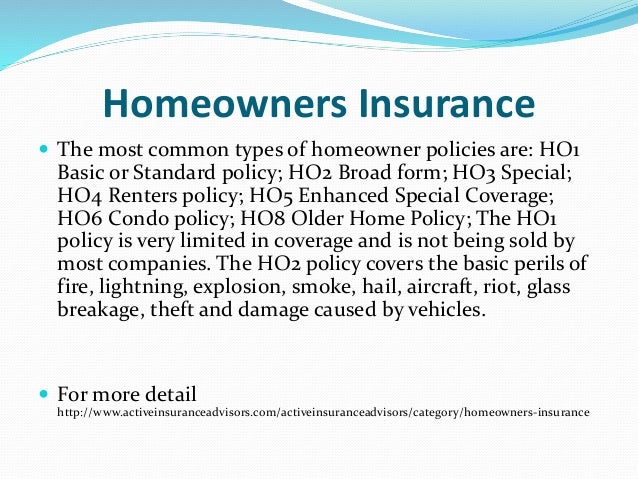

Ho3 Insurance Form. As a homeowner, you have a few choices when it comes to the type of coverage and policy forms you may want. Ho3 vs ho6 homeowners policy. It can also save them from any legal casualties like medical expenses if accidents occur in their houses. Insurance services office, inc., 1999 ho 00 03 10 00 c.

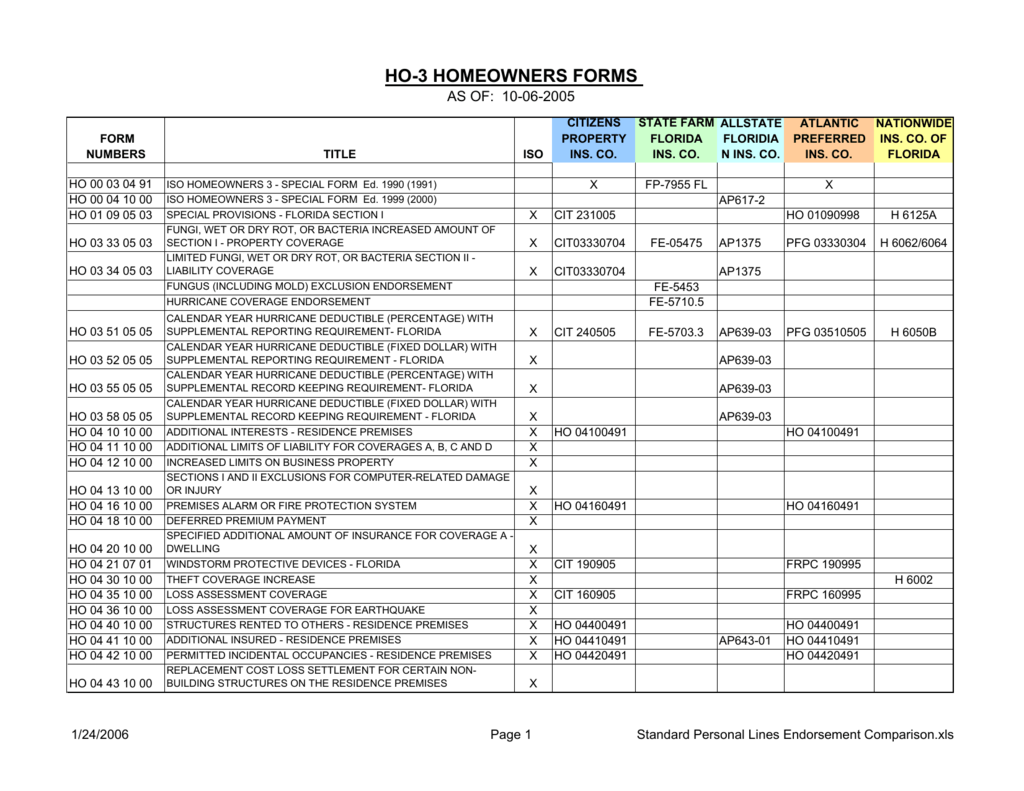

ho3 homeowners forms From studylib.net

ho3 homeowners forms From studylib.net

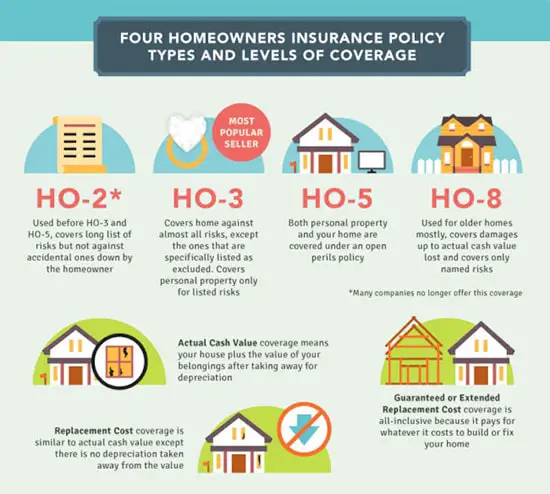

These forms standardize coverage from insurance company to insurance company. It can also save them from any legal casualties like medical expenses if accidents occur in their houses. Generally, homeowners insurance is higher than landlord insurance. Assuming that you qualify for both forms, the ho5 is the form of choice. Most are designed for homes, but ho4 is renters insurance, ho6 is for condos and ho7 is for mobile homes. Ho4 similar to the ho3 policy, the ho4 was “ created specifically for those who rent the home they live in.

Sometimes noted as a “special form” policy, it is.

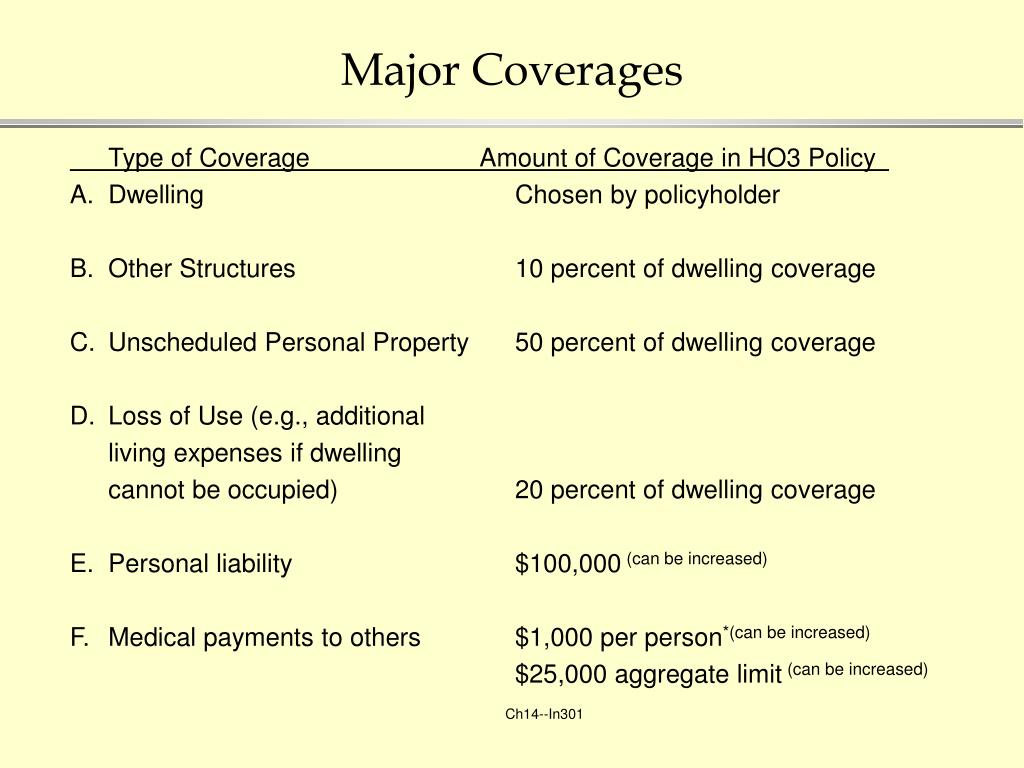

Ho3 vs ho6 homeowners policy. These forms standardize coverage from insurance company to insurance company. The ho5 not only provides broader coverage, but can also simplify the claims process. Insurance services office, inc., 1999 ho 00 03 10 00 c. Ho3 protects your home but also additional structures, you and your family from liability/medical costs, and your possessions. Includes copyrighted material of insurance services office, inc., with its permission page 1 of 26.

Source: homeownerinsurancekamimodo.blogspot.com

Source: homeownerinsurancekamimodo.blogspot.com

While the initial price tag of the ho5 may be higher than the ho3, the. Ho3 insurance will also cover you if someone gets injured on your property and it’s your fault, or you or anyone listed on your policy accidentally damages someone else’s property or stuff. Most are designed for homes, but ho4 is renters insurance, ho6 is for condos and ho7 is for mobile homes. Get unbiased insurance education from licensed experts and also avoid dodgy sales calls. Contents (personal property) are covered on a named perils basis.

Source: thejudgereport827.web.fc2.com

Source: thejudgereport827.web.fc2.com

The exact coverage amounts can usually be finessed a little, but ho3 insurance is what most people are talking about when it comes having home insurance. Special form (ho3) policy is the most common homeowners insurance policy form. Most are designed for homes, but ho4 is renters insurance, ho6 is for condos and ho7 is for mobile homes. The largest difference between the two policies is going to be that an ho3 policy is specifically for a house and an ho6 policy was created for a condo. $1,500 on watercraft of all types, including their trailers, furnishings, equipment and

Source: tcsib.com

Source: tcsib.com

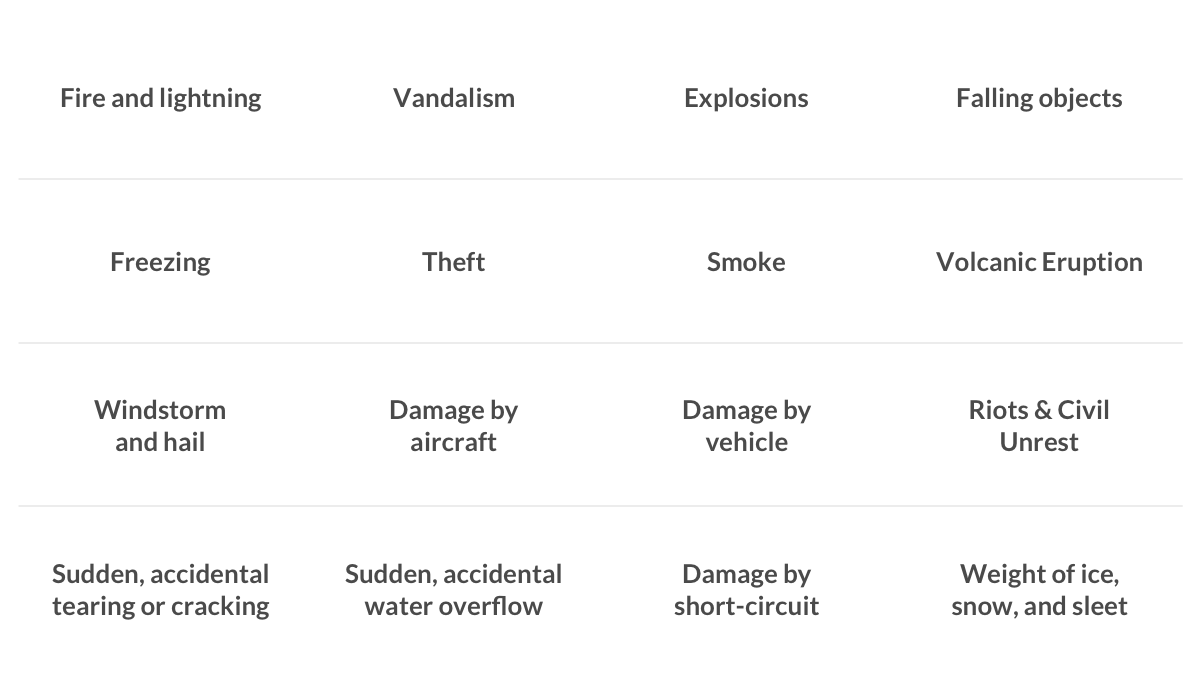

Ho3 policies typically pay for: Policy and a named perils policy. What is an ho3 homeowners policy. You can get home insurance coverage within minutes of getting your quotes and applying. Sometimes noted as a “special form” policy, it is.

Source: insurancediaries.com

Source: insurancediaries.com

With its permission copyright, insurance services office, inc., 1999 3. The largest difference between the two policies is going to be that an ho3 policy is specifically for a house and an ho6 policy was created for a condo. Ho3 insurance will also cover you if someone gets injured on your property and it’s your fault, or you or anyone listed on your policy accidentally damages someone else’s property or stuff. Is covered on an open perils basis and your. Be careful if you are offered an ho8 policy for your homeowners insurance.

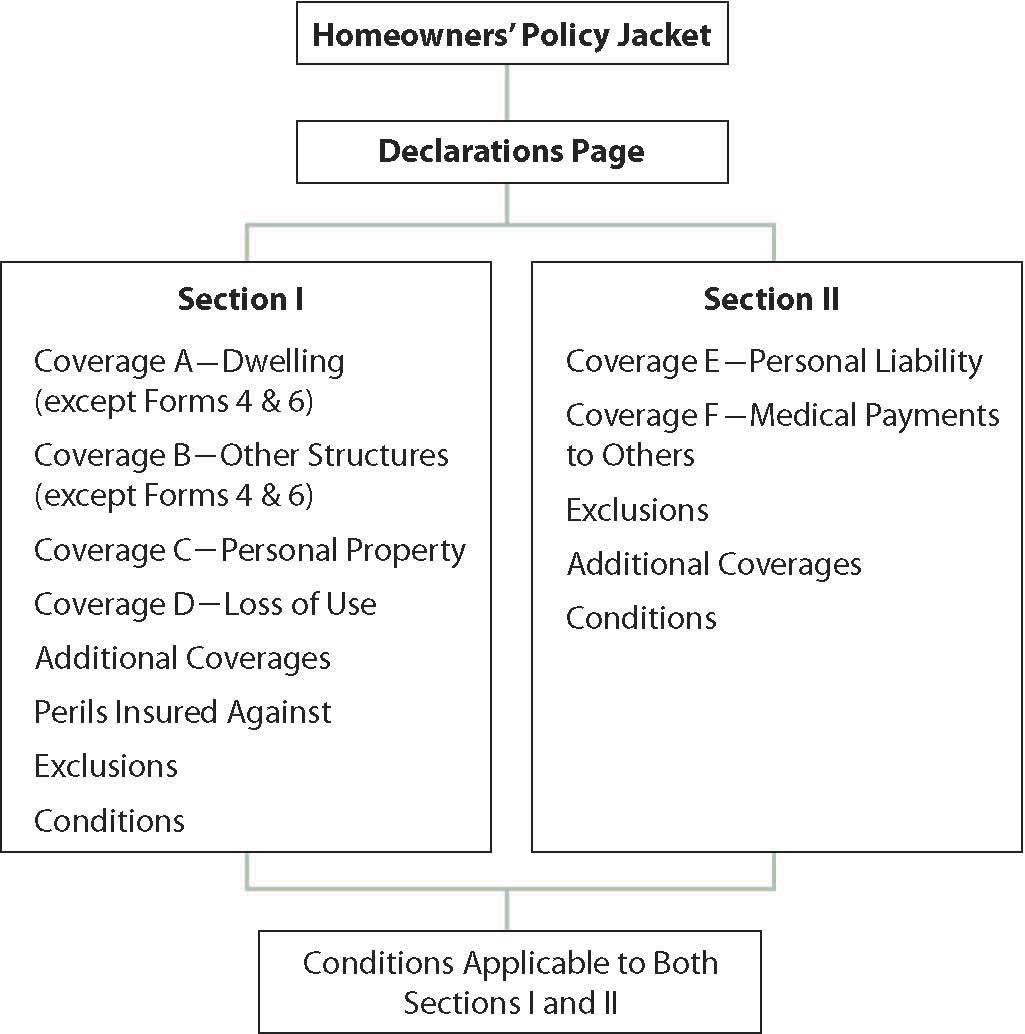

Source: saylordotorg.github.io

Source: saylordotorg.github.io

Ho3 insurance will also cover you if someone gets injured on your property and it’s your fault, or you or anyone listed on your policy accidentally damages someone else’s property or stuff. However, coverage for personal property is on a named perils basis. Assuming that you qualify for both forms, the ho5 is the form of choice. $1,500 on watercraft of all types, including their trailers, furnishings, equipment and It can also save them from any legal casualties like medical expenses if accidents occur in their houses.

Source: blog.thimmeschkastner.com

Source: blog.thimmeschkastner.com

As a homeowner, you have a few choices when it comes to the type of coverage and policy forms you may want. Ho3 policies typically pay for: You can get home insurance coverage within minutes of getting your quotes and applying. $1,500 on watercraft of all types, including their trailers, furnishings, equipment and This policy protects homeowners from unexpected damage to the house, other structures, and personal properties from disasters.

Source: quora.com

Be careful if you are offered an ho8 policy for your homeowners insurance. An ho3 form is written on an open perils basis (i.e., a loss is covered unless its cause is specifically excluded) for dwelling and other structures. Both home insurance types offer cover for all perils, except the listed exclusions detailed in the policy. It can also save them from any legal casualties like medical expenses if accidents occur in their houses. You can get home insurance coverage within minutes of getting your quotes and applying.

Source: quora.com

Be careful if you are offered an ho8 policy for your homeowners insurance. Which form your agent uses for your home depends largely on how much coverage you need. Homeowners policy special form 3 (ho 3) — part of the insurance services office, inc. Ho5 usually excludes losses caused by: While the initial price tag of the ho5 may be higher than the ho3, the.

Source: slideserve.com

Source: slideserve.com

The ho8 has two significant differences from its more mature brother, the ho3: This policy protects homeowners from unexpected damage to the house, other structures, and personal properties from disasters. Insurance services office, inc., 1999 ho 00 03 10 00 c. While the initial price tag of the ho5 may be higher than the ho3, the. As a homeowner, you have a few choices when it comes to the type of coverage and policy forms you may want.

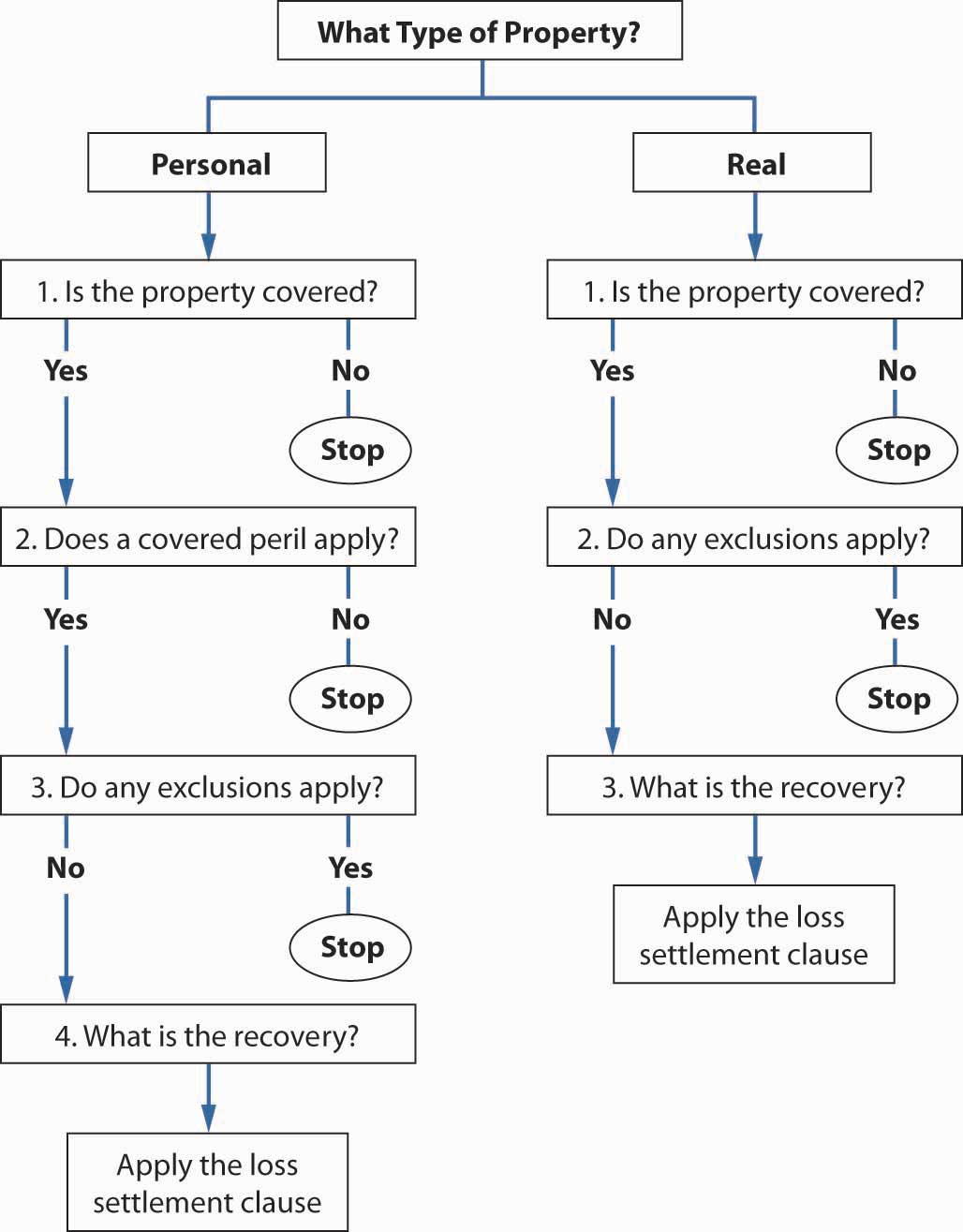

Source: form—-0.blogspot.com

However, coverage for personal property is on a named perils basis. The ho3 insurance policy is a hybrid policy the ho3 insurance policy is a hybrid of an open perils. An open perils policy does not specifically list the perilsyour home. Ho5 usually excludes losses caused by: This policy protects homeowners from unexpected damage to the house, other structures, and personal properties from disasters.

Source: slideshare.net

Source: slideshare.net

The ho8 has two significant differences from its more mature brother, the ho3: Sometimes noted as a “special form” policy, it is. This type of coverage is called ‘ personal liability ’ coverage, and it appears on most homeowners and renters policies. That the statements in the application(s) are your representations; These forms standardize coverage from insurance company to insurance company.

Source: form—-0.blogspot.com

Ho5 usually excludes losses caused by: Sometimes noted as a “special form” policy, it is. The exact coverage amounts can usually be finessed a little, but ho3 insurance is what most people are talking about when it comes having home insurance. Knowing the difference between ho3 and ho5 helps you shop for the ideal level of coverage. Assuming that you qualify for both forms, the ho5 is the form of choice.

Source: studylib.net

Source: studylib.net

With its permission copyright, insurance services office, inc., 1999 3. What is an ho3 homeowners policy. Ho3 vs ho6 homeowners policy. An open perils policy does not specifically list the perilsyour home. An ho3 form is written on an open perils basis (i.e., a loss is covered unless its cause is specifically excluded) for dwelling and other structures.

Source: youtube.com

Source: youtube.com

However, coverage for personal property is on a named perils basis. However, coverage for personal property is on a named perils basis. A couple of common forms of homeowners insurance are: Both home insurance types offer cover for all perils, except the listed exclusions detailed in the policy. As a homeowner, you have a few choices when it comes to the type of coverage and policy forms you may want.

Source: homeownersinsurancecover.net

Source: homeownersinsurancecover.net

An ho3 form is written on an open perils basis (i.e., a loss is covered unless its cause is specifically excluded) for dwelling and other structures. $1,500 on watercraft of all types, including their trailers, furnishings, equipment and Contents (personal property) are covered on a named perils basis. Ho3 policies typically pay for: Ho 00 03 10 00 includes copyrighted material of insurance services office, inc.

Source: tgsinsurance.com

Source: tgsinsurance.com

Ho3 protects your home but also additional structures, you and your family from liability/medical costs, and your possessions. Policy and a named perils policy. An open perils policy does not specifically list the perilsyour home. Insurance services office, inc., 1999 ho 00 03 10 00 c. $1,500 on watercraft of all types, including their trailers, furnishings, equipment and

Source: slideshare.net

Source: slideshare.net

While the initial price tag of the ho5 may be higher than the ho3, the. The exact coverage amounts can usually be finessed a little, but ho3 insurance is what most people are talking about when it comes having home insurance. What is an ho3 homeowners policy. Assuming that you qualify for both forms, the ho5 is the form of choice. Ho3 policies typically pay for:

Source: lemonade.com

Source: lemonade.com

As a homeowner, you have a few choices when it comes to the type of coverage and policy forms you may want. There are eight homeowners insurance forms, starting with ho1 and ending with ho8. This type of coverage is called ‘ personal liability ’ coverage, and it appears on most homeowners and renters policies. The largest difference between the two policies is going to be that an ho3 policy is specifically for a house and an ho6 policy was created for a condo. This policy protects homeowners from unexpected damage to the house, other structures, and personal properties from disasters.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title ho3 insurance form by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.