Your Ho 4 insurance policy images are ready in this website. Ho 4 insurance policy are a topic that is being searched for and liked by netizens today. You can Download the Ho 4 insurance policy files here. Get all royalty-free photos.

If you’re looking for ho 4 insurance policy images information connected with to the ho 4 insurance policy keyword, you have visit the ideal blog. Our site always gives you suggestions for viewing the maximum quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

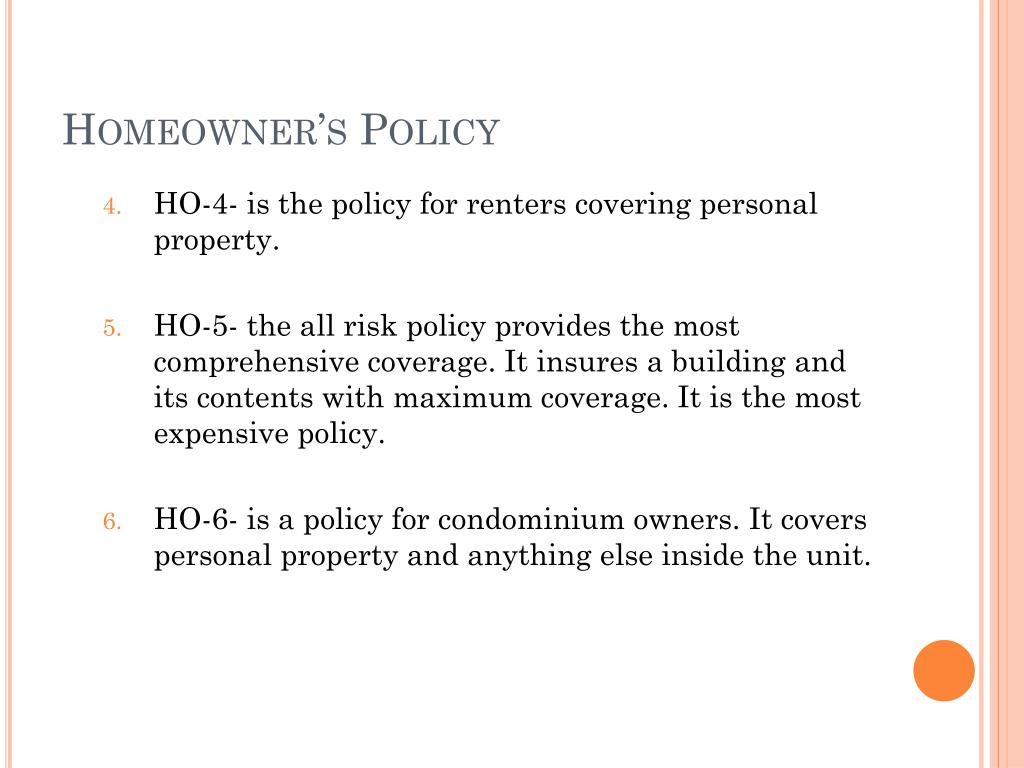

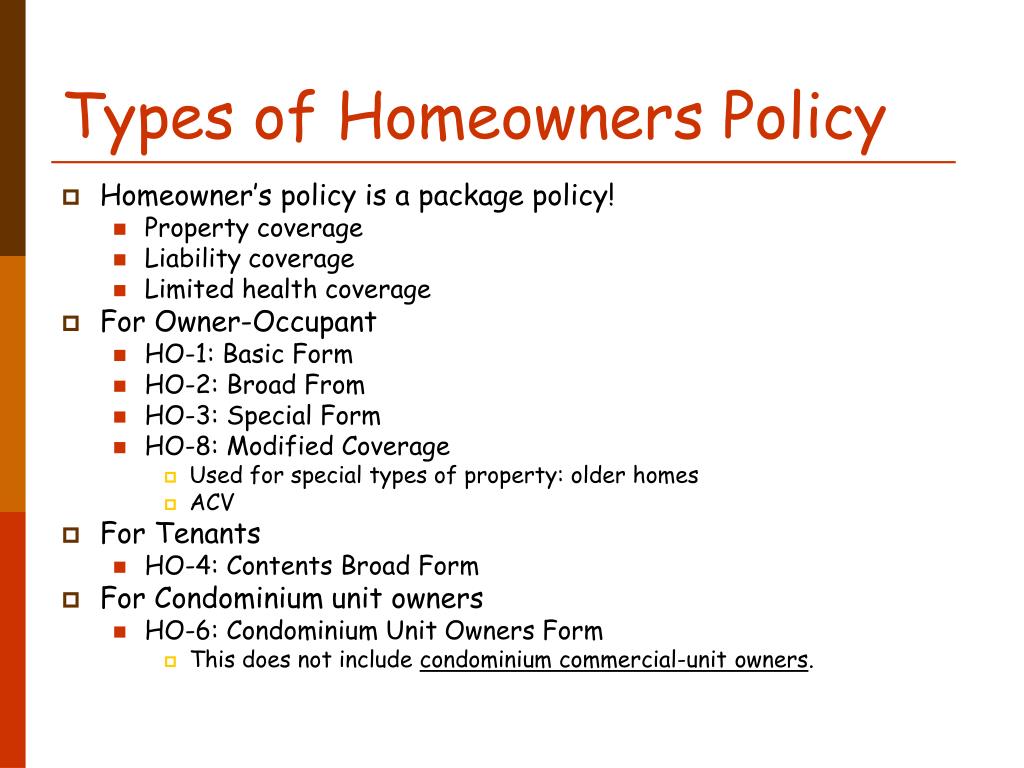

Ho 4 Insurance Policy. This policy does not cover the house or apartment that is being rented as that would be covered on the landlords policy. Ho4 insurance is a named perils policy, which means the coverage steps in when the incidents listed in the policy damage your stuff. The ho4 insurance policy is most commonly referred to as renters insurance. What is the difference between an ho6 (condo) and ho4 (renters) insurance policy?

What is an HO4 insurance policy? From coverage.com

What is an HO4 insurance policy? From coverage.com

If you own the condo, you need the ho6. What does an ho4 policy cover? When you rent, you’re leasing the use of the space. Named perils and open perils. The renters policy will provide for coverage for personal property held within the dwelling. Also known as tenants insurance or an ho 4 policy, it covers personal property losses similar to those insured by homeowners insurance, like fire and theft, but does not cover the building itself.

The reason for this is fairly obvious.

A rental policy will cover a renters personal property, personal liability, and some of them will cover loss of use. Subject to the policy limits that apply, we will pay only that part of the total of all loss payable under section i that exceeds the deductible amount shown in the Named perils and open perils. A policy type that is specifically for renters. A rental policy will cover a renters personal property, personal liability, and some of them will cover loss of use. However, not all homeowners insurance policies are created equal, so it’s best to shop around and read carefully to find a policy that will best fit your needs.

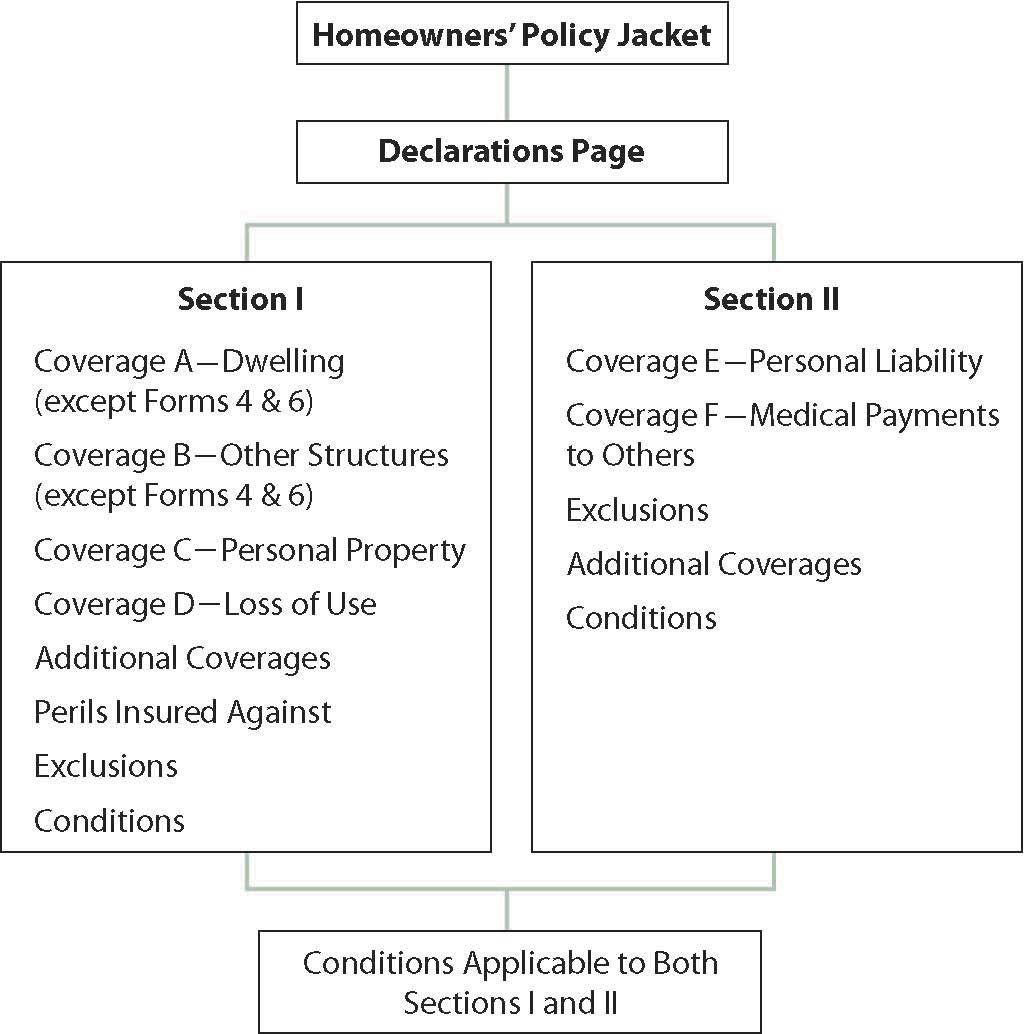

Source: saylordotorg.github.io

Source: saylordotorg.github.io

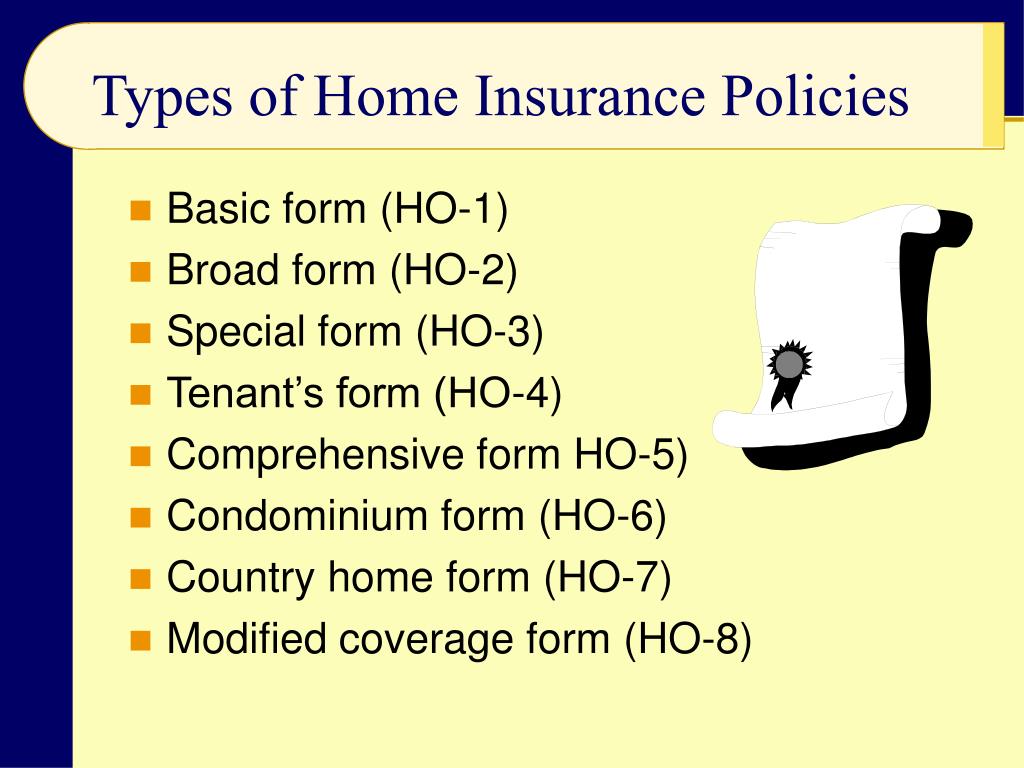

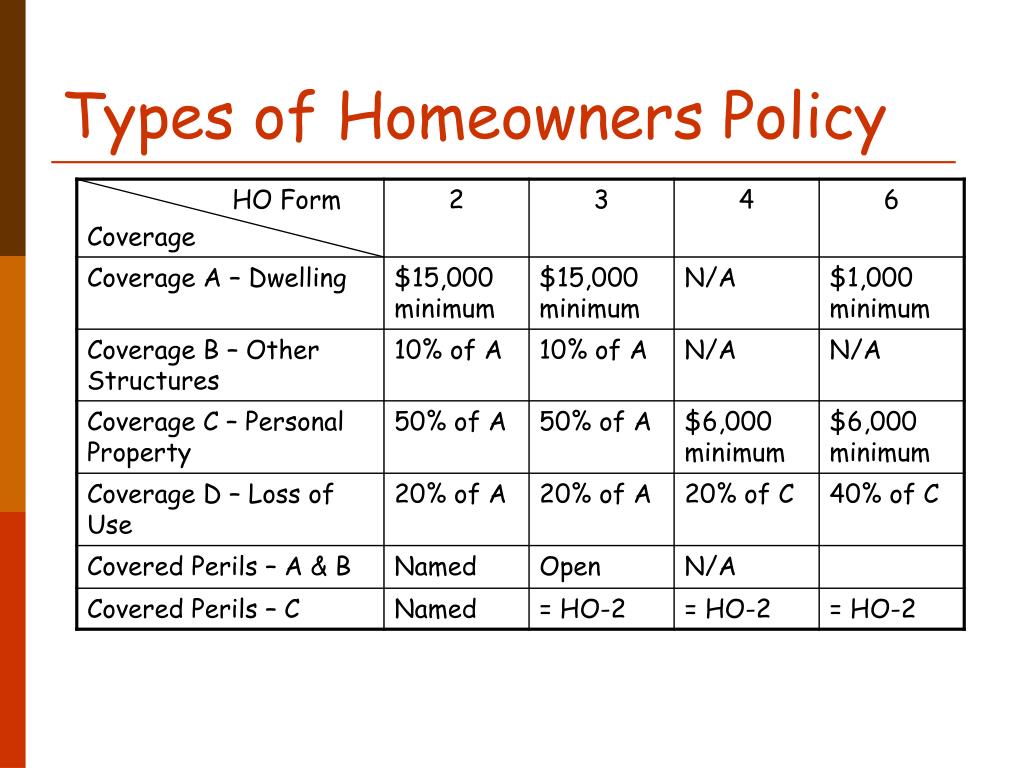

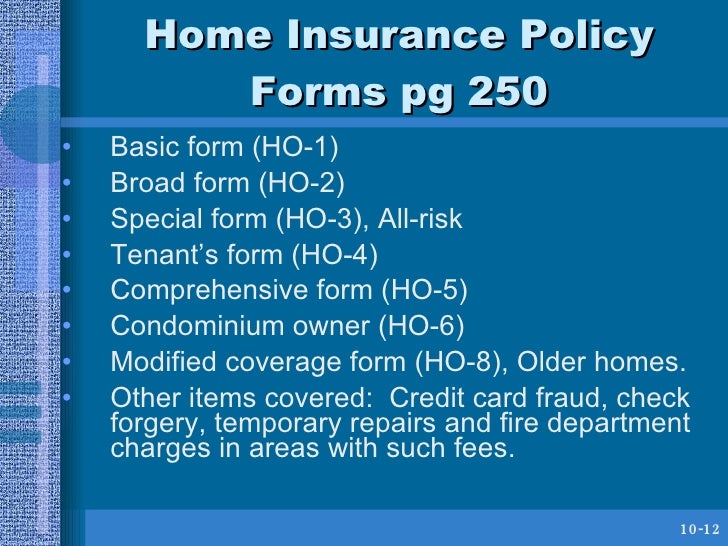

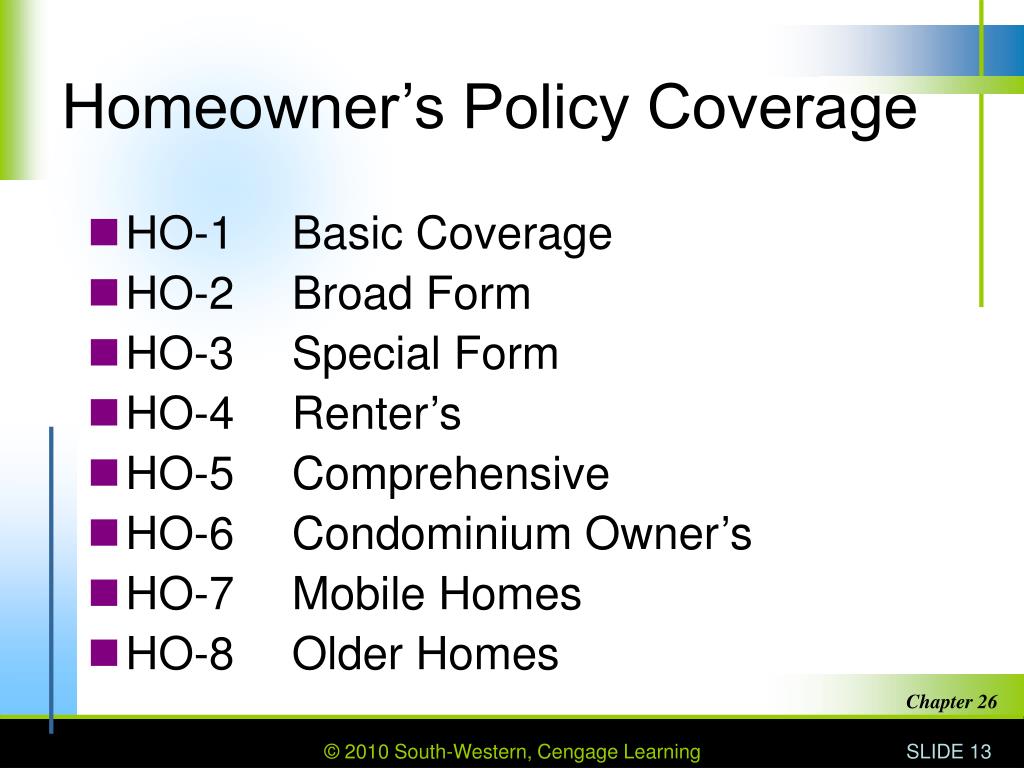

The different types of home insurance are: The ho4 insurance policy is most commonly referred to as renters insurance. Ho4 insurance, or renters insurance, is financial coverage for 1) damages or losses to your stuff 2) legal fees if you’re sued 3) other’s medical bills if you’re at fault and 4) temp living expenses if your place becomes uninhabitable. If you own the condo, you need the ho6. This policy was created to protect a renters personal property and their personal liability and some of them will cover loss of use.

Source: securesupport.citizensfla.com

Renters insurance is a type of policy that provides coverage for your personal belongings and. The reason for this is fairly obvious. When you rent, you’re leasing the use of the space. This is an ideal policy for someone renting an apartment or house. Renters insurance is a type of policy that provides coverage for your personal belongings and.

Source: coverage.com

Source: coverage.com

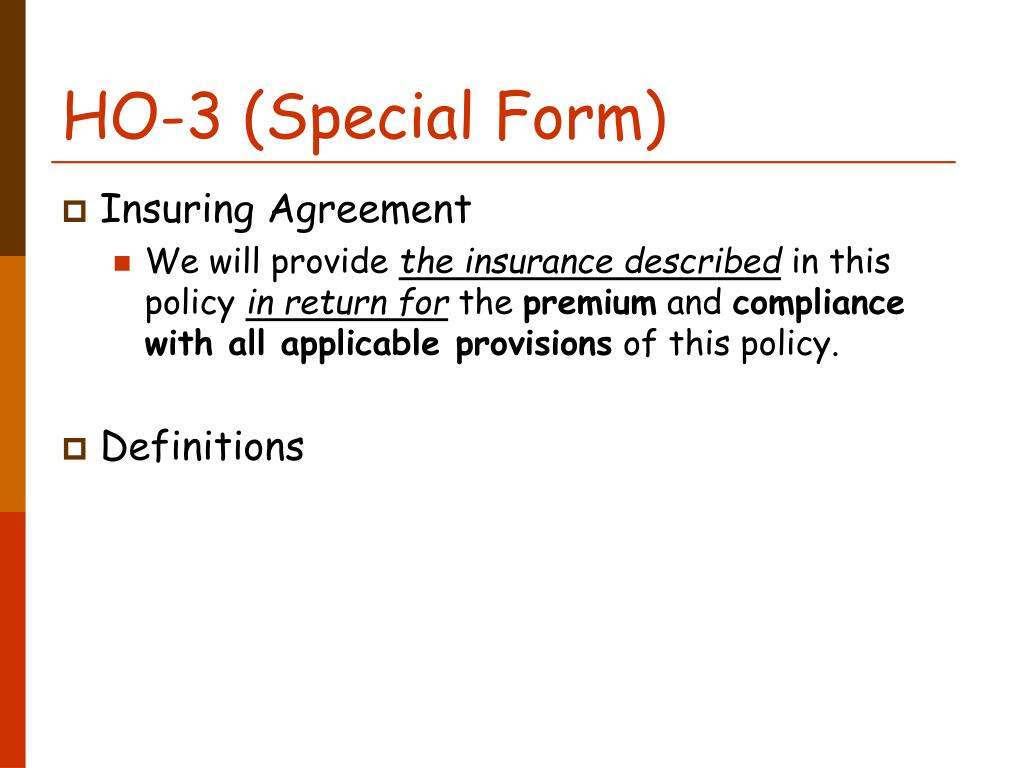

The term “peril” refers to the type of force or incident that causes a loss. Ho4 insurance, or renters insurance, is financial coverage for 1) damages or losses to your stuff 2) legal fees if you’re sued 3) other’s medical bills if you’re at fault and 4) temp living expenses if your place becomes uninhabitable. Also known as tenants insurance or an ho 4 policy, it covers personal property losses similar to those insured by homeowners insurance, like fire and theft, but does not cover the building itself. Subject to the policy limits that apply, we will pay only that part of the total of all loss payable under section i that exceeds the deductible amount shown in the What is the difference between an ho6 (condo) and ho4 (renters) insurance policy?

Source: slideshare.net

Source: slideshare.net

The additional coverage in the ho6 is essential. Your renters insurance provides for loss of use coverage if a covered. A rental policy will cover a renters personal property, personal liability, and some of them will cover loss of use. What does an ho4 policy cover? The different types of home insurance are:

Source: chegg.com

Source: chegg.com

This is an ideal policy for someone renting an apartment or house. For instance, there are policies available for unique living situations. Named perils and open perils. The reason for this is fairly obvious. The term “peril” refers to the type of force or incident that causes a loss.

Source: slideserve.com

Source: slideserve.com

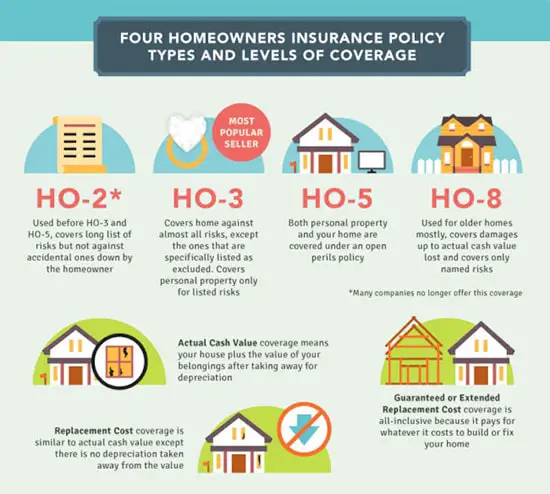

The exact coverage amounts can usually be finessed a little, but ho3 insurance is what most people are talking about when it comes having home insurance. There are two categories of insurance policies; The different types of home insurance are: Ho4 insurance, or renters insurance, is financial coverage for 1) damages or losses to your stuff 2) legal fees if you’re sued 3) other’s medical bills if you’re at fault and 4) temp living expenses if your place becomes uninhabitable. Renters insurance is a type of policy that provides coverage for your personal belongings and.

Source: clovered.com

Source: clovered.com

The renter�s landlord would need a separate landlord insurance policy to help protect the structure of the rental property. A policy type that is specifically for renters. For instance, there are policies available for unique living situations. The exact coverage amounts can usually be finessed a little, but ho3 insurance is what most people are talking about when it comes having home insurance. The renters policy will provide for coverage for personal property held within the dwelling.

Source: quoteble.com

Source: quoteble.com

A policy type that is specifically for renters. This policy does not cover the house or apartment that is being rented as that would be covered on the landlords policy. However, not all homeowners insurance policies are created equal, so it’s best to shop around and read carefully to find a policy that will best fit your needs. The term “peril” refers to the type of force or incident that causes a loss. The additional coverage in the ho6 is essential.

Source: slideserve.com

Source: slideserve.com

The additional coverage in the ho6 is essential. Named perils and open perils. You have no insurable interest in the structure. The renter�s landlord would need a separate landlord insurance policy to help protect the structure of the rental property. There are two categories of insurance policies;

Source: slideshare.net

Source: slideshare.net

When you rent, you’re leasing the use of the space. Renters insurance is a type of policy that provides coverage for your personal belongings and. Typically with these policies, your liability and your personal property are covered up to the policy limits. Ho4 policies usually cover damage caused by these 16 named perils: For instance, there are policies available for unique living situations.

Source: slideserve.com

Source: slideserve.com

Named perils and open perils. Types of homeowners insurance this guide goes into the six types of homeowners insurance policies you can purchase for your home. Similar to homeowners insurance, renters insurance covers the contents of the home, apartment, or a condo the tenant rents but does not own. The ho4 is a named perils policy. The different types of home insurance are:

Source: slideserve.com

Source: slideserve.com

The renters policy will provide for coverage for personal property held within the dwelling. The different types of home insurance are: The ho4 is a named perils policy. This is an ideal policy for someone renting an apartment or house. A rental policy will cover a renters personal property, personal liability, and some of them will cover loss of use.

Source: homeownersinsurancecover.net

Source: homeownersinsurancecover.net

This policy does not cover the house or apartment that is being rented as that would be covered on the landlords policy. A rental policy will cover a renters personal property, personal liability, and some of them will cover loss of use. The different types of home insurance are: This is known as the standard homeowners insurance policy, which we will discuss further in detail below. The renters policy will provide for coverage for personal property held within the dwelling.

Source: slideshare.net

Source: slideshare.net

The reason for this is fairly obvious. This is known as the standard homeowners insurance policy, which we will discuss further in detail below. When you rent, you’re leasing the use of the space. What is the difference between an ho6 (condo) and ho4 (renters) insurance policy? Subject to the policy limits that apply, we will pay only that part of the total of all loss payable under section i that exceeds the deductible amount shown in the

Source: slideserve.com

Source: slideserve.com

A rental policy will cover a renters personal property, personal liability, and some of them will cover loss of use. Typically with these policies, your liability and your personal property are covered up to the policy limits. When you rent, you’re leasing the use of the space. Also known as tenants insurance or an ho 4 policy, it covers personal property losses similar to those insured by homeowners insurance, like fire and theft, but does not cover the building itself. The different types of home insurance are:

Source: slideserve.com

Source: slideserve.com

When you rent, you’re leasing the use of the space. You have no insurable interest in the structure. A policy type that is specifically for renters. If you own the condo, you need the ho6. The ho4 is a named perils policy.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

The renter�s landlord would need a separate landlord insurance policy to help protect the structure of the rental property. Ho4 insurance, or renters insurance, is financial coverage for 1) damages or losses to your stuff 2) legal fees if you’re sued 3) other’s medical bills if you’re at fault and 4) temp living expenses if your place becomes uninhabitable. However, not all homeowners insurance policies are created equal, so it’s best to shop around and read carefully to find a policy that will best fit your needs. A rental policy will cover a renters personal property, personal liability, and some of them will cover loss of use. The renter�s landlord would need a separate landlord insurance policy to help protect the structure of the rental property.

Source: blog.theswca.com

Source: blog.theswca.com

Types of homeowners insurance this guide goes into the six types of homeowners insurance policies you can purchase for your home. What does an ho4 policy cover? Your renters insurance provides for loss of use coverage if a covered. The renter�s landlord would need a separate landlord insurance policy to help protect the structure of the rental property. Similar to homeowners insurance, renters insurance covers the contents of the home, apartment, or a condo the tenant rents but does not own.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title ho 4 insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.