Your Hmrc national insurance rates images are available in this site. Hmrc national insurance rates are a topic that is being searched for and liked by netizens now. You can Get the Hmrc national insurance rates files here. Find and Download all free vectors.

If you’re looking for hmrc national insurance rates pictures information related to the hmrc national insurance rates topic, you have pay a visit to the right blog. Our website frequently provides you with hints for seeing the highest quality video and picture content, please kindly search and locate more informative video content and images that match your interests.

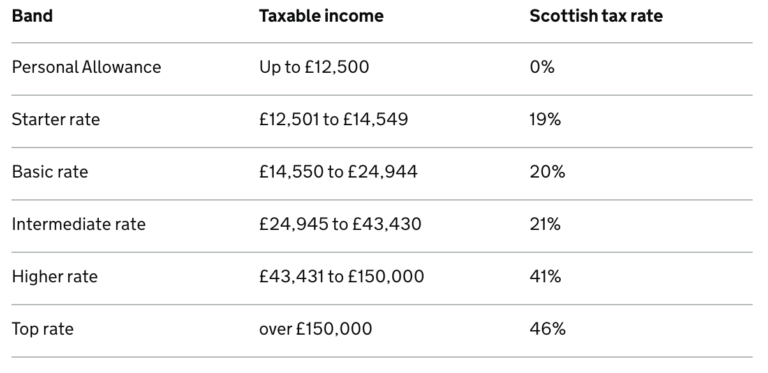

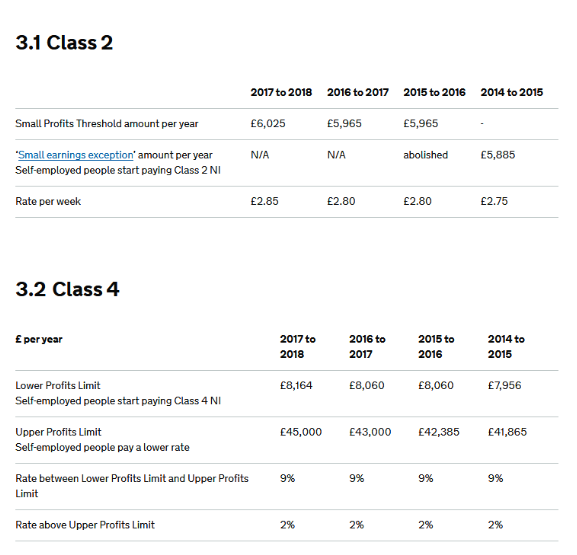

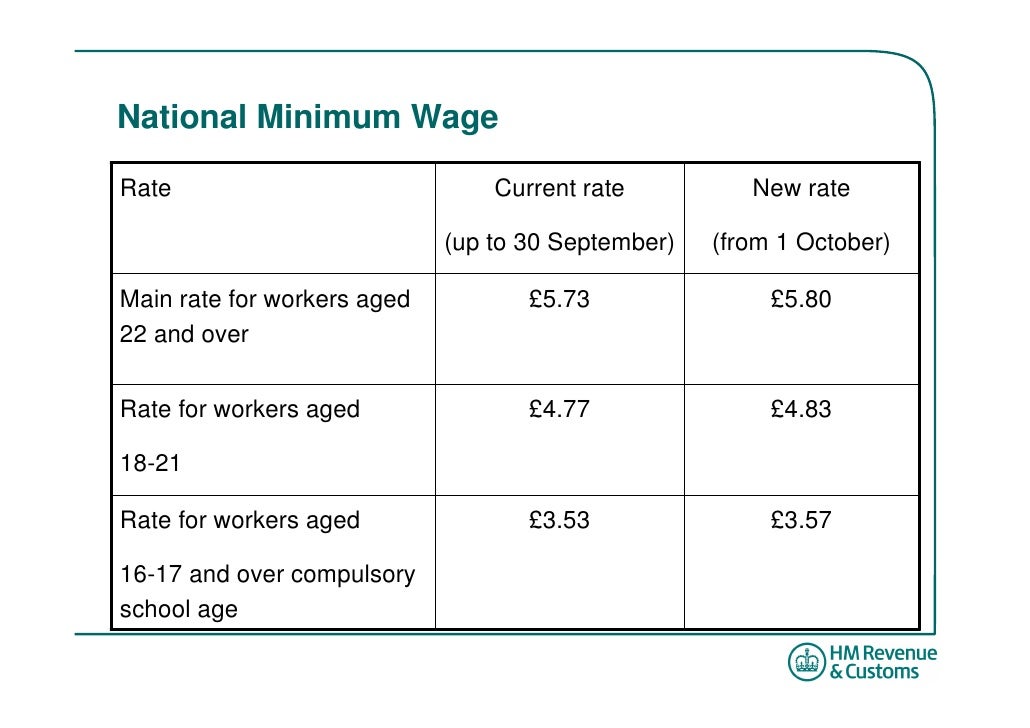

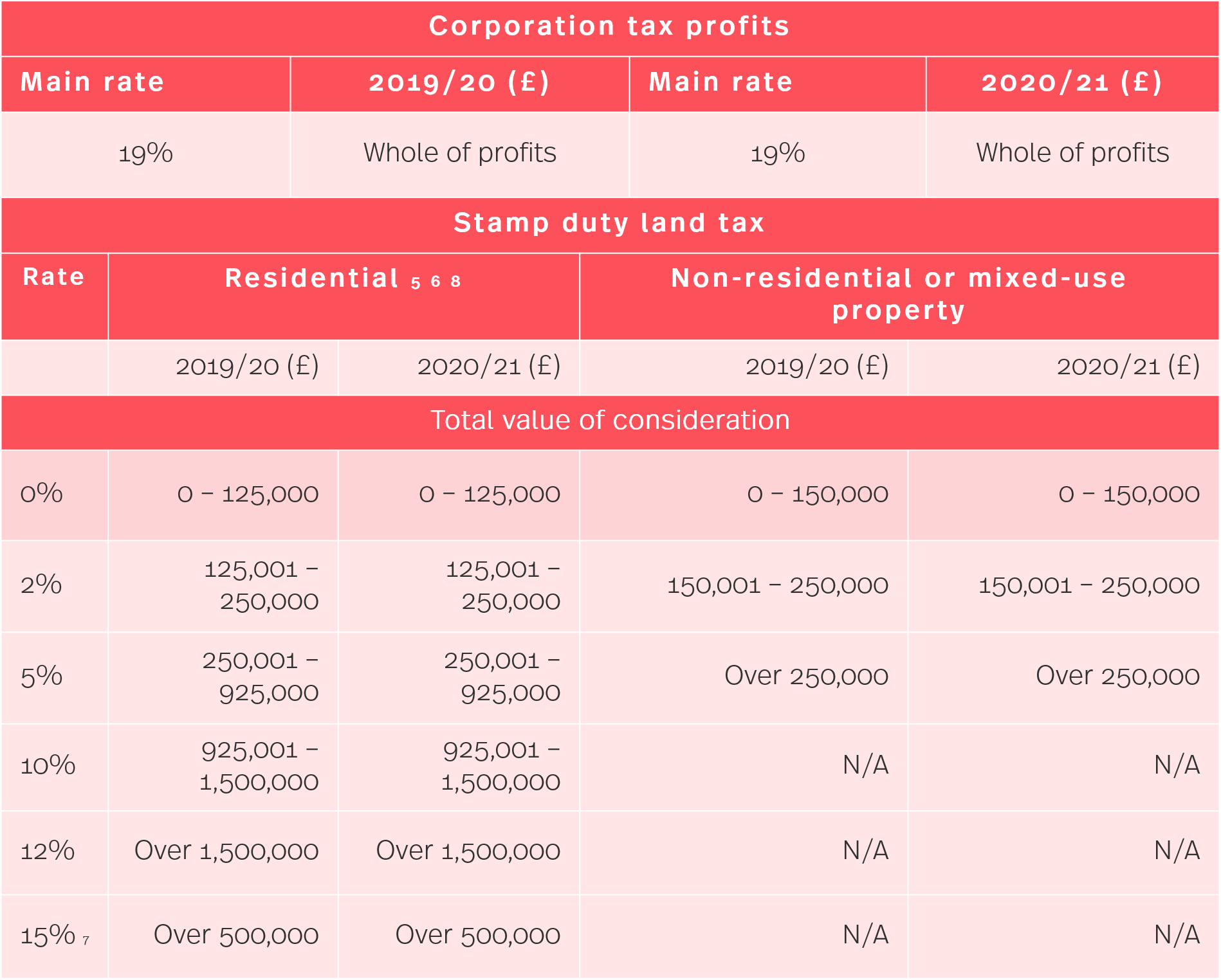

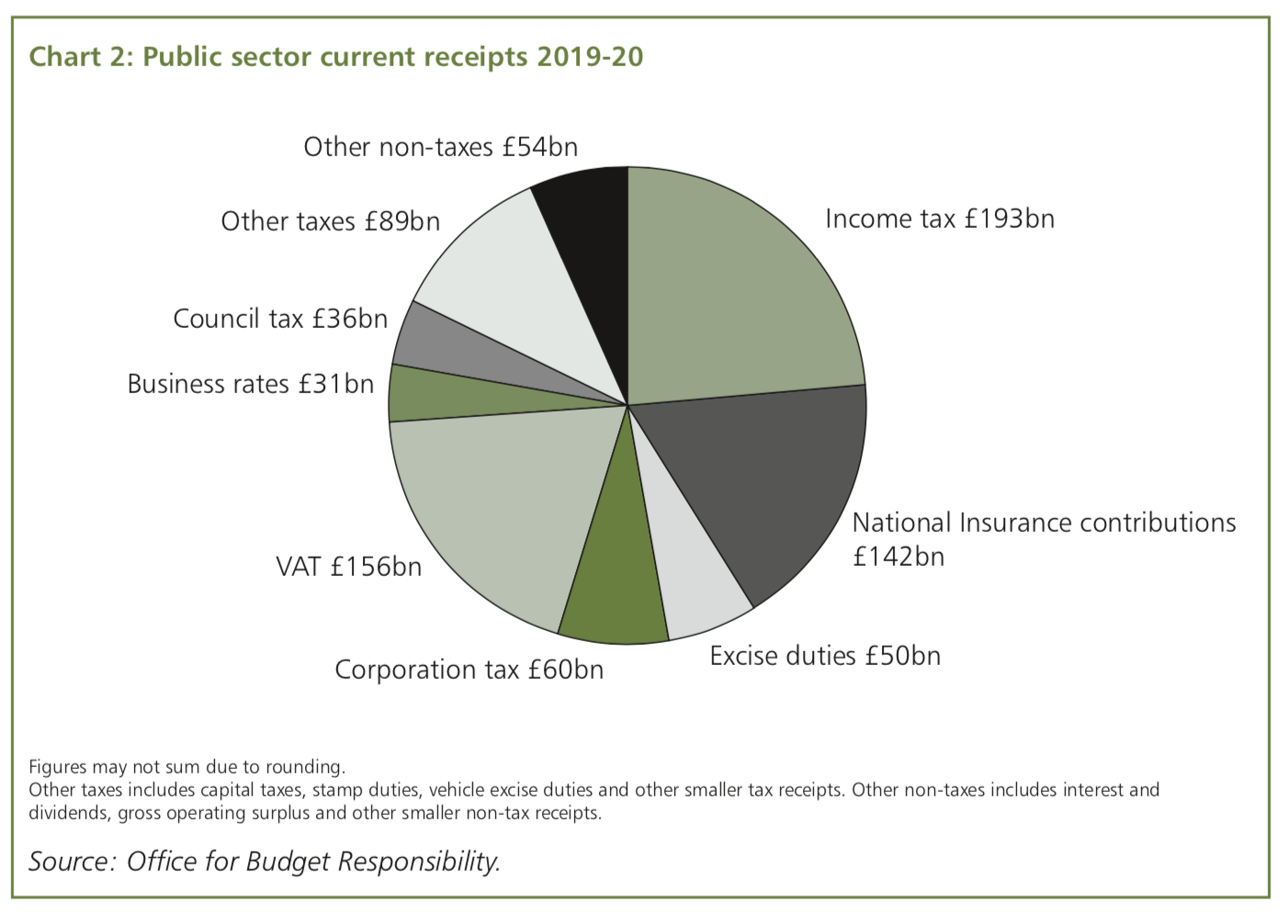

Hmrc National Insurance Rates. Tax credits, child benefit and guardian�s allowance. Class 2 nic rate applies for any earnings over £6,205 per annum and is payable for each week. Stamp duty land tax rates. Class 4 national insurance contribution rates.

CAPSA Accountants From capsa-online.co.uk

CAPSA Accountants From capsa-online.co.uk

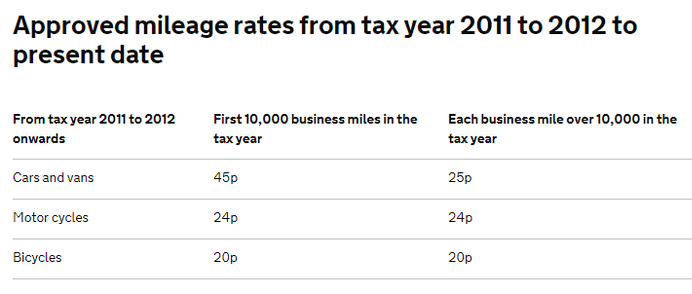

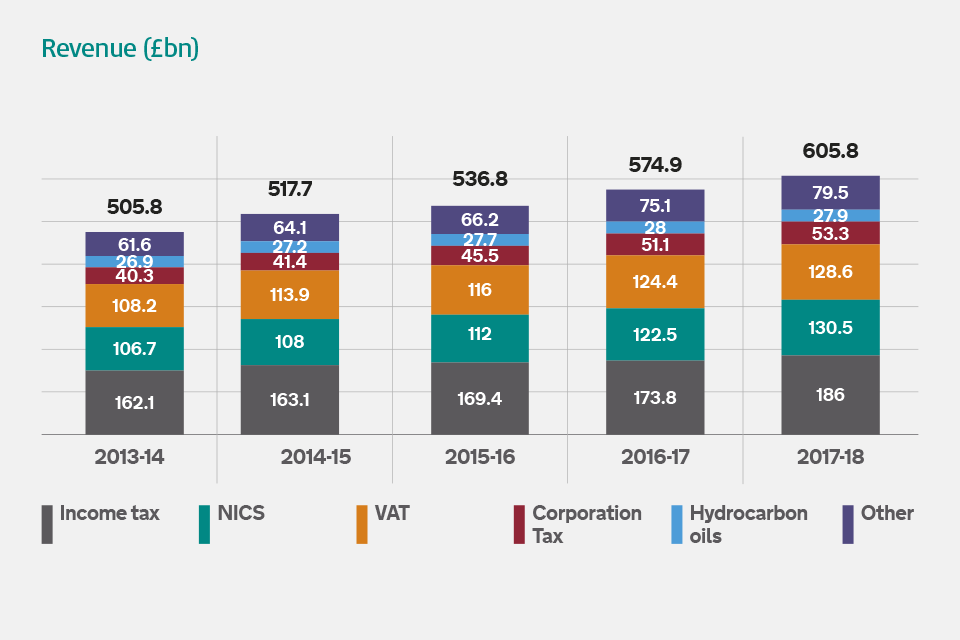

9% on profits between £9,501 and £50,000 and. Each year the full rates and thresholds change so we would recommend checking for any updates. Our plan for health and social care, its plan for funding the nhs and social care sector. The 1.25% levy in national insurance contributions applies from 6. The tables in this article show both the earnings thresholds and the contribution rates. These national insurance rates include the new health and social care levy for the.

Employers pay class 1 nics of 13.8% on all earnings above the secondary threshold for almost all employees.

These national insurance rates include the new health and social care levy for the. These national insurance rates include the new health and social care levy for the. The tables below show the earnings thresholds and the. The new rate of 13.25 percent will apply to both employed and self employed workers. Income tax and national insurance. Updated rates, allowances and duties for tax year 2021 to 2022.

Source: ericadevargas.blogspot.com

Source: ericadevargas.blogspot.com

For example, if they are under 16 years of age. Rates, allowances and limits for national insurance. Rate for employees deferring national insurance. Stamp duty land tax rates. Income tax and national insurance.

Source: nationalinsurancenumber.org

Source: nationalinsurancenumber.org

Tax credits, child benefit and guardian�s allowance. The new rate of 13.25 percent will apply to both employed and self employed workers. If you earn less than this amount you�ll pay no national insurance contributions. Rate for employees deferring national insurance. National insurance rates & thresholds for 2022/23.

Source: schoolbusinessservices.co.uk

Source: schoolbusinessservices.co.uk

Tax credits, child benefit and guardian�s allowance. If you earn less than this amount you�ll pay no national insurance contributions. Hmrc change and update the tax brackets every year. Rate for employees deferring national insurance. Check the latest guidance on tax reliefs and brackets h

Source: paystream.co.uk

Source: paystream.co.uk

Check the latest guidance on tax reliefs and brackets h Find out more about national insurance on our accounting glossary. 9% on profits between £9,658 and £50,270 and 2% on profits thereafter; You paid 2% on any earnings above £50,000. Income tax and national insurance.

Source: freelifephysio.com

Source: freelifephysio.com

The government has announced its plan for funding the nhs and social care sector. Each year the full rates and thresholds change so we would recommend checking for any updates. Our plan for health and social care, its plan for funding the nhs and social care sector. The tables below show the earnings thresholds and the. Stamp duty land tax rates.

Source: taxresearch.org.uk

Source: taxresearch.org.uk

This rate has remained the same for several years. Employers’ national insurance is a type of class 1 national insurance that employers have to pay to hmrc in respect of their employees’ wages. Check the latest guidance on tax reliefs and brackets h Checklist to help you submit paye information to hmrc 1. 9% on profits between £9,501 and £50,000 and.

Source: capsa-online.co.uk

Source: capsa-online.co.uk

Find out more about national insurance on our accounting glossary. This will include a new health & social care levy which will be delivered by a raise in class 1 and class 4 national insurance contributions (nics) of 1.25%. So we are able to pass this information on to you ahead of the officail hmrc website. £169 per week, £732 per month or £8,788 per year. 9% on profits between £9,658 and £50,270 and 2% on profits thereafter;

Source: newsstellar.com

Source: newsstellar.com

This will include a new health & social care levy which will be delivered by a raise in class 1 and class 4 national insurance contributions (nics) of 1.25%. Category letter ‘x’ is used for employees who do not have to pay national insurance. The government has announced its plan for funding the nhs and social care sector. Stamp duty land tax rates. National insurance rates & thresholds for 2022/23.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

Stamp duty land tax rates. The above is based on tax year 2018 to 2019. These national insurance rates include the new health and social care levy for the. Class 4 applies to profits for the whole year and has it’s own brackets: Our plan for health and social care, its plan for funding the nhs and social care sector.

Source: slideshare.net

Source: slideshare.net

Category letter ‘x’ is used for employees who do not have to pay national insurance. Income tax and national insurance. Employer class 1 national insurance rates. Each year the full rates and thresholds change so we would recommend checking for any updates. Checklist to help you submit paye information to hmrc 1.

Source: insuredclaims.blogspot.com

Source: insuredclaims.blogspot.com

The above is based on tax year 2018 to 2019. So we are able to pass this information on to you ahead of the officail hmrc website. £169 per week, £732 per month or £8,788 per year. You paid 2% on any earnings above £50,000. The form rt11, ‘deductions working sheet’ which has replaced form p11 for employers who are not required to file online, must show ‘tax year starting 6 april 2021’.

Source: schoolbusinessservices.co.uk

Source: schoolbusinessservices.co.uk

You can find earlier rates and allowances published by hmrc on the national archive website. Stamp duty land tax rates. The tables in this article show both the earnings thresholds and the contribution rates. National insurance rates & thresholds for 2022/23. You paid 2% on any earnings above £50,000.

Source: ninasmg.blogspot.com

Source: ninasmg.blogspot.com

Stamp duty land tax rates. For full details of how employers should pay towards all employees’ national insurance, including rebates and special rates, check. Class 4 national insurance contribution rates. Income tax and national insurance. 9% on profits between £9,501 and £50,000 and.

Source: handhaccountants.com

Source: handhaccountants.com

Employer class 1 national insurance rates. Rate for employees deferring national insurance. From april 2016 the rate of class 1 secondary nics is 0% for apprentices under the age of. Rates, allowances and limits for national insurance. So we are able to pass this information on to you ahead of the officail hmrc website.

Source: sexaccountants.co.uk

Source: sexaccountants.co.uk

Class 4 national insurance contribution rates. This rate has remained the same for several years. Which national insurance contributions (nics) tables to use. Hmrc change and update the tax brackets every year. Rate for employees deferring national insurance.

Source: ericadevargas.blogspot.com

Source: ericadevargas.blogspot.com

Employer class 1 national insurance rates. Find out more about national insurance on our accounting glossary. You paid 2% on any earnings above £50,000. Hmrc change and update the tax brackets every year. £169 per week, £732 per month or £8,788 per year.

Source: payadvice.uk

Source: payadvice.uk

Employer class 1 national insurance rates. Check the latest guidance on tax reliefs and brackets h Class 4 applies to profits for the whole year and has it’s own brackets: For ease, a glossary can be found at the end of the article. The government has announced its plan for funding the nhs and social care sector.

Source: taxresearch.org.uk

Source: taxresearch.org.uk

These national insurance rates include the new health and social care levy for the. Income tax and national insurance. Tax credits, child benefit and guardian�s allowance. Class 4 applies to profits for the whole year and has it’s own brackets: The government has announced its plan for funding the nhs and social care sector.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hmrc national insurance rates by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.