Your Hit deer auto insurance images are available. Hit deer auto insurance are a topic that is being searched for and liked by netizens today. You can Get the Hit deer auto insurance files here. Get all royalty-free images.

If you’re looking for hit deer auto insurance pictures information linked to the hit deer auto insurance keyword, you have pay a visit to the ideal site. Our website always provides you with hints for downloading the highest quality video and image content, please kindly surf and find more informative video articles and images that fit your interests.

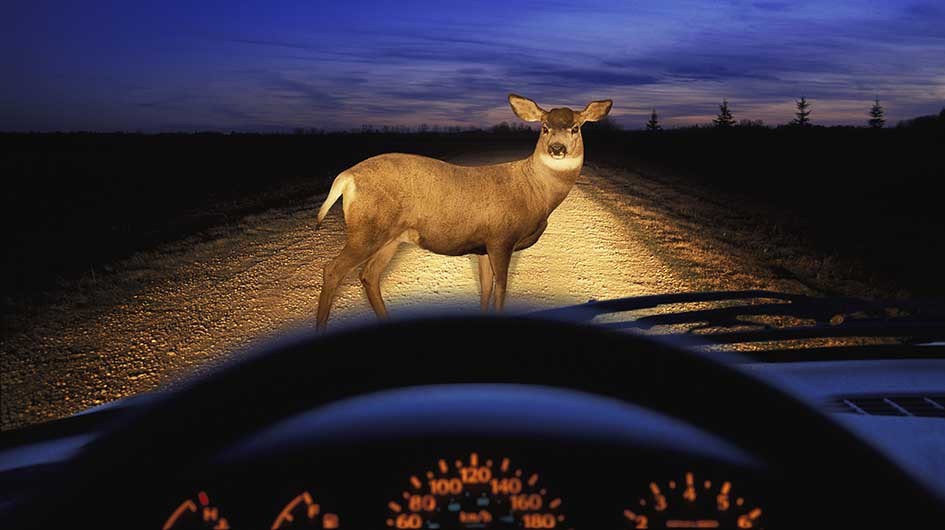

Hit Deer Auto Insurance. Yes, car insurance companies classify hitting a deer as an accident due to the impact. You swerved but still hit the deer. If you want auto insurance that covers a deer, you need to have comprehensive coverage. Insurance coverage for hitting deer if you have full coverage on your auto insurance policy there are two types of coverage that will help repair your vehicle in the event of a covered loss.

Can I File a Claim with My Insurance if I Hit a Deer with From lieserlawfirm.com

Can I File a Claim with My Insurance if I Hit a Deer with From lieserlawfirm.com

It will be covered as part of the claim if you have comprehensive coverage. Some states let the policyholder choose if the loss. It is important to have a car insurance policy that includes comprehensive coverage, as a deer can come out of nowhere and cause a lot of damage to your vehicle if you’re unlucky enough to hit one. State farm ® estimates over 1.5 million animal collision insurance claims in the united states between july 1, 2019 and june 30, 2020. The average car insurance claim for deer strikes increased by $162, state farm claims data show. While being involved in an accident with another car, or even a stationary object like a tree or telephone pole is classified as a collision, hitting a deer — or any other animal — is viewed as incidental.

What type of insurance covers hitting a deer?

Hitting a deer or other animal isn’t the only full coverage claim you can make. The average car insurance claim for deer strikes increased by $162, state farm claims data show. State farm ® estimates over 1.5 million animal collision insurance claims in the united states between july 1, 2019 and june 30, 2020. If you hit a deer and have comprehensive auto insurance, this will be covered under a separate deductible than what your collision insurance provides. Liability and collision insurance are intended to cover damages in an accident with someone and/or their property, not something such as a wild animal. Hitting a deer or other animal isn’t the only full coverage claim you can make.

Source: marshfieldinsurance.agency

Source: marshfieldinsurance.agency

If your car isn’t totaled after hitting a deer (which it very well might be), then it will certainly need a lot of time in a repair shop, and that’s never cheap. This is because striking a deer is considered a “no fault” type loss. If you hit a deer, your insurance company will only pay to repair damage to your vehicle if you have what is called comprehensive coverage. Vehicle damage from hitting a deer is covered by your auto policy�s comprehensive coverage. The average car insurance claim for deer strikes increased by $162, state farm claims data show.

Source: lieserlawfirm.com

Source: lieserlawfirm.com

Even if you�re vigilant about avoiding animal collisions, the risk of hitting a deer with your vehicle heightens in the late fall and early winter. Some states let the policyholder choose if the loss. Does your insurance go up if you hit a deer? Comprehensive can cover damages to your car caused by events that are out of your control, like hitting a deer or other animal. This is the part of auto insurance coverage that includes damage sustained from something other than a collision, like theft, vandalism, natural disasters like hurricanes and fires, and animal impact.

Source: scavoneins.com

Source: scavoneins.com

It is important to have a car insurance policy that includes comprehensive coverage, as a deer can come out of nowhere and cause a lot of damage to your vehicle if you’re unlucky enough to hit one. Now you may face a raise in your car insurance rates for something you feel you could not avoid. Hitting a deer is an unpredictable car accident that is fortunately covered by a specific component of car insurance called comprehensive, or comp, coverage.this is the part of auto insurance coverage that includes damage sustained from something other than a collision, like theft, vandalism, natural disasters like hurricanes and fires, and animal impact. According to the insurance information institute, on average in 2018, 1 in every 167 drivers will have a claim from hitting a deer, elk, moose or caribou. Does car insurance cover a vehicle when it hits a deer?

Source: bluefireinsurance.com

Source: bluefireinsurance.com

Comprehensive coverage should pay for the necessary repairs after you pay your deductible. If you want auto insurance that covers a deer, you need to have comprehensive coverage. If you hit a deer and have comprehensive auto insurance, this will be covered under a separate deductible than what your collision insurance provides. According to the insurance information institute, on average in 2018, 1 in every 167 drivers will have a claim from hitting a deer, elk, moose or caribou. Read your comprehensive coverage policy to see if collisions with animals are covered.

Source: strategic-insurance.com

Source: strategic-insurance.com

This is because striking a deer is considered a “no fault” type loss. Now you may face a raise in your car insurance rates for something you feel you could not avoid. Anytime you hit an animal and file a claim, you’ll have to pay the deductible on your comprehensive policy. Yes, car insurance companies classify hitting a deer as an accident due to the impact. This is because striking a deer is considered a “no fault” type loss.

Source: quotewizard.com

Source: quotewizard.com

State farm ® estimates over 1.5 million animal collision insurance claims in the united states between july 1, 2019 and june 30, 2020. Any claim you file under your insurance policy. Anytime you hit an animal and file a claim, you’ll have to pay the deductible on your comprehensive policy. Comprehensive insurance is one of the two physical damage coverage options that you can include in your auto insurance policy. Hitting an inanimate object with your vehicle is a collision, and collision coverage often comes with higher deductibles and premiums than comprehensive policies, which often cover animal mishaps.

Source: pennlive.com

Source: pennlive.com

What type of insurance covers hitting a deer? You swerved but still hit the deer. Any claim you file under your insurance policy. According to the insurance information institute, on average in 2018, 1 in every 167 drivers will have a claim from hitting a deer, elk, moose or caribou. For example, the collision deductible might be $1,000 while the comprehensive deductible is only $500.

Source: newsroom.statefarm.com

Source: newsroom.statefarm.com

What to do after a deer collision. In many cases, the comprehensive deductible is lower than the collision deductible. So, if you have comprehensive insurance that covers hitting a. It is important to have a car insurance policy that includes comprehensive coverage, as a deer can come out of nowhere and cause a lot of damage to your vehicle if you’re unlucky enough to hit one. What type of insurance covers hitting a deer?

Source: blog.autoslash.com

Source: blog.autoslash.com

The average car insurance claim for deer strikes increased by $162, state farm claims data show. Vehicle damage from hitting a deer is covered by your auto policy�s comprehensive coverage. Deer accidents are most common from october through december with the. Even if you�re vigilant about avoiding animal collisions, the risk of hitting a deer with your vehicle heightens in the late fall and early winter. State farm ® estimates over 1.5 million animal collision insurance claims in the united states between july 1, 2019 and june 30, 2020.

Source: obernauerinsuranceagency.com

Source: obernauerinsuranceagency.com

If you hit a deer, your policy must include comprehensive coverage for your insurance company to cover the cost of repairs to your vehicle. For your comprehensive coverage to cover the accident, your car must come in contact with the animal. For example, the collision deductible might be $1,000 while the comprehensive deductible is only $500. Does car insurance cover a vehicle when it hits a deer? Unfortunately, not everyone buys comprehensive coverage when they sign up for insurance.

Source: reasonablecontractor.com

As odd as it sounds, colliding with a deer is not considered a collision — at least not to insurance companies. Some states let the policyholder choose if the loss. While being involved in an accident with another car, or even a stationary object like a tree or telephone pole is classified as a collision, hitting a deer — or any other animal — is viewed as incidental. If you want auto insurance that covers a deer, you need to have comprehensive coverage. Even if you�re vigilant about avoiding animal collisions, the risk of hitting a deer with your vehicle heightens in the late fall and early winter.

Source: friendship-f0rever.blogspot.com

Source: friendship-f0rever.blogspot.com

How does hitting a deer affect your car insurance? For your comprehensive coverage to cover the accident, your car must come in contact with the animal. A tow may be needed after a deer accident. This is the part of auto insurance coverage that includes damage sustained from something other than a collision, like theft, vandalism, natural disasters like hurricanes and fires, and animal impact. If you want auto insurance that covers a deer, you need to have comprehensive coverage.

Source: laclassedemaitressemarie.blogspot.com

If you hit a deer, your insurance company will only pay to repair damage to your vehicle if you have what is called comprehensive coverage. You swerved but still hit the deer. Unfortunately, not everyone buys comprehensive coverage when they sign up for insurance. Plus, car insurance may not necessarily cover your vehicle damage from hitting a deer depending on the policy you have. The average car insurance claim for deer strikes increased by $162, state farm claims data show.

Source: get-quotes.org

Source: get-quotes.org

If there’s no physical contact with the deer (e.g. Vehicle damage from hitting a deer is covered by your auto policy�s comprehensive coverage. What to do after a deer collision. Hitting a deer or other animal isn’t the only full coverage claim you can make. You swerve and hit a tree), it will probably be considered a collision loss.

Source: leejeansoutletshop.com

Source: leejeansoutletshop.com

This is because striking a deer is considered a “no fault” type loss. A tow may be needed after a deer accident. Currently, west virginia has the highest rate of deer strikes, where the odds of hitting a. According to the insurance information institute, on average in 2018, 1 in every 167 drivers will have a claim from hitting a deer, elk, moose or caribou. As odd as it sounds, colliding with a deer is not considered a collision — at least not to insurance companies.

Source: shieldagency.com

Source: shieldagency.com

Some states let the policyholder choose if the loss. How does hitting a deer affect your car insurance? If you file a claim for hitting a deer, it has the potential to raise your insurance premiums. For your comprehensive coverage to cover the accident, your car must come in contact with the animal. Even if you�re vigilant about avoiding animal collisions, the risk of hitting a deer with your vehicle heightens in the late fall and early winter.

Source: einsure.com

Source: einsure.com

Plus, car insurance may not necessarily cover your vehicle damage from hitting a deer depending on the policy you have. You swerve and hit a tree), it will probably be considered a collision loss. Even if you�re vigilant about avoiding animal collisions, the risk of hitting a deer with your vehicle heightens in the late fall and early winter. While being involved in an accident with another car, or even a stationary object like a tree or telephone pole is classified as a collision, hitting a deer — or any other animal — is viewed as incidental. Move your vehicle to a safe place.

Source: quoteinspector.com

Source: quoteinspector.com

Does car insurance cover a vehicle when it hits a deer? What to do after a deer collision. It will be covered as part of the claim if you have comprehensive coverage. Hitting an inanimate object with your vehicle is a collision, and collision coverage often comes with higher deductibles and premiums than comprehensive policies, which often cover animal mishaps. Even if you have never had this experience, insurance companies are raising rates in states with high or rapidly increasing rates of deer strikes.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hit deer auto insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.