Your Hire reward insurance images are available. Hire reward insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Hire reward insurance files here. Download all royalty-free photos and vectors.

If you’re searching for hire reward insurance images information related to the hire reward insurance interest, you have visit the ideal site. Our website frequently provides you with hints for seeking the highest quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

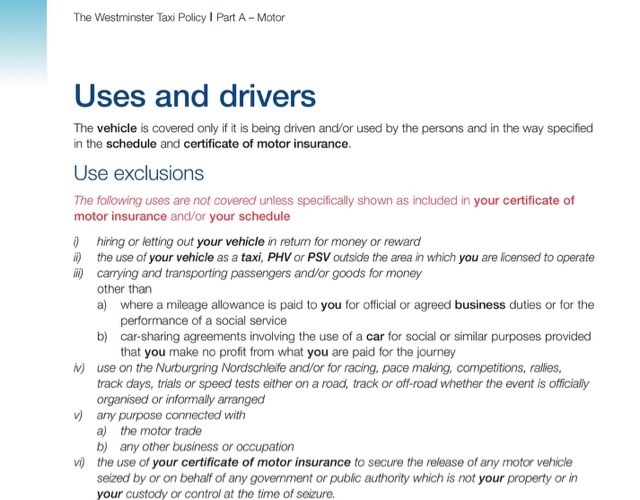

Hire Reward Insurance. Hire and reward insurance is essential for couriers, hauliers, taxi drivers, furniture removers and anyone who carries people or the property of others in exchange for a fee. We’ve been providing hire & reward insurance cover to taxi drivers across the uk for over 40 years. Hire and reward is a class of insurance use that allows you to legally carry other people’s goods in return for payment. Hire & reward van insurance is a type of commercial van insurance known as carriage of goods for hire and reward.

Hire And Reward Insurance Companies at Insurance From revisi.net

Hire And Reward Insurance Companies at Insurance From revisi.net

Get insured online in minutes and start earning money from deliveries now. Van, hgv, car, motorcycle, and other vehicles can all be covered by hire and reward insurance, regardless of whether the vehicle is owned by an individual or a company. Hire and reward insurance, also known as �the carriage of goods for hire and reward� is a type of commercial insurance policy for your car or van that is legally required in the uk if you are a courier whose job it is to make several deliveries (parcels or food delivery) to people in local areas. Vans, hgvs, cars, motorbikes and more can all be covered by hire and reward insurance, whether the vehicle is owned by an individual or a company. Often also called courier insurance, hire and reward policies offer a specialist type of cover. Vans, hgvs, cars, motorbikes and more can all be covered by hire and reward insurance, whether the vehicle is owned by an individual or a company.

As a result, the price of a hire and reward policy will depend on the provider in question as well as a number of other factors.

In terms of hire and reward insurance premiums, they are typically a little more expensive than your standard car insurance policy. Hire and reward policies permit you to use your car, bike or van as a primary part of your business while you transport goods or passengers for money. Indeed, having hire and reward insurance is vital for people in the transportation industry, as you will not be covered in the case of a claim if you are involved in an accident during the course of your work. If you are or intend to use your car for such purpose you will need a hire and reward car insurance policy. Hire and reward insurance, also known as �the carriage of goods for hire and reward� is a type of commercial insurance policy for your car or van that is legally required in the uk if you are a courier whose job it is to make several deliveries (parcels or food delivery) to people in local areas. It is appropriate for delivery drivers & couriers as it typically applies to drivers making multiple stops or those with many customers.

Source: inshur.com

Source: inshur.com

It allows you to legally offer the services of transporting people’s goods. It allows you to legally offer the services of transporting people’s goods. We know the hard work and and logistics involved in the courier industry, our policies will deliver the right cover for courier companies & self employed couriers. Hire and reward insurance is essential for taxi drivers, courier drivers, private hire drivers, chauffeur drivers or anyone that carries people or property of others in exchange for a fee. What is hire and reward insurance?

Source: multiquotetime.com

Source: multiquotetime.com

Van, hgv, car, motorcycle, and other vehicles can all be covered by hire and reward insurance, regardless of whether the vehicle is owned by an individual or a company. Whatever taxi you drive, including electric and hybrid vehicles, we’ll have the right hire and reward quote at the right price for you! Hire and reward is designed to account for the additional risks of using your vehicle for business (as opposed to traditional social, domestic & pleasure purposes such as going to the shops or down to the. Vans, hgvs, cars, motorbikes and more can all be covered by hire and reward insurance, whether the vehicle is owned by an individual or a company. We provide hire and reward insurance for vehicles licensed by local uk authorities, or the department of transport.

Source: revisi.net

Source: revisi.net

Hire and reward is a type of insurance that allows you to legally deliver anyone else’s goods to people in exchange for payment. Hire and reward policies permit you to use your car, bike or van as a primary part of your business while you transport goods or passengers for money. We are hire & reward insurance specialists, we can help you find the right policy for your business. Hire and reward is a type of insurance that allows you to legally deliver anyone else’s goods to people in exchange for payment. It’s a legal requirement for anyone who uses their own vehicle to drive people or goods for work.

Source: taxileaks.blogspot.com

Source: taxileaks.blogspot.com

Hire and reward insurance is essential for couriers, hauliers, taxi drivers, furniture removers and anyone who carries people or the property of others in exchange for a fee. Hire and reward insurance, also known as �the carriage of goods for hire and reward� is a type of commercial insurance policy for your car or van that is legally required in the uk if you are a courier whose job it is to make several deliveries (parcels or food delivery) to people in local areas. We are hire & reward insurance specialists, we can help you find the right policy for your business. You will also need to have your hire and reward insurance available for inspection when your vehicle attends the vehicle test centre (see �carry or display of hire and. This policy is also designed for hauliers, taxi drivers, furniture removers, or anyone else.

Source: mymoneycomparison.com

Source: mymoneycomparison.com

In terms of hire and reward insurance premiums, they are typically a little more expensive than your standard car insurance policy. What is hire and reward insurance? This is because you are not only insuring the vehicle in question, but also the products and tools that are inside it. Whether you need hire and reward insurance for parcel delivery or you’re providing a service like furniture removal, you will need specialist cover if you are receiving a payment for these services. If you are a new applicant or are renewing your vehicle licence, from 27 june 2016 you will only pass your vehicle inspection if you have hire and reward insurance in place at the point of licensing.

Source: revisi.net

Source: revisi.net

Especially if it is a large part of your business, it will be more expensive than your traditional business insurance, but this is an acceptable factor in light of the magnitude of protection you will receive. Hire and reward is a type of insurance that is a legal requirement for drivers who carry other people’s goods or passengers in return for payment. Especially if it is a large part of your business, it will be more expensive than your traditional business insurance, but this is an acceptable factor in light of the magnitude of protection you will receive. It’s a legal requirement for anyone who uses their own vehicle to drive people or goods for work. In short, the answer is yes.

Source: pinterest.com

Source: pinterest.com

You will also need to have your hire and reward insurance available for inspection when your vehicle attends the vehicle test centre (see �carry or display of hire and. While there is a lot of confusion online about what hire & reward means, it doesn’t need to be too complicated. Using your vehicle as a source of income exposes drivers to more risks than a regular. Get insured online in minutes and start earning money from deliveries now. Hire and reward is a type of insurance that allows you to legally deliver anyone else’s goods to people in exchange for payment.

Source: pinterest.com

Source: pinterest.com

We’ve been providing hire & reward insurance cover to taxi drivers across the uk for over 40 years. In terms of hire and reward insurance premiums, they are typically a little more expensive than your standard car insurance policy. It’s a legal requirement for anyone who uses their own vehicle to drive people or goods for work. Hire and reward insurance is essential for couriers, hauliers, taxi drivers, furniture removers and anyone who carries people or the property of others in exchange for a fee. Hire & reward is just a form of vehicle insurance designed for anyone using their vehicle in return for payment.

Source: taxi-news.co.uk

Source: taxi-news.co.uk

What is hire & reward insurance? The pay as you go or use model is relatively new to the uk insurance marketplace. What is hire and reward insurance? As a result, the price of a hire and reward policy will depend on the provider in question as well as a number of other factors. Hire and reward taxi cover competitive, flexible hire and reward taxi cover for uk cab drivers.

Source: autoscraze.com

Source: autoscraze.com

Hire and reward is a type of insurance that is a legal requirement for drivers who carry other people’s goods or passengers in return for payment. Van, hgv, car, motorcycle, and other vehicles can all be covered by hire and reward insurance, regardless of whether the vehicle is owned by an individual or a company. We are hire & reward insurance specialists, we can help you find the right policy for your business. If you are a new applicant or are renewing your vehicle licence, from 27 june 2016 you will only pass your vehicle inspection if you have hire and reward insurance in place at the point of licensing. While there is a lot of confusion online about what hire & reward means, it doesn’t need to be too complicated.

Source: revisi.net

Source: revisi.net

Using your vehicle as a source of income exposes drivers to more risks than a regular. The pay as you go or use model is relatively new to the uk insurance marketplace. It’s a legal requirement for anyone who uses their own vehicle to drive people or goods for work. This is because you are not only insuring the vehicle in question, but also the products and tools that are inside it. First introduced in 2013 under the cuvva brand.

Source: insurancerevolution.co.uk

Source: insurancerevolution.co.uk

It allows you to legally offer the services of transporting people’s goods. Hire and reward is a type of insurance that allows you to legally deliver anyone else’s goods to people in exchange for payment. Hire and reward is a class of insurance use that allows you to legally carry other people’s goods in return for payment. What is hire & reward insurance? Hire and reward insurance is essential for couriers, hauliers, taxi drivers, furniture removers and anyone who carries people or the property of others in exchange for a fee.

Source: quotegoat.com

Source: quotegoat.com

It is appropriate for delivery drivers & couriers as it typically applies to drivers making multiple stops or those with many customers. It allows you to legally offer the services of transporting people’s goods. You will also need to have your hire and reward insurance available for inspection when your vehicle attends the vehicle test centre (see �carry or display of hire and. Hire & reward van insurance is a type of commercial van insurance known as carriage of goods for hire and reward. What is hire & reward van insurance?

Source: recruitingtimes.org

Source: recruitingtimes.org

Hire and reward insurance, also known as �the carriage of goods for hire and reward� is a type of commercial insurance policy for your car or van that is legally required in the uk if you are a courier whose job it is to make several deliveries (parcels or food delivery) to people in local areas. In terms of hire and reward insurance premiums, they are typically a little more expensive than your standard car insurance policy. Hire and reward insurance protects anyone who uses their vehicle to deliver other people’s or other people’s goods in exchange for remuneration (“reward”). It is appropriate for delivery drivers & couriers as it typically applies to drivers making multiple stops or those with many customers. Hire and reward policies permit you to use your car, bike or van as a primary part of your business while you transport goods or passengers for money.

Source: inshur.com

Source: inshur.com

Hire and reward insurance is essential for couriers, hauliers, taxi drivers, furniture removers and anyone who carries people or the property of others in exchange for a fee. We’ve been providing hire & reward insurance cover to taxi drivers across the uk for over 40 years. If you are using your private vehicle, car, van or bike to provide a delivery service you need a special type of cover often referred to as pay as you go hire and reward insurance. It allows you to legally offer the services of transporting people’s goods. Is hire and reward insurance worth the money?

Source: taxileaks.blogspot.com

Source: taxileaks.blogspot.com

In short, the answer is yes. Hire and reward is designed to account for the additional risks of using your vehicle for business (as opposed to traditional social, domestic & pleasure purposes such as going to the shops or down to the. Class 3 insurance cover is essential for drivers operating as delivery drivers, taxis, courier drivers, chauffeurs, funeral cars, or anyone else. Hire and reward taxi cover competitive, flexible hire and reward taxi cover for uk cab drivers. This policy is also designed for hauliers, taxi drivers, furniture removers, or anyone else.

Whether you need hire and reward insurance for parcel delivery or you’re providing a service like furniture removal, you will need specialist cover if you are receiving a payment for these services. It allows you to legally offer the services of transporting people’s goods. This is because you are not only insuring the vehicle in question, but also the products and tools that are inside it. We provide hire and reward insurance for vehicles licensed by local uk authorities, or the department of transport. We know the hard work and and logistics involved in the courier industry, our policies will deliver the right cover for courier companies & self employed couriers.

Source: car-insurancee.com

Source: car-insurancee.com

Hire and reward policies permit you to use your car, bike or van as a primary part of your business while you transport goods or passengers for money. If you are using your private vehicle, car, van or bike to provide a delivery service you need a special type of cover often referred to as pay as you go hire and reward insurance. Hire and reward insurance is essential for couriers, hauliers, taxi drivers, furniture removers and anyone who carries people or the property of others in exchange for a fee. As a result, the price of a hire and reward policy will depend on the provider in question as well as a number of other factors. Van, hgv, car, motorcycle, and other vehicles can all be covered by hire and reward insurance, regardless of whether the vehicle is owned by an individual or a company.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hire reward insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.