Your High risk homeowners insurance florida images are ready. High risk homeowners insurance florida are a topic that is being searched for and liked by netizens today. You can Find and Download the High risk homeowners insurance florida files here. Get all royalty-free photos and vectors.

If you’re looking for high risk homeowners insurance florida images information connected with to the high risk homeowners insurance florida topic, you have come to the right site. Our website frequently gives you suggestions for refferencing the highest quality video and picture content, please kindly search and find more informative video articles and images that match your interests.

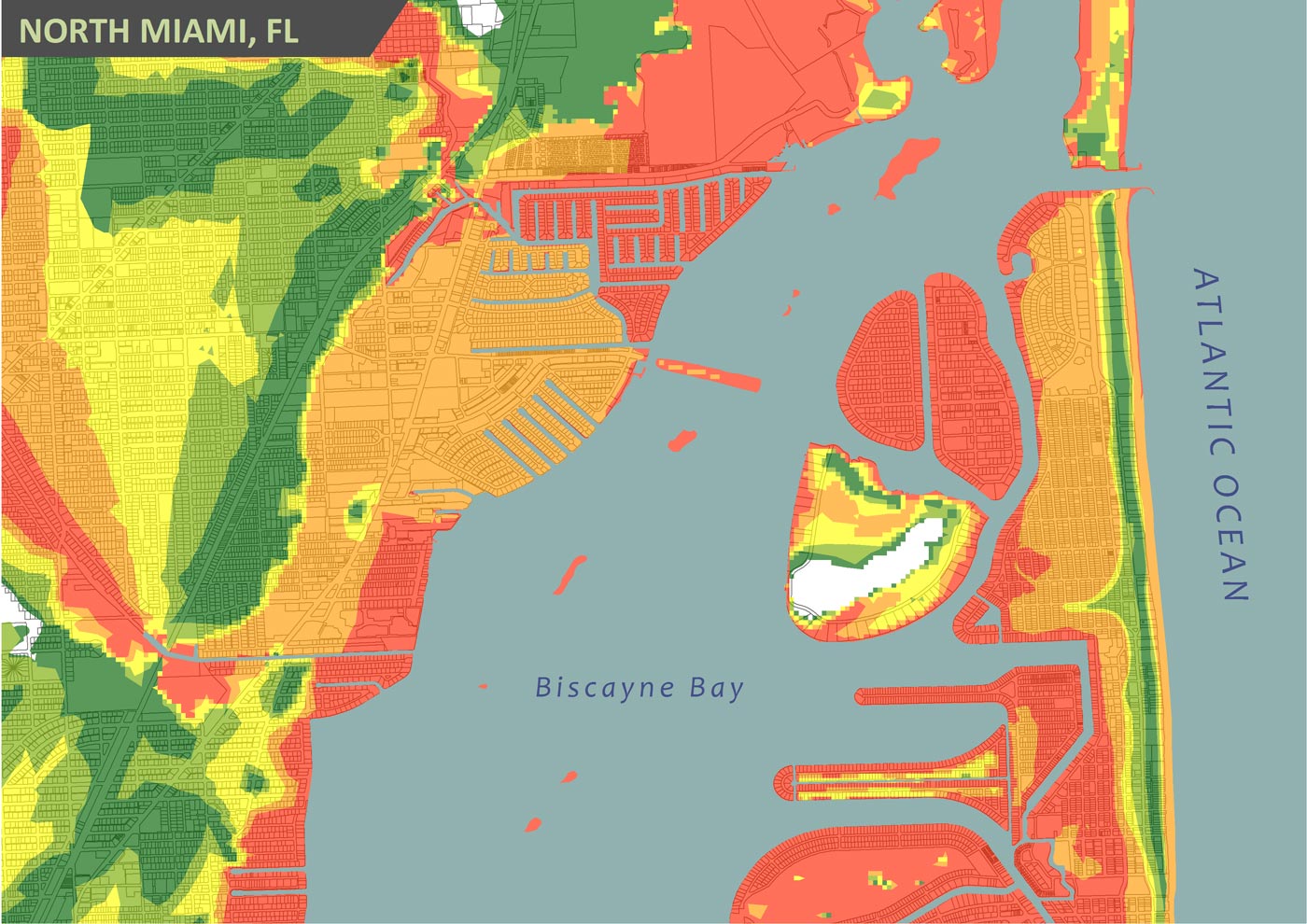

High Risk Homeowners Insurance Florida. This can encompass a wide variety of different areas, but in florida, the main concern is coastal property. Do i need hurricane insurance in florida? Despite the high risk, florida doesn’t specifically require hurricane insurance. High risk insurance is available in most areas.

High Risk Homeowners Insurance Florida at Insurance From revisi.net

Homes with older electrical, plumbing, and hvac systems When your home is classified as high risk, you may have trouble finding a provider that will insure your home. High risk homeowner’s insurance may cost more than standard insurance. The high risk of catastrophic damage means that many property insurers don’t write coverage in florida. This can encompass a wide variety of different areas, but in florida, the main concern is coastal property. If the consumer finds the right agent they will learn that high risk is not synonymous with substandard coverage.

The high risk of catastrophic damage means that many property insurers don’t write coverage in florida.

The best way to get an affordable homeowners insurance policy in florida is to get quotes from as many insurance companies as possible. High risk homeowner’s insurance may cost more than standard insurance. Instead of one company taking on the risk of your home, multiple sources combine to carry your risk. If you live in a high risk weather area, you. If the consumer finds the right agent they will learn that high risk is not synonymous with substandard coverage. The average cost for home insurance in florida is $1,405 per year or $118 per month.

Source: fashionfabulous4passionrandom.blogspot.com

The best way to get an affordable homeowners insurance policy in florida is to get quotes from as many insurance companies as possible. Unfortunately, there are a couple of drawbacks to this type of insurance. High risk homeowner’s insurance may cost more than standard insurance. Living in a high crime zip code where vandalism, theft, and other crimes are likely ; Areas prone to severe weather ;

Source: sungateinsurance.com

Source: sungateinsurance.com

Each state has one, and it is partially subsidized by taxpayers and by private insurers. Out of the 12 homeowners insurance companies to make our best homeowners insurance companies of 2022 list, eight of the providers are available in florida. Each state has one, and it is partially subsidized by taxpayers and by private insurers. 23172 plaza pointe drive suite 205 laguna hills, ca 92653 phone: High risk is defined as:

High risk insurance is available in most areas. New applicants can purchase policies from citizens only if they receive no comparable private offers or if the rates offered by private companies are 15% higher than those offered by citizens. Areas prone to severe weather ; High risk insurance is available in most areas. Fair access to insurance requirements (fair) programs were created to help people with high risk homes find insurance.

Source: fashionfabulous4passionrandom.blogspot.com

Source: fashionfabulous4passionrandom.blogspot.com

Instead of one company taking on the risk of your home, multiple sources combine to carry your risk. In fact, they may have trouble getting homeowners insurance, period. Of the insurance providers that do write business in. Thankfully, there are ways to decrease your rate. Areas prone to severe weather ;

Source: homeinsuranceking.com

Source: homeinsuranceking.com

Unfortunately, there are a couple of drawbacks to this type of insurance. Worst homeowners insurance companies in 2022. New applicants can purchase policies from citizens only if they receive no comparable private offers or if the rates offered by private companies are 15% higher than those offered by citizens. Of the insurance providers that do write business in. While home insurance includes some coverage for business property, like a laptop, the limits are usually too low to address all your needs.

Source: revisi.net

Source: revisi.net

In florida, the average annual cost of homeowners insurance for a property with $250,000 in dwelling coverage is $1,353. While home insurance includes some coverage for business property, like a laptop, the limits are usually too low to address all your needs. Unfortunately, there are a couple of drawbacks to this type of insurance. 5 heritage property & casualty insurance company 241,822 6 american integrity insurance company of florida 236.796 7 united property & casualty insurance company 187,412 8 st johns insurance. High risk is defined as:

Source: yentircilegna.blogspot.com

Source: yentircilegna.blogspot.com

5 heritage property & casualty insurance company 241,822 6 american integrity insurance company of florida 236.796 7 united property & casualty insurance company 187,412 8 st johns insurance. In fact, they may have trouble getting homeowners insurance, period. Unfortunately, there are a couple of drawbacks to this type of insurance. The average cost for home insurance in florida is $1,405 per year or $118 per month. If you live in a high risk weather area, you.

Source: yentircilegna.blogspot.com

Source: yentircilegna.blogspot.com

23172 plaza pointe drive suite 205 laguna hills, ca 92653 phone: 5 heritage property & casualty insurance company 241,822 6 american integrity insurance company of florida 236.796 7 united property & casualty insurance company 187,412 8 st johns insurance. If you are in a high crime area, you can receive a discount if you install a monitored security system. Each state has one, and it is partially subsidized by taxpayers and by private insurers. Most new homeowners insurance applicants through florida’s citizens must first seek coverage through a clearinghouse to see if any private options are available.

Source: revisi.net

Source: revisi.net

Thankfully, there are ways to decrease your rate. Instead of one company taking on the risk of your home, multiple sources combine to carry your risk. If you live in a high risk weather area, you. Despite the high risk, florida doesn’t specifically require hurricane insurance. Businesses also usually mean increased foot traffic and.

Source: yentircilegna.blogspot.com

Source: yentircilegna.blogspot.com

Businesses also usually mean increased foot traffic and. Premium costs aren�t bad relative to the rest of the us — although floridians do pay 5% more per year on average. The best way to get an affordable homeowners insurance policy in florida is to get quotes from as many insurance companies as possible. Of the insurance providers that do write business in. If you are in a high crime area, you can receive a discount if you install a monitored security system.

Source: ecosfera.cat

Source: ecosfera.cat

Businesses also usually mean increased foot traffic and. This can encompass a wide variety of different areas, but in florida, the main concern is coastal property. Unfortunately, there are a couple of drawbacks to this type of insurance. High risk homeowner’s insurance may cost more than standard insurance. The rising cost of damage from extreme weather comes on top of a confluence of other factors that are driving the cost of homeowners’ insurance higher.

Source: localsyr.com

Source: localsyr.com

Thankfully, there are ways to decrease your rate. While home insurance includes some coverage for business property, like a laptop, the limits are usually too low to address all your needs. Thankfully, there are ways to decrease your rate. Fair access to insurance requirements (fair) programs were created to help people with high risk homes find insurance. Premium costs aren�t bad relative to the rest of the us — although floridians do pay 5% more per year on average.

Source: yentircilegna.blogspot.com

Source: yentircilegna.blogspot.com

This can encompass a wide variety of different areas, but in florida, the main concern is coastal property. When your home is classified as high risk, you may have trouble finding a provider that will insure your home. In florida, the average annual cost of homeowners insurance for a property with $250,000 in dwelling coverage is $1,353. Each state has one, and it is partially subsidized by taxpayers and by private insurers. Living in a high crime zip code where vandalism, theft, and other crimes are likely ;

Source: expertinsurancereviews.com

Source: expertinsurancereviews.com

If you are in a high crime area, you can receive a discount if you install a monitored security system. High risk is defined as: Unfortunately, there are a couple of drawbacks to this type of insurance. Living in a high crime zip code where vandalism, theft, and other crimes are likely ; Businesses also usually mean increased foot traffic and.

Source: revisi.net

Of the insurance providers that do write business in. Living in a high crime zip code where vandalism, theft, and other crimes are likely ; While home insurance includes some coverage for business property, like a laptop, the limits are usually too low to address all your needs. In fact, they may have trouble getting homeowners insurance, period. The average cost for home insurance in florida is $1,405 per year or $118 per month.

Source: yentircilegna.blogspot.com

Source: yentircilegna.blogspot.com

The high risk of catastrophic damage means that many property insurers don’t write coverage in florida. Worst homeowners insurance companies in 2022. High risk is defined as: If you are in a high crime area, you can receive a discount if you install a monitored security system. Depending on your proximity to the ocean, the average rate in your region may vary considerably.

Source: tampabay.com

Source: tampabay.com

Each state has one, and it is partially subsidized by taxpayers and by private insurers. The average cost for home insurance in florida is $1,405 per year or $118 per month. Worst homeowners insurance companies in florida in 2022. If the consumer finds the right agent they will learn that high risk is not synonymous with substandard coverage. Despite the high risk, florida doesn’t specifically require hurricane insurance.

Source: atlantahotnews.blogspot.com

Source: atlantahotnews.blogspot.com

5 heritage property & casualty insurance company 241,822 6 american integrity insurance company of florida 236.796 7 united property & casualty insurance company 187,412 8 st johns insurance. 5 heritage property & casualty insurance company 241,822 6 american integrity insurance company of florida 236.796 7 united property & casualty insurance company 187,412 8 st johns insurance. If you live in a high risk weather area, you. Businesses also usually mean increased foot traffic and. The best way to get an affordable homeowners insurance policy in florida is to get quotes from as many insurance companies as possible.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title high risk homeowners insurance florida by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.