Your High risk driver insurance ny images are ready in this website. High risk driver insurance ny are a topic that is being searched for and liked by netizens now. You can Find and Download the High risk driver insurance ny files here. Get all royalty-free photos and vectors.

If you’re looking for high risk driver insurance ny pictures information linked to the high risk driver insurance ny topic, you have visit the ideal site. Our site always provides you with hints for downloading the highest quality video and image content, please kindly search and find more enlightening video articles and graphics that fit your interests.

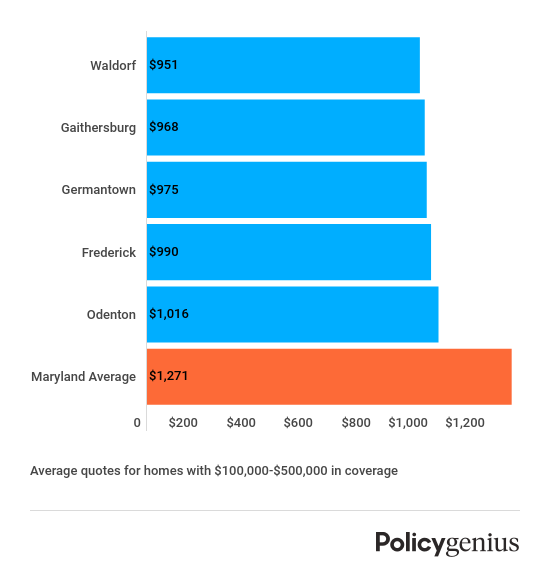

High Risk Driver Insurance Ny. Though all of the risk factors listed below will increase your car insurance, some will increase it more than others. The new york automobile insurance plan (nyaip) is for drivers who can�t get car insurance coverage, perhaps because they have a poor driving record or file too many claims. However, the amount your premiums increase will vary depending on a number of variables. With an average annual premium of $1,633, that�s a 38% increase from state farm�s insurance premium for standard drivers.

The General Auto Insurance Review Low Rates for HighRisk From pinterest.com

The General Auto Insurance Review Low Rates for HighRisk From pinterest.com

For example, a dui/dwi conviction can raise your premiums by around 65%, which. To cover that risk, the insurer charges a higher premium. They also will give you the option to purchase additional coverage if you want it. However, if you cannot find an auto insurance company that will sell you an auto policy with the required coverages you need or want, the new york automobile insurance plan (nyaip), commonly known as the auto plan or assigned risk plan, is a special insurance facility established under new york state law to assure that. In addition, the insurer may offer fewer perks, or less coverage. Though all of the risk factors listed below will increase your car insurance, some will increase it more than others.

People who have had one or more car accidents drivers who have been convicted of dui or driving while intoxicated (dwi)

In addition, the insurer may offer fewer perks, or less coverage. At highriskinsurance.ca we will help you find the best rates and insurance policy with professional service and knowledgeable licensed insurance professionals specially trained to understand your specific high risk needs. People who have had one or more car accidents drivers who have been convicted of dui or driving while intoxicated (dwi) The new york automobile insurance plan (nyaip) is for drivers who can�t get car insurance coverage, perhaps because they have a poor driving record or file too many claims. However, under auto plan rules, drivers are eligible for a careful driver discount if they are accident free and conviction free for at least one year in the auto plan and have at least four years. Premiums for auto plan coverage are generally higher, because the overall loss experience for this group of drivers has been consistently worse compared to the voluntary market.

Source: insurancespecialists.com

Source: insurancespecialists.com

However, the amount your premiums increase will vary depending on a number of variables. However, under auto plan rules, drivers are eligible for a careful driver discount if they are accident free and conviction free for at least one year in the auto plan and have at least four years. That�s about 39% more than the average cost of car insurance in new york overall. For example, a dui/dwi conviction can raise your premiums by around 65%, which. New drivers and, for some insurers, young drivers;

Source: insurancebyfrost.com

Source: insurancebyfrost.com

Though all of the risk factors listed below will increase your car insurance, some will increase it more than others. Once you are classified as a high risk driver you need to find licensed professional that provide drivers the choice of insurance companies serving their area. New drivers and, for some insurers, young drivers; For example, a small fender bender is not as bad as a dui, nor is being a teen driver as bad as having a reckless driving tick… For example, if you�ve been convicted of driving under the influence (dui) of drugs or alcohol or have multiple violations such as speeding tickets, you may be considered a high risk driver, requiring special high risk auto insurance.

Source: coverage.com

Source: coverage.com

However, under auto plan rules, drivers are eligible for a careful driver discount if they are accident free and conviction free for at least one year in the auto plan and have at least four years. At highriskinsurance.ca we will help you find the best rates and insurance policy with professional service and knowledgeable licensed insurance professionals specially trained to understand your specific high risk needs. For example, a small fender bender is not as bad as a dui, nor is being a teen driver as bad as having a reckless driving tick… Your driving record will determine if you need high risk car insurance. Drivers in new york much have at least $10,000 of property damage coverage , as well as personal injury protection, bodily liability , and death coverage of $25,000/$50,000 for.

Source: keithmichaels.co.uk

Source: keithmichaels.co.uk

For example, a small fender bender is not as bad as a dui, nor is being a teen driver as bad as having a reckless driving tick… Your driving record will determine if you need high risk car insurance. Though all of the risk factors listed below will increase your car insurance, some will increase it more than others. In addition, the insurer may offer fewer perks, or less coverage. They also will give you the option to purchase additional coverage if you want it.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

With an average annual premium of $1,633, that�s a 38% increase from state farm�s insurance premium for standard drivers. The new york automobile insurance plan (nyaip) is for drivers who can�t get car insurance coverage, perhaps because they have a poor driving record or file too many claims. With an average annual premium of $1,633, that�s a 38% increase from state farm�s insurance premium for standard drivers. Your driving record will determine if you need high risk car insurance. However, if you cannot find an auto insurance company that will sell you an auto policy with the required coverages you need or want, the new york automobile insurance plan (nyaip), commonly known as the auto plan or assigned risk plan, is a special insurance facility established under new york state law to assure that.

Source: pinterest.com

Source: pinterest.com

There are several reasons why an auto insurance carrier might consider you high risk. Premiums for auto plan coverage are generally higher, because the overall loss experience for this group of drivers has been consistently worse compared to the voluntary market. The new york automobile insurance plan (nyaip) is for drivers who can�t get car insurance coverage, perhaps because they have a poor driving record or file too many claims. With an average annual premium of $1,633, that�s a 38% increase from state farm�s insurance premium for standard drivers. For example, a dui/dwi conviction can raise your premiums by around 65%, which.

Source: insurancecomswa.blogspot.com

At highriskinsurance.ca we will help you find the best rates and insurance policy with professional service and knowledgeable licensed insurance professionals specially trained to understand your specific high risk needs. In addition, the insurer may offer fewer perks, or less coverage. They also will give you the option to purchase additional coverage if you want it. The new york automobile insurance plan (nyaip) is for drivers who can�t get car insurance coverage, perhaps because they have a poor driving record or file too many claims. At highriskinsurance.ca we will help you find the best rates and insurance policy with professional service and knowledgeable licensed insurance professionals specially trained to understand your specific high risk needs.

Source: bankrate.com

Source: bankrate.com

However, the amount your premiums increase will vary depending on a number of variables. For example, if you�ve been convicted of driving under the influence (dui) of drugs or alcohol or have multiple violations such as speeding tickets, you may be considered a high risk driver, requiring special high risk auto insurance. Drivers in new york much have at least $10,000 of property damage coverage , as well as personal injury protection, bodily liability , and death coverage of $25,000/$50,000 for. People who have had one or more car accidents drivers who have been convicted of dui or driving while intoxicated (dwi) They also will give you the option to purchase additional coverage if you want it.

Source: slideshare.net

Source: slideshare.net

For example, a small fender bender is not as bad as a dui, nor is being a teen driver as bad as having a reckless driving tick… The new york automobile insurance plan (nyaip) is for drivers who can�t get car insurance coverage, perhaps because they have a poor driving record or file too many claims. And the fact that they�re high risk is reflected in their car insurance premiums. For example, if you�ve been convicted of driving under the influence (dui) of drugs or alcohol or have multiple violations such as speeding tickets, you may be considered a high risk driver, requiring special high risk auto insurance. People who have had one or more car accidents drivers who have been convicted of dui or driving while intoxicated (dwi)

Source: curtishelmsinsurance.com

Source: curtishelmsinsurance.com

Though all of the risk factors listed below will increase your car insurance, some will increase it more than others. With an average annual premium of $1,633, that�s a 38% increase from state farm�s insurance premium for standard drivers. The average yearly cost for a preferred or normal driver to obtain new york automobile insurance is $1,001. However, under auto plan rules, drivers are eligible for a careful driver discount if they are accident free and conviction free for at least one year in the auto plan and have at least four years. Our brokers specialize in policies that help you get back on the road and build your driving record back to where you want it.

Source: loyainsurancecompany.org

Source: loyainsurancecompany.org

And the fact that they�re high risk is reflected in their car insurance premiums. New york’s assigned risk insurance program will provide you with the minimum insurance required by law. They also will give you the option to purchase additional coverage if you want it. However, under auto plan rules, drivers are eligible for a careful driver discount if they are accident free and conviction free for at least one year in the auto plan and have at least four years. New drivers and, for some insurers, young drivers;

Source: simplyhelpfultips.com

Source: simplyhelpfultips.com

Once you are classified as a high risk driver you need to find licensed professional that provide drivers the choice of insurance companies serving their area. The new york automobile insurance plan (nyaip) is for drivers who can�t get car insurance coverage, perhaps because they have a poor driving record or file too many claims. For example, a dui/dwi conviction can raise your premiums by around 65%, which. That�s about 39% more than the average cost of car insurance in new york overall. To cover that risk, the insurer charges a higher premium.

Source: pinterest.com

Source: pinterest.com

Our brokers specialize in policies that help you get back on the road and build your driving record back to where you want it. Though all of the risk factors listed below will increase your car insurance, some will increase it more than others. They also will give you the option to purchase additional coverage if you want it. With an average annual premium of $1,633, that�s a 38% increase from state farm�s insurance premium for standard drivers. For example, a small fender bender is not as bad as a dui, nor is being a teen driver as bad as having a reckless driving tick…

Source: myseniorlives.com

Source: myseniorlives.com

That�s about 39% more than the average cost of car insurance in new york overall. For example, if you�ve been convicted of driving under the influence (dui) of drugs or alcohol or have multiple violations such as speeding tickets, you may be considered a high risk driver, requiring special high risk auto insurance. Your driving record will determine if you need high risk car insurance. To cover that risk, the insurer charges a higher premium. They also will give you the option to purchase additional coverage if you want it.

![]() Source: ers.com

Source: ers.com

The new york automobile insurance plan (nyaip) is for drivers who can�t get car insurance coverage, perhaps because they have a poor driving record or file too many claims. For example, if you�ve been convicted of driving under the influence (dui) of drugs or alcohol or have multiple violations such as speeding tickets, you may be considered a high risk driver, requiring special high risk auto insurance. And the fact that they�re high risk is reflected in their car insurance premiums. With an average annual premium of $1,633, that�s a 38% increase from state farm�s insurance premium for standard drivers. However, if you cannot find an auto insurance company that will sell you an auto policy with the required coverages you need or want, the new york automobile insurance plan (nyaip), commonly known as the auto plan or assigned risk plan, is a special insurance facility established under new york state law to assure that.

Source: icainsurance.com

Source: icainsurance.com

There are several reasons why an auto insurance carrier might consider you high risk. People who have had one or more car accidents drivers who have been convicted of dui or driving while intoxicated (dwi) For example, a small fender bender is not as bad as a dui, nor is being a teen driver as bad as having a reckless driving tick… And the fact that they�re high risk is reflected in their car insurance premiums. Though all of the risk factors listed below will increase your car insurance, some will increase it more than others.

Source: lawleyinsurance.com

Source: lawleyinsurance.com

However, if you cannot find an auto insurance company that will sell you an auto policy with the required coverages you need or want, the new york automobile insurance plan (nyaip), commonly known as the auto plan or assigned risk plan, is a special insurance facility established under new york state law to assure that. New york’s assigned risk insurance program will provide you with the minimum insurance required by law. To cover that risk, the insurer charges a higher premium. Drivers in new york much have at least $10,000 of property damage coverage , as well as personal injury protection, bodily liability , and death coverage of $25,000/$50,000 for. The new york automobile insurance plan (nyaip) is for drivers who can�t get car insurance coverage, perhaps because they have a poor driving record or file too many claims.

Source: prlog.org

Source: prlog.org

Premiums for auto plan coverage are generally higher, because the overall loss experience for this group of drivers has been consistently worse compared to the voluntary market. To cover that risk, the insurer charges a higher premium. However, if you cannot find an auto insurance company that will sell you an auto policy with the required coverages you need or want, the new york automobile insurance plan (nyaip), commonly known as the auto plan or assigned risk plan, is a special insurance facility established under new york state law to assure that. Once you are classified as a high risk driver you need to find licensed professional that provide drivers the choice of insurance companies serving their area. However, under auto plan rules, drivers are eligible for a careful driver discount if they are accident free and conviction free for at least one year in the auto plan and have at least four years.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title high risk driver insurance ny by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.