Your High blood pressure and life insurance images are available in this site. High blood pressure and life insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the High blood pressure and life insurance files here. Find and Download all free vectors.

If you’re searching for high blood pressure and life insurance pictures information linked to the high blood pressure and life insurance topic, you have pay a visit to the ideal site. Our website always provides you with hints for seeking the maximum quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

High Blood Pressure And Life Insurance. Exclusion (turned down) if blood pressure is still dangerously high or has not been stable for a long enough period of time. As long as your pressure readings are stable and within the recommended limits. The question can you get life insurance with high blood pressure comes up all the time and the answer is normally yes you can. Final word on life insurance with high blood pressure medications.

Life Insurance and High Blood Pressure Pacific Insurance From pacificinsurancegroup.com

Life Insurance and High Blood Pressure Pacific Insurance From pacificinsurancegroup.com

Your application will be assessed taking the following information into account: Every ailment and preexisting condition, such as diabetes, depression, cholesterol and high blood pressure readings, are scrutinized in the underwriting process. The good news is, getting life insurance with high blood pressure is very achievable and is not a concern, but insurance companies will rate you higher if you have high blood pressure that is not controlled. If there any other health issues present If you want to buy life insurance with a medical exam and worry about high blood pressure, there are some things you can do to lower your blood pressure for the life insurance exam. As long as your pressure readings are stable and within the recommended limits.

The question can you get life insurance with high blood pressure comes up all the time and the answer is normally yes you can.

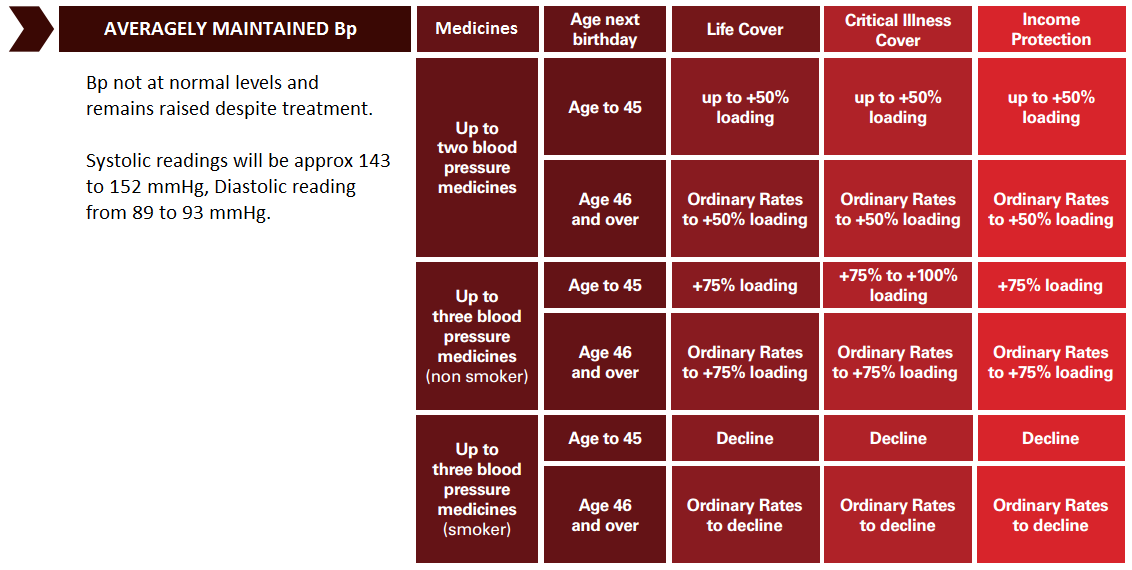

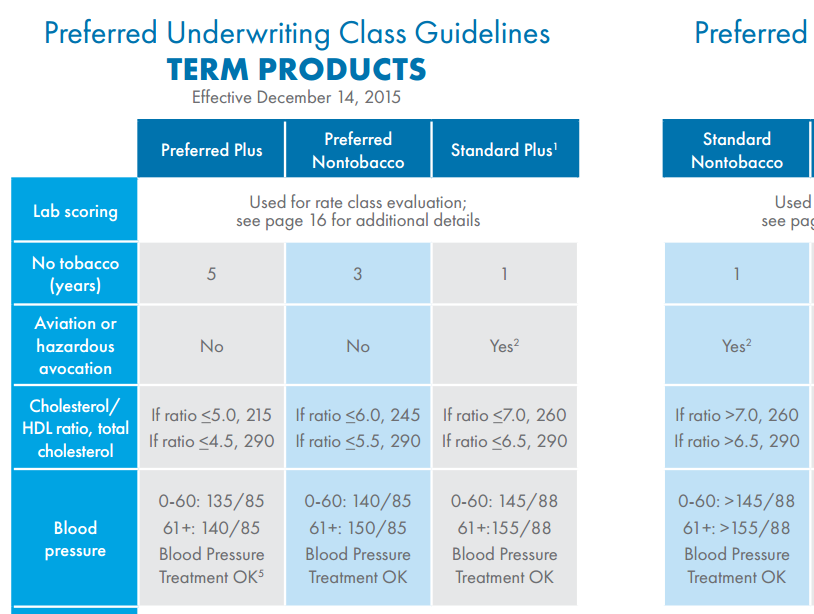

The below chart shows the carriers we have found to be the most. The impact high blood pressure will have on your ability to secure life insurance will depend on the severity of your condition and how well you’re managing it. More than 1 in every 3 americans suffer from hypertension, so most hbp medications are going to pass through underwriting with no issue. If you want to buy life insurance with a medical exam and worry about high blood pressure, there are some things you can do to lower your blood pressure for the life insurance exam. When underwriting hypertension and life insurance, an insurance company wants to know about the typical issues such as your lifestyle and medical history as well as your high blood pressure/hypertension. Life insurance riders for high blood pressure.

Source: bestliferates.org

Source: bestliferates.org

You can still get life insurance even if you have high blood pressure or hypertension. Yes, you can get life insurance with high blood pressure. The effect of high blood pressure on premiums. Exclusion (turned down) if blood pressure is still dangerously high or has not been stable for a long enough period of time. A life insurance company will raise the premiums of a policy to account for the risks that are associated with high blood pressure, which can be an early indicator of cardiovascular diseases such as heart attacks and strokes.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Each case is unique but there are some patterns in how life insurance companies handle high blood pressure cases. More than 1 in every 3 americans suffer from hypertension, so most hbp medications are going to pass through underwriting with no issue. The life insurance company will most likely ask you additional questions about your condition to get a better understanding of your situation. The life insurance company will look at your overall health. The impact high blood pressure will have on your ability to secure life insurance will depend on the severity of your condition and how well you’re managing it.

Source: healthtn.com

Source: healthtn.com

Life insurance premiums are dependent on many factors, including blood pressure reading, cholesterol level, age, alcohol and tobacco use, weight and general overall health. The question can you get life insurance with high blood pressure comes up all the time and the answer is normally yes you can. You can still get life insurance even if you have high blood pressure or hypertension. Final word on life insurance with high blood pressure medications. The effect of high blood pressure on premiums.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

If you have moderately high blood pressure, you can qualify for more affordable rates. Hypertension and life insurance the cdc reports that 1/3 of adults suffer from elevated blood pressure levels. The good news is, getting life insurance with high blood pressure is very achievable and is not a concern, but insurance companies will rate you higher if you have high blood pressure that is not controlled. A life insurance company will raise the premiums of a policy to account for the risks that are associated with high blood pressure, which can be an early indicator of cardiovascular diseases such as heart attacks and strokes. More than 1 in every 3 americans suffer from hypertension, so most hbp medications are going to pass through underwriting with no issue.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Almost every life insurance company will allow the applicant to add various riders to their insurance policy to broaden coverage and add living benefits for the insured. Your application will be assessed taking the following information into account: Hypertension and life insurance the cdc reports that 1/3 of adults suffer from elevated blood pressure levels. You can still get life insurance even if you have high blood pressure or hypertension. Life insurance companies will look at your overall health, including lifestyle and habits, the relationship of your weight to your height,.

Source: pacificinsurancegroup.com

Source: pacificinsurancegroup.com

Life insurance underwriting professions take into consideration all aspects an applicant who has high blood pressure. Studies have shown that individuals with high blood pressure have a higher risk of other conditions such as heart attack, stroke, aneurysm, or even kidney failure, to name a few. High blood pressure at first has few symptoms but if it is not treated will cause severe damage to the heart, lungs, blood vessels and kidneys; It is often an early indicator of cardiovascular disease, such as stroke and heart attack. Your application will be assessed taking the following information into account:

Source: youtube.com

Source: youtube.com

Make sure you shop around if you have hypertension and want life insurance. High blood pressure can impact your life insurance. Life insurance companies tend to regard high blood pressure differently, with some companies being more lenient than others. How high blood pressure effects premiums. Yes, it’s possible to get life insurance if you have high blood pressure.

Source: onlinemortgageadvisor.co.uk

Source: onlinemortgageadvisor.co.uk

The question can you get life insurance with high blood pressure comes up all the time and the answer is normally yes you can. You can still get life insurance even if you have high blood pressure or hypertension. Mar 02, 2017 · high blood pressure is the pressure of the blood on the arteries as the heart beats; The combination of blood pressure, high cholesterol would be alarming as well! The life insurance company will most likely ask you additional questions about your condition to get a better understanding of your situation.

Source: pinnaclequote.com

Source: pinnaclequote.com

Your treatment plan, age of onset, blood pressure readings, and overall health impact your premiums. Studies have shown that individuals with high blood pressure have a higher risk of other conditions such as heart attack, stroke, aneurysm, or even kidney failure, to name a few. The life insurance company will look at your overall health. The life insurance company will most likely ask you additional questions about your condition to get a better understanding of your situation. If you have moderately high blood pressure, you can qualify for more affordable rates.

Source: riskquoter.com

Source: riskquoter.com

The below chart shows the carriers we have found to be the most. Whether an applicant can qualify for life insurance with high blood pressure depends on five essential aspects: In applying for life insurance with a history of high blood pressure it is important to understand both your diagnosis and how this condition can potentially affect policy approval. Exclusion (turned down) if blood pressure is still dangerously high or has not been stable for a long enough period of time. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: effortlessinsurance.com

Source: effortlessinsurance.com

The life insurance company will most likely ask you additional questions about your condition to get a better understanding of your situation. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Whether an applicant can qualify for life insurance with high blood pressure depends on five essential aspects: How high blood pressure effects premiums. Each company will have its own specific underwriting guidelines as it relates to life insurance approvals and high blood pressure.

Source: onlinemortgageadvisor.co.uk

Source: onlinemortgageadvisor.co.uk

You�ll pay more for life insurance if you have critically high blood pressure (i.e., systolic blood pressure higher than 180). Your application will be assessed taking the following information into account: Yes, it’s possible to get life insurance if you have high blood pressure. Life insurance riders for high blood pressure. In applying for life insurance with a history of high blood pressure it is important to understand both your diagnosis and how this condition can potentially affect policy approval.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. These patterns can help high blood pressure patients better plan for and prepare for questions regarding their underlying health condition during the application process. The combination of blood pressure, high cholesterol would be alarming as well! You can still get life insurance even if you have high blood pressure or hypertension. How high blood pressure effects premiums.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Life insurance premiums are dependent on many factors, including blood pressure reading, cholesterol level, age, alcohol and tobacco use, weight and general overall health. A life insurance company will raise the premiums of a policy to account for the risks that are associated with high blood pressure, which can be an early indicator of cardiovascular diseases such as heart attacks and strokes. Life insurance companies will raise premiums to account for the various risks that are caused by high blood pressure. If there any other health issues present You can still get life insurance even if you have high blood pressure or hypertension.

Source: topquotelifeinsurance.com

Source: topquotelifeinsurance.com

The impact high blood pressure will have on your ability to secure life insurance will depend on the severity of your condition and how well you’re managing it. Hypertension and life insurance the cdc reports that 1/3 of adults suffer from elevated blood pressure levels. You can still get life insurance even if you have high blood pressure or hypertension. High blood pressure at first has few symptoms but if it is not treated will cause severe damage to the heart, lungs, blood vessels and kidneys; Yes, you can get life insurance with high blood pressure.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

When underwriting hypertension and life insurance, an insurance company wants to know about the typical issues such as your lifestyle and medical history as well as your high blood pressure/hypertension. Final word on life insurance with high blood pressure medications. This will help them to determine your. The good news is, getting life insurance with high blood pressure is very achievable and is not a concern, but insurance companies will rate you higher if you have high blood pressure that is not controlled. Life insurance has a long history with hypertension medications, and that doesn’t look to change anytime soon.

Source: simplelifeinsure.com

Source: simplelifeinsure.com

The combination of blood pressure, high cholesterol would be alarming as well! Make sure you shop around if you have hypertension and want life insurance. Life insurance premiums are dependent on many factors, including blood pressure reading, cholesterol level, age, alcohol and tobacco use, weight and general overall health. Almost every life insurance company will allow the applicant to add various riders to their insurance policy to broaden coverage and add living benefits for the insured. If there any other health issues present

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title high blood pressure and life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.