Your Health insurance vs critical illness images are ready. Health insurance vs critical illness are a topic that is being searched for and liked by netizens now. You can Find and Download the Health insurance vs critical illness files here. Find and Download all free vectors.

If you’re looking for health insurance vs critical illness pictures information related to the health insurance vs critical illness keyword, you have visit the ideal blog. Our website always provides you with suggestions for viewing the maximum quality video and image content, please kindly surf and find more informative video content and images that match your interests.

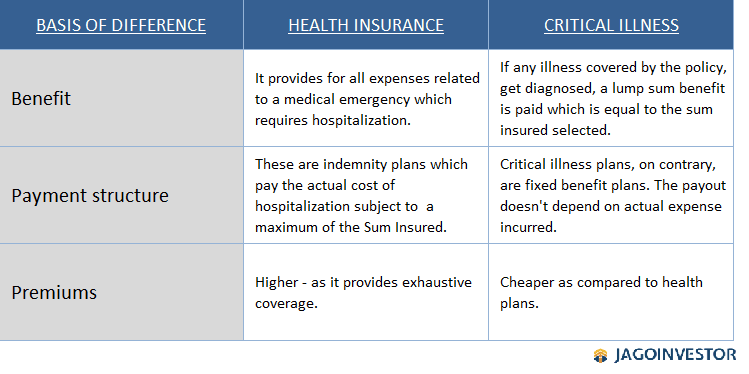

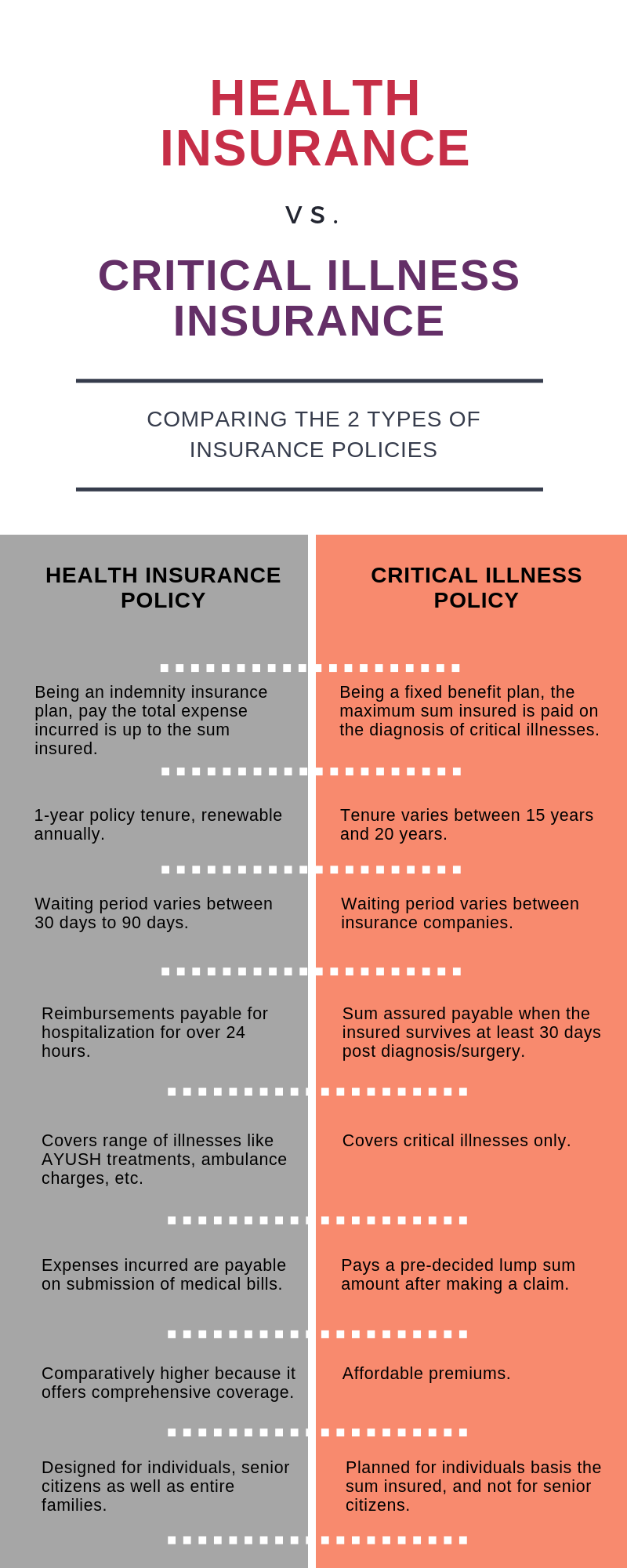

Health Insurance Vs Critical Illness. Thus, the premium amount is also higher. • can use it to pay for your medical expenses or as a replacement of your monthly income. • covers all expenses of cancer. But the more members there are in the health insurance plan, the higher the premium of it and, compared to that, critical illness insurance turns out to be relatively cheaper.

Health Insurance Vs Critical Illness Critical Illness From dallaslatest.blogspot.com

Health Insurance Vs Critical Illness Critical Illness From dallaslatest.blogspot.com

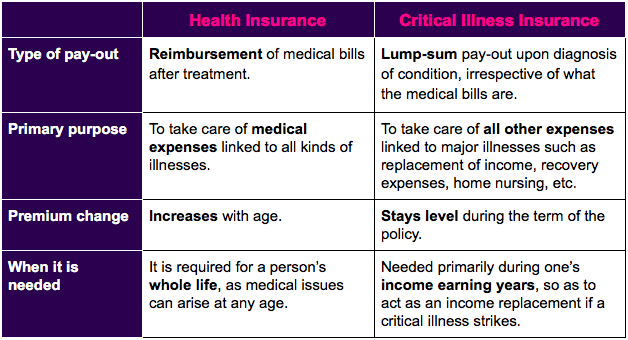

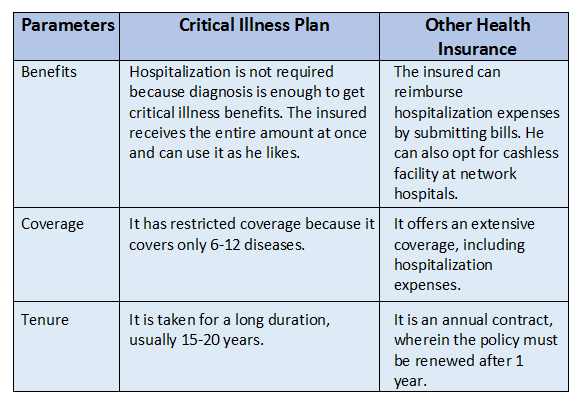

Health insurance plans are viable until the term of the policy ends. However, critical illness plans do not have such high coverage. A medical insurance policy protects you in the event of a medical emergency which requires hospitalisation, by covering for the cost of treatment. Instead, it makes a lump sum payout to the patient depending upon the illness cover chosen. Such illnesses can require prolonged treatment and care. Difference between health insurance & critical illness insurance policy:

Health insurance that specifically covers treatment expenses for cancer.

Everyone gets ill to some degree in their lives; Both policies are meant to offer financial coverage as per the situation of the policyholder. The difference between medical insurance and critical illness insurance standard medical insurance plans cover hospitalization costs and reimburse your medical expenses. Instead, it makes a lump sum payout to the patient depending upon the illness cover chosen. If you are diagnosed with one of the covered illnesses, you receive the entire sum. Difference between health insurance & critical illness insurance policy:

Source: dallaslatest.blogspot.com

Source: dallaslatest.blogspot.com

While they pay the stated amount in cash, check or transfer, there�s nothing else following that, even if you have more bills. Critical illness insurance and cancer insurance are great supplemental coverages along with your standard health insurance plan. The normal health insurance cost is higher because it covers a wider scope of possible events. • can use it to pay for your medical expenses or as a replacement of your monthly income. A critical illness plan only covers some specific critical illnesses listed in the policy document.

Source: imoney.my

Source: imoney.my

Whereas critical illness insurance can be purchased for only one person. There is, usually, no upper limit in choosing the sum assured under life insurance plans. If you are diagnosed with one of the covered illnesses, you receive the entire sum. Both critical illness insurance and health insurance provide sufficient coverage for different situations. On the other hand, cancer insurance covers all the costs directly and indirectly associated with.

Source: jagoinvestor.com

Source: jagoinvestor.com

A critical illness policy could help pay for these treatments while you use your health insurance for other (covered) expenses. A critical illness policy could help pay for these treatments while you use your health insurance for other (covered) expenses. Critical illness cover vs health insurance. Such illnesses can require prolonged treatment and care. In contrast, critical illness insurance is a benefit policy that pays you a set amount in one go if you are diagnosed with any of the covered critical illnesses.

Source: guitarragewebsite.blogspot.com

Source: guitarragewebsite.blogspot.com

On the other hand, cancer insurance covers all the costs directly and indirectly associated with. On the other hand, in critical illness, you get a lump sum in case you are diagnosed with a critical illness, which is covered by the policy. • covers all expenses of cancer. The difference between medical insurance and critical illness insurance standard medical insurance plans cover hospitalization costs and reimburse your medical expenses. Both critical illness insurance and health insurance provide sufficient coverage for different situations.

Source: hypokhagneries.blogspot.com

Source: hypokhagneries.blogspot.com

The coverage offered by both plans differs in terms of their nature. There is, usually, no upper limit in choosing the sum assured under life insurance plans. There are a few major differences between health insurance and critical illness insurance policies. On the other hand, cancer insurance covers all the costs directly and indirectly associated with. Health insurance that specifically covers treatment expenses for cancer.

Source: alltrendingtrades.com

Source: alltrendingtrades.com

A critical illness policy covers serious illnesses, surgical. However, hospitalization accounts for only 35% of the expense. Health insurance and critical illness insurance both have a waiting period. A traditional health insurance plan primarily covers expenditures around hospitalization. Critical illness insurance and cancer insurance are great supplemental coverages along with your standard health insurance plan.

![]() Source: arbetovinsurance.com

Source: arbetovinsurance.com

The normal health insurance cost is higher because it covers a wider scope of possible events. A critical illness policy could help pay for these treatments while you use your health insurance for other (covered) expenses. However, hospitalization accounts for only 35% of the expense. • can use it to pay for your medical expenses or as a replacement of your monthly income. It is better to have both as regular health insurance will cover you for medical emergencies, it won’t cover you for serious illnesses since.

Source: fincash.com

Source: fincash.com

Here is a comparison between comprehensive health insurance and critical illness insurance plans to help you decide which works better for you: The plan covers a list of critical illnesses and treatments, the common ones being cancer, stroke, multiple sclerosis, major organ transplant, open chest cabg, heart attack, etc. Instead, it makes a lump sum payout to the patient depending upon the illness cover chosen. So, a claim cannot be submitted within 3 months of policy purchase. Whereas critical illness insurance can be purchased for only one person.

Source: angloifa.com

Source: angloifa.com

While they pay the stated amount in cash, check or transfer, there�s nothing else following that, even if you have more bills. Critical illness cover vs health insurance. In contrast, critical illness insurance is a benefit policy that pays you a set amount in one go if you are diagnosed with any of the covered critical illnesses. A critical illness policy covers serious illnesses, surgical. If you are diagnosed with one of the covered illnesses, you receive the entire sum.

Source: youtube.com

Source: youtube.com

With a critical illness cover, you are able to. On the other hand, a critical illness insurance policy provides financial aid in the form of a lump sum payout, in the event you are diagnosed with a critical illness. Under critical illness plans, the maximum sum insured levels range between rs.10 lakhs and rs.25 lakhs. Early, major and advanced stages of cancer. Health insurance plans are viable until the term of the policy ends.

Source: socialvillage.in

Source: socialvillage.in

There are a few major differences between health insurance and critical illness insurance policies. The difference between medical insurance and critical illness insurance standard medical insurance plans cover hospitalization costs and reimburse your medical expenses. A traditional health insurance plan primarily covers expenditures around hospitalization. The reimbursed amount will be only to the extent of the actual costs or expenses incurred, and nothing more and may have limits. On the other hand, cancer insurance covers all the costs directly and indirectly associated with.

Source: hypokhagneries.blogspot.com

Health insurance plans allow a higher coverage amount compared to critical illness plans. With a critical illness cover, you are able to. Unlike health cover, a critical illness plan does not pay for hospitalisation. A critical illness policy covers serious illnesses, surgical. However, critical illness plans do not have such high coverage.

Source: coverfox.com

Source: coverfox.com

Under critical illness plans, the maximum sum insured levels range between rs.10 lakhs and rs.25 lakhs. On the other hand, critical illness policies have a set limit to how much they�ll pay. So, a claim cannot be submitted within 3 months of policy purchase. Usually, up to 20 lethal diseases are covered under the critical illness insurance plan. Waiting period of this policy is mostly 3 months.

Source: dallaslatest.blogspot.com

Source: dallaslatest.blogspot.com

However, hospitalization accounts for only 35% of the expense. Whereas critical illness insurance can be purchased for only one person. There is, usually, no upper limit in choosing the sum assured under life insurance plans. On the other hand, a critical illness insurance policy provides financial aid in the form of a lump sum payout, in the event you are diagnosed with a critical illness. If you are diagnosed with one of the covered illnesses, you receive the entire sum.

Source: findbestinsurquotes.com

Source: findbestinsurquotes.com

The difference between medical insurance and critical illness insurance standard medical insurance plans cover hospitalization costs and reimburse your medical expenses. A critical illness policy could help pay for these treatments while you use your health insurance for other (covered) expenses. Usually, up to 20 lethal diseases are covered under the critical illness insurance plan. On the other hand, critical illness policies have a set limit to how much they�ll pay. Thus, the premium amount is also higher.

![]() Source: paisabazaar.com

Source: paisabazaar.com

A critical illness insurance will pay you a lump sum amount once any of the listed critical illness is diagnosed and then the policy will cease to exist. Everyone gets ill to some degree in their lives; Here is a comparison between comprehensive health insurance and critical illness insurance plans to help you decide which works better for you: It is better to have both as regular health insurance will cover you for medical emergencies, it won’t cover you for serious illnesses since. On the other hand, critical illness policies have a set limit to how much they�ll pay.

Source: insurancefirst.sg

Source: insurancefirst.sg

Both critical illness insurance and health insurance provide sufficient coverage for different situations. On the other hand, a critical illness insurance policy provides financial aid in the form of a lump sum payout, in the event you are diagnosed with a critical illness. Here is a comparison between comprehensive health insurance and critical illness insurance plans to help you decide which works better for you: Both policies are meant to offer financial coverage as per the situation of the policyholder. Difference between health insurance & critical illness insurance policy:

Source: youtube.com

Source: youtube.com

Thus, the premium amount is also higher. A life insurance plan pays a benefit if the life insured dies during the term of the plan. A critical illness insurance will pay you a lump sum amount once any of the listed critical illness is diagnosed and then the policy will cease to exist. But the more members there are in the health insurance plan, the higher the premium of it and, compared to that, critical illness insurance turns out to be relatively cheaper. Health insurance that specifically covers treatment expenses for listed critical illnesses.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title health insurance vs critical illness by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.