Your Health insurance reserve requirements images are ready in this website. Health insurance reserve requirements are a topic that is being searched for and liked by netizens now. You can Download the Health insurance reserve requirements files here. Get all royalty-free images.

If you’re searching for health insurance reserve requirements pictures information linked to the health insurance reserve requirements interest, you have visit the right site. Our website always gives you hints for seeking the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

Health Insurance Reserve Requirements. The topic of pdrs has been discussed in various authoritative guidance materials and also in published actuarial literature. Assets and liabilities are defined in the health insurance reserves model regulation, instructions for the actuarial opinion of the naic health annual statement, and in the practice note on the revised actuarial statement of opinion instructions for the naic health annual statement effective december 31, 2010 (unless the company is required An analysis of the credibility of the experience; Weilant 2 december 2012 executive summary in the united states, premium deficiency reserves (pdrs) are, when needed, one of several categories of accident and health liabilities required under statutory accounting principles, gaap, and by actuarial

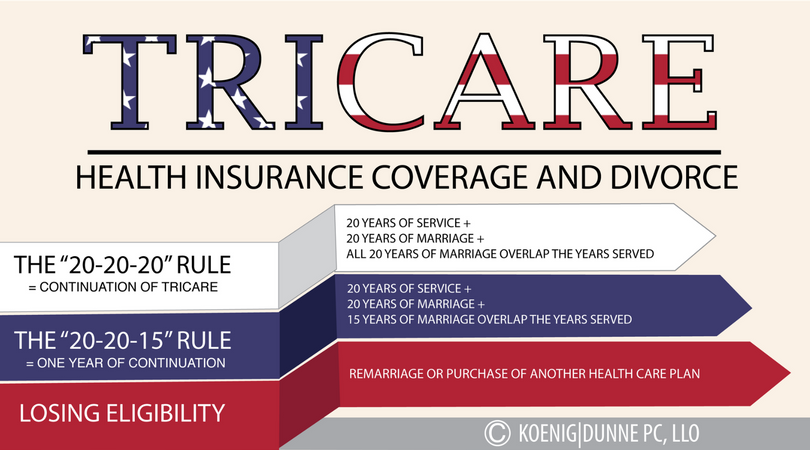

TRICARE Health Insurance Coverage and Divorce Koenig Dunne From koenigdunne.com

TRICARE Health Insurance Coverage and Divorce Koenig Dunne From koenigdunne.com

Also, section 3 of the aomr (which is titled “scope”) states that the aomr is applicable to life insurance companies and fraternal benefit societies. All types of insurance, including life, health and auto, have reserve requirements. Required as part of gaap and statutory accounting ! In the united states, premium deficiency reserves (pdrs) are one of several categories of accident and health liabilities required under statutory accounting principles, gaap, and by actuarial standards of practice. Usually, the reserve requirement amounts to 10 to 12 percent of the insurer’s revenue. State insurance departments set minimum reserve requirements in the state�s insurance code.

The purpose of this rule is to establish the minimum reserve standards for all individual and group health insurance coverages, including single premium credit disability insurance.

This rule is promulgated pursuant to the authority vested in. Prior to the adoption by a company of either c.3.b.ii, a plan of modification to the reserve basis must be prepared and must include: An analysis of the credibility of the experience; This ensures that the reserves are sufficiently protected from loss. The increase in reserves is anticipated to be zero in the first year and, depending on the valuation interest rate, approximately twelve percent at durations two through five and diminishing to lesser percentages thereafter. Health insurance reserves minimum reserve requirements the following requirements apply to all individual and group health and accident and sickness insurance excluding credit.

Source: muntzpartners.com.au

Source: muntzpartners.com.au

Usually an adjuster is required to make a preliminary adjustment within 24 or 48 hours of the claim being reported. Required as part of gaap and statutory accounting ! Allowance for future expenses needs to take into account both overheads and directly attributable expenses, and future expense inflation. (b) claim reserve standards for total disability due to. Health insurance reserves minimum reserve requirements the following requirements apply to all individual and group health and accident and sickness insurance excluding credit.

Source: reservehealth.com

Source: reservehealth.com

This includes reported and unreported claims for both accrued and tmaccrued benefits. In order to establish accurate reserves, insurance companies require their adjusters to make regular adjustments to the value of claims. Appropriate claim expense reserves are also required to be estimated for claim settlement The topic of pdrs has been discussed in various authoritative guidance materials and also in published actuarial literature. Some states may not extend the aomr requirements to health maintenance organizations or hospital,

Source: mossadams.com

Source: mossadams.com

Allowance for future expenses needs to take into account both overheads and directly attributable expenses, and future expense inflation. When opining on reserves, the actuary should refer to appropriate and current aomr requirements. Allowance for future expenses needs to take into account both overheads and directly attributable expenses, and future expense inflation. Appropriate claim expense reserves are also required to be estimated for claim settlement Claim reserves (a) reserves are required for claims on all health insurance policies, whether of type a, b, c or d, providing benefits for continuing loss, such as loss of time for hospitalization.

Source: novapublishers.com

Source: novapublishers.com

Required as part of gaap and statutory accounting ! Also, section 3 of the aomr (which is titled “scope”) states that the aomr is applicable to life insurance companies and fraternal benefit societies. Required as part of gaap and statutory accounting ! Usually, the reserve requirement amounts to 10 to 12 percent of the insurer’s revenue. Health insurance reserves minimum reserve requirements the following requirements apply to all individual and group health and accident and sickness insurance excluding credit.

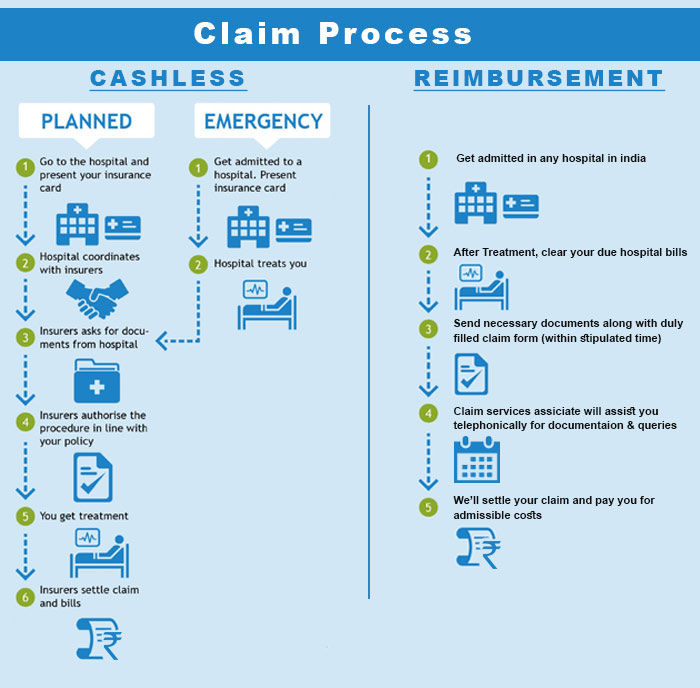

Source: theindianwire.com

Source: theindianwire.com

(b) claim reserve standards for total disability due to. Health insurance reserves minimum reserve requirements the following requirements apply to all individual and group health and accident and sickness insurance excluding credit. Claim reserves (a) reserves are required for claims on all health insurance policies, whether of type a, b, c or d, providing benefits for continuing loss, such as loss of time for hospitalization. This rule is promulgated pursuant to the authority vested in. Usually, the reserve requirement amounts to 10 to 12 percent of the insurer’s revenue.

Source: doctorheck.blogspot.com

Source: doctorheck.blogspot.com

This ensures that the reserves are sufficiently protected from loss. This ensures that the reserves are sufficiently protected from loss. (b) claim reserve standards for total disability due to. The reserve requirements in the valuation manual satisfy the minimum valuation requirements of the standard valuation law. Health insurance reserves minimum reserve requirements the following requirements apply to all individual and group health and accident and sickness insurance excluding credit.

Source: graphicreserve.com

Source: graphicreserve.com

All types of insurance, including life, health and auto, have reserve requirements. Premium deficiency reserve requirements for accident and health insurance michael e. Health insurance reserves minimum reserve requirements the following requirements apply to all individual and group health and accident and sickness insurance excluding credit. For short term health insurance business that is annually renewable, it means to the end of the policy year. This ensures that the reserves are sufficiently protected from loss.

Source: policyx.com

Source: policyx.com

All other credit insurance is not subject to this rule. Appropriate claim expense reserves are also required to be estimated for claim settlement In the united states, premium deficiency reserves (pdrs) are one of several categories of accident and health liabilities required under statutory accounting principles, gaap, and by actuarial standards of practice. Weilant 2 december 2012 executive summary in the united states, premium deficiency reserves (pdrs) are, when needed, one of several categories of accident and health liabilities required under statutory accounting principles, gaap, and by actuarial Or benefits are reviewable so that they fully reflect the risks.

Source: researchgate.net

Source: researchgate.net

The increase in reserves is anticipated to be zero in the first year and, depending on the valuation interest rate, approximately twelve percent at durations two through five and diminishing to lesser percentages thereafter. From this description, it is. All other credit insurance is not subject to this rule. With insurance code §425.072(a), which requires using the valuation manual for setting reserves on accident and health insurance policies issued on or after the operative date; This includes reported and unreported claims for both accrued and tmaccrued benefits.

Source: una.edu

Other (balance before reinsurance) other (reinsurance balance) the basis of the reserve requirements takes into account these balances and separate account amounts and determines a percentage that the insurer needs to keep on hand. These typically amount to about 10 percent to 12 percent of an insurance company’s annual revenue, according to fineweb.com. In order to establish accurate reserves, insurance companies require their adjusters to make regular adjustments to the value of claims. (2) appropriate claim expense reserves are required with respect to the estimated expense of settlement of all incurred but unpaid claims. Usually, the reserve requirement amounts to 10 to 12 percent of the insurer’s revenue.

Source: thelundreport.org

Source: thelundreport.org

All types of insurance, including life, health and auto, have reserve requirements. Assets and liabilities are defined in the health insurance reserves model regulation, instructions for the actuarial opinion of the naic health annual statement, and in the practice note on the revised actuarial statement of opinion instructions for the naic health annual statement effective december 31, 2010 (unless the company is required In general, claim reserves are required on all health insurance policies for incurred but unpaid claims. Prior to the adoption by a company of either c.3.b.ii, a plan of modification to the reserve basis must be prepared and must include: Appropriate claim expense reserves are also required to be estimated for claim settlement

Source: pharmgradprograms.usc.edu

Source: pharmgradprograms.usc.edu

Assets and liabilities are defined in the health insurance reserves model regulation, instructions for the actuarial opinion of the naic health annual statement, and in the practice note on the revised actuarial statement of opinion instructions for the naic health annual statement effective december 31, 2010 (unless the company is required These typically amount to about 10 percent to 12 percent of an insurance company’s annual revenue, according to fineweb.com. Allowance for future expenses needs to take into account both overheads and directly attributable expenses, and future expense inflation. (2) appropriate claim expense reserves are required with respect to the estimated expense of settlement of all incurred but unpaid claims. In order to establish accurate reserves, insurance companies require their adjusters to make regular adjustments to the value of claims.

Source: blog.capterra.com

Source: blog.capterra.com

Reserves are needed to pay claims in the future when premiums are received prior to the insured event ! With insurance code §425.072(a), which requires using the valuation manual for setting reserves on accident and health insurance policies issued on or after the operative date; Appropriate claim expense reserves are also required to be estimated for claim settlement Usually an adjuster is required to make a preliminary adjustment within 24 or 48 hours of the claim being reported. Health insurance reserves minimum reserve requirements the following requirements apply to all individual and group health and accident and sickness insurance excluding credit.

![Health Care Reform New Reporting Requirements [Infographic] Health Care Reform New Reporting Requirements [Infographic]](https://cdn.slidesharecdn.com/ss_cropped_thumbnails/health-care-reform-new-reporting-requirements-infographic-140103091622-phpapp02/thumbnail-large.jpg?cb=1388740654) Source: slideshare.net

Source: slideshare.net

Allowance for future expenses needs to take into account both overheads and directly attributable expenses, and future expense inflation. (b) claim reserve standards for total disability due to. These typically amount to about 10 percent to 12 percent of an insurance company’s annual revenue, according to fineweb.com. All types of insurance, including life, health and auto, have reserve requirements. With insurance code §425.072(a), which requires using the valuation manual for setting reserves on accident and health insurance policies issued on or after the operative date;

Source: revisi.net

Source: revisi.net

Health insurance reserves minimum reserve requirements the following requirements apply to all individual and group health and accident and sickness insurance excluding credit. Prior to the adoption by a company of either c.3.b.ii, a plan of modification to the reserve basis must be prepared and must include: The topic of pdrs has been discussed in various authoritative guidance materials and also in published actuarial literature. Claim reserves (a) reserves are required for claims on all health insurance policies, whether of type a, b, c or d, providing benefits for continuing loss, such as loss of time for hospitalization. When opining on reserves, the actuary should refer to appropriate and current aomr requirements.

Source: revisi.net

Source: revisi.net

The reserve requirements in the valuation manual satisfy the minimum valuation requirements of the standard valuation law. Required as part of gaap and statutory accounting ! Assets and liabilities are defined in the health insurance reserves model regulation, instructions for the actuarial opinion of the naic health annual statement, and in the practice note on the revised actuarial statement of opinion instructions for the naic health annual statement effective december 31, 2010 (unless the company is required Premium deficiency reserve requirements for accident and health insurance michael e. With insurance code §425.072(a), which requires using the valuation manual for setting reserves on accident and health insurance policies issued on or after the operative date;

Source: ygkenpo.jp

Source: ygkenpo.jp

In order to establish accurate reserves, insurance companies require their adjusters to make regular adjustments to the value of claims. This includes reported and unreported claims for both accrued and tmaccrued benefits. Premium deficiency reserve requirements for accident and health insurance michael e. The increase in reserves is anticipated to be zero in the first year and, depending on the valuation interest rate, approximately twelve percent at durations two through five and diminishing to lesser percentages thereafter. Prior to the adoption by a company of either c.3.b.ii, a plan of modification to the reserve basis must be prepared and must include:

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title health insurance reserve requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.