Your Health insurance in divorce for spouse images are ready in this website. Health insurance in divorce for spouse are a topic that is being searched for and liked by netizens now. You can Get the Health insurance in divorce for spouse files here. Get all royalty-free images.

If you’re looking for health insurance in divorce for spouse pictures information linked to the health insurance in divorce for spouse topic, you have pay a visit to the ideal site. Our site frequently provides you with hints for viewing the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

Health Insurance In Divorce For Spouse. Can i keep ex wife on health insurance? This will help when it comes to costs, as you will not be used to paying the premiums for a. In all cases following a divorce, an employer will no longer cover a spouse under an employee’s healthcare policy. However, you do have other options.

CAN I STAY ON MY EX’S HEALTH INSURANCE POLICY AFTER WE’RE From lorilaird.com

CAN I STAY ON MY EX’S HEALTH INSURANCE POLICY AFTER WE’RE From lorilaird.com

Choosing legal separation over divorce. When a divorce is filed, there are automatic temporary restraining orders that go into effect, whereby neither party may sell or dispose of any property from the marriage, and both parties must keep the marital. A dependent spouse may consider cobra insurance benefits. This will help when it comes to costs, as you will not be used to paying the premiums for a. Below are a few options you may have for health insurance after divorce: The law is quite clear on that.

Only spouses and dependent children are allowed to be included in your insurance coverage.

The law is quite clear on that. Usually, the parent covering the health insurance costs for the children can include that cost within the child support calculation. There may also be discrepancy between whether a health insurance plan may be available to a spouse or minor child during a divorce versus being available to a party or a child once the divorce is finalized. Do i have to keep health insurance on my spouse? Only spouses and dependent children are allowed to be included in your insurance coverage. You are not obligated to continue insurance for your spouse unless you�ve been ordered by a court to do so.

Source: amarallaw.com

Source: amarallaw.com

However, you will be eligible for cobra health insurance coverage for up to 18 or 36 months (depending on the circumstances), just like any employee who loses coverage. This implies that if you are subject to a judgment of judicial separation, you are no longer considered a dependent of your spouse or partner for health. These benefits are available up to 36 months, depending on the. If you have a self and family enrollment or your spouse is covered under your self plus one enrollment, your spouse is eligible to continue coverage under your enrollment while you are legally separated or in the process of getting a divorce or an annulment. This is not a circumstance that you can control, as these terms are determined between your employer and the insurance company.

Source: pinterest.com

Source: pinterest.com

There are other mechanisms to specifically address the health insurance issue, such as: If cobra applies to your situation, a judge will factor it into your spousal support, so it may be in your best interest to consider providing health support during and for a limited. Importantly you will at most 60 days after your divorce to contact the health insurance plan. While a person’s health insurance coverage from their spouse may end as soon as the divorce is allowed by the judge, the coverage for both of your children will likely not be impacted by these proceedings. Most health insurance plans treat a judgment for legal separation the same as a judgment for dissolution of marriage.

Source: greatlakesdfs.com

Source: greatlakesdfs.com

These benefits are available up to 36 months, depending on the. We have been legally separated for over 4 years and he has been dragging out the divorce to keep health insurance. This implies that if you are subject to a judgment of judicial separation, you are no longer considered a dependent of your spouse or partner for health. A dependent spouse may consider cobra insurance benefits. Do i have to keep health insurance on my spouse?

Source: shapirofamilylaw.com

Source: shapirofamilylaw.com

The law is quite clear on that. Cobra is a federal law that requires that you be eligible to apply for health insurance coverage through your spouse�s plan even after your divorce has been finalized. We have been legally separated for over 4 years and he has been dragging out the divorce to keep health insurance. Choosing legal separation over divorce. There are other mechanisms to specifically address the health insurance issue, such as:

Source: goldbergjones-wa.com

Source: goldbergjones-wa.com

This would not be considered a divorce; Usually, the parent covering the health insurance costs for the children can include that cost within the child support calculation. Do i have to keep health insurance on my spouse? Divorce can leave you without your spouse’s company health insurance plan. During the divorce proceedings, the party who is paying for health insurance for the other spouse, cannot remove that spouse from his or her health insurance.

Source: lorilaird.com

Source: lorilaird.com

After you get divorced, you may be able to temporarily keep your health coverage through a law known as “cobra.” Whether health insurance can be maintained during a divorce might lie with the terms of the health insurance plan or other governmental regulations. After you get divorced, you may be able to temporarily keep your health coverage through a law known as “cobra.” This implies that if you are subject to a judgment of judicial separation, you are no longer considered a dependent of your spouse or partner for health. Most health insurance plans treat a judgment for legal separation the same as a judgment for dissolution of marriage.

Source: jeannecolemanlaw.com

Source: jeannecolemanlaw.com

Divorce can leave you without your spouse’s company health insurance plan. When a divorce is filed, there are automatic temporary restraining orders that go into effect, whereby neither party may sell or dispose of any property from the marriage, and both parties must keep the marital. Only spouses and dependent children are allowed to be included in your insurance coverage. Cobra is a federal law that requires that you be eligible to apply for health insurance coverage through your spouse�s plan even after your divorce has been finalized. Also keep in mind that your spouse may have to keep you on their health insurance until the divorce is finalized.

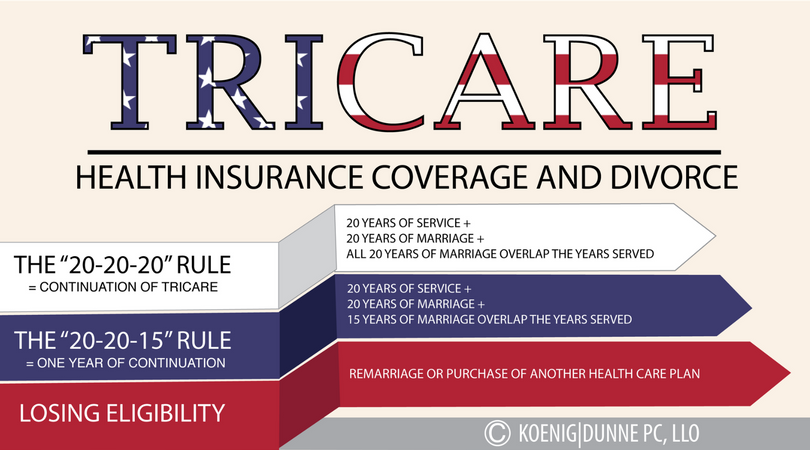

Source: koenigdunne.com

Source: koenigdunne.com

With an adult, it’s much simpler. A spouse will have 60 days to notify the employee’s health plan administrator that they would like to continue coverage. Can i keep ex wife on health insurance? These benefits are available up to 36 months, depending on the. You can�t remove your spouse from your insurance before divorce.

Source: jwbfamilylaw.com

Source: jwbfamilylaw.com

Cobra is a federal law that requires that you be eligible to apply for health insurance coverage through your spouse�s plan even after your divorce has been finalized. Most health insurance plans treat a judgment for legal separation the same as a judgment for dissolution of marriage. If your spouse provided a family plan, you will no longer have access to this coverage after the divorce is finalized, although most courts will allow you to remain on the insurance policy until the final decree is entered. Cobra is a federal law that requires that you be eligible to apply for health insurance coverage through your spouse�s plan even after your divorce has been finalized. There are multiple health insurance options for a divorcing spouse, including the following:

Source: bwg-law.com

Source: bwg-law.com

After you get divorced, you may be able to temporarily keep your health coverage through a law known as “cobra.” With an adult, it’s much simpler. This means that you will no longer be eligible to be covered under your spouse or partner�s health insurance plan. Normally, couples going through a divorce will have to purchase independent health insurance policies once the divorce is final. Importantly you will at most 60 days after your divorce to contact the health insurance plan.

Source: pinterest.com

Source: pinterest.com

This implies that if you are subject to a judgment of judicial separation, you are no longer considered a dependent of your spouse or partner for health. Also keep in mind that your spouse may have to keep you on their health insurance until the divorce is finalized. You are not obligated to continue insurance for your spouse unless you�ve been ordered by a court to do so. Yes, it is possible for you to work out with your partner what is going to be in your divorce settlement. However, after your divorce, you are legally obliged to remove your spouse from your health insurance cover.

Source: survivedivorce.com

Source: survivedivorce.com

A dependent spouse may consider cobra insurance benefits. Importantly you will at most 60 days after your divorce to contact the health insurance plan. Choosing legal separation over divorce. You are not obligated to continue insurance for your spouse unless you�ve been ordered by a court to do so. A spouse will have 60 days to notify the employee’s health plan administrator that they would like to continue coverage.

Source: sampair.com

Source: sampair.com

However, a spouse does have rights under cobra to continue coverage. Usually, the parent covering the health insurance costs for the children can include that cost within the child support calculation. However, during a separation, even if a divorce is pending in the court system, the policy most often covers both people because they are still legally married. Can i keep ex wife on health insurance? There are other mechanisms to specifically address the health insurance issue, such as:

Source: pinterest.com

Source: pinterest.com

Once the health insurance policy is terminated, the dependent spouse must apply for coverage, usually within 60 days. This means that you will no longer be eligible to be covered under your spouse or partner�s health insurance plan. Normally, couples going through a divorce will have to purchase independent health insurance policies once the divorce is final. This implies that if you are subject to a judgment of judicial separation, you are no longer considered a dependent of your spouse or partner for health. This means that if you are subject to a judgment of legal separation, you are no longer the dependent of your spouse or partner for.

Source: greatlakesdfs.com

Source: greatlakesdfs.com

The law is quite clear on that. However, after your divorce, you are legally obliged to remove your spouse from your health insurance cover. We have been legally separated for over 4 years and he has been dragging out the divorce to keep health insurance. These benefits are available up to 36 months, depending on the. (rsa 415:18, vii b) became effective january 1, 2008 and permits a former spouse to continue to be covered by their spouse’s employee group health insurance policy for up to three years after the divorce decree.

Source: kansaslegalservices.org

Source: kansaslegalservices.org

There are other mechanisms to specifically address the health insurance issue, such as: This will help when it comes to costs, as you will not be used to paying the premiums for a. Most health insurance plans treat a judgment for legal separation the same as a judgment for dissolution of marriage. During the divorce proceedings, the party who is paying for health insurance for the other spouse, cannot remove that spouse from his or her health insurance. However, during a separation, even if a divorce is pending in the court system, the policy most often covers both people because they are still legally married.

Source: brandonlegalgroup.com

Source: brandonlegalgroup.com

When a divorce is filed, there are automatic temporary restraining orders that go into effect, whereby neither party may sell or dispose of any property from the marriage, and both parties must keep the marital. If you stop it, he could go to court and ask that it be continued and. Can i keep ex wife on health insurance? However, you do have other options. Normally, couples going through a divorce will have to purchase independent health insurance policies once the divorce is final.

Source: murfreesborofamilylaw.com

Source: murfreesborofamilylaw.com

Importantly you will at most 60 days after your divorce to contact the health insurance plan. If your spouse provided a family plan, you will no longer have access to this coverage after the divorce is finalized, although most courts will allow you to remain on the insurance policy until the final decree is entered. However, during a separation, even if a divorce is pending in the court system, the policy most often covers both people because they are still legally married. This means that you will no longer be eligible to be covered under your spouse or partner�s health insurance plan. This is not a circumstance that you can control, as these terms are determined between your employer and the insurance company.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title health insurance in divorce for spouse by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.