Your Health insurance features that tend to reduce moral hazard include images are available. Health insurance features that tend to reduce moral hazard include are a topic that is being searched for and liked by netizens now. You can Find and Download the Health insurance features that tend to reduce moral hazard include files here. Download all free vectors.

If you’re looking for health insurance features that tend to reduce moral hazard include images information linked to the health insurance features that tend to reduce moral hazard include interest, you have pay a visit to the right site. Our website always gives you suggestions for viewing the highest quality video and image content, please kindly surf and locate more informative video articles and images that match your interests.

Health Insurance Features That Tend To Reduce Moral Hazard Include. For example, ehrlich and becker modeled health insurance as reducing individuals’ (unobserved) effort in maintaining their health; For example, ehrlich and becker(1972)modeledhealthinsuranceasreducingindividuals’(unobserved)effortin maintaining their health; There are several ways to reduce moral hazard, including incentives, policies to prevent immoral behavior and regular monitoring. In the health industry, moral hazard happens when you behave in a way that increases the cost for the insurer.

From venturebeat.com

From venturebeat.com

Because health insurance covers (some of) the financial costs that would be caused by poor health behaviors, individuals may have less incentive to avoid them—they may exercise less, eat more cheeseburgers, and smoke more—when they. Key features of this “implicit contract” are: A managed care method with physician incentives is given to control moral hazard in health insurance [29]. Automobile insurance is the insurance paid to cover an automobile and faces the problem of moral hazard where the insured tend to neglect and become irresponsible since they are sure of payment. When costly treatments raise costs for everyone. • the payout is dependent on contingencies such as ill health or unemployment.

A health insurance moral hazard:

A managed care method with physician incentives is given to control moral hazard in health insurance [29]. In liability insurance, moral hazard is divided into four types which includes, policy holder hazard, underwriting hazard, jurisprudential hazard and claimant hazard. We use “moral hazard” here in the health economics sense of excessive care consumption. First, given that ex ante moral hazard is driven by the rational behaviour of insurance enrollees facing lower ex post medical costs, incentive programmes can be designed to reduce the impact of such moral hazard behaviours and the social welfare losses. Moral hazard as the slope of health care spending (with respect to price), and by “selection on moral hazard” we refer to the component of adverse selection that is driven by heterogeneity in this slope parameter. • unemployment insurance & disability insurance.

Health insurance features that tend to reduce moral hazard include a. For example, nrcms administrators can invest in educational programmes (such as counseling services on. A health insurance moral hazard: “moral hazard,” it has been conjectured that health insurance may induce individuals to exert less (unobserved) effort in maintaining their health. In other words, while traditional models of adverse selection focus on heterogeneity in (and selection on) the level

Source: venturebeat.com

Source: venturebeat.com

• health provision • state pension • social care for the elderly & infirm. A health insurance moral hazard: Because health insurance covers (some of) the financial costs A deductible is the amount a person must pay for avail. • health provision • state pension • social care for the elderly & infirm.

Source: petrofilm.com

Source: petrofilm.com

While many cases could be treated with preventive care plans—which includes diagnostic tests and drugs to keep an illness from getting worse—most consumers opt for more expensive, curative care that includes surgeries and drugs that, while expensive. For example, ehrlich and becker modeled health insurance as reducing individuals’ (unobserved) effort in maintaining their health; That is, the insurer reimburses a constant fraction of health care expenditure. First, given that ex ante moral hazard is driven by the rational behaviour of insurance enrollees facing lower ex post medical costs, incentive programmes can be designed to reduce the impact of such moral hazard behaviours and the social welfare losses. The moral hazard problem with health insurance is that when people have insurance, they will demand higher quantities of health care.

Source: voleyball-games.blogspot.com

Source: voleyball-games.blogspot.com

Automobile insurance is the insurance paid to cover an automobile and faces the problem of moral hazard where the insured tend to neglect and become irresponsible since they are sure of payment. It was arrow’s 1963 analysis of moral hazard that arguably led to its prominence in healthcare policy today. There are several ways to reduce moral hazard, including incentives, policies to prevent immoral behavior and regular monitoring. A deductible is the amount a person must pay for avail. To balance the efficiency of public and private hospitals in health system, a.

Source: slideserve.com

Source: slideserve.com

“moral hazard,” it has been conjectured that health insurance may induce individuals to exert less (unobserved) effort in maintaining their health. Moral hazard as the slope of health care spending (with respect to price), and by “selection on moral hazard” we refer to the component of adverse selection that is driven by heterogeneity in this slope parameter. Individuals who do not have to pay for medical services tend to seek more expensive and even riskier services that they would not require otherwise. A health insurance moral hazard: A deductible is the amount a person must pay for avail.

Source: venturebeat.com

Source: venturebeat.com

This is known as primary moral hazard, in which individual risks are. In the health industry, moral hazard happens when you behave in a way that increases the cost for the insurer. A deductible is the amount a person must pay for avail. “moral hazard,” it has been conjectured that health insurance may induce individuals to exert less (unobserved) effort in maintaining their health. • health provision • state pension • social care for the elderly & infirm.

Source: venturebeat.com

Source: venturebeat.com

Moral hazards are commonly seen in the case of health insurance. It was arrow’s 1963 analysis of moral hazard that arguably led to its prominence in healthcare policy today. When costly treatments raise costs for everyone. In the health industry, moral hazard happens when you behave in a way that increases the cost for the insurer. While many cases could be treated with preventive care plans—which includes diagnostic tests and drugs to keep an illness from getting worse—most consumers opt for more expensive, curative care that includes surgeries and drugs that, while expensive.

Source: slideserve.com

Source: slideserve.com

In the health industry, moral hazard happens when you behave in a way that increases the cost for the insurer. For example, nrcms administrators can invest in educational programmes (such as counseling services on. At the root of moral hazard is unbalanced or asymmetric information. When costly treatments raise costs for everyone. • health provision • state pension • social care for the elderly & infirm.

Source: essaybuys.com

Source: essaybuys.com

A health insurance moral hazard: All of the above feb 08 2022 03:27 pm While many cases could be treated with preventive care plans—which includes diagnostic tests and drugs to keep an illness from getting worse—most consumers opt for more expensive, curative care that includes surgeries and drugs that, while expensive. A health insurance moral hazard: The moral hazard problem with health insurance is that when people have insurance, they will demand higher quantities of health care.

Source: petrofilm.com

Source: petrofilm.com

• unemployment insurance & disability insurance. To balance the efficiency of public and private hospitals in health system, a. “moral hazard,” it has been conjectured that health insurance may induce individuals to exert less (unobserved) effort in maintaining their health. Health insurance features that tend to reduce moral hazard include a. The moral hazard problem with health insurance is that when people have insurance, they will demand higher quantities of health care.

Source: essaybuys.com

Source: essaybuys.com

• the payout is dependent on contingencies such as ill health or unemployment. Because health insurance covers (some of) the financial costs that would be caused by poor health behaviors, individuals may have less incentive to avoid them—they may exercise less, eat more cheeseburgers, and smoke more—when they. • health provision • state pension • social care for the elderly & infirm. A deductible is the amount a person must pay for avail. In liability insurance, moral hazard is divided into four types which includes, policy holder hazard, underwriting hazard, jurisprudential hazard and claimant hazard.

Because health insurance covers (some of) the financial costs that would be caused by poor health behaviors, individuals may have less incentive to avoid them—they may exercise less, eat more cheeseburgers, and smoke more—when they. Health insurance features that tend to reduce moral hazard include a. At the root of moral hazard is unbalanced or asymmetric information. A managed care method with physician incentives is given to control moral hazard in health insurance [29]. For example, ehrlich and becker(1972)modeledhealthinsuranceasreducingindividuals’(unobserved)effortin maintaining their health;

Source: petrofilm.com

Source: petrofilm.com

• health provision • state pension • social care for the elderly & infirm. To balance the efficiency of public and private hospitals in health system, a. It was arrow’s 1963 analysis of moral hazard that arguably led to its prominence in healthcare policy today. Automobile insurance is the insurance paid to cover an automobile and faces the problem of moral hazard where the insured tend to neglect and become irresponsible since they are sure of payment. That is, the insurer reimburses a constant fraction of health care expenditure.

Source: blog.petrieflom.law.harvard.edu

Source: blog.petrieflom.law.harvard.edu

A managed care method with physician incentives is given to control moral hazard in health insurance [29]. For example, nrcms administrators can invest in educational programmes (such as counseling services on. A deductible is the amount a person must pay for avail. One example is the discussion surrounding how to prevent people from taking on risky behaviors, such as smoking, if they feel that they will be caught by the safety net of their insurance if something goes wrong. That is, the insurer reimburses a constant fraction of health care expenditure.

Source: essaybuys.com

Source: essaybuys.com

• health provision • state pension • social care for the elderly & infirm. Health insurance features that tend to reduce moral hazard include a. That is, the insurer reimburses a constant fraction of health care expenditure. This is known as primary moral hazard, in which individual risks are. We use “moral hazard” here in the health economics sense of excessive care consumption.

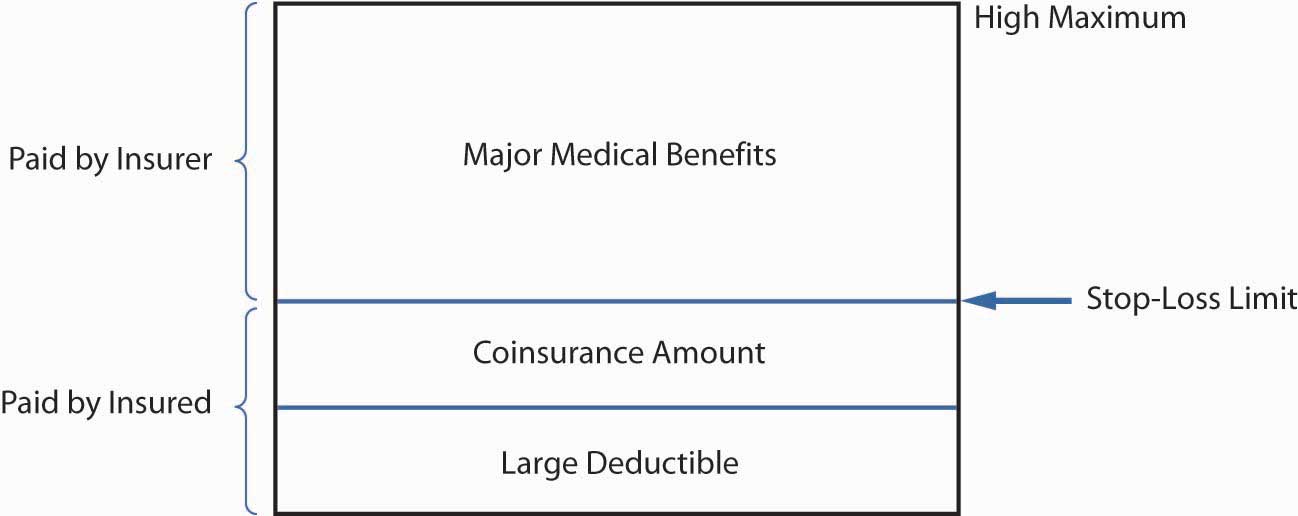

Source: flatworldknowledge.lardbucket.org

Source: flatworldknowledge.lardbucket.org

For example, nrcms administrators can invest in educational programmes (such as counseling services on. The moral hazard problem with health insurance is that when people have insurance, they will demand higher quantities of health care. Firms at a competitive disadvantage with their foreign competitors. Because health insurance covers (some of) the financial costs An exception is blomqvist (2011).

Source: belghiti2007.e-monsite.com

Source: belghiti2007.e-monsite.com

All of the above feb 08 2022 03:27 pm “moral hazard,” it has been conjectured that health insurance may induce individuals to exert less (unobserved) effort in maintaining their health. Firms at a competitive disadvantage with their foreign competitors. The moral hazard problem with health insurance is that when people have insurance, they will demand higher quantities of health care. In other words, while traditional models of adverse selection focus on heterogeneity in (and selection on) the level

Source: venturebeat.com

Source: venturebeat.com

For example, ehrlich and becker(1972)modeledhealthinsuranceasreducingindividuals’(unobserved)effortin maintaining their health; In liability insurance, moral hazard is divided into four types which includes, policy holder hazard, underwriting hazard, jurisprudential hazard and claimant hazard. Automobile insurance is the insurance paid to cover an automobile and faces the problem of moral hazard where the insured tend to neglect and become irresponsible since they are sure of payment. • the payout is dependent on contingencies such as ill health or unemployment. For example, ehrlich and becker(1972)modeledhealthinsuranceasreducingindividuals’(unobserved)effortin maintaining their health;

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title health insurance features that tend to reduce moral hazard include by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.