Your Health insurance dependent vs beneficiary images are ready in this website. Health insurance dependent vs beneficiary are a topic that is being searched for and liked by netizens now. You can Download the Health insurance dependent vs beneficiary files here. Find and Download all free photos and vectors.

If you’re looking for health insurance dependent vs beneficiary pictures information related to the health insurance dependent vs beneficiary topic, you have visit the ideal site. Our website always provides you with hints for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

Health Insurance Dependent Vs Beneficiary. (if you are a member of a health plan, like a group health plan, original medicare, or medicaid, (3). A dependent for health insurance is the term for any person who is eligible for health insurance coverage under a policyholder’s plan. The person or entity that you designate as a beneficiary, however, may or. Dependents (those listed on your health and dental benefits) and beneficiaries (those named on your life insurance and pension as recipients should you pass away) can change over the years.

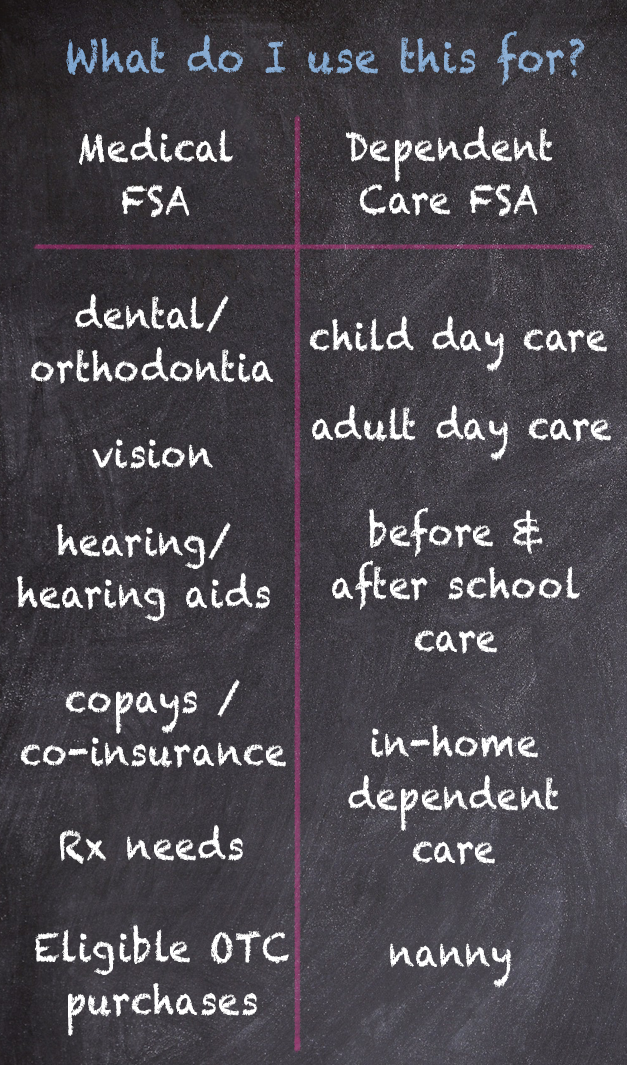

Dependent Care Tax Credit VS. Dependent Care Spending From sabcflex.com

Dependent Care Tax Credit VS. Dependent Care Spending From sabcflex.com

While a beneficiary can anyone such as a person, trustee, institution, estate entity who is entitled to benefits from the benefactor, dependents are mostly children or a spouse. Group plans, on the other hand, are offered by businesses as an employee benefit, and they often include dependent coverage. The age 26 rule does not apply. Expenses for the insured and each covered dependent while covered under the health plan. Those are two different things but both depend on your company. What’s more, you are required to provide health insurance for anyone whom you claim as a tax dependent.

Having a dependent and secondary possession while dependent is relying upon;

What’s more, you are required to provide health insurance for anyone whom you claim as a tax dependent. From the employee main home page, select the university benefits tile. A beneficiary is a person or entity you decide to leave some type of inheritance to if. The definition for an eligible dependent for purposes of health savings accounts has not changed. A dependent is usually some you can add to your health insurance plans, this includes spouses and children and can include unmarried partners (also called domestic partners) depending on. The court, in such situations, mostly decrees that the financially dependent spouse be named the beneficiary of the life insurance policy.

Source: vdocuments.site

Source: vdocuments.site

Although a common core of benefits may be required, the employee can determine how his or her remaining benefit. There are two general types of health insurance, private and group. A dependent for health insurance is the term for any person who is eligible for health insurance coverage under a policyholder’s plan. Dependents can be children of the policyholder, spouses, and other qualifying family members dependents receive coverage from the policyholder dependents that are adult children can stay on their parents� plans until the age of 26 the precise definition of a dependent, as it relates to health insurance, is a complex A primary beneficiary is an individual chosen in a will, trust or health insurance

Source: home.lps.org

Source: home.lps.org

Designating dependents under medical and/or dental insurance has no connection to designating beneficaries. Health insurance, vacations, retirement plans and child care. A dependent may be added to a retiree’s medical and/or dental insurance plan and then be eligible to receive benefits under the selected health insurance (2). It is beneficial to review these every couple of years to ensure they are accurate. The primary beneficiary is first in line to receive insurance assets and the contingent beneficiary is second in line.

Source: igniter.buzz

Source: igniter.buzz

A dependent (in life insurance) is someone you will be adding to your primary life insurance policy, such as a spouse or child, so that they can get covered. There are several differences between primary and contingent beneficiaries. The court, in such situations, mostly decrees that the financially dependent spouse be named the beneficiary of the life insurance policy. Having a dependent and secondary possession while dependent is relying upon; From the employee main home page, select the university benefits tile.

Source: wageworks.com

Source: wageworks.com

What’s more, you are required to provide health insurance for anyone whom you claim as a tax dependent. Whenever you experience a life change, it is a good idea to confirm that your beneficiary designations are still current with your wishes. A dependent may be a spouse or child. The beneficiary can be either the legal heirs or financial institutions like banks who have provided loan/ finance to the policyholder. A dependent for health insurance is the term for any person who is eligible for health insurance coverage under a policyholder�s plan.

Source: benefitresource.com

Source: benefitresource.com

Typically, dependents are spouses and biological, adopted or step children of the primary beneficiary. While a beneficiary can anyone such as a person, trustee, institution, estate entity who is entitled to benefits from the benefactor, dependents are mostly children or a spouse. Dependent enrollment and beneficiary designation. (if you are a member of a health plan, like a group health plan, original medicare, or medicaid, (3). According to healthcare.gov, if you can count someone as a dependent on your taxes, they’re also a dependent on your health insurance plan.

Source: escatologiaaberta.blogspot.com

There are several differences between primary and contingent beneficiaries. Dependents can be children of the policyholder, spouses, and other qualifying family members dependents receive coverage from the policyholder dependents that are adult children can stay on their parents� plans until the age of 26 the precise definition of a dependent, as it relates to health insurance, is a complex Dependent enrollment and beneficiary designation. Expenses for the insured and each covered dependent while covered under the health plan. Individuals purchase private insurance directly from the health insurance company, and it rarely comes with any type of coverage that extends to dependents.

Source: in.nau.edu

Source: in.nau.edu

The age 26 rule does not apply. Dependent enrollment and beneficiary designation. A dependent may be added to a retiree’s medical and/or dental insurance plan and then be eligible to receive benefits under the selected health insurance (2). What’s more, you are required to provide health insurance for anyone whom you claim as a tax dependent. Dependents for taxes & health insurance.

Source: curiousandcalculated.com

Source: curiousandcalculated.com

Typically, dependents are spouses and biological, adopted or step children of the primary beneficiary. Designating dependents under medical and/or dental insurance has no connection to designating beneficaries. There are two general types of health insurance, private and group. Dependents can be children of the policyholder, spouses, and other qualifying family members dependents receive coverage from the policyholder dependents that are adult children can stay on their parents� plans until the age of 26 the precise definition of a dependent, as it relates to health insurance, is a complex A beneficiary is a person or entity you decide to leave some type of inheritance to if.

Source: slideserve.com

Source: slideserve.com

As adjectives the difference between beneficiary and dependent is that beneficiary is holding some office or valuable possession, in subordination to another; A dependent for health insurance is the term for any person who is eligible for health insurance coverage under a policyholder�s plan. The court, in such situations, mostly decrees that the financially dependent spouse be named the beneficiary of the life insurance policy. Holding under a feudal or other superior; The primary beneficiary is first in line to receive insurance assets and the contingent beneficiary is second in line.

Source: pinterest.com

Source: pinterest.com

Dependents can be children of the policyholder, spouses, and other qualifying family members dependents receive coverage from the policyholder dependents that are adult children can stay on their parents� plans until the age of 26 the precise definition of a dependent, as it relates to health insurance, is a complex While a beneficiary can anyone such as a person, trustee, institution, estate entity who is entitled to benefits from the benefactor, dependents are mostly children or a spouse. A beneficiary is an individualwho has a financial interest in the life of the policyholder. Expenses for the insured and each covered dependent while covered under the health plan. A primary beneficiary is an individual chosen in a will, trust or health insurance

Source: sabcflex.com

Source: sabcflex.com

Those are two different things but both depend on your company. Although a common core of benefits may be required, the employee can determine how his or her remaining benefit. According to healthcare.gov, if you can count someone as a dependent on your taxes, they’re also a dependent on your health insurance plan. So if you intend to include a child or other relative as a tax. The individual or individuals may be desigated as a dependent for medical insurance, a dependent for dental insurance and a beneficary for death benefits, but the selections are separate and must be made for each.

Source: igniter.buzz

Source: igniter.buzz

Dependent enrollment and beneficiary designation. A beneficiary is an individualwho has a financial interest in the life of the policyholder. The primary beneficiary is first in line to receive insurance assets and the contingent beneficiary is second in line. Eligible dependents the following family members are considered eligible dependents and can be added to your health insurance. A primary beneficiary is an individual chosen in a will, trust or health insurance

![The Employee State Insurance[ESI] Act,1948 The Employee State Insurance[ESI] Act,1948](https://image.slidesharecdn.com/88da15d1-bff6-4d25-b9fd-32a6fe52ebb4-150415044419-conversion-gate01/95/the-employee-state-insuranceesi-act1948-3-638.jpg?cb=1429075734) Source: slideshare.net

Source: slideshare.net

According to healthcare.gov, if you can count someone as a dependent on your taxes, they’re also a dependent on your health insurance plan. Expenses for the insured and each covered dependent while covered under the health plan. A beneficiary can be a person or a legal entity that is designated by you to receive a benefit, such as life insurance. The definition for an eligible dependent for purposes of health savings accounts has not changed. As adjectives the difference between beneficiary and dependent is that beneficiary is holding some office or valuable possession, in subordination to another;

Source: peoplekeep.com

A beneficiary can be a person or a legal entity that is designated by you to receive a benefit, such as life insurance. According to healthcare.gov, if you can count someone as a dependent on your taxes, they’re also a dependent on your health insurance plan. A dependent for health insurance is the term for any person who is eligible for health insurance coverage under a policyholder’s plan. Dependents can be children of the policyholder, spouses, and other qualifying family members dependents receive coverage from the policyholder dependents that are adult children can stay on their parents� plans until the age of 26 the precise definition of a dependent, as it relates to health insurance, is a complex Expenses for the insured and each covered dependent while covered under the health plan.

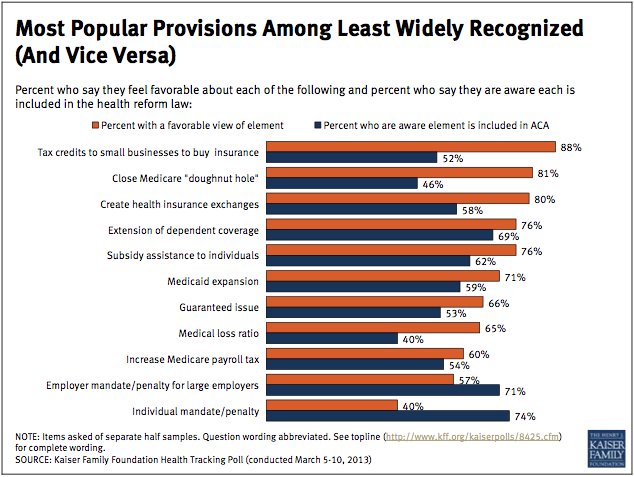

Source: obamacarefacts.com

Source: obamacarefacts.com

Holding under a feudal or other superior; There are several differences between primary and contingent beneficiaries. Whenever you experience a life change, it is a good idea to confirm that your beneficiary designations are still current with your wishes. So if you intend to include a child or other relative as a tax. Group plans, on the other hand, are offered by businesses as an employee benefit, and they often include dependent coverage.

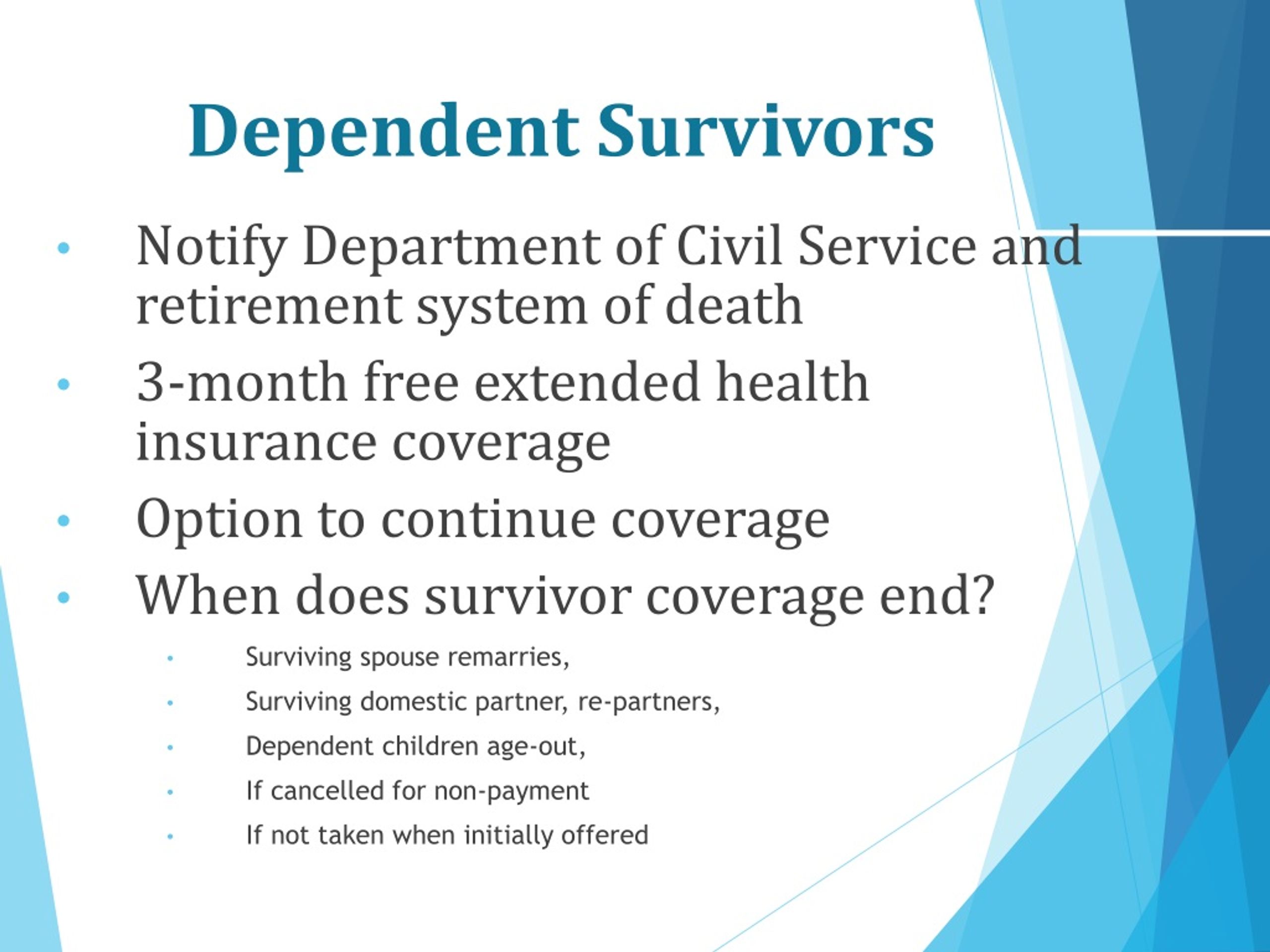

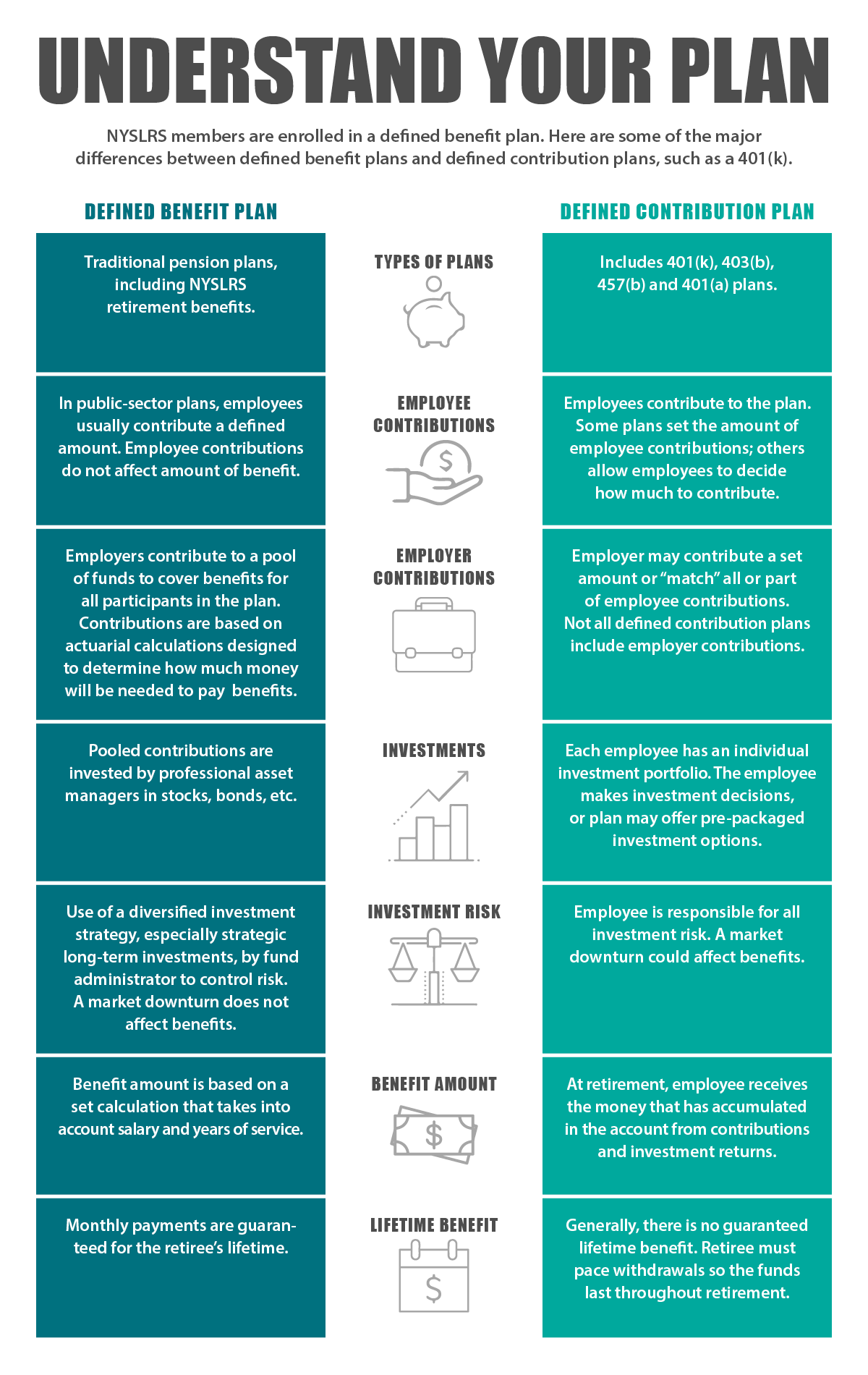

Source: nyretirementnews.com

Source: nyretirementnews.com

The definition for an eligible dependent for purposes of health savings accounts has not changed. From the employee main home page, select the university benefits tile. A beneficiary is a person or entity you decide to leave some type of inheritance to if. For example, if you will be including your spouse in your medical coverage and designating him or her as a recipient of your life insurance, then your spouse is both a dependent and a beneficiary. A dependent (in life insurance) is someone you will be adding to your primary life insurance policy, such as a spouse or child, so that they can get covered.

Source: escatologiaaberta.blogspot.com

Source: escatologiaaberta.blogspot.com

A primary beneficiary is an individual chosen in a will, trust or health insurance Having a dependent and secondary possession while dependent is relying upon; On the other hand, a dependent refers to a person who relies on another person for their primary source of income. Eligible dependents the following family members are considered eligible dependents and can be added to your health insurance. What’s more, you are required to provide health insurance for anyone whom you claim as a tax dependent.

Source: heritage.org

Source: heritage.org

A dependent may be a spouse or child. The person or entity that you designate as a beneficiary, however, may or. The definition for an eligible dependent for purposes of health savings accounts has not changed. Having a dependent and secondary possession while dependent is relying upon; A primary beneficiary is an individual chosen in a will, trust or health insurance

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title health insurance dependent vs beneficiary by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.