Your Health insurance 80 20 deductible images are available. Health insurance 80 20 deductible are a topic that is being searched for and liked by netizens today. You can Download the Health insurance 80 20 deductible files here. Find and Download all free vectors.

If you’re looking for health insurance 80 20 deductible images information connected with to the health insurance 80 20 deductible keyword, you have come to the ideal site. Our website always gives you hints for seeking the maximum quality video and image content, please kindly search and locate more informative video articles and images that fit your interests.

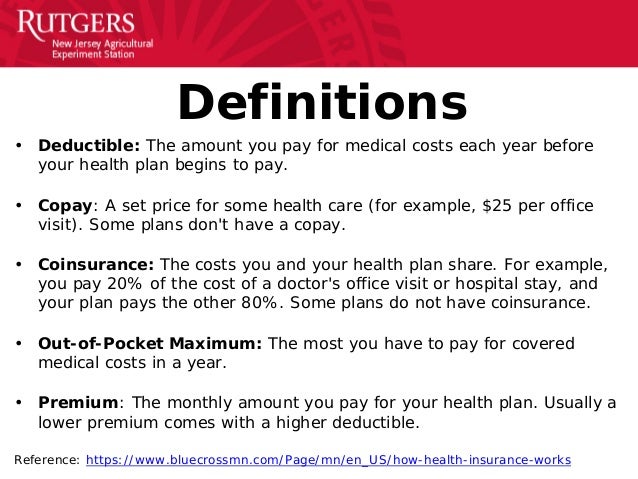

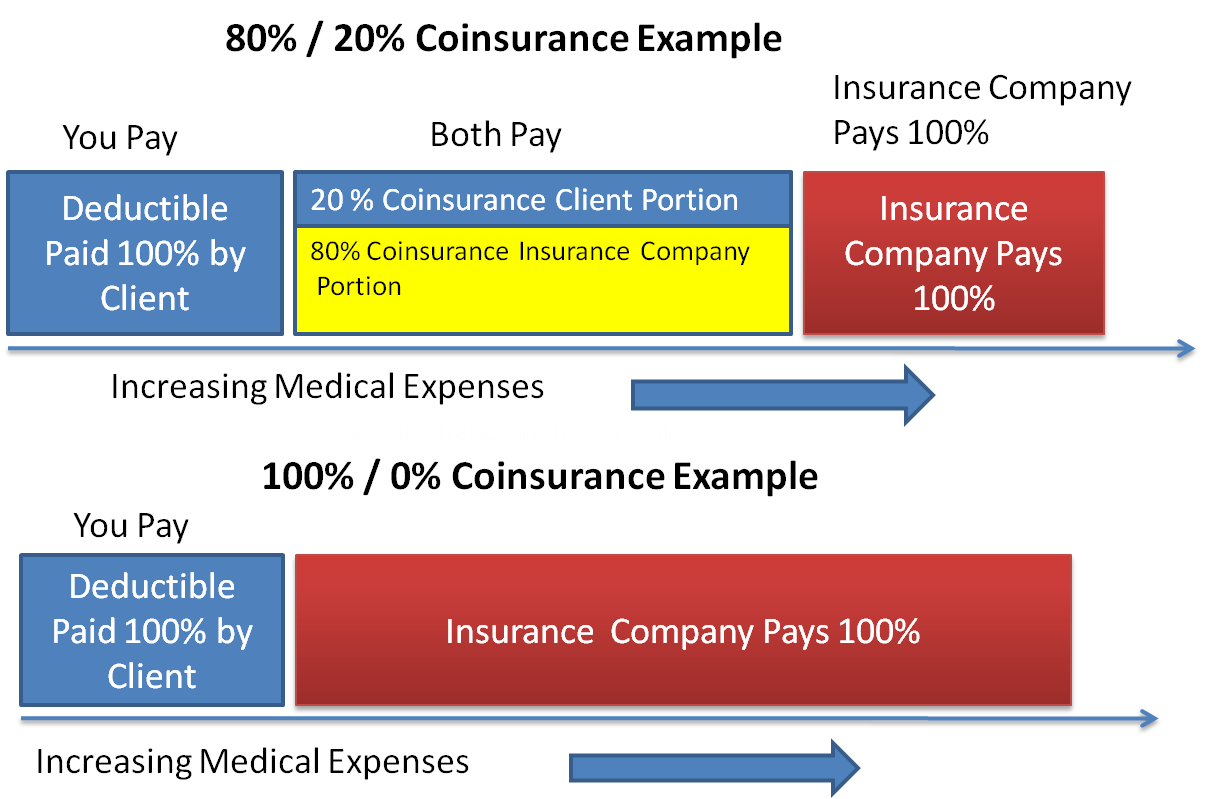

Health Insurance 80 20 Deductible. Deductibles the 80/20 provision typically begins after the insured reaches the deductible. Once you do, the insurance company will pay 80 percent of your qualified medical expenses. The insurance plan will pay $8,000 or 80%. Once you pay the deductible amount, insurance begins to pay, and you pay.

What Is Coinsurance? From daveramsey.com

What Is Coinsurance? From daveramsey.com

Try this site where you can compare quotes: You pay the second.) coinsurance can be tricky. What happens if i don’t meet my deductible? Once you pay the deductible amount, insurance begins to pay, and you pay. She has met 45% of. Then, the plan covers 100% of your remaining eligible medical expenses for.

In an 80/20 insurance plan, you are expected to pay all of your healthcare costs until you meet your annual deductible.

Just now coinsurance goes into effect only after your annual deductible has been met, you have a plan that splits coinsurance costs 80/20, meaning your insurer pays 80% while you pay 20%. There is a range of deductible options you can choose from (e.g. You are responsible for the. Many health insurance policies involve coinsurance, which means you are responsible for a certain percentage of charges after paying your deductible. What is coinsurance of 80/20? Just now coinsurance goes into effect only after your annual deductible has been met, you have a plan that splits coinsurance costs 80/20, meaning your insurer pays 80% while you pay 20%.

Source: de.slideshare.net

Source: de.slideshare.net

Try this site where you can compare quotes: You are responsible for the. See the answer see the answer done loading. What happens if i don’t meet my deductible? What is coinsurance of 80/20?

Source: canonprintermx410.blogspot.com

Source: canonprintermx410.blogspot.com

See the answer see the answer done loading. //insurequote.info/index.html?src=compare// related dose anyone know any cars with cheap insurance for a. (whether it�s 80/20 or 90/10, your insurance company pays the first number; Your plan’s 80/20 coinsurance leaves you responsible for 20% of what’s remaining, which is $460. The 80/20 ppo plan is a preferred provider organization (ppo) plan administered by blue cross and blue shield of north carolina (blue cross nc).

Source: familycarepa.com

Source: familycarepa.com

This is where your coinsurance kicks in. You have a $1,000 deductible and 20% coinsurance and a maximum out of pocket of $5,000 every year. Once you do, the insurance company will pay 80 percent of your qualified medical expenses. The 80/20 ppo plan is a preferred provider organization (ppo) plan administered by blue cross and blue shield of north carolina (blue cross nc). If you have an 80/20 medical plan, then after you meet your annual deductible, your insurance company pays for 80 percent of health costs while you pay 20 percent.

Source: personalfinanceplan.in

Source: personalfinanceplan.in

An individual who purchases a health plans with $500 deductible and 80/20 coinsurance to $10,000 will have a maximum out of pocket expense of $2500. She has met 45% of. In an 80/20 insurance plan, you are expected to pay all of your healthcare costs until you meet your annual deductible. The 80/20 ppo plan is a preferred provider organization (ppo) plan administered by blue cross and blue shield of north carolina (blue cross nc). This is where your coinsurance kicks in.

Source: picshealth.blogspot.com

Source: picshealth.blogspot.com

Once you pay the deductible amount, insurance begins to pay, and you pay. Of the remaining $10,000, you will pay 20% or $2,000. This leaves $1,840 remaining that your insurance will cover. Just now coinsurance goes into effect only after your annual deductible has been met, you have a plan that splits coinsurance costs 80/20, meaning your insurer pays 80% while you pay 20%. Many health insurance policies involve coinsurance, which means you are responsible for a certain percentage of charges after paying your deductible.

Source: myinvestmentideas.com

Source: myinvestmentideas.com

Of the remaining $10,000, you will pay 20% or $2,000. Insurance companies arrive at this number by adding the deductible to the insured’s coinsurance percentage. Our study finds that in 2020, the average annual deductible for single, individual coverage is $4,364 and $8,439 for family coverage. Your insurance company would pay the balance. Many health insurance policies involve coinsurance, which means you are responsible for a certain percentage of charges after paying your deductible.

Source: rfimasters.com

Source: rfimasters.com

This leaves $1,840 remaining that your insurance will cover. Afterward, the insurance will start, and your insurance company will cover the 80% of the costs while leaving you with the 20%. Many health insurance policies involve coinsurance, which means you are responsible for a certain percentage of charges after paying your deductible. You now have $10,000 remaining of unpaid charges. A deductible is the amount you pay for health care services each year before your health insurance pays its portion of the cost of covered services.

Source: daveramsey.com

Source: daveramsey.com

Under the terms of an 80/20 coinsurance plan, the insured is responsible for 20% of medical costs, while the insurer pays the remaining 80%. Aisha has a health insurance policy with an 80 / 20 coinsurance and deductible of $3,200. You pay $1,000 first, which is the amount of your deductible. What is coinsurance of 80/20? For 80/20 insurance, you will have to pay the deductible first.

Source: slideshare.net

Source: slideshare.net

This means that the insurer will pay 80% and you must pay the other 20%. Once you pay the deductible amount, insurance begins to pay, and you pay. (whether it�s 80/20 or 90/10, your insurance company pays the first number; Under the terms of an 80/20 coinsurance plan, the insured is responsible for 20% of medical costs, while the insurer pays the remaining 80%. You have a $1,000 deductible and 20% coinsurance and a maximum out of pocket of $5,000 every year.

Source: relakhs.com

Source: relakhs.com

This means that the insurer will pay 80% and you must pay the other 20%. You pay $1,000 first, which is the amount of your deductible. What is coinsurance of 80/20? A deductible is the amount you pay for health care services each year before your health insurance pays its portion of the cost of covered services. What happens if i don’t meet my deductible?

Source: janebenston.com

Source: janebenston.com

What is coinsurance of 80/20? Our study finds that in 2020, the average annual deductible for single, individual coverage is $4,364 and $8,439 for family coverage. Many health insurance policies involve coinsurance, which means you are responsible for a certain percentage of charges after paying your deductible. Coinsurance = 80/20 (plan pays 80%, you pay 20%) summary Then, the plan covers 100% of your remaining eligible medical expenses for.

Source: individualhealthinsurancedenrai.blogspot.com

Source: individualhealthinsurancedenrai.blogspot.com

Insurance companies arrive at this number by adding the deductible to the insured’s coinsurance percentage. Your plan’s 80/20 coinsurance leaves you responsible for 20% of what’s remaining, which is $460. A deductible is the amount you pay for health care services each year before your health insurance pays its portion of the cost of covered services. [$500 (deductible amount) + $2000 (or 20% of $10,000 coinsurance) = $2500] The amount you pay once you meet your deductible—a percentage of costs of a covered health care service in an insurance plan.

Source: caclubindia.com

Source: caclubindia.com

You now have $10,000 remaining of unpaid charges. The individual deductible on the 80/20 plan was reduced by $1,960, which is good news for everyone, but especially single employees with no dependents and families where one person generally uses most of the healthcare dollars on the plan. What is coinsurance of 80/20? In an 80/20 insurance plan, you are expected to pay all of your healthcare costs until you meet your annual deductible. Coinsurance = 80/20 (plan pays 80%, you pay 20%) summary

Source: stableinvestor.com

Source: stableinvestor.com

What happens if i don’t meet my deductible? You pay the second.) coinsurance can be tricky. Once you pay the deductible amount, insurance begins to pay, and you pay. The 80/20 ppo plan is a preferred provider organization (ppo) plan administered by blue cross and blue shield of north carolina (blue cross nc). There is a range of deductible options you can choose from (e.g.

Source: tax2win.in

Source: tax2win.in

You have a $1,000 deductible and 20% coinsurance and a maximum out of pocket of $5,000 every year. With an 80/20 plan with a deductible, you pay the deductible first. She has met 45% of. The 80/20 ppo plan is a preferred provider organization (ppo) plan administered by blue cross and blue shield of north carolina (blue cross nc). Try this site where you can compare quotes:

Source: blog.cdphp.com

Source: blog.cdphp.com

Try this site where you can compare quotes: She has met 45% of. Patient has met annual deductible of $250; You are responsible for the. Our study finds that in 2020, the average annual deductible for single, individual coverage is $4,364 and $8,439 for family coverage.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The 80/20 ppo plan is a preferred provider organization (ppo) plan administered by blue cross and blue shield of north carolina (blue cross nc). Aisha has a health insurance policy with an 80 / 20 coinsurance and deductible of $3,200. See the answer see the answer done loading. (whether it�s 80/20 or 90/10, your insurance company pays the first number; Of the remaining $10,000, you will pay 20% or $2,000.

Source: indiainfoline.com

Source: indiainfoline.com

You pay $1,000 first, which is the amount of your deductible. In an 80/20 insurance plan, you are expected to pay all of your healthcare costs until you meet your annual deductible. There is a range of deductible options you can choose from (e.g. In health insurance policies, 80/20 is a common coinsurance provision that requires the insurance company to pay 80 percent of the medical costs and the insured to pay 20 percent. Deductibles the 80/20 provision typically begins after the insured reaches the deductible.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title health insurance 80 20 deductible by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.