Your Hard insurance market images are ready in this website. Hard insurance market are a topic that is being searched for and liked by netizens today. You can Download the Hard insurance market files here. Download all free photos.

If you’re looking for hard insurance market images information connected with to the hard insurance market interest, you have come to the ideal blog. Our website frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly hunt and find more informative video articles and graphics that match your interests.

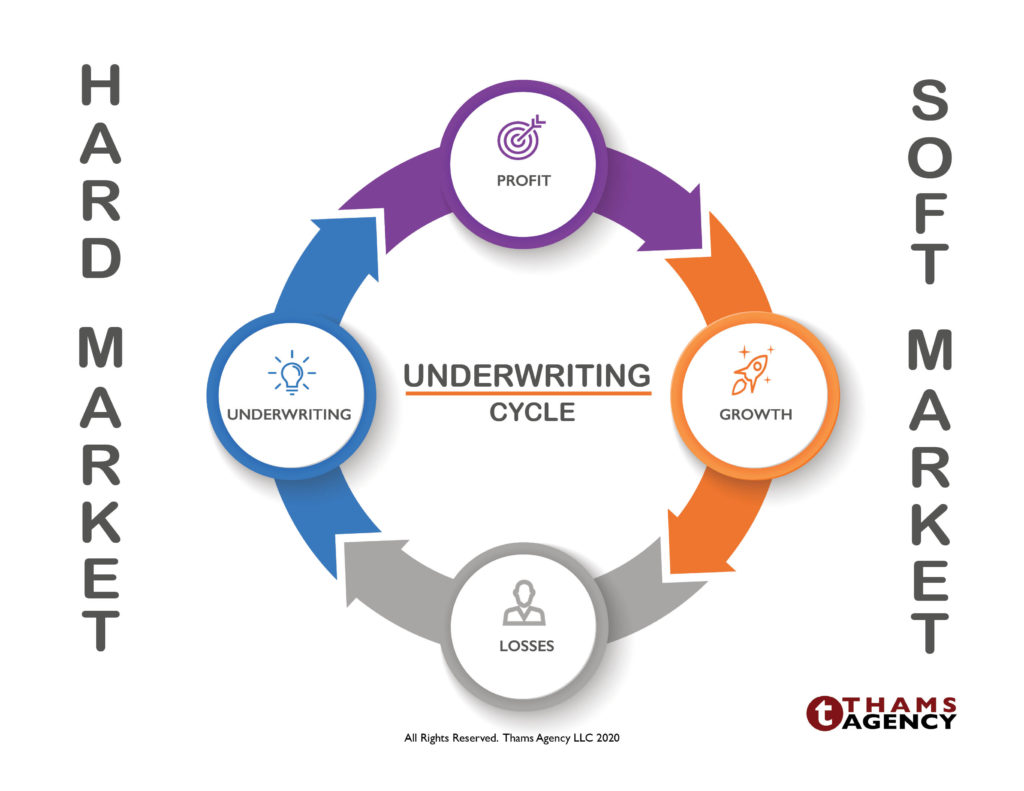

Hard Insurance Market. Navigating the hard market q3 2021. A period of time during which insurance companies are able to assess high premiums and therefore achieve high profits. Everything you need to know about the hardening insurance market. One type of insurance that is gaining very strong momentum, and clearly.

Group Captives Benefits in a Hard Insurance Market From captiveresources.com

Group Captives Benefits in a Hard Insurance Market From captiveresources.com

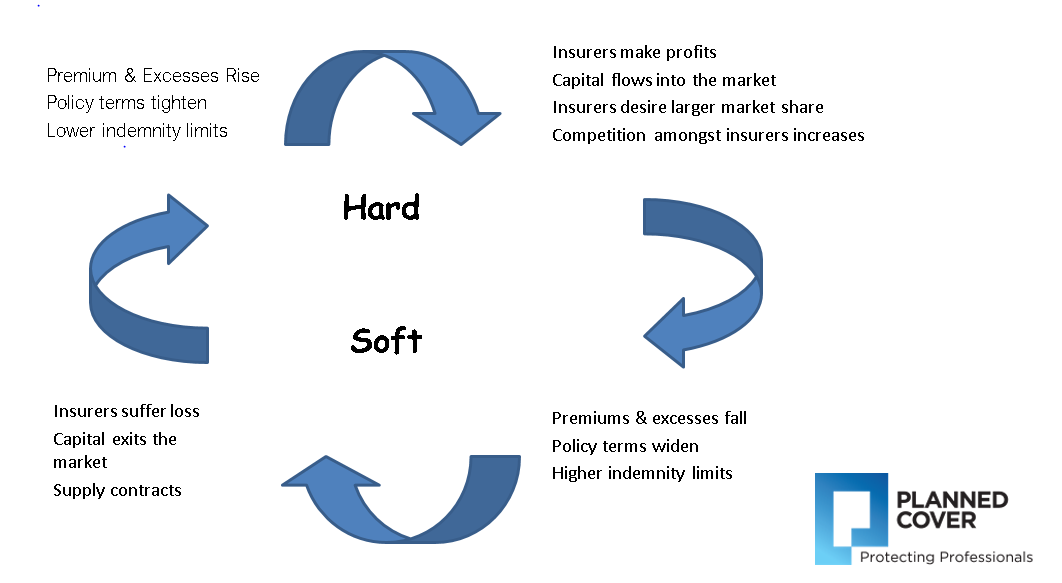

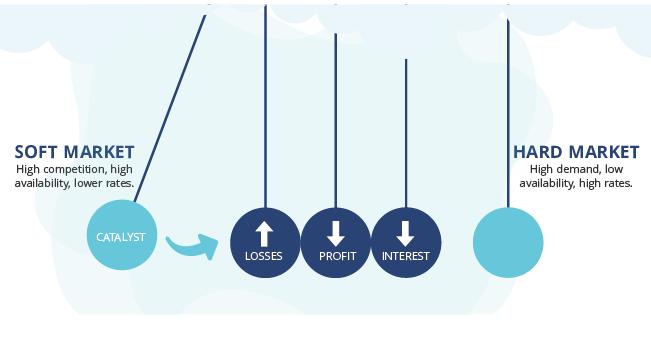

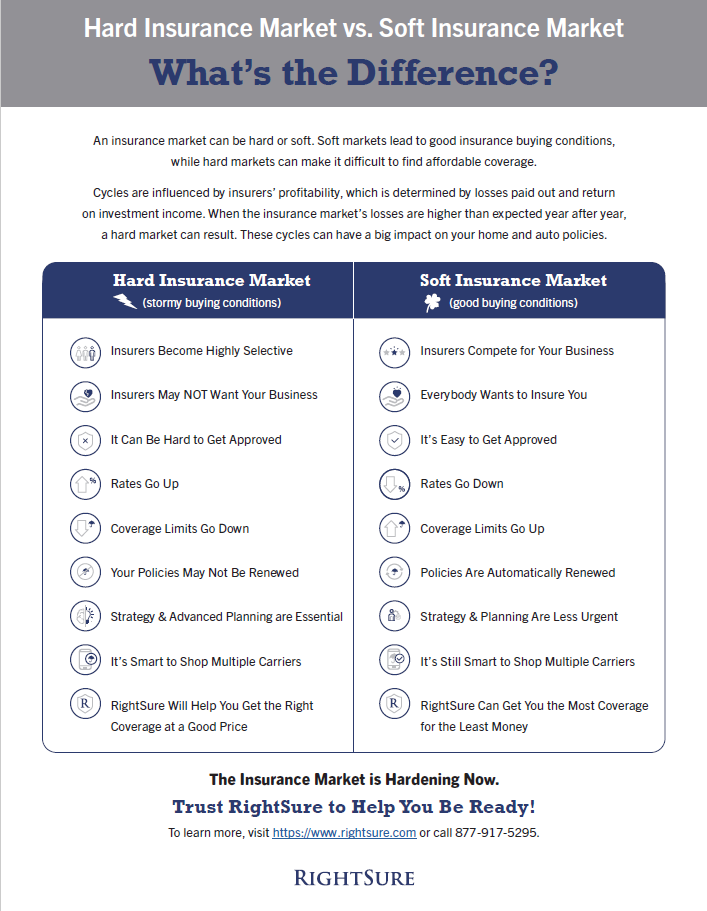

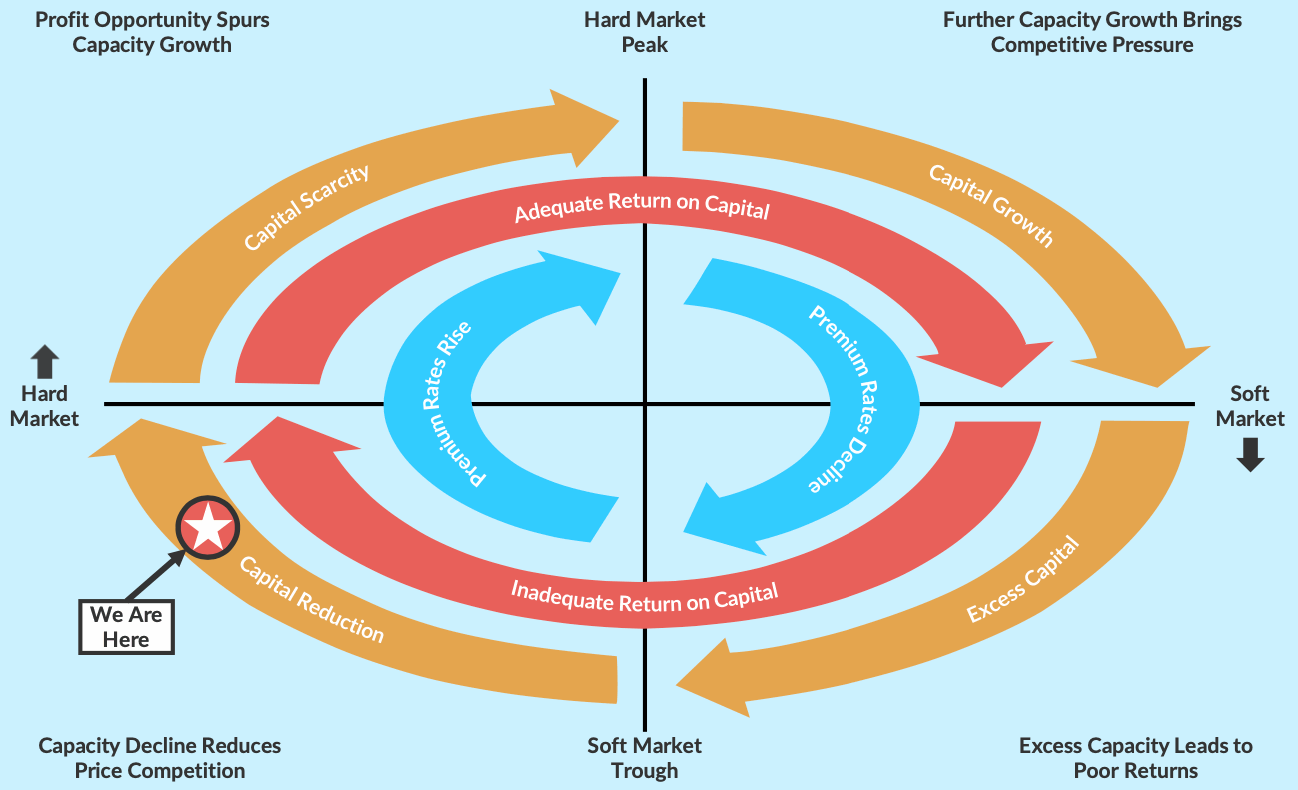

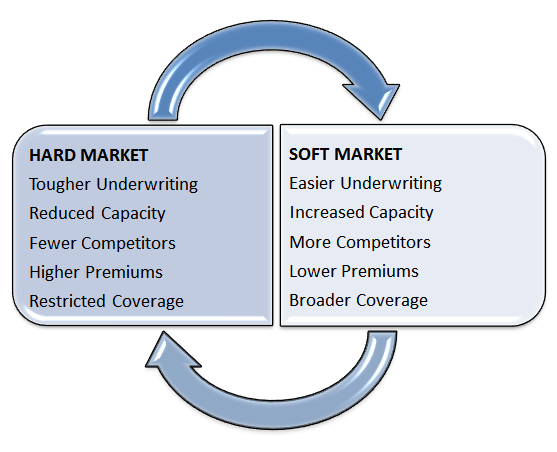

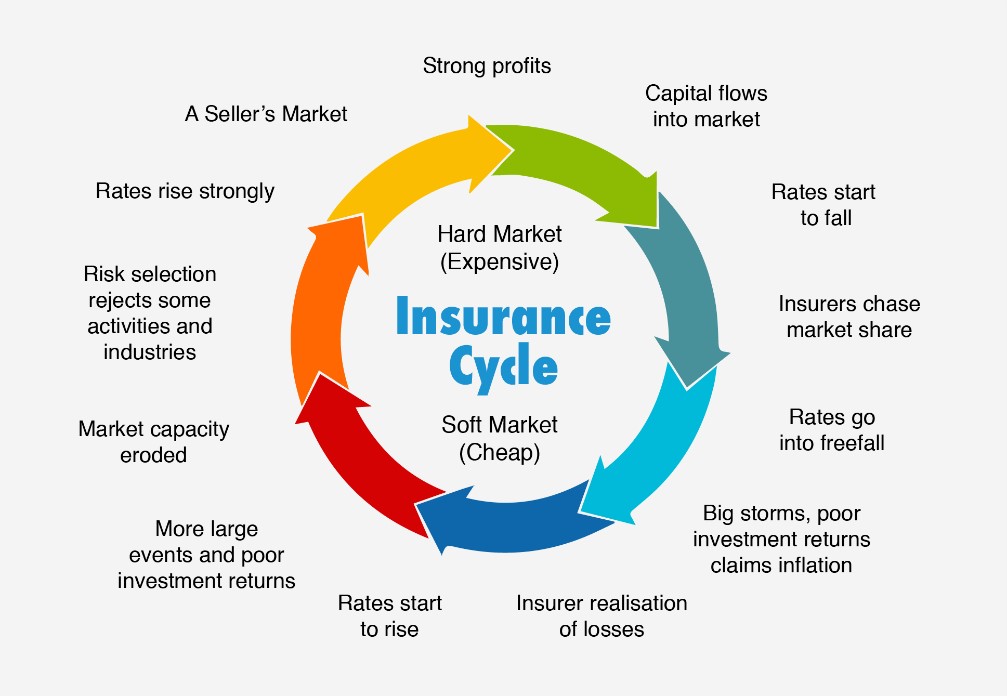

Reduced supply of insurance as some insurers will exit certain sectors. Navigating the hard market q3 2021. Reduced risk appetite is caused by elevated modelling uncertainty arising from. Entering 2020, corporate policyholders already faced a hardening insurance market. Less flexibility from insurance underwriters. A hard insurance market is characterized by a high demand for insurance coverage and a reduced supply.

Why are we currently facing a hard market?

The insurance crisis in the construction sector continues to deepen during 2020 and has now spread to other sectors, including accountancy and legal. What are the effects of the hard market? For example, when you have more capacity in the market,. The report delivers insights from our experts into the current market conditions across key business insurance classes, factors affecting the availability of insurance and the strategies to address. Architects, engineers and surveyors have already seen a significant increase in their insurance costs and greater cover restrictions, as insurance. Essentially it is an upswing in the insurance market cycle when premiums increase.

Source: rew-online.com

Source: rew-online.com

A hard market is a period of rising premiums, and decreased capacity. Entering 2020, corporate policyholders already faced a hardening insurance market. What exactly do we mean by a �hard market�? This contributes to their profitability. A hard insurance market may occur after a disaster, which enables insurers to tighten their underwriting standards and therefore write fewer policies on lower risk clients.

Source: scrivens.ca

Source: scrivens.ca

This can be caused by a number. Navigating the hard market q3 2021. With business uncertainty continuing to affect insurance availability and cost, gallagher has released our insurance market conditions report: The insurance crisis in the construction sector continues to deepen during 2020 and has now spread to other sectors, including accountancy and legal. Why are we currently facing a hard market?

Source: sec.gov

Source: sec.gov

A hard market is a period of rising premiums, and decreased capacity. Essentially it is an upswing in the insurance market cycle when premiums increase. Hard insurance market a period of time during which insurance companies are able to assess high premiums and therefore achieve high profits. While some of these tools are newly developed, others are making a comeback in terms increased prominence or having adopted a different form. Insurance companies use very strict underwriting standards and issue a limited number of policies.

Source: thamsagency.com

Source: thamsagency.com

A hard insurance market means there’s a high demand for insurance coverage and a reduced supply. Less competition among insurance carriers. Entering 2020, corporate policyholders already faced a hardening insurance market. It’s worth knowing that market cycles in the insurance market will usually have an effect on each other. Architects, engineers and surveyors have already seen a significant increase in their insurance costs and greater cover restrictions, as insurance.

Source: oraclegroup.com.au

Source: oraclegroup.com.au

What exactly do we mean by a �hard market�? One type of insurance that is gaining very strong momentum, and clearly. With business uncertainty continuing to affect insurance availability and cost, gallagher has released our insurance market conditions report: Why are we currently facing a hard market? Several factors can contribute to this kind of environment in the insurance industry, including an increase in severe weather events and catastrophes, a higher prevalence of insurance fraud, low investment returns, and inflation.

Source: plannedcover.com.au

Source: plannedcover.com.au

It has several characteristics, such as a: It has several characteristics, such as a: Everything you need to know about the hardening insurance market. Hard insurance market a period of time during which insurance companies are able to assess high premiums and therefore achieve high profits. A hard insurance market is the upswing in a market cycle when insurance premium rates are escalating, and insurers are disinclined to negotiate terms.

Source: sec.gov

Source: sec.gov

Entering 2020, corporate policyholders already faced a hardening insurance market. Everything you need to know about the hardening insurance market. Premiums are high and insurance carriers don’t want to negotiate terms. What exactly do we mean by a �hard market�? Less competition among insurance carriers.

Source: reithandassociates.com

Source: reithandassociates.com

What are the effects of the hard market? A hard insurance market means there’s a high demand for insurance coverage and a reduced supply. A soft insurance market is the opposite of a hard one. On the other hand, the characteristics of a hard market include: The upside and opportunities available.

Source: smartvid.io

Source: smartvid.io

Navigating the hard market q3 2021. On the other hand, the characteristics of a hard market include: With business uncertainty continuing to affect insurance availability and cost, gallagher has released our insurance market conditions report: A soft insurance market is the opposite of a hard one. It has several characteristics, such as a:

Source: prolink.insure

Source: prolink.insure

More stringent underwriting criteria, which means underwriting is more difficult; In a ‘hard’ market’ premiums begin to increase and the capacity for most types of insurance decreases. On the other hand, the characteristics of a hard market include: One type of insurance that is gaining very strong momentum, and clearly. Insurance companies use very strict underwriting standards and issue a limited number of policies.

Source: rightsure.com

Source: rightsure.com

It has several characteristics, such as a: How do we identify a hard market? For example, when you have more capacity in the market,. A hard insurance market means there’s a high demand for insurance coverage and a reduced supply. One type of insurance that is gaining very strong momentum, and clearly.

Source: artemis.bm

Source: artemis.bm

A hard insurance market may occur after a disaster, which enables insurers to tighten their underwriting standards and therefore write fewer policies on lower risk clients. A hard insurance market means there’s a high demand for insurance coverage and a reduced supply. Hard market — in the insurance industry, the upswing in a market cycle, when premiums increase and capacity for most types of insurance decreases. Tighter capacity has been mostly the result of reduced risk appetite rather than capital shortage. In a ‘hard’ market’ premiums begin to increase and the capacity for most types of insurance decreases.

Source: ltc-associates.com

Source: ltc-associates.com

Insurers impose strict underwriting standards and issue a limited number of policies. Reduced risk appetite is caused by elevated modelling uncertainty arising from. Architects, engineers and surveyors have already seen a significant increase in their insurance costs and greater cover restrictions, as insurance. The report delivers insights from our experts into the current market conditions across key business insurance classes, factors affecting the availability of insurance and the strategies to address. The market for insurance is cyclical.

Source: blackfordinsurance.com

Source: blackfordinsurance.com

This can be caused by a number. The insurance crisis in the construction sector continues to deepen during 2020 and has now spread to other sectors, including accountancy and legal. Navigating the hard market q3 2021. For example, when you have more capacity in the market,. Premiums are high and insurance carriers don’t want to negotiate terms.

Source: victual.com.au

Source: victual.com.au

Rate hardening in re/insurance is expected to continue through 2022. A hard insurance market may occur after a disaster, which enables insurers to tighten their underwriting standards and therefore write fewer policies on lower risk clients. To put it simply, a hard market is a period of time when there is a high demand for insurance, but a lower supply of coverage available. This can be caused by a number. A hard insurance market is the upswing in a market cycle when insurance premium rates are escalating, and insurers are disinclined to negotiate terms.

Source: oneillinsurance.com

Source: oneillinsurance.com

While some of these tools are newly developed, others are making a comeback in terms increased prominence or having adopted a different form. It’s worth knowing that market cycles in the insurance market will usually have an effect on each other. On the other hand, the characteristics of a hard market include: Essentially it is an upswing in the insurance market cycle when premiums increase. Reduced supply of insurance as some insurers will exit certain sectors.

Source: captiveresources.com

Source: captiveresources.com

A soft insurance market is the opposite of a hard one. To put it simply, a hard market is a period of time when there is a high demand for insurance, but a lower supply of coverage available. Less flexibility from insurance underwriters. A hard insurance market is the upswing in a market cycle when insurance premium rates are escalating, and insurers are disinclined to negotiate terms. Hard market — in the insurance industry, the upswing in a market cycle, when premiums increase and capacity for most types of insurance decreases.

Source: jgsinsurance.com

Source: jgsinsurance.com

Less flexibility from insurance underwriters. Less flexibility from insurance underwriters. Hard insurance market a period of time during which insurance companies are able to assess high premiums and therefore achieve high profits. Tighter capacity has been mostly the result of reduced risk appetite rather than capital shortage. In a ‘hard’ market’ premiums begin to increase and the capacity for most types of insurance decreases.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title hard insurance market by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.