Your Hail damage auto insurance claim images are ready in this website. Hail damage auto insurance claim are a topic that is being searched for and liked by netizens today. You can Get the Hail damage auto insurance claim files here. Get all free images.

If you’re looking for hail damage auto insurance claim pictures information connected with to the hail damage auto insurance claim topic, you have pay a visit to the ideal site. Our site frequently provides you with hints for refferencing the maximum quality video and image content, please kindly hunt and locate more informative video articles and images that fit your interests.

Hail Damage Auto Insurance Claim. Let’s say you planned on a. Regardless of the amount, an insurer will usually cover the damage minus the deductible. The difference between the two is that insurance rates for the former aren’t likely to increase due to a hail claim. The two biggest deductibles on a texas car insurance policy are referred to as collision and comprehensive.

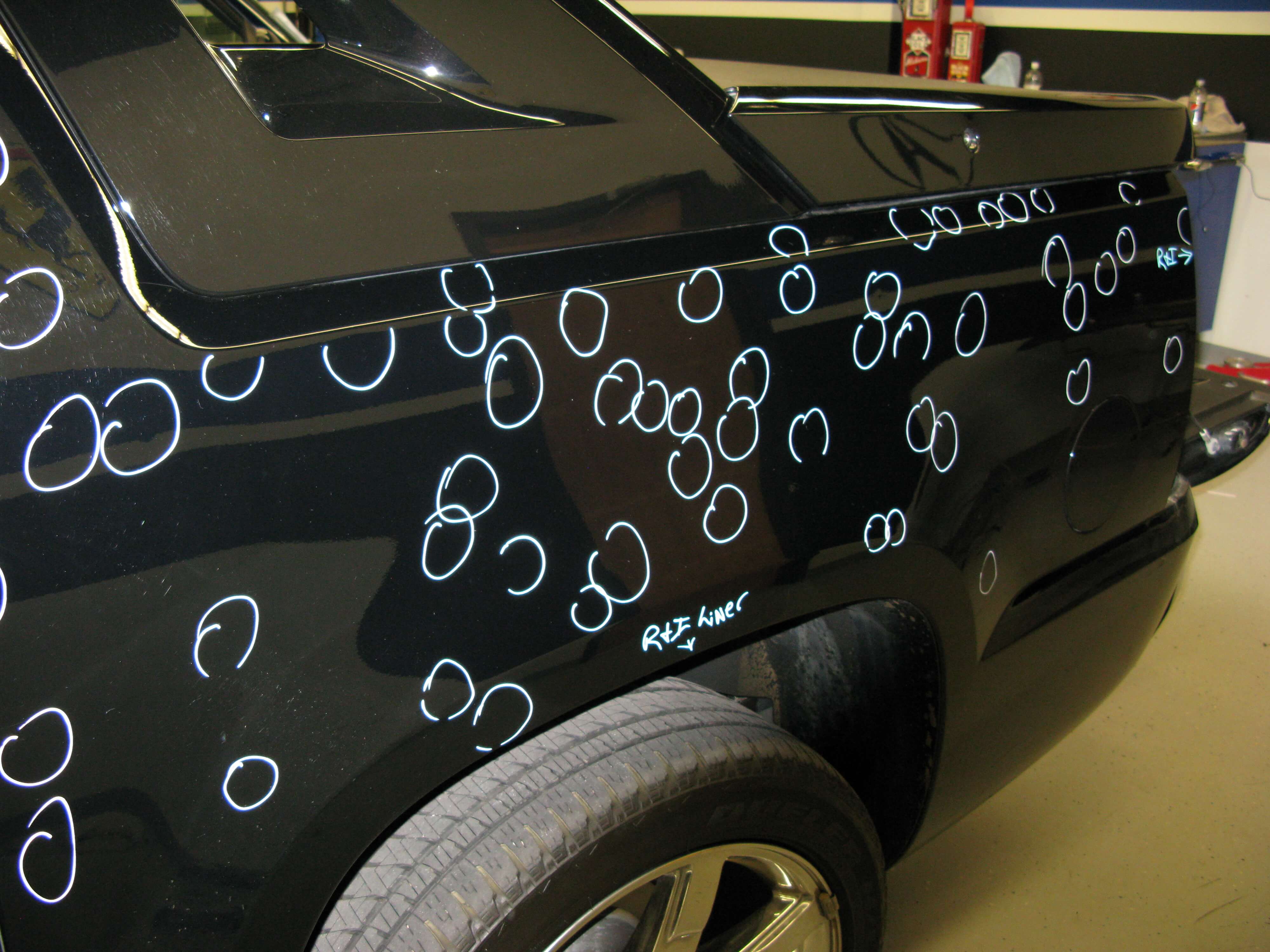

Car Hail Damage Paintless Dent Repair Auto Color From autocolorwi.com

Car Hail Damage Paintless Dent Repair Auto Color From autocolorwi.com

It is considered a comprehensive claim. Providers determine deductibles at the time you purchase car insurance on your vehicle. After all, comprehensive coverage includes such damaging events in the terms of said policy. Of course your claim may be higher or lower. Regardless of the amount, an insurer will usually cover the damage minus the deductible. The two biggest deductibles on a texas car insurance policy are referred to as collision and comprehensive.

For the purpose of fixing hail damage on insured cars, insurance companies paid $5.37 billion.

How long do you have to claim hail damage on car? Unfortunately, many people believe common myths about hail damage insurance claims. The average hail damage auto claim in 2020 was more than $4,300, according to state farm 2020 hail claims data. However, filing an insurance claim is not something i would have had full confidence in completing correctly alone. They will guide you through their own hail damage claim process on the phone. A car is considered totaled if repair costs exceed its depreciated value.

Source: denverautobodyrepair.net

Source: denverautobodyrepair.net

A car is considered totaled if repair costs exceed its depreciated value. Of course your claim may be higher or lower. When you have hail damage to your car, the first step in filing a claim is contacting your auto insurance company to file a claim. The adjuster will determine whether your insurer will pay for repairs or if your car is totaled. In doing so, you’re going to want to follow some very specific instructions so you don’t make the same mistakes many motorists do.

Source: mumby.com

Source: mumby.com

With a comprehensive claim, you will have to pay a deductible (usually $500 or $1000), while the insurance company bears the remaining cost to repair hail damage. Many insurance companies require a deductible with a comprehensive policy, but sometimes they offer a zero deductible at an additional cost. In order for a hail damage claim to be honored, your policy must have comprehensive coverage included. Because hail damage falls under the act of god category, filing a single claim shouldn’t affect your premiums. After all, comprehensive coverage includes such damaging events in the terms of said policy.

Source: aceofdents.com

Source: aceofdents.com

The two biggest deductibles on a texas car insurance policy are referred to as collision and comprehensive. Fortunately, people who suffered property damage in a hail storm may be able to obtain insurance compensation for repairs or to replace property that is a total loss. Hail is typically covered under comprehensive automobile insurance, which covers damage from storms and other losses not related to collisions. With a comprehensive claim, you will have to pay a deductible (usually $500 or $1000), while the insurance company bears the remaining cost to repair hail damage. For the purpose of fixing hail damage on insured cars, insurance companies paid $5.37 billion.

Source: miraclebodyandpaint.com

Source: miraclebodyandpaint.com

Regardless of the amount, an insurer will usually cover the damage minus the deductible. Let’s say you planned on a. The difference between the two is that insurance rates for the former aren’t likely to increase due to a hail claim. Providers determine deductibles at the time you purchase car insurance on your vehicle. The adjuster will determine whether your insurer will pay for repairs or if your car is totaled.

Source: dentpass.com

Source: dentpass.com

Hail damage is covered like any other standard claim. There’s not much you can do to avoid hail damage if your caught on the road. If your car suffered hail damage in denver, for instance, and you were slow to file a claim, you might find yourself 100,000 th in line for repairs. For auto hail damage claims the average payout was about $4,300. A hailstorm wreaks havoc on unprotected vehicles.

Source: siouxfallsdentrepair.com

Source: siouxfallsdentrepair.com

Allstate hail damage car insurance. With allstate, you are able to file a claim online, over the phone, or even on their app. Hail damage can also be a challenge to fix. A hailstorm wreaks havoc on unprotected vehicles. Providers determine deductibles at the time you purchase car insurance on your vehicle.

Source: thebalance.com

Source: thebalance.com

It is considered a comprehensive claim. Many insurance companies require a deductible with a comprehensive policy, but sometimes they offer a zero deductible at an additional cost. Here are the four easy steps to file a car hail damage insurance claim: A hail damage claim will only raise your auto insurance rates if you are located in an area that is more prone to hail. To safeguard themselves against the risk of hail, your insurance provider may raise the cost of auto insurance, given the high risks involved.

Source: blog.honestpolicy.com

Source: blog.honestpolicy.com

Hail damage car insurance claims process. What is an auto hail claim? Hail is not covered by your basic car insurance policy. A hailstorm wreaks havoc on unprotected vehicles. In some cases, believing in these myths causes people to not file insurance claims.

Source: allstarpdr.com

Source: allstarpdr.com

Providers determine deductibles at the time you purchase car insurance on your vehicle. The claims process consists of either filing online here. A body shop may use filler in the dents, then repaint the damaged areas. If your car suffered hail damage in denver, for instance, and you were slow to file a claim, you might find yourself 100,000 th in line for repairs. There’s not much you can do to avoid hail damage if your caught on the road.

Source: autocolorwi.com

Source: autocolorwi.com

Hail is not covered by your basic car insurance policy. Vehicle hail damage claims averaged more than $4,300 per claim in 2020, according to state farm data. The two biggest deductibles on a texas car insurance policy are referred to as collision and comprehensive. Comprehensive and collision insurance are usually sold together. A dent repair can cost upwards of $100.

Source: advanceddentrepairs.com.au

Source: advanceddentrepairs.com.au

In order for a hail damage claim to be honored, your policy must have comprehensive coverage included. Comprehensive and collision insurance are usually sold together. With allstate, you are able to file a claim online, over the phone, or even on their app. Allstate hail damage car insurance. Vehicle hail damage claims averaged more than $4,300 per claim in 2020, according to state farm data.

Source: autocolorwi.com

Source: autocolorwi.com

For the purpose of fixing hail damage on insured cars, insurance companies paid $5.37 billion. If your vehicle is declared a total loss someday (due to collision, flooding, irreparable storm damage, etc.), your insurance company will subtract the amount of this hail damage payout from your vehicle’s total value. Hail is not covered by your basic car insurance policy. A hailstorm wreaks havoc on unprotected vehicles. They will guide you through their own hail damage claim process on the phone.

Source: thinkinsure.ca

Source: thinkinsure.ca

What is an auto hail claim? Because hail damage falls under the act of god category, filing a single claim shouldn’t affect your premiums. The first step is to contact your insurance agent or the insurance company. Unfortunately, many people believe common myths about hail damage insurance claims. Hail damage can also be a challenge to fix.

Source: einsurance.com

Source: einsurance.com

When you file a car insurance claim for hail damage, you will work with your claim adjuster and an auto body shop to get a repair estimate. By prajakta dhopade on july 23, 2015. Average insurance payout for hail damage. If your car is confirmed to be totaled because of a hail insurance claim and you plan to keep driving it, ask your insurer to purchase the vehicle for its salvage worth. In some cases, believing in these myths causes people to not file insurance claims.

Source: martininsurance.com

Source: martininsurance.com

Hail damage can also be a challenge to fix. For auto hail damage claims the average payout was about $4,300. After you file a car insurance claim for hail damage, an insurance adjuster will assess the extent of the damage and determine if. With allstate, you are able to file a claim online, over the phone, or even on their app. Hail damage car insurance claims process.

Source: carinsurancecompanies.net

Source: carinsurancecompanies.net

It is a good idea to call your insurer as soon as possible after the storm, because major storms can cause a delay in the processing of claims. Filing repeatedly claims might, however. The average homeowner claim totaled nearly $12,000, according to state farm 2020 hail claims data. You must have comprehensive insurance to file a hail damage claim. They offer comprehensive coverage, so you know that if there is extensive hail damage it will be covered.

Source: comparethemarket.com.au

Source: comparethemarket.com.au

In doing so, you’re going to want to follow some very specific instructions so you don’t make the same mistakes many motorists do. With allstate, you are able to file a claim online, over the phone, or even on their app. Of course your claim may be higher or lower. Hail damage car insurance claims process. Let’s say you planned on a.

Source: insurify.com

Source: insurify.com

But before filing a hail claim, it’s. Of course your claim may be higher or lower. When you file a car insurance claim for hail damage, you will work with your claim adjuster and an auto body shop to get a repair estimate. With a comprehensive claim, you will have to pay a deductible (usually $500 or $1000), while the insurance company bears the remaining cost to repair hail damage. It is a good idea to call your insurer as soon as possible after the storm, because major storms can cause a delay in the processing of claims.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hail damage auto insurance claim by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.