Your Gusto unemployment insurance images are ready. Gusto unemployment insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Gusto unemployment insurance files here. Get all free photos and vectors.

If you’re searching for gusto unemployment insurance images information connected with to the gusto unemployment insurance topic, you have pay a visit to the right blog. Our website always provides you with hints for seeking the maximum quality video and picture content, please kindly surf and find more enlightening video articles and images that fit your interests.

Gusto Unemployment Insurance. All plans include unlimited customer service via chat, email, and phone. Here’s what you need to know. Next, you supply any data needed for your state(s), such as the state unemployment insurance (sui) tax. Employee paycheck loans and cash management tools via the wallet app;

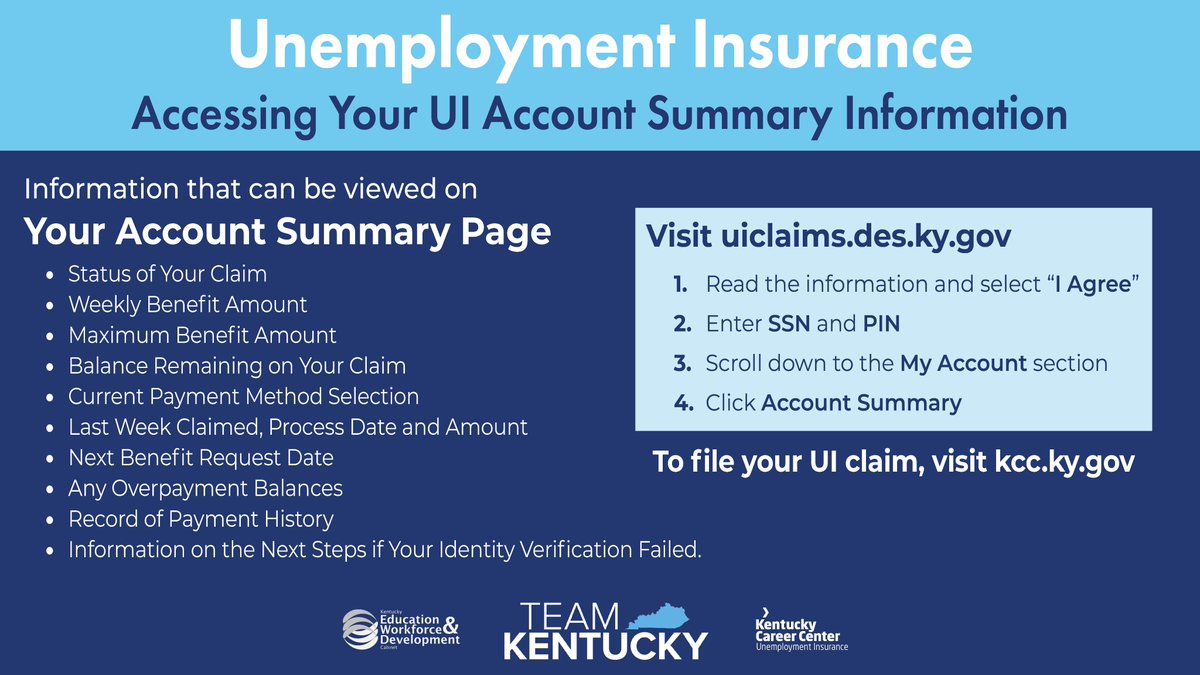

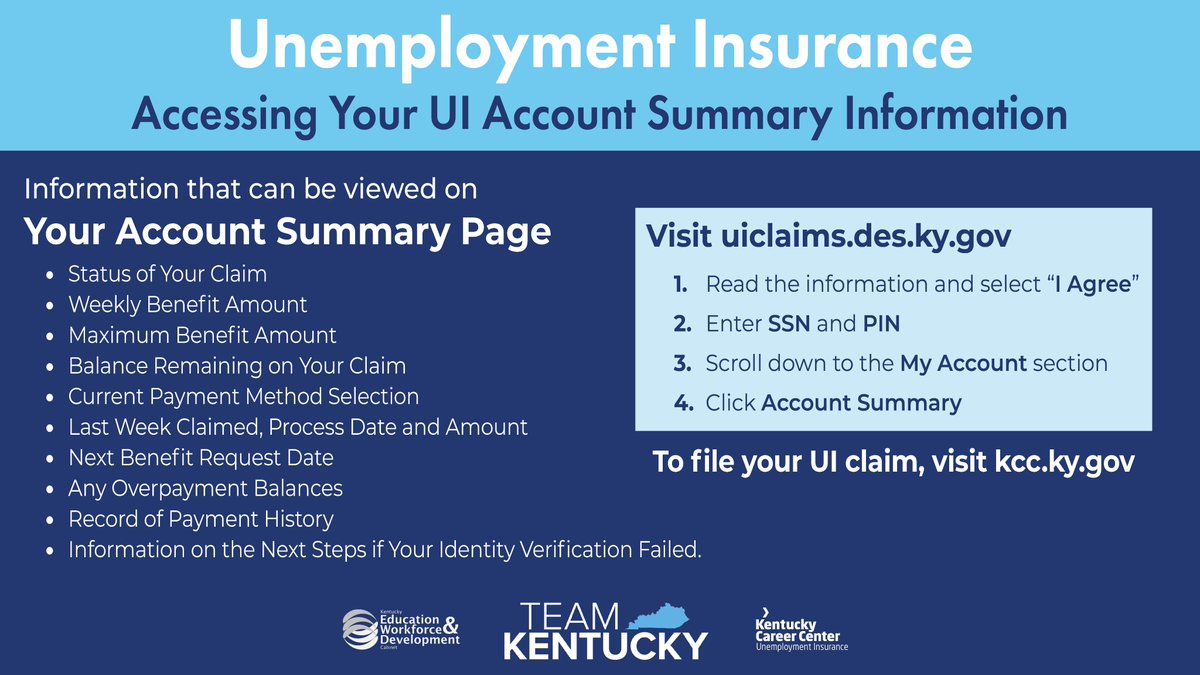

Unemployment Benefits Uiclaims Des Ky Gov / Angela Farris From christianavtv-images.blogspot.com

Unemployment Benefits Uiclaims Des Ky Gov / Angela Farris From christianavtv-images.blogspot.com

Next, you supply any data needed for your state(s), such as the state unemployment insurance (sui) tax. Gusto understands the intricate details for every state, so you don’t have to (note: It includes all the features of the other plans, accounting software integration, state unemployment insurance services, tools for screening and onboarding employees, and an employee handbook builder. Providing state tax details can be an especially complicated process, so. And for added convenience, all of these benefits are handled and organized on the same online dashboard for faster, easier management. Here’s what you need to know.

Stated employee benefits require that the employer has an active account with gusto.

Some of the most relevant features are available from gusto including employee health benefits like health insurance and unemployment, time off tracking and payments, college savings, and 401ks. Keep in mind that state unemployment rates will fluctuate based on how often you dismiss workers and how many of those fired get unemployment benefits. No matter the size or stage of your company, gusto puts the tools you need to hire, pay, and manage your team at. The two fica tax rates for employers are: Many employers should expect to pay higher taxes for state unemployment insurance in 2022. Gusto is all about payroll administration and employee management, whereas paychex offers more tools with endless scaling capabilities;

Source: uk.pcmag.com

Source: uk.pcmag.com

All plans include unlimited customer service via chat, email, and phone. They prepare paperwork, send direct deposit. It includes all the features of the other plans, accounting software integration, state unemployment insurance services, tools for screening and onboarding employees, and an employee handbook builder. There is a monthly cost of $4 per participant per account for fsa and commuter benefits (subject to a $20 monthly minimum), and a $2.50 per participant monthly cost for hsa (with no minimum). Gusto automatically pays federal and state unemployment insurance and deducts garnishments.

Source: gusto.com

Source: gusto.com

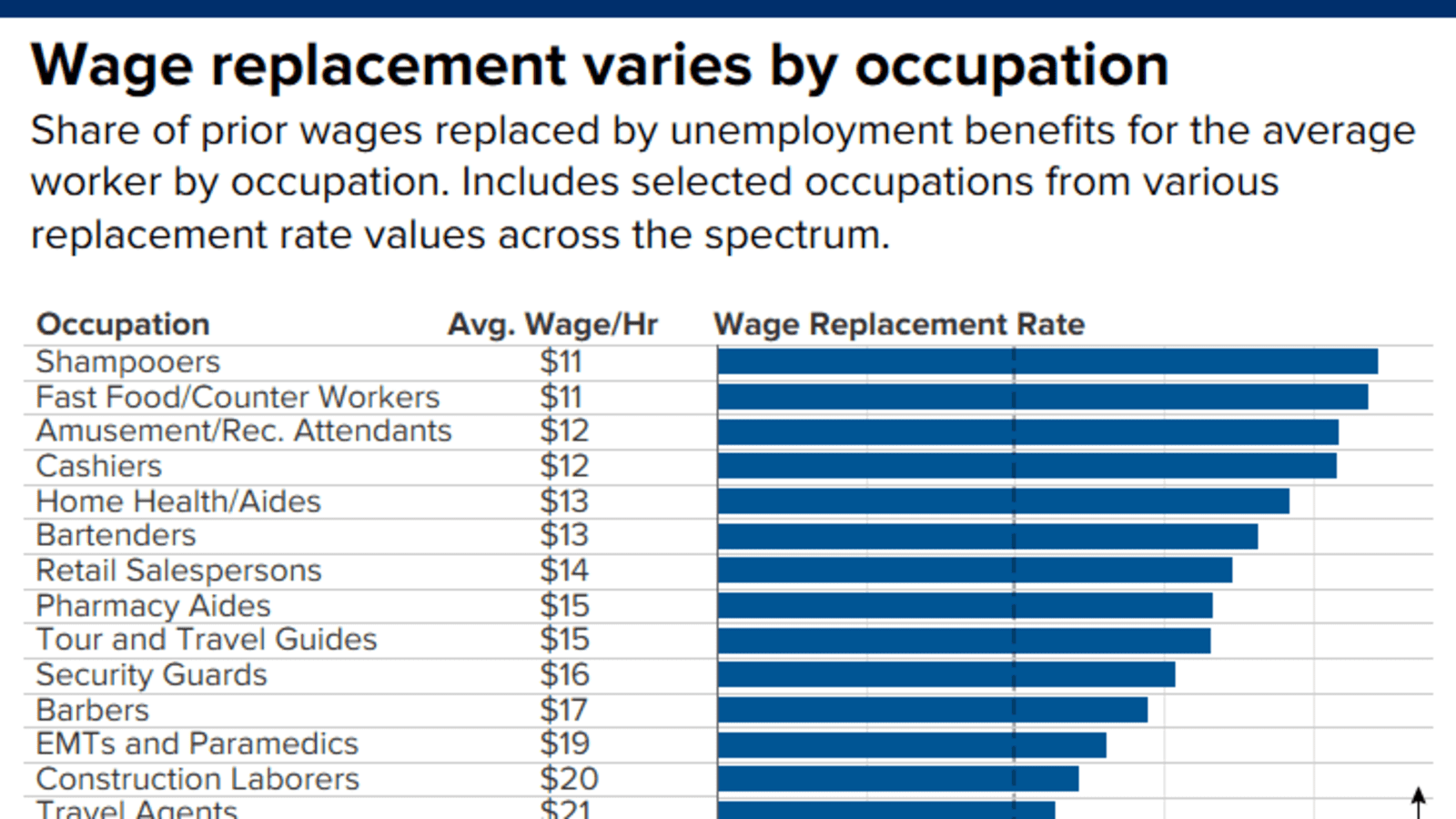

There is a monthly cost of $4 per participant per account for fsa and commuter benefits (subject to a $20 monthly minimum), and a $2.50 per participant monthly cost for hsa (with no minimum). I don’t know about gusto’s international capabilities). Gusto understands the intricate details for every state, so you don’t have to (note: 52 rows unemployment benefits for every state in the u.s. According to the table above, an employee earning $30,000 per year may pay an average of $3,600 in fica tax, unemployment tax, and workers’ compensation insurance.

Source: ploymen.blogspot.com

Source: ploymen.blogspot.com

Some of the most relevant features are available from gusto including employee health benefits like health insurance and unemployment, time off tracking and payments, college savings, and 401ks. Your unemployment insurance tax rate can be found on the most recent notice of liability you received from the. Whether you choose to offer one, two, or all three of these benefits, there is an annual service charge of $200. Unemployment insurance and garnishment support No matter the size or stage of your company, gusto puts the tools you need to hire, pay, and manage your team at.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

By making the most complicated business tasks simple and personal, gusto is reimagining payroll, benefits and hr for modern companies. Gusto serves over 200,000 companies nationwide and has offices in san francisco, denver, and new york. The two fica tax rates for employers are: I don’t know about gusto’s international capabilities). ¹gusto is a payroll services company, not a bank.

Source: gusto.com

Source: gusto.com

*do not include this when entering your unemployment rate in gusto. Stated employee benefits require that the employer has an active account with gusto. Support for all 50 us states; There is a monthly cost of $4 per participant per account for fsa and commuter benefits (subject to a $20 monthly minimum), and a $2.50 per participant monthly cost for hsa (with no minimum). It includes all the features of the other plans, accounting software integration, state unemployment insurance services, tools for screening and onboarding employees, and an employee handbook builder.

Source: gusto.com

Source: gusto.com

Providing state tax details can be an especially complicated process, so. Futa taxes fund federal unemployment insurance, which is a government program that provides temporary financial support to eligible employees after they’ve been terminated due to no fault of their own. They prepare paperwork, send direct deposit. No administrative fees on workers compensation plans; I don’t know about gusto’s international capabilities).

Source: christianavtv-images.blogspot.com

Source: christianavtv-images.blogspot.com

Gusto only offers health insurance for employees in 27 states. Your unemployment insurance tax rate can be found on the most recent notice of liability you received from the. And for added convenience, all of these benefits are handled and organized on the same online dashboard for faster, easier management. Unemployment insurance and garnishment support I don’t know about gusto’s international capabilities).

Source: gusto.com

Source: gusto.com

Unemployment insurance and garnishment support In most states, employees are not responsible for funding sui and so contributions are not typically withheld from employee wages. Other freebies in all subscriptions include: By making the most complicated business tasks simple and personal, gusto is reimagining payroll, benefits and hr for modern companies. Gusto understands the intricate details for every state, so you don’t have to (note:

Source: gusto.com

Source: gusto.com

No matter the size or stage of your company, gusto puts the tools you need to hire, pay, and manage your team at. Support for all 50 us states; You�ll be asked to enter it separately. Due to the pandemic driving high rates of unemployment, state funds have been depleted—and replenishing these funds will (partly) come out of higher employer payroll taxes. 52 rows unemployment benefits for every state in the u.s.

Source: unemop.blogspot.com

Source: unemop.blogspot.com

No administrative fees on workers compensation plans; *do not include this when entering your unemployment rate in gusto. Whether you choose to offer one, two, or all three of these benefits, there is an annual service charge of $200. For business owners who would like help with wage garnishment and state unemployment insurance, adp offers the enhanced plan. The federal unemployment tax act (futa) requires it for every state where your company has employees.

52 rows unemployment benefits for every state in the u.s. Gusto is all about payroll administration and employee management, whereas paychex offers more tools with endless scaling capabilities; Banking services provided by nbkc bank, member fdic. Next, you supply any data needed for your state(s), such as the state unemployment insurance (sui) tax. Gusto understands the intricate details for every state, so you don’t have to (note:

Source: dakotafreepress.com

Source: dakotafreepress.com

All plans include unlimited customer service via chat, email, and phone. You�ll be asked to enter it separately. ¹gusto is a payroll services company, not a bank. Gusto understands the intricate details for every state, so you don’t have to (note: They prepare paperwork, send direct deposit.

Source: gusto.com

Source: gusto.com

No administrative fees on workers compensation plans; Keep in mind that state unemployment rates will fluctuate based on how often you dismiss workers and how many of those fired get unemployment benefits. Gusto’s mission is to create a world where work empowers a better life. Your unemployment insurance tax rate can be found on the most recent notice of liability you received from the. Gusto automatically pays federal and state unemployment insurance and deducts garnishments.

Source: gusto.com

Source: gusto.com

Here’s what you need to know. Run payroll and benefits with gusto. The two fica tax rates for employers are: Gusto automatically pays federal and state unemployment insurance and deducts garnishments. *do not include this when entering your unemployment rate in gusto.

Source: dakotafreepress.com

Source: dakotafreepress.com

¹gusto is a payroll services company, not a bank. Providing state tax details can be an especially complicated process, so. Stated employee benefits require that the employer has an active account with gusto. No matter the size or stage of your company, gusto puts the tools you need to hire, pay, and manage your team at. Unemployment insurance and garnishment support

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

Due to the pandemic driving high rates of unemployment, state funds have been depleted—and replenishing these funds will (partly) come out of higher employer payroll taxes. Other freebies in all subscriptions include: Gusto understands the intricate details for every state, so you don’t have to (note: This is typically automatically facilitated by a payroll software like gusto. Some of the most relevant features are available from gusto including employee health benefits like health insurance and unemployment, time off tracking and payments, college savings, and 401ks.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

By making the most complicated business tasks simple and personal, gusto is reimagining payroll, benefits and hr for modern companies. Support for all 50 us states; Other freebies in all subscriptions include: In most states, employees are not responsible for funding sui and so contributions are not typically withheld from employee wages. No matter the size or stage of your company, gusto puts the tools you need to hire, pay, and manage your team at.

Source: gusto.com

Source: gusto.com

According to the table above, an employee earning $30,000 per year may pay an average of $3,600 in fica tax, unemployment tax, and workers’ compensation insurance. Due to the pandemic driving high rates of unemployment, state funds have been depleted—and replenishing these funds will (partly) come out of higher employer payroll taxes. You�ll be asked to enter it separately. Next, you supply any data needed for your state(s), such as the state unemployment insurance (sui) tax. By making the most complicated business tasks simple and personal, gusto is reimagining payroll, benefits and hr for modern companies.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title gusto unemployment insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.