Your Guarantor definition insurance images are ready in this website. Guarantor definition insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Guarantor definition insurance files here. Get all free photos.

If you’re searching for guarantor definition insurance images information linked to the guarantor definition insurance interest, you have visit the ideal site. Our website always provides you with hints for refferencing the highest quality video and image content, please kindly surf and find more enlightening video content and images that fit your interests.

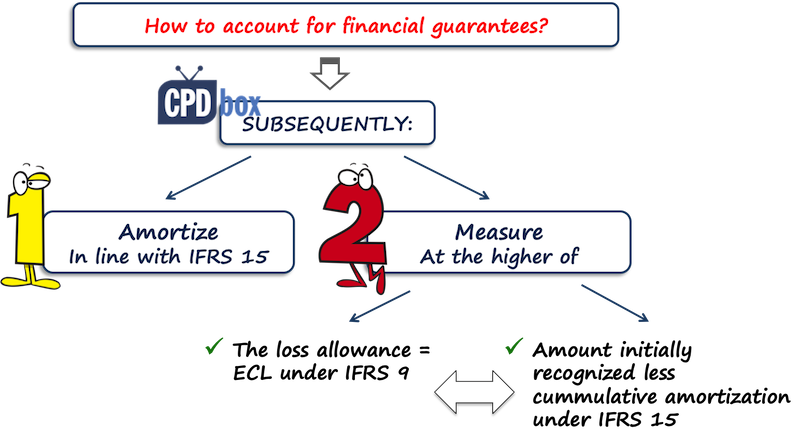

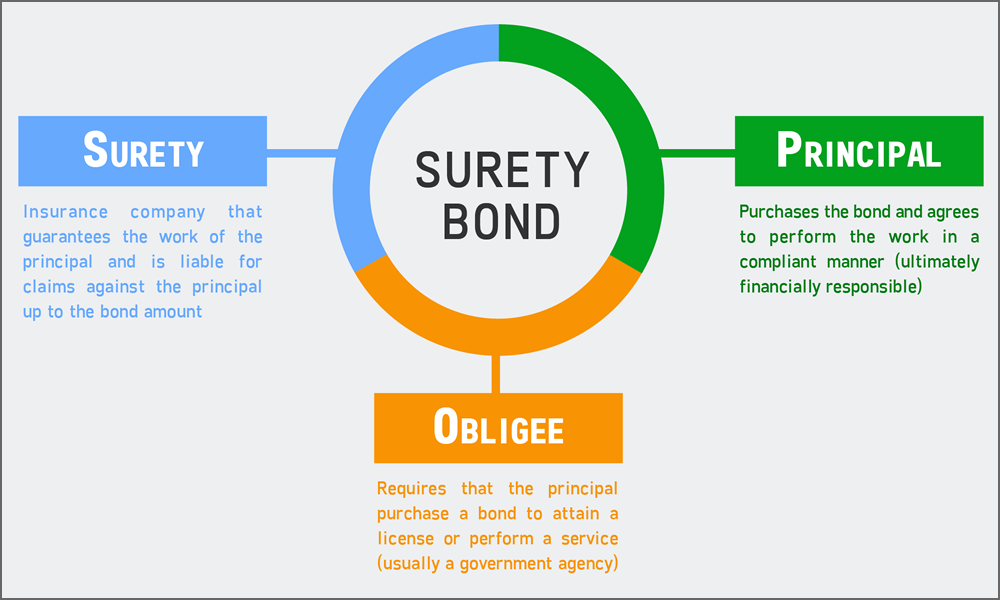

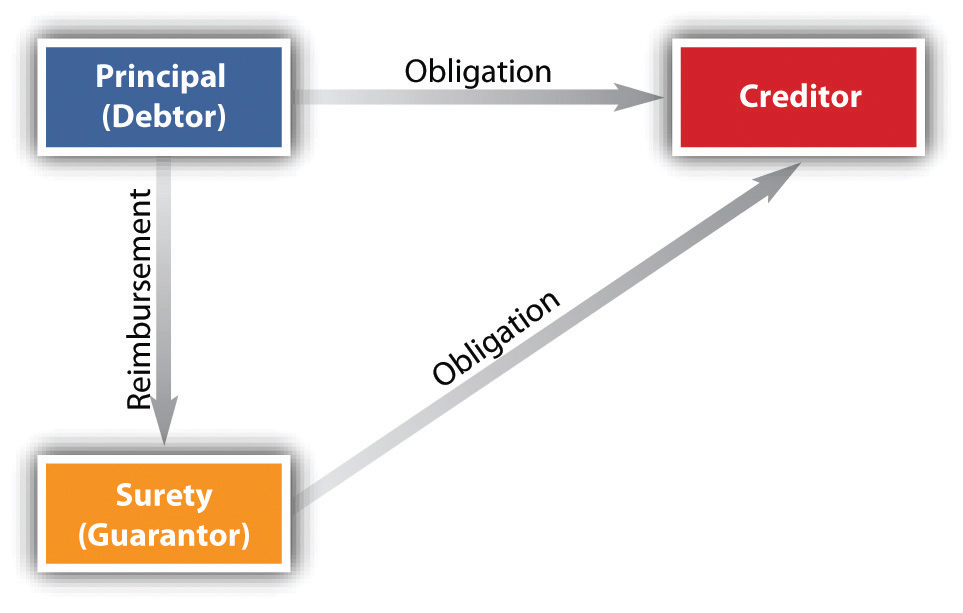

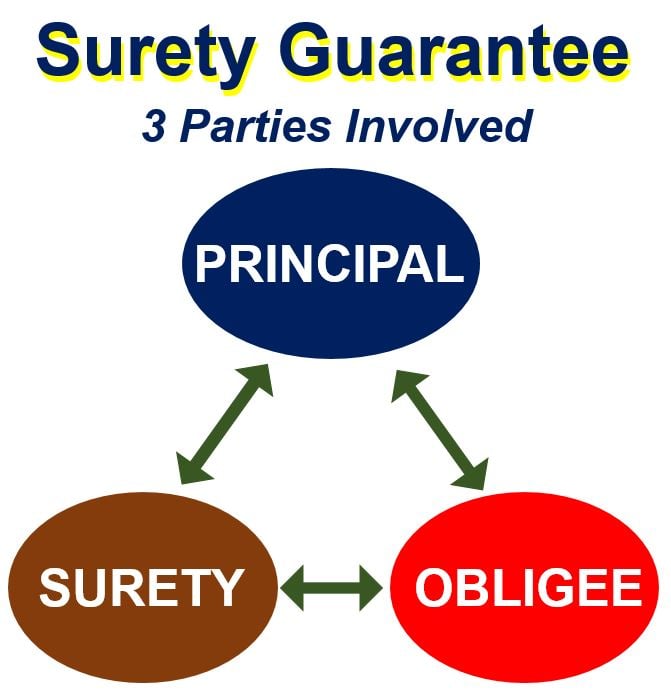

Guarantor Definition Insurance. A guarantor is a third party in a contract who promises to pay for certain liabilities if one of the other parties in the contract defaults on their obligations. This type of insurance is also known as surety insurance. The person who executes the guaranty insurance is know as the guarantor. A surety[1] is an accessory security for a main obligation.

Insurance Definition Guarantor Sba Form 148 Download From username-d2009.blogspot.com

Insurance Definition Guarantor Sba Form 148 Download From username-d2009.blogspot.com

Loan covenant a loan covenant is an agreement stipulating the terms and conditions of loan policies between a borrower and a lender. • the guarantor is always the patient, unless the patient is a minor or an incapacitated adult. Extremely aggressive behavior by an insurance agent to convince a prospect to purchase the insurance product without due regard for the prospect�s ability to pay the premiums and/or. • the guarantor is not the insurance subscriber, the husband, or the head of household. They are usually a form of insurance for the lender. A completion guarantee is a bond provided by the guarantor that a film would be finished within the agreed time schedule.

Means the undertaking to perform an agreement or contract or to discharge a trust, duty or obligation on default of the person liable for the performance or discharge or to pay money on the default or in place of the performance or discharge, or where there is loss or damage through the default, but does not include credit insurance;

There are a few different instances when someone might need. Extremely aggressive behavior by an insurance agent to convince a prospect to purchase the insurance product without due regard for the prospect�s ability to pay the premiums and/or. The guarantor, an insurer or a bank, promises the same performance as the principal debtor. This guarantee is given to the film financier and insulates the financier from any overruns that result in cost escalations and increase the financing requirement. Answered on may 7, 2013. The object of a surety is therefore the performance of the obligation towards the principal.

Source: username-d2009.blogspot.com

Source: username-d2009.blogspot.com

The object of a surety is therefore the performance of the obligation towards the principal. Read more about the role of a guarantor in finance. • the guarantor is not the insurance subscriber, the husband, or the head of household. A guarantee is a promise of performance to a beneficiary in the event that the person who would normally provide a service or good fails to do so. A health insurance guarantor is the person or entity legally responsible for the remaining payment for health care services after insurance has payed.

An insurance guarantor is there to guarantee that you’ll receive your benefits regardless of your insurers’ financial health. There are a few different instances when someone might need. This type of insurance is also known as surety insurance. This means that a surety follows the main obligation. • the guarantor is always the patient, unless the patient is a minor or an incapacitated adult.

Source: mgtblog.com

Source: mgtblog.com

There are a few different instances when someone might need. Guarantor a guarantor is a third party that pays for a debt if the borrower misses their payments. Loan covenant a loan covenant is an agreement stipulating the terms and conditions of loan policies between a borrower and a lender. Means the undertaking to perform an agreement or contract or to discharge a trust, duty or obligation on default of the person liable for the performance or discharge or to pay money on the default or in place of the performance or discharge, or where there is loss or damage through the default, but does not include credit insurance; A guarantee inserts a third party into a legal agreement to provide an extra layer of protection for the beneficiary.

Source: lexisnexis.co.uk

Source: lexisnexis.co.uk

Guaranty insurance is a type of insurance used mainly to indemnify the loss caused to a person by another’s default or misconduct. A guarantor (orresponsible party) is the person held accountable for the patient’s bill. Usually adults are their own guarantors. A guarantor is a third party in a contract who promises to pay for certain liabilities if one of the other parties in the contract defaults on their obligations. The guarantor is only obliged to do so within.

Source: slideshare.net

Source: slideshare.net

Loan covenant a loan covenant is an agreement stipulating the terms and conditions of loan policies between a borrower and a lender. This guarantee is given to the film financier and insulates the financier from any overruns that result in cost escalations and increase the financing requirement. The guarantor, an insurer or a bank, promises the same performance as the principal debtor. A completion guarantee is a bond provided by the guarantor that a film would be finished within the agreed time schedule. • the guarantor is not the insurance subscriber, the husband, or the head of household.

Source: suretybondsdirect.com

Source: suretybondsdirect.com

There are a few different instances when someone might need. In this article, we explore some of the issues guarantors should consider when reviewing the definitions, representations, warranties and covenants and obligations in an indemnity. They are usually a form of insurance for the lender. A guarantor is a person who guarantees to pay a borrower�s debt if they default on a loan obligation. A guarantor (orresponsible party) is the person held accountable for the patient’s bill.

Source: emeraldcardaccount.blogspot.com

The guarantor is only obliged to do so within. A person or entity that agrees to be responsible for another�s debt or performance under a contract, if the other fails to pay or perform. Usually adults are their own guarantors. Guaranty insurance is a type of insurance used mainly to indemnify the loss caused to a person by another’s default or misconduct. Who needs an insurance guarantor?

Source: blog.cdphp.com

Source: blog.cdphp.com

Loan covenant a loan covenant is an agreement stipulating the terms and conditions of loan policies between a borrower and a lender. An insurance guarantor person or entity that assures that the promises given by one party to. The guarantor is the person who is responsible for the medical bill if all other payment options (e.g., medicaid, personal health insurance, a driver�s motor vehicle coverage) fall short of covering the full cost of treatment. An insurance guarantor will be someone who can act on behalf of someone who cannot pay their bills. Loan covenant a loan covenant is an agreement stipulating the terms and conditions of loan policies between a borrower and a lender.

Source: saylordotorg.github.io

Source: saylordotorg.github.io

A guarantor (orresponsible party) is the person held accountable for the patient’s bill. An insurance guarantor is there to guarantee that you’ll receive your benefits regardless of your insurers’ financial health. The object of a surety is therefore the performance of the obligation towards the principal. • the guarantor is always the patient, unless the patient is a minor or an incapacitated adult. Loan covenant a loan covenant is an agreement stipulating the terms and conditions of loan policies between a borrower and a lender.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

The health insurance company is a guarantor of sorts (if you have a fully insured plan) but there may also be other carriers backing them up. Who needs an insurance guarantor? A surety[1] is an accessory security for a main obligation. There�s no insurance that can protect you from this. A type of insurance that a loan company can buy to protect itself in case someone who borrows money….

Source: username-d2009.blogspot.com

Source: username-d2009.blogspot.com

Who needs an insurance guarantor? What is the meaning of an insurance guarantor? They are usually a form of insurance for the lender. The guarantor, an insurer or a bank, promises the same performance as the principal debtor. • the guarantor is not the insurance subscriber, the husband, or the head of household.

Source: bizfluent.com

Source: bizfluent.com

Guarantors sometimes appear on insurance contracts and also provide a sort of insurance themselves. Extremely aggressive behavior by an insurance agent to convince a prospect to purchase the insurance product without due regard for the prospect�s ability to pay the premiums and/or. Loan covenant a loan covenant is an agreement stipulating the terms and conditions of loan policies between a borrower and a lender. If you are looking for the most affordable policies, you can check them out in our best policies and best insurance companies reviews. They are usually a form of insurance for the lender.

Source: bwtradefinance.com

Source: bwtradefinance.com

In this article, we explore some of the issues guarantors should consider when reviewing the definitions, representations, warranties and covenants and obligations in an indemnity. This type of insurance is also known as surety insurance. An insurance guarantor person or entity that assures that the promises given by one party to. An insurance guarantor is there to guarantee that you’ll receive your benefits regardless of your insurers’ financial health. They are usually a form of insurance for the lender.

Source: myinsuranceshark.com

Source: myinsuranceshark.com

A person or entity that agrees to be responsible for another�s debt or performance under a contract, if the other fails to pay or perform. A guarantee is a promise of performance to a beneficiary in the event that the person who would normally provide a service or good fails to do so. The guarantor is the person who is responsible for the medical bill if all other payment options (e.g., medicaid, personal health insurance, a driver�s motor vehicle coverage) fall short of covering the full cost of treatment. Means the undertaking to perform an agreement or contract or to discharge a trust, duty or obligation on default of the person liable for the performance or discharge or to pay money on the default or in place of the performance or discharge, or where there is loss or damage through the default, but does not include credit insurance; The guarantor is only obliged to do so within.

Source: slideshare.net

Source: slideshare.net

Who needs an insurance guarantor? The object of a surety is therefore the performance of the obligation towards the principal. If you are looking for the most affordable policies, you can check them out in our best policies and best insurance companies reviews. The person who executes the guaranty insurance is know as the guarantor. There�s no insurance that can protect you from this.

Source: pza4911.blogspot.com

Source: pza4911.blogspot.com

A guarantor is a person who guarantees to pay a borrower�s debt if they default on a loan obligation. This means that a surety follows the main obligation. This type of insurance is also known as surety insurance. A guarantor is a third party in a contract who promises to pay for certain liabilities if one of the other parties in the contract defaults on their obligations. An insurance guarantor will be someone who can act on behalf of someone who cannot pay their bills.

Source: noteslearning.com

Source: noteslearning.com

The object of a surety is therefore the performance of the obligation towards the principal. A type of insurance that a loan company can buy to protect itself in case someone who borrows money…. With self funded health insurance your employer or union is the guarantor and they may have reinsurance in place to back them. Who needs an insurance guarantor? A guarantor is a person who guarantees to pay a borrower�s debt if they default on a loan obligation.

Source: investopedia.com

Source: investopedia.com

This type of insurance is also known as surety insurance. A guarantee is a promise of performance to a beneficiary in the event that the person who would normally provide a service or good fails to do so. The only real way to. Guarantor a guarantor is a third party that pays for a debt if the borrower misses their payments. This type of insurance is also known as surety insurance.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title guarantor definition insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.