Your Guaranteed insurability option images are available in this site. Guaranteed insurability option are a topic that is being searched for and liked by netizens now. You can Get the Guaranteed insurability option files here. Download all royalty-free vectors.

If you’re looking for guaranteed insurability option pictures information related to the guaranteed insurability option keyword, you have pay a visit to the ideal site. Our website frequently gives you suggestions for viewing the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

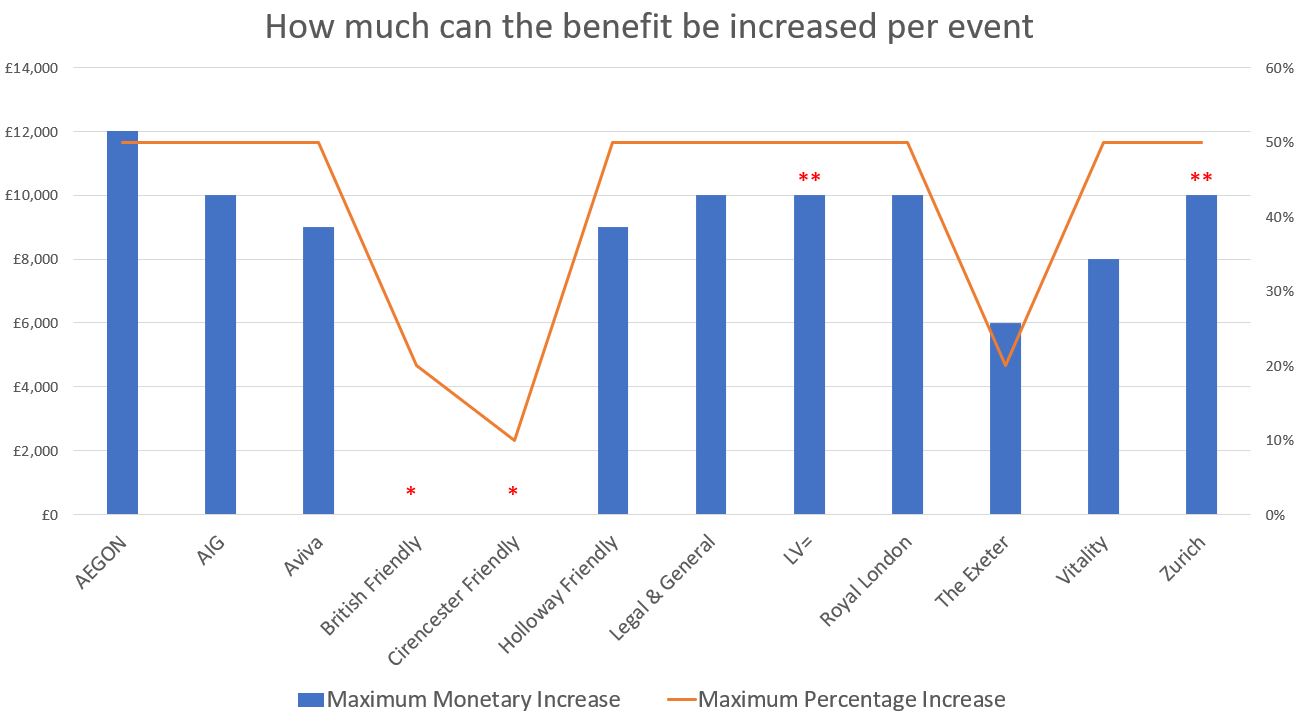

Guaranteed Insurability Option. A rider is an additional benefit to a life insurance policy beyond the death benefit. Guaranteed insurability (also known as the life events options) lets you increase your cover without the need to undergo medical underwriting. The terms and conditions of a. The guaranteed insurability option rider is a rider for life insurance that allows the owner to purchase additional coverage periodically at certain attained ages or upon certain special occasions such as marriage and the birth of a child.

Guaranteed Refund Option Local Life Pro From locallifepro.com

Guaranteed Refund Option Local Life Pro From locallifepro.com

A guaranteed insurability rider lets the policyholder buy additional coverage for their policy at a later date with no further underwriting. The guaranteed insurability option rider is a rider for life insurance that allows the owner. Guaranteed insurability option is for business protection, in which case see section 4.2 instead. Guaranteed insurability option riders are optional. A rider is an additional benefit to a life insurance policy beyond the death benefit. Enjoy the assurance of adding your benefit as the need arises

With this rider in place, you get the choice to buy additional life insurance at specific points called option dates.

The guaranteed insurability option rider is a rider for life insurance that allows the owner to purchase additional coverage periodically at certain attained ages or upon certain special occasions such as marriage and the birth of a child. A guaranteed insurability rider is an optional benefit included with some life insurance policies. The guaranteed insurability option rider is a rider for life insurance that allows the owner to purchase additional coverage periodically at certain attained ages or upon certain special occasions such as marriage and the birth of a child. Guaranteed insurability option life insurance. A “guaranteed insurability rider,” also known as a “guaranteed insurability option” or “guaranteed purchase option,” is available in some companies for children’s life insurance policies. It is available on some life insurance , mortgage protection and income protection policies.

Source: finance.zacks.com

Source: finance.zacks.com

A rider is an additional benefit to a life insurance policy beyond the death benefit. A guaranteed insurability option is a rider to an insurance policy that requires the insurance company to renew the policy for a specific duration regardless of changes to the health of the policyholder. It is available on some life insurance , mortgage protection and income protection policies. Be sure to check your policy documents as some “simplified” products leave this valuable benefit out. The guaranteed insurability (gi) rider is available on certain life insurance policies and allows you to purchase additional insurance at specific dates in the future (subject to minimums and maximums) without having to go through an exam or answer health questions.

Source: blogpapi.com

Source: blogpapi.com

The guaranteed insurability (gi) rider is available on certain life insurance policies and allows you to purchase additional insurance at specific dates in the future (subject to minimums and maximums) without having to go through an exam or answer health questions. Guaranteed insurability option life insurance. Guaranteed insurability option riders are optional. Be sure to check your policy documents as some “simplified” products leave this valuable benefit out. Some life insurance policies include a guaranteed insurability option as standard, or simply, the option to increase your cover if your needs change.

Source: lifeinsurancepost.com

Source: lifeinsurancepost.com

The choice to use the option is guaranteed and the coverage is added with no evidence of insurability required, meaning no. Be sure to check your policy documents as some “simplified” products leave this valuable benefit out. Enjoy the assurance of adding your benefit as the need arises Guaranteed insurability (also known as the life events options) lets you increase your cover without the need to undergo medical underwriting. Commonly shortened to gio rider (for guaranteed insurability option ), this popular feature enables you to tailor your coverage to your individual needs and preferences as your life changes over the years.

Source: professionalparaplanner.co.uk

Source: professionalparaplanner.co.uk

The guaranteed insurability riders, also known as the future purchase option, future increase option, guaranteed purchase option, or guaranteed increase option rider, allows the insured of a life or disability insurance policy to purchase additional coverage without going through a new medical exam. A guaranteed insurability option is a rider to an insurance policy that requires the insurance company to renew the policy for a specific duration regardless of changes to the health of the policyholder. Be sure to check your policy documents as some “simplified” products leave this valuable benefit out. Guaranteed insurability option is for business protection, in which case see section 4.2 instead. With this rider in place, you get the choice to buy additional life insurance at specific points called option dates.

Source: brokerworldmag.com

Source: brokerworldmag.com

1 the guaranteed insurability option rider is not available with the eriexpress life product. You can use this option in the event of: If you choose to add one to your life insurance policy, the cost of your coverage will go up. A guaranteed insurability rider, also called a gi rider, is a life insurance rider that allows the owner of a life insurance policy to buy additional life insurance with no underwriting. 4.1 increasing the sum assured 4.1.1 when can you use the guaranteed insurability option?

Source: youtube.com

Source: youtube.com

A guaranteed insurability rider is an optional benefit included with some life insurance policies. Your salary is increased as the result of a promotion or a change in employer. The guaranteed insurability option rider is a rider for life insurance that allows the owner. The choice to use the option is guaranteed and the coverage is added with no evidence of insurability required, meaning no. Guaranteed insurability option is for business protection, in which case see section 4.2 instead.

Source: newportagency.com

Source: newportagency.com

1 the guaranteed insurability option rider is not available with the eriexpress life product. You have a child, you adopt a child, or become the legal guardian of a child. The guaranteed insurability option rider is a rider for life insurance that allows the owner. Your guaranteed insurability option also covers divorce and the dissolving of a civil partnership. Guaranteed insurability option riders are optional.

Source: outline.ca

Source: outline.ca

A guaranteed insurability option is a life insurance rider that allows the policy owner to buy additional life insurance coverage at specific later dates without submitting any additional evidence of insurability. The guaranteed insurability riders, also known as the future purchase option, future increase option, guaranteed purchase option, or guaranteed increase option rider, allows the insured of a life or disability insurance policy to purchase additional coverage without going through a new medical exam. The terms and conditions of a. 4.1 increasing the sum assured 4.1.1 when can you use the guaranteed insurability option? Enjoy the assurance of adding your benefit as the need arises

Source: youtube.com

Source: youtube.com

Guaranteed insurability (also known as the life events options) lets you increase your cover without the need to undergo medical underwriting. This rider guarantees you the option to buy a predetermined amount of additional life insurance at specified intervals without requiring proof of insurability. A guaranteed insurability rider lets the policyholder buy additional coverage for their policy at a later date with no further underwriting. The choice to use the option is guaranteed and the coverage is added with no evidence of insurability required, meaning no. Your salary is increased as the result of a promotion or a change in employer.

Source: lsminsurance.ca

Source: lsminsurance.ca

Guaranteed insurability option is for business protection, in which case see section 4.2 instead. Most insurers include this benefit as standard. This rider guarantees you the option to buy a predetermined amount of additional life insurance at specified intervals without requiring proof of insurability. With this rider in place, you get the choice to buy additional life insurance at specific points called option dates. Speak with your agent for more details.

Source: reassured.co.uk

Source: reassured.co.uk

With this rider in place, you get the choice to buy additional life insurance at specific points called option dates. Speak with your agent for more details. What is a guaranteed insurability option rider? 4.1 increasing the sum assured 4.1.1 when can you use the guaranteed insurability option? Speak with your agent for more details.

Source: indianmoney.com

Source: indianmoney.com

Enjoy the assurance of adding your benefit as the need arises Put simply, this super feature allows you to increase the value of your life insurance policy without being reassessed. You can use this option in the event of: With this rider in place, you get the choice to buy additional life insurance at specific points called option dates. The terms and conditions of a.

Source: protective.com

Source: protective.com

Guaranteed insurability option life insurance. Your salary is increased as the result of a promotion or a change in employer. A guaranteed insurability rider is an optional benefit included with some life insurance policies. Be sure to check your policy documents as some “simplified” products leave this valuable benefit out. It is available on some life insurance , mortgage protection and income protection policies.

Source: locallifepro.com

Source: locallifepro.com

If you choose to add one to your life insurance policy, the cost of your coverage will go up. A guaranteed insurability rider lets the policyholder buy additional coverage for their policy at a later date with no further underwriting. Most insurers include this benefit as standard. The guaranteed insurability option rider is a rider for life insurance that allows the owner. The terms and conditions of a.

Source: lion.ie

Source: lion.ie

The guaranteed insurability option rider is a rider for life insurance that allows the owner to purchase additional coverage periodically at certain attained ages or upon certain special occasions such as marriage and the birth of a child. Guaranteed insurability option riders are optional. Guaranteed insurability option is for business protection, in which case see section 4.2 instead. The guaranteed insurability (gi) rider is available on certain life insurance policies and allows you to purchase additional insurance at specific dates in the future (subject to minimums and maximums) without having to go through an exam or answer health questions. A guaranteed insurability rider, also called a gi rider, is a life insurance rider that allows the owner of a life insurance policy to buy additional life insurance with no underwriting.

Source: reassured.co.uk

Source: reassured.co.uk

Put simply, this super feature allows you to increase the value of your life insurance policy without being reassessed. By rob harvey | aug 4, 2021 | guaranteed insurability options, guaranteed insurability options, guaranteed insurability options, income protection | 0 |. A guaranteed insurability rider is an optional benefit included with some life insurance policies. A guaranteed insurability option is a life insurance rider that allows the policy owner to buy additional life insurance coverage at specific later dates without submitting any additional evidence of insurability. The choice to use the option is guaranteed and the coverage is added with no evidence of insurability required, meaning no.

Source: drewberryinsurance.co.uk

Source: drewberryinsurance.co.uk

What is a guaranteed insurability option rider? You can use this option in the event of: The specific provisions of the option vary, but normally insurance may be purchased. Speak with your agent for more details. Your guaranteed insurability option also covers divorce and the dissolving of a civil partnership.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title guaranteed insurability option by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.