Your Guaranteed cost insurance images are ready in this website. Guaranteed cost insurance are a topic that is being searched for and liked by netizens now. You can Get the Guaranteed cost insurance files here. Download all free photos and vectors.

If you’re looking for guaranteed cost insurance images information linked to the guaranteed cost insurance interest, you have pay a visit to the right blog. Our website frequently provides you with suggestions for viewing the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Guaranteed Cost Insurance. This important coverage closes the gap between your current policy limit on your home and the actual cost to repair or rebuild. This simply means that you pay a flat fee (or rate) up front for a specific amount of coverage. The typical insurance policy is called “guaranteed cost” coverage. While the prices are relatively similar, the guaranteed issue policy.

Lowest Price Guarantee EnviroGuard Pest Control From enviroguardpestcontrol.co.uk

Lowest Price Guarantee EnviroGuard Pest Control From enviroguardpestcontrol.co.uk

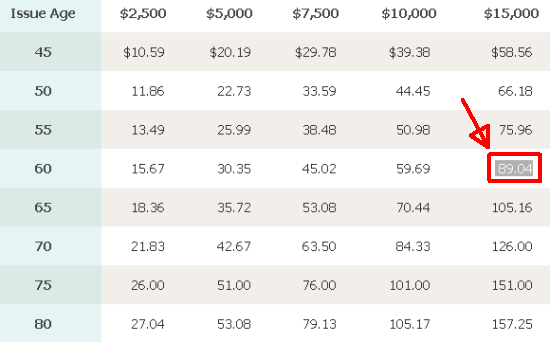

Upgrading your homeowners insurance to include guaranteed replacement cost is simple 1. Clients pay a set premium based on their exposure base for the policy term regardless of the number and amount of losses that occur during this period. This simply means that you pay a flat fee (or rate) up front for a specific amount of coverage. The policy is not adjusted for losses as in a loss sensitive program. Get a guaranteed issue life insurance policy starting with coverages from $5,000 all the way up to $25,000. We capitalize on our underwriters’ technical expertise and provide specialized solutions to middle market contractors.

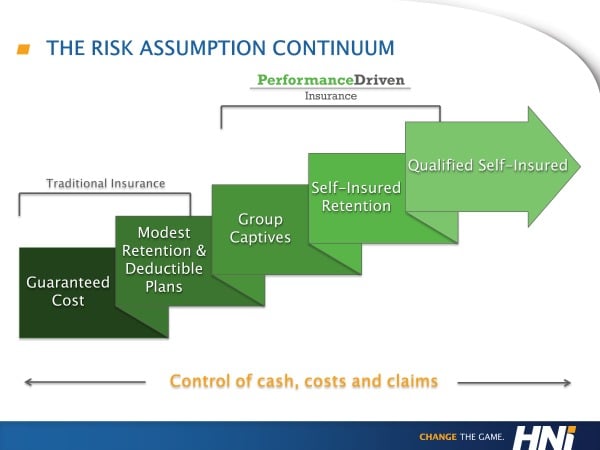

Typically, when a business opens, it’s on a traditional guaranteed cost workers’ compensation program or first dollar $0 deductible program.

Rates start at $20/month for a female and $29/month for a. This means if your staffing company has a claim, your insurance carrier is responsible for paying that claim starting dollar 1. Loss sensitive plans, meanwhile, often make sense for larger businesses with the financial security to handle higher deductibles and frequent or severe claims. In comparison, a guaranteed issue policy for $25,000 costs $919 per year. Rates start at $20/month for a female and $29/month for a. The policy is not adjusted for losses as in a loss sensitive program.

Source: youtube.com

Source: youtube.com

A guaranteed cost premium is a flat fee for insurance coverage that’s not subject to adjustments based on loss experience, or the amount of. After a loss you want to rebuild, like, kind and quality. Municipalities (villages, towns, townships and cities) with populations under 100,000 This contrasts with insurance on a loss sensitive plan, in which the final premium is dependent. A guaranteed cost program means that you will pay a flat fee of sorts for a given policy period.

Source: enviroguardpestcontrol.co.uk

Source: enviroguardpestcontrol.co.uk

Rates start at $20/month for a female and $29/month for a. That means if your house is destroyed by a fire or severe storm, your insurance will pay to rebuild it to the way it was before the disaster — even if the cost is double or triple your. Just contact your local erie agent to make it happen. However, as your business grows, you may want to Qcs insurance program is a guaranteed cost insurance program exclusively for members of qcs purchasing cooperative.

Source: duganinsurance.com

Source: duganinsurance.com

A guaranteed cost program means that you will pay a flat fee of sorts for a given policy period. A rate is agreed on at the inception of the policy and is multiplied by the appropriate exposure base (e.g., sales, payroll, number of vehicles, or square footage) to yield the premium. The typical insurance policy is called “guaranteed cost” coverage. The premium varies only with changes to the exposure bases. This important coverage closes the gap between your current policy limit on your home and the actual cost to repair or rebuild.

Source: aesthetecurator.com

Source: aesthetecurator.com

After a loss you want to rebuild, like, kind and quality. Qcs insurance program is a guaranteed cost insurance program exclusively for members of qcs purchasing cooperative. Rates start at $20/month for a female and $29/month for a. The premium varies only with changes to the exposure bases. This contrasts with insurance on a loss sensitive plan, in which the final premium is dependent.

Source: pinterest.com

Source: pinterest.com

Typically, when a business opens, it’s on a traditional guaranteed cost workers’ compensation program or first dollar $0 deductible program. However, as your business grows, you may want to After a loss you want to rebuild, like, kind and quality. A guaranteed cost program means that you will pay a flat fee of sorts for a given policy period. Loss sensitive plans, meanwhile, often make sense for larger businesses with the financial security to handle higher deductibles and frequent or severe claims.

Source: pinterest.com

Source: pinterest.com

While the prices are relatively similar, the guaranteed issue policy. Loss sensitive plans, meanwhile, often make sense for larger businesses with the financial security to handle higher deductibles and frequent or severe claims. While the prices are relatively similar, the guaranteed issue policy. This important coverage closes the gap between your current policy limit on your home and the actual cost to repair or rebuild. Guaranteed cost insurance — any insurance for which the insured pays a fixed premium (or a fixed rate that is applied to an exposure base) for the policy term, regardless of the number and amount of losses that occur during the policy term.

Source: pinterest.com

Source: pinterest.com

Small businesses can benefit from an insurance program that provides this convenience while minimizing their risk. Upgrading your homeowners insurance to include guaranteed replacement cost is simple 1. Oryx’s construction practice focuses on defined segments of this industry. Clients pay a set premium based on their exposure base for the policy term regardless of the number and amount of losses that occur during this period. The policy is not adjusted for losses as in a loss sensitive program.

Source: cfainsure.com

Source: cfainsure.com

This important coverage closes the gap between your current policy limit on your home and the actual cost to repair or rebuild. Guaranteed replacement cost is a homeowners insurance endorsement that ensures you’ll be paid the full amount to rebuild your home after a disaster, regardless of how much it costs. Upgrading your homeowners insurance to include guaranteed replacement cost is simple 1. Clients pay a set premium based on their exposure base for the policy term regardless of the number and amount of losses that occur during this period. From an insurance program that provides this convenience while minimizing their risk.

Source: dreamstime.com

Source: dreamstime.com

A) standard guaranteed cost plans and b) discounted guaranteed cost plans. Small businesses can benefit from an insurance program that provides this convenience while minimizing their risk. Just contact your local erie agent to make it happen. We capitalize on our underwriters’ technical expertise and provide specialized solutions to middle market contractors. Our commitment is to provide world class underwriting, claims handling and risk management to our customers.

Source: compareinsurancesonline.ca

Source: compareinsurancesonline.ca

A rate is agreed on at the inception of the policy and is multiplied by the appropriate exposure base (e.g., sales, payroll, number of vehicles, or square footage) to yield the premium. This simply means that you pay a flat fee (or rate) up front for a specific amount of coverage. The typical insurance policy is called “guaranteed cost” coverage. Typically, when a business opens, it’s on a traditional guaranteed cost workers’ compensation program or first dollar $0 deductible program. Upgrading your homeowners insurance to include guaranteed replacement cost is simple 1.

Source: esosojazosazules.blogspot.com

Source: esosojazosazules.blogspot.com

However, as your business grows, you may want to This simply means that you pay a flat fee (or rate) up front for a specific amount of coverage. Upgrading your homeowners insurance to include guaranteed replacement cost is simple 1. While the prices are relatively similar, the guaranteed issue policy. From an insurance program that provides this convenience while minimizing their risk.

Source: pinterest.com

Source: pinterest.com

Get a guaranteed issue life insurance policy starting with coverages from $5,000 all the way up to $25,000. Guaranteed acceptance life insurance, also called guaranteed issue or gi life insurance, is typically a whole life insurance policy with a limited death benefit. While the prices are relatively similar, the guaranteed issue policy. Proper coverage will protect you from rising costs that are out of your control. In comparison, a guaranteed issue policy for $25,000 costs $919 per year.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Oryx’s construction practice focuses on defined segments of this industry. Guaranteed cost insurance — any insurance for which the insured pays a fixed premium (or a fixed rate that is applied to an exposure base) for the policy term, regardless of the number and amount of losses that occur during the policy term. Guaranteed cost — premiums charged on a prospective basis without adjustment for loss experience during the policy period. This simply means that you pay a flat fee (or rate) up front for a specific amount of coverage. Our commitment is to provide world class underwriting, claims handling and risk management to our customers.

Source: insurancemaneuvers.com

Source: insurancemaneuvers.com

However, as your business grows, you may want to Oryx’s construction practice focuses on defined segments of this industry. A rate is agreed on at the inception of the policy and is multiplied by the appropriate exposure base (e.g., sales, payroll, number of vehicles, or square footage) to yield the premium. Municipalities (villages, towns, townships and cities) with populations under 100,000 In comparison, a guaranteed issue policy for $25,000 costs $919 per year.

Source: dreamstime.com

Source: dreamstime.com

In comparison, a guaranteed issue policy for $25,000 costs $919 per year. That means if your house is destroyed by a fire or severe storm, your insurance will pay to rebuild it to the way it was before the disaster — even if the cost is double or triple your. Upgrading your homeowners insurance to include guaranteed replacement cost is simple 1. This important coverage closes the gap between your current policy limit on your home and the actual cost to repair or rebuild. Qcs insurance program is a guaranteed cost insurance program exclusively for members of qcs purchasing cooperative.

Source: insurancemaneuvers.com

Source: insurancemaneuvers.com

The policy is not adjusted for losses as in a loss sensitive program. Clients pay a set premium based on their exposure base for the policy term regardless of the number and amount of losses that occur during this period. Guaranteed acceptance life insurance, also called guaranteed issue or gi life insurance, is typically a whole life insurance policy with a limited death benefit. Loss sensitive plans, meanwhile, often make sense for larger businesses with the financial security to handle higher deductibles and frequent or severe claims. This means if your staffing company has a claim, your insurance carrier is responsible for paying that claim starting dollar 1.

Source: dreamstime.com

Source: dreamstime.com

This contrasts with insurance on a loss sensitive plan, in which the final premium is dependent. Guaranteed cost insurance — any insurance for which the insured pays a fixed premium (or a fixed rate that is applied to an exposure base) for the policy term, regardless of the number and amount of losses that occur during the policy term. Our commitment is to provide world class underwriting, claims handling and risk management to our customers. That means if your house is destroyed by a fire or severe storm, your insurance will pay to rebuild it to the way it was before the disaster — even if the cost is double or triple your. After a loss you want to rebuild, like, kind and quality.

Source: stumbleforward.com

Source: stumbleforward.com

This important coverage closes the gap between your current policy limit on your home and the actual cost to repair or rebuild. A guaranteed cost program means that you will pay a flat fee of sorts for a given policy period. The typical insurance policy is called “guaranteed cost” coverage. The premium varies only with changes to the exposure bases. Small businesses can benefit from an insurance program that provides this convenience while minimizing their risk.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title guaranteed cost insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.