Your Group life insurance policies are generally written as images are ready in this website. Group life insurance policies are generally written as are a topic that is being searched for and liked by netizens today. You can Find and Download the Group life insurance policies are generally written as files here. Download all royalty-free vectors.

If you’re looking for group life insurance policies are generally written as images information linked to the group life insurance policies are generally written as interest, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for seeking the highest quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

Group Life Insurance Policies Are Generally Written As. Group life insurance policies are generally written as. Group life insurance is a benefit offered by groups to their members — most commonly by employers to their workers. Establishing group life insurance coverage with. Group life coverage is a sort of life insurance policy wherein only one contract covers a whole gathering of individuals.

Yes, your insurer is obligated to deal with your insurance From richtertriallaw.com

Yes, your insurer is obligated to deal with your insurance From richtertriallaw.com

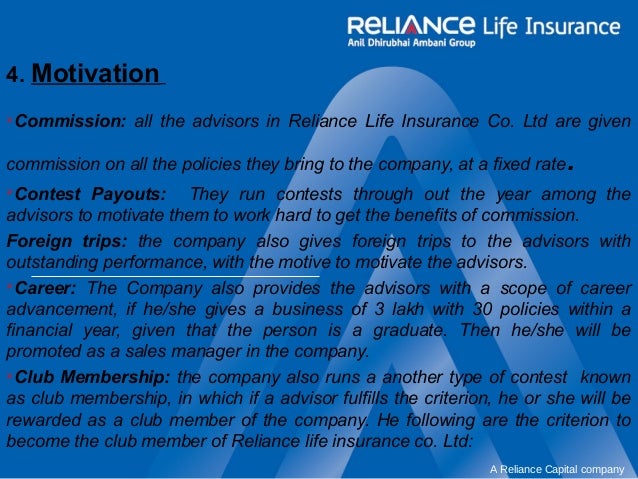

Typically, the policy owner is an employer or an entity such as a labor organization, and the policy covers the employees or members of the group. Generally, your beneficiaries won’t pay taxes on life insurance benefits and you don’t need to pay any taxes on your policy during your lifetime. Life insurance provides protection against life risk. Group life insurance policies are generally written as a. Group life insurance policies are plans that are written under one contract, generally owned by an employer, and provide coverage to a group of employees. Group life insurance policies are generally written as is a tool to reduce your risks.

Normally, the arrangement proprietor is a business or an element, for example, a work association, and the strategy covers the workers or individuals who are a part of the group.group life insurance is frequently given as a component of a total.

Group life insurance policies are generally written as a. Group life insurance is often provided as part of a complete employee benefit package. Life insurance provides protection against life risk. Those looking for lifelong coverage should opt for permanent life insurance. Group life insurance may be part of an employee benefit package. Establishing group life insurance coverage with.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Typically, the policyowner is an employer or other entity such as a union, and the policy covers the employees or members of the group. Group life coverage is a sort of life insurance policy wherein only one contract covers a whole gathering of individuals. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. Group life insurance is a benefit offered by groups to their members — most commonly by employers to their workers. What is group life insurance?

Source: nerdwallet.com

Source: nerdwallet.com

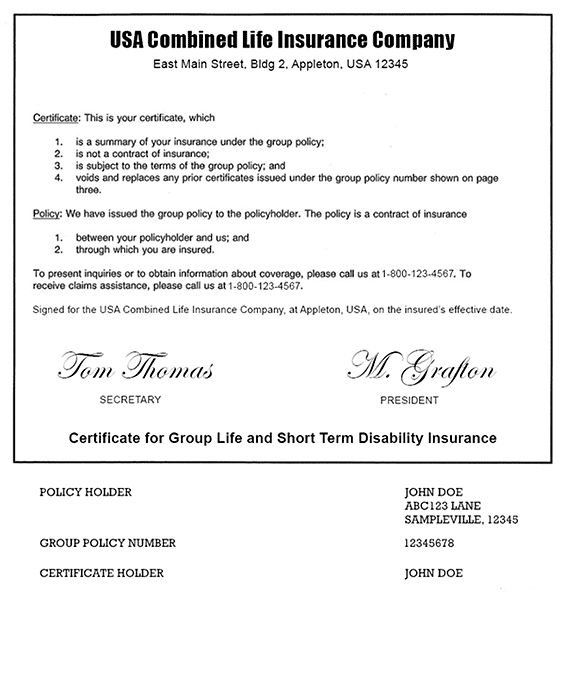

Group life insurance policies are generally written as annually renewable term under a trustee group life policy, who would be eligible for a certificate of coverage? You can legally sell your life insurance policy if you don’t need it. These documents are not a contract. Life insurance provides protection against life risk. Group life insurance policies are plans that are written under one contract, generally owned by an employer, and provide coverage to a group of employees.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

What is group life insurance? Group life insurance policies are generally written as is a tool to reduce your risks. Depending on the contract, other events such as terminal illness or critical illness can. Group life insurance may be part of an employee benefit package. But there are a few exceptions, which mostly apply to policies with a cash value:

Source: lawfirmnewswire.com

Source: lawfirmnewswire.com

Group life insurance policies are generally written as and risk reduction. Group life insurance is a benefit offered by groups to their members — most commonly by employers to their workers. Group life insurance policies are generally written as a term rider annually renewable term increasing term group whole life annual renewable term when an Affordability term life insurance policies are less expensive than other types of life insurance policies and generally have lower premium costs. Group life insurance policies are generally written as.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Group life insurance policies are generally written as a. Selling your own life insurance policy: You can legally sell your life insurance policy if you don’t need it. A group of life insurance. Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policy holder).

Source: richtertriallaw.com

Source: richtertriallaw.com

This booklet and the employee benefits proposal together outline the basic features of your proposed insurance plan. Generally, your beneficiaries won’t pay taxes on life insurance benefits and you don’t need to pay any taxes on your policy during your lifetime. Life insurance provides protection against life risk. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. A person who is insured within a group contract will be given a.

Source: mynextmove.org

Source: mynextmove.org

Group life coverage is a sort of life insurance policy wherein only one contract covers a whole gathering of individuals. You can legally sell your life insurance policy if you don’t need it. Length term life insurance has an expiration date, which can align with a mortgage or when your children graduate college. The second policy holder is then left without cover, and might find it harder to take out a new policy as premiums get higher as you get older. With a group life insurance policy, the insurance contract is between the group and the insurance company, and the participating group members receive certificates of coverage.

Source: indianexpress.com

Source: indianexpress.com

Group life insurance, also called group term life insurance, is one life insurance contract that covers a group of people. Group life insurance policies are generally written as is a tool to reduce your risks. General insurance is a general term used for all the insurance plans that safeguard things other than life, such as your valuables against theft, natural disasters, accidents, etc. Group life insurance is a benefit offered by groups to their members — most commonly by employers to their workers. Traditional life insurance products such as universal life and term life for individuals, and group life, remain an important part of the business, making up the remaining 25 percent of direct premiums written.

Source: economiapersonal.com.ar

Source: economiapersonal.com.ar

Traditional life insurance products such as universal life and term life for individuals, and group life, remain an important part of the business, making up the remaining 25 percent of direct premiums written. Establishing group life insurance coverage with. Typically, the policy owner is an employer or an entity such as a labor organization, and the policy covers the employees or members of the group. Traditional life insurance products such as universal life and term life for individuals, and group life, remain an important part of the business, making up the remaining 25 percent of direct premiums written. Those looking for lifelong coverage should opt for permanent life insurance.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Affordability term life insurance policies are less expensive than other types of life insurance policies and generally have lower premium costs. Life insurance provides protection against life risk. This booklet and the employee benefits proposal together outline the basic features of your proposed insurance plan. Group life insurance policies are plans that are written under one contract, generally owned by an employer, and provide coverage to a group of employees. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Life insurance provides protection against life risk. Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policy holder). What is group life insurance? Depending on the contract, other events such as terminal illness or critical illness can. Typically, the policy owner is an employer or an entity such as a labor organization, and the policy covers the employees or members of the group.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Group life insurance policies are plans that are written under one contract, generally owned by an employer, and provide coverage to a group of employees. A person who is insured within a group contract will be given a. Establishing group life insurance coverage with. Group life insurance may be part of an employee benefit package. Group life insurance policies are generally written as a term rider annually renewable term increasing term group whole life annual renewable term when an

Source: creditmantri.com

Source: creditmantri.com

With a group life insurance policy, the insurance contract is between the group and the insurance company, and the participating group members receive certificates of coverage. A group of life insurance. Group life insurance policies are generally written as a. Affordability term life insurance policies are less expensive than other types of life insurance policies and generally have lower premium costs. Accident and health insurance, which includes distinctive products apart from traditional health insurance, accounts for 27 percent of direct premiums written.

Source: myfrugalbusiness.com

Source: myfrugalbusiness.com

Policy proceeds will be paid if the employee dies during the conversion period. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. A group of life insurance. Group life insurance, also called group term life insurance, is one life insurance contract that covers a group of people. Traditional life insurance products such as universal life and term life for individuals, and group life, remain an important part of the business, making up the remaining 25 percent of direct premiums written.

Source: bankrate.com

Source: bankrate.com

Depending on the contract, other events such as terminal illness or critical illness can. Group life insurance policies are generally written as a. Life insurance provides protection against life risk. Typically, the policy owner is an employer or an entity such as a labor organization, and the policy covers the employees or members of the group. Group life insurance may be part of an employee benefit package.

Source: selllifeinsurancepolicyrusumido.blogspot.com

Source: selllifeinsurancepolicyrusumido.blogspot.com

These documents are not a contract. Group life insurance is a type of life insurance in which a single contract covers an entire group of people. Employers commonly offer it as part of a benefits package: Normally, the arrangement proprietor is a business or an element, for example, a work association, and the strategy covers the workers or individuals who are a part of the group.group life insurance is frequently given as a component of a total. Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policy holder).

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Group life insurance policies are generally written as a. What is group life insurance? Group life insurance is life insurance that is purchased under a single contract covering a group of people. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. Normally, the arrangement proprietor is a business or an element, for example, a work association, and the strategy covers the workers or individuals who are a part of the group.group life insurance is frequently given as a component of a total.

Source: bellblack.com

Source: bellblack.com

Group life insurance policies are generally written as annually renewable term under a trustee group life policy, who would be eligible for a certificate of coverage? Group life insurance is a type of life insurance in which a single contract covers an entire group of people. Establishing group life insurance coverage with. Group life insurance policies are generally written as. Group life insurance policies are generally written as term insurance and offered to employees who meet eligibility requirements, such as being a permanent employee or 30 days after hire.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title group life insurance policies are generally written as by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.