Your Graded life insurance images are available in this site. Graded life insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Graded life insurance files here. Download all free vectors.

If you’re looking for graded life insurance pictures information linked to the graded life insurance interest, you have come to the right site. Our website always provides you with hints for refferencing the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that match your interests.

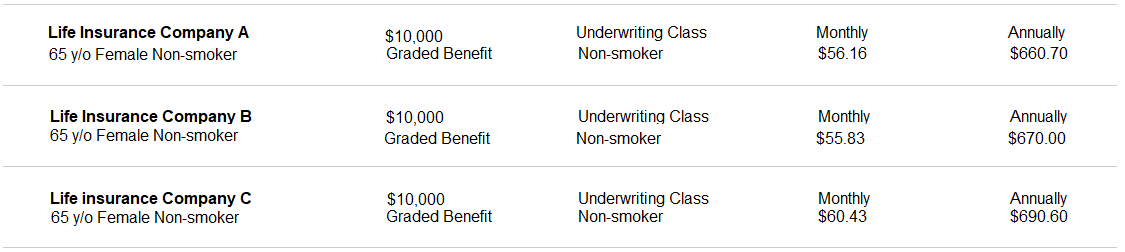

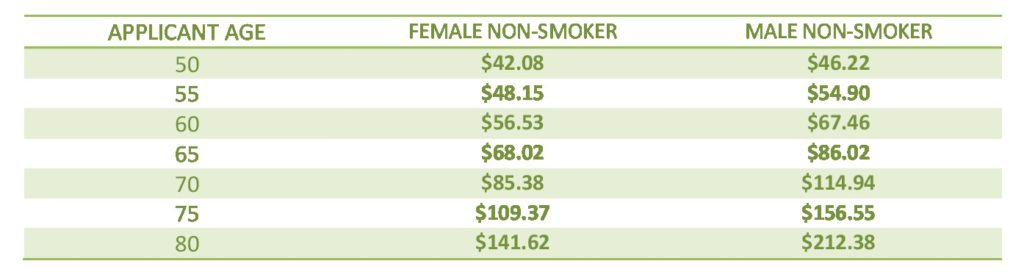

Graded Life Insurance. A graded whole life insurance policy provides an excellent opportunity for people to buy coverage who typically would never be able to qualify for a policy. Our graded benefit whole life insurance provides an easy and affordable way to help your loved ones pay for your end of life expenses. This means that if you have coverage, the death benefit will not pay out in full until that waiting. If the person dies of natural causes within the first two years of the policy, a graded death benefit ranging from 110% to 120% of premiums will be.

Graded Premium Whole Life Insurance PolicyScout From policyscout.com

Graded Premium Whole Life Insurance PolicyScout From policyscout.com

Guaranteed issue whole life insurance is the ideal choice for many people who this death benefit is a “graded benefit,” which means it won’t kick in (31). Our graded benefit whole life insurance provides an easy and affordable way to help your loved ones pay for your end of life expenses. A graded life insurance policy is permanent whole life insurance that is designed for those who can’t qualify for traditional or “regular” life insurance. However, instead of the premium “jumping up” all at once, a graded premium whole life contract “steps up” periodically so that they are higher than those of a straight whole life insurance policy. Since these types of policies typically are sold to older individuals with no underwriting, this type of. In short, a graded death benefit life insurance policy is a type of life insurance that includes a waiting period before the full death benefit is in force.

It may be an option for people who are unable to be approved for standard life insurance.

A graded whole life insurance policy provides an excellent opportunity for people to buy coverage who typically would never be able to qualify for a policy. A graded life insurance policy is permanent whole life insurance that is designed for those who can’t qualify for traditional or “regular” life insurance. A graded life insurance policy is a life insurance policy that starts out with lower premiums and pays out a smaller death benefit than a traditional life insurance policy. If you�ve had cancer, a stroke, a heart attack, or some other health condition and you�ve been. There are 4 basic features you need to. Graded benefit is a term used largely in final expense insurance and guaranteed issue life insurance type policies where the death benefit of the policy is suspended for the first two to three years unless the death is accidental.

Source: policyscout.com

Source: policyscout.com

Graded death benefit years & coverage by life insurance carrier — the definition of the graded death benefit is the waiting period imposed on all (22). This means that if you have coverage, the death benefit will not pay out in full until that waiting. Guaranteed issue whole life insurance is the ideal choice for many people who this death benefit is a “graded benefit,” which means it won’t kick in (31). Only after coverage has been in effect for several years is the death benefit increased to the actual stated face amount. Graded benefit is a term used largely in final expense insurance and guaranteed issue life insurance type policies where the death benefit of the policy is suspended for the first two to three years unless the death is accidental.

Source: petersoninsurance.com

Source: petersoninsurance.com

Most insurance companies quote the policy using units. A graded life insurance policy is a life insurance policy that starts out with lower premiums and pays out a smaller death benefit than a traditional life insurance policy. Graded benefit is a term used largely in final expense insurance and guaranteed issue life insurance type policies where the death benefit of the policy is suspended for the first two to three years unless the death is accidental. There are 4 basic features you need to. A graded life insurance policy is a type of policy that is often misunderstood because there is a waiting period. it is permanent, whole life insurance that is typically for those who have been turned down for coverage before because of health reasons.

Source: choicelifequote.com

Source: choicelifequote.com

What is graded whole life insurance? Only after coverage has been in effect for several years is the death benefit increased to the actual stated face amount. This gives you a timeline to pay the premiums before the full benefits take effect. These policies are a type of no medical exam policy. The idea behind graded policies is that they offer people who are at risk for health problems—but might not be able to afford traditional life insurance premiums—a way to buy some coverage.

Source: easyquotes4you.com

Source: easyquotes4you.com

There is no medical exam required. Keeping this in view, what is a graded benefit life insurance policy? Graded benefit whole life insurance, also known as gbl insurance, is a specialty type of whole life insurance that is usually offered as life insurance policy for people that might have a hard time getting other types of life insurance. What is a graded death benefit life insurance policy? If you should pass on during this time, your heirs will still get some payout.

Source: rheumatoidarthritislifeinsurance.com

Source: rheumatoidarthritislifeinsurance.com

If the person dies of natural causes within the first two years of the policy, a graded death benefit ranging from 110% to 120% of premiums will be. If you should pass on during this time, your heirs will still get some payout. A number of guaranteed issue life insurance contracts contain provisions allowing for a graded benefit during the first several years of coverage. Graded benefit life insurance is best for seniors ages 50 to 70 years old. A graded life insurance policy is a type of policy that is often misunderstood because there is a waiting period. it is permanent, whole life insurance that is typically for those who have been turned down for coverage before because of health reasons.

Source: lifeinsuranceunited.com

Source: lifeinsuranceunited.com

The policy usually pays out limited death benefits during the first few years, and usually requires premiums that are somewhat higher than standard life. — a graded whole life insurance policy is one that pays a lower amount if you die within the first few years after (30). This means that if you have coverage, the death benefit will not pay out in full until that waiting. What is a graded death benefit life insurance policy? The application is very easy and fast.

Source: youtube.com

Source: youtube.com

This means that if you have coverage, the death benefit will not pay out in full until that waiting. Graded benefit is a term used largely in final expense insurance and guaranteed issue life insurance type policies where the death benefit of the policy is suspended for the first two to three years unless the death is accidental. Graded benefit life insurance is best for seniors ages 50 to 70 years old. Some companies may sell to older seniors, but 80 years old is usually the cutoff. Best graded life insurance 🚘 feb 2022.

Source: lifepolicyshopper.com

Source: lifepolicyshopper.com

One may also ask, how does return of premium life. Guaranteed issue whole life insurance is the ideal choice for many people who this death benefit is a “graded benefit,” which means it won’t kick in (31). Graded benefit is a term used largely in final expense insurance and guaranteed issue life insurance type policies where the death benefit of the policy is suspended for the first two to three years unless the death is accidental. There is no medical exam required. If you should pass on during this time, your heirs will still get some payout.

Source: trendsbuzzer.com

Source: trendsbuzzer.com

What is graded whole life insurance? Since these types of policies typically are sold to older individuals with no underwriting, this type of. A graded whole life insurance policy provides an excellent opportunity for people to buy coverage who typically would never be able to qualify for a policy. If you�ve had cancer, a stroke, a heart attack, or some other health condition and you�ve been. Only after coverage has been in effect for several years is the death benefit increased to the actual stated face amount.

![]() Source: easyquotes4you.com

Source: easyquotes4you.com

Since these types of policies typically are sold to older individuals with no underwriting, this type of. A graded death benefit policy is a type of whole life insurance policy with a waiting period. If you should pass on during this time, your heirs will still get some payout. Guaranteed issue whole life insurance is the ideal choice for many people who this death benefit is a “graded benefit,” which means it won’t kick in (31). A graded benefit policy is one that pays a lower amount if death occurs during the first few years after the policy is purchased.

![Graded Death Benefit Life Insurance [Best Rates & Approvals] Graded Death Benefit Life Insurance [Best Rates & Approvals]](https://2dk6h52laytg1me0hx3vdmp8icw-wpengine.netdna-ssl.com/images/2016/12/graded-death-benefit-life-insurance.png) Source: rootfin.com

Source: rootfin.com

Best graded life insurance 🚘 feb 2022. A graded life insurance policy is intended for people in very bad health who can�t qualify for a full benefit policy. Most insurance companies quote the policy using units. A number of guaranteed issue life insurance contracts contain provisions allowing for a graded benefit during the first several years of coverage. Graded benefit whole life insurance, also known as gbl insurance, is a specialty type of whole life insurance that is usually offered as life insurance (21).

Source: youtube.com

Source: youtube.com

A graded life insurance policy is intended for people in very bad health who can�t qualify for a full benefit policy. Only after coverage has been in effect for several years is the death benefit increased to the actual stated face amount. Issuance of the policy will depend on answers to medical questions. People who have been declined for life insurance from all One may also ask, how does return of premium life.

Source: rheumatoidarthritislifeinsurance.com

Source: rheumatoidarthritislifeinsurance.com

There are 4 basic features you need to. The policy usually pays out limited death benefits during the first few years, and usually requires premiums that are somewhat higher than standard life. Keeping this in view, what is a graded benefit life insurance policy? What is graded whole life insurance? A graded life insurance policy is a life insurance policy that starts out with lower premiums and pays out a smaller death benefit than a traditional life insurance policy.

Source: insurethevillage.com

Source: insurethevillage.com

A number of guaranteed issue life insurance contracts contain provisions allowing for a graded benefit during the first several years of coverage. The application is very easy and fast. Only after coverage has been in effect for several years is the death benefit increased to the actual stated face amount. Our graded benefit whole life insurance provides an easy and affordable way to help your loved ones pay for your end of life expenses. Graded benefit whole life insurance, also known as gbl insurance, is a specialty type of whole life insurance that is usually offered as life insurance (21).

Source: ehow.com

Source: ehow.com

If you�ve had cancer, a stroke, a heart attack, or some other health condition and you�ve been. One may also ask, how does return of premium life. Only after coverage has been in effect for several years is the death benefit increased to the actual stated face amount. Our graded benefit whole life insurance provides an easy and affordable way to help your loved ones pay for your end of life expenses. Graded benefit is a term used largely in final expense insurance and guaranteed issue life insurance type policies where the death benefit of the policy is suspended for the first two to three years unless the death is accidental.

Source: premiumlifeinsurance.net

Source: premiumlifeinsurance.net

Most insurance companies quote the policy using units. A graded benefit policy is. What is graded whole life insurance? A graded death benefit policy is a type of whole life insurance policy with a waiting period. A graded life insurance policy is a life insurance policy that starts out with lower premiums and pays out a smaller death benefit than a traditional life insurance policy.

Source: trendsbuzzer.com

Source: trendsbuzzer.com

The idea behind graded policies is that they offer people who are at risk for health problems—but might not be able to afford traditional life insurance premiums—a way to buy some coverage. There are 4 basic features you need to. A graded benefit policy is one that pays a lower amount if death occurs during the first few years after the policy is purchased. These policies are a type of no medical exam policy. This gives you a timeline to pay the premiums before the full benefits take effect.

Source: finance.zacks.com

Source: finance.zacks.com

A graded life insurance policy is a type of policy that is often misunderstood because there is a waiting period. it is permanent, whole life insurance that is typically for those who have been turned down for coverage before because of health reasons. These policies are a type of no medical exam policy. A graded life insurance policy is permanent whole life insurance that is designed for those who can’t qualify for traditional or “regular” life insurance. A graded life insurance policy is a type of policy that is often misunderstood because there is a waiting period. it is permanent, whole life insurance that is typically for those who have been turned down for coverage before because of health reasons. Best graded life insurance 🚘 feb 2022.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title graded life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.