Your Good faith insurance images are ready. Good faith insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Good faith insurance files here. Find and Download all royalty-free photos.

If you’re searching for good faith insurance images information linked to the good faith insurance interest, you have pay a visit to the right blog. Our website frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

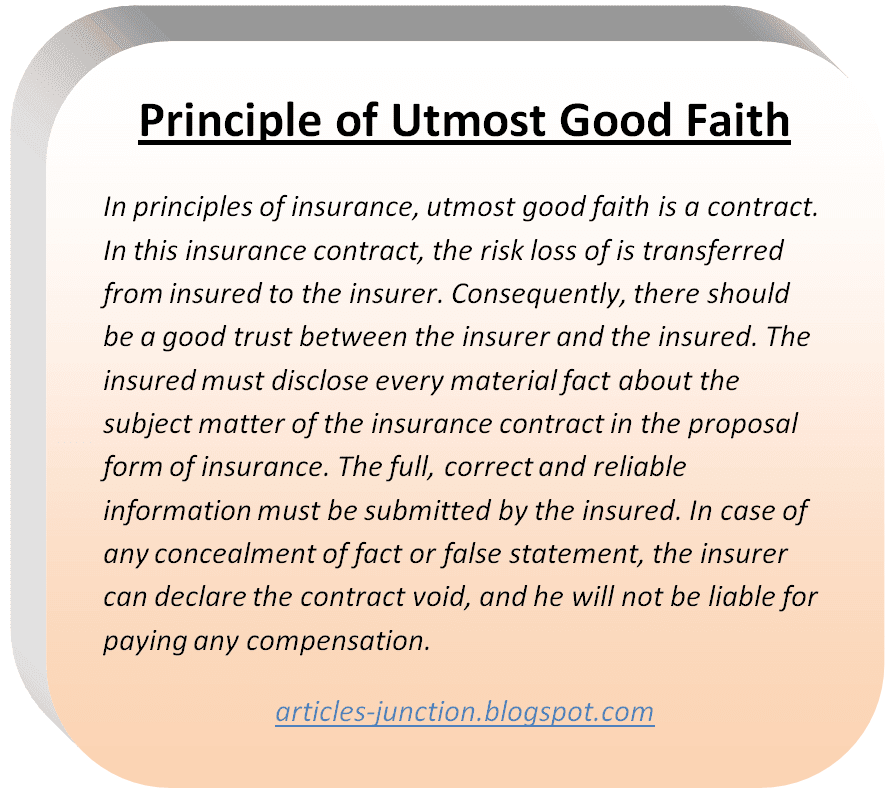

Good Faith Insurance. Good faith claims are claims where the terms are reasonably upheld by the insurer. For the former, it means total disclosure about facts that may affect the purchase of the policy or the need for claims in the future. As in love, good faith is basic to insurance contracts. But the rule is as often broken in insurance contracts as in love.

Real estate closings in Maryland FAQs Federal Title From pinterest.com

Real estate closings in Maryland FAQs Federal Title From pinterest.com

A proposer who purposely hides certain information or misrepresents certain particulars does not act in good faith. Good faith means that the (1). Luckily, it is much easier to find a great rate for insurance now than ever before. Good faith and insurance contracts sets out an exhaustive analysis of the law concerning the duty of utmost good faith, as applied to insurance contracts. Utmost good faith principle is applied to insurance because of all information regarding the insurance must be disclosed in. The insurer also has a right to believe that the insured will act in good faith.

Good faith and insurance contracts sets out an exhaustive analysis of the law concerning the duty of utmost good faith, as applied to insurance contracts.

This focus is based on a recognition that insurers have greater access to relevant sources of information and communications systems. In the context of insurance, as each policy represents a contract between the insurer and insured, both parties must act in good faith. What is utmost good faith in insurance class 11? In the uk, this principle was recently abolished by virtue of the consumer insurance disclosure and representations act (2012) and the insurance act (2015), both acts. The essay’s introduction, body paragraphs and the conclusion are provided below. As in love, good faith is basic to insurance contracts.

Source: iluvamericangirl.blogspot.com

Source: iluvamericangirl.blogspot.com

Goodfaith was founded in 2006 by a group of professionals to provide insurance consultancy and risk management services to all the sectors of the society. The duty of good faith cuts both ways — both insurer and insured have an obligation to act in good faith. The doctrine of utmost good faith is a principle used in insurance contracts, legally obliging all parties to act honestly and not mislead or. It means that both the policyholder and the insurer need to disclose all material and relevant information to each other before commencement of the contract. It means that both the proposer (who wishes to buy the.

Source: reviewmyclaim.co.nz

Source: reviewmyclaim.co.nz

Goodfaith was founded in 2006 by a group of professionals to provide insurance consultancy and risk management services to all the sectors of the society. Good faith means fair and open dealing between parties in a contract. Feb 20, 2019 — the duty of good faith requires an insurance company to treat its policyholders reasonably, fairly and in good faith. The doctrine of utmost good faith is a principle used in insurance contracts, legally obliging all parties to act honestly and not mislead or. Good faith insurance broker is one of the leading insurance broker based in mumbai.

Source: ourtownfla.com

Source: ourtownfla.com

Utmost good faith, uberrimae fedei in latin, refers to the principle of honesty expected from both the insured and the insurer when in the process of transacting a policy. It means that both the policyholder and the insurer need to disclose all material and relevant information to each other before commencement of the contract. In the context of insurance, as each policy represents a contract between the insurer and insured, both parties must act in good faith. A proposer who purposely hides certain information or misrepresents certain particulars does not act in good faith. Utmost good faith (uberrima fides) indicates both the parties to the insurance contract must disclose all facts material to the risk voluntarily to each other.

Source: mylittledream-oficial.blogspot.com

Good faith and insurance contracts sets out an exhaustive analysis of the law concerning the duty of utmost good faith, as applied to insurance contracts. Principle of utmost good faith in insurance. This essay sample essay on utmost good faith offers an extensive list of facts and arguments related to it. Goodfaith was founded in 2006 by a group of professionals to provide insurance consultancy and risk management services to all the sectors of the society. Utmost good faith, uberrimae fedei in latin, refers to the principle of honesty expected from both the insured and the insurer when in the process of transacting a policy.

Source: pinterest.com

Source: pinterest.com

But the rule is as often broken in insurance contracts as in love. Now in its fourth edition, it has been updated to address the arrival of the insurance act 2015,. It requires honesty, sincerity, and integrity among the parties engaging in a contract, regardless of the outcomes of an action. The insurer also has a right to believe that the insured will act in good faith. It is the duty of the insured to disclose all the material facts relating to risk to be covered.

Source: kalyan-city.blogspot.com

Source: kalyan-city.blogspot.com

In the context of insurance, as each policy represents a contract between the insurer and insured, both parties must act in good faith. It requires honesty, sincerity, and integrity among the parties engaging in a contract, regardless of the outcomes of an action. An insurance company’s good faith obligation. An insurance contract requires utmost good faith from both parties in all circumstances. The reference by the law commissions to the insurers� duties to obtain information coincides with a general increased focus on insurers� duties of good faith.

Source: pinterest.com

Source: pinterest.com

An insurance contract requires utmost good faith from both parties in all circumstances. This essay sample essay on utmost good faith offers an extensive list of facts and arguments related to it. The duty of good faith cuts both ways — both insurer and insured have an obligation to act in good faith. Good faith claims are claims where the terms are reasonably upheld by the insurer. It means that both the policyholder and the insurer need to disclose all material and relevant information to each other before commencement of the contract.

Source: carakamulia.com

Source: carakamulia.com

The reference by the law commissions to the insurers� duties to obtain information coincides with a general increased focus on insurers� duties of good faith. Goodfaith was founded in 2006 by a group of professionals to provide insurance consultancy and risk management services to all the sectors of the society. Good faith claims are claims where the terms are reasonably upheld by the insurer. It requires honesty, sincerity, and integrity among the parties engaging in a contract, regardless of the outcomes of an action. As an insurance company, there is an obligation to deal honestly in the underwriting process.

Source: iedunote.com

Source: iedunote.com

We have obtained the license from the ‘insurance regulatory and development authority’ (irda) of india on 20th june 2006, to operate as direct insurance broker for both life and general insurance. Utmost good faith, uberrimae fedei in latin, refers to the principle of honesty expected from both the insured and the insurer when in the process of transacting a policy. In the context of insurance, as each policy represents a contract between the insurer and insured, both parties must act in good faith. Goodfaith was founded in 2006 by a group of professionals to provide insurance consultancy and risk management services to all the sectors of the society. Any breach of this duty shall make the contract voidable at the choice of the aggrieved party.

Source: businessradiox.com

Source: businessradiox.com

Principle of utmost good faith is one of the basic features of an insurance policy. Utmost good faith, uberrimae fedei in latin, refers to the principle of honesty expected from both the insured and the insurer when in the process of transacting a policy. It is commonly known that contracts of insurance are contracts of utmost good faith, requiring the parties to deal with each other fairly and in good faith. Good faith offers several different options for dental coverage through partnering with multiple carriers to. It requires honesty, sincerity, and integrity among the parties engaging in a contract, regardless of the outcomes of an action.

Source: pinterest.com

Source: pinterest.com

Utmost good faith, uberrimae fedei in latin, refers to the principle of honesty expected from both the insured and the insurer when in the process of transacting a policy. A proposer who purposely hides certain information or misrepresents certain particulars does not act in good faith. For the former, it means total disclosure about facts that may affect the purchase of the policy or the need for claims in the future. Neither party must conceal any relevant facts. Health insurance | motor insurance | accidental insurance | motor insurance | trade insurance | home insurance metadata

Source: badfaithinsider.com

Source: badfaithinsider.com

In the context of insurance, as each policy represents a contract between the insurer and insured, both parties must act in good faith. But the rule is as often broken in insurance contracts as in love. Feb 20, 2019 — the duty of good faith requires an insurance company to treat its policyholders reasonably, fairly and in good faith. A proposer who purposely hides certain information or misrepresents certain particulars does not act in good faith. And everything you need to know.

Source: youtube.com

Source: youtube.com

The duty of good faith cuts both ways — both insurer and insured have an obligation to act in good faith. In the uk, this principle was recently abolished by virtue of the consumer insurance disclosure and representations act (2012) and the insurance act (2015), both acts. It means that both the policyholder and the insurer need to disclose all material and relevant information to each other before commencement of the contract. Feb 20, 2019 — the duty of good faith requires an insurance company to treat its policyholders reasonably, fairly and in good faith. Insurers� duties of good faith.

Source: researchgate.net

Source: researchgate.net

Good faith means that the (1). (1) any rule of law permitting a party to a contract of insurance to avoid the contract on the ground that the utmost good faith has. It is the duty of the insured to disclose all the material facts relating to risk to be covered. Goodfaith was founded in 2006 by a group of professionals to provide insurance consultancy and risk management services to all the sectors of the society. In the context of insurance, as each policy represents a contract between the insurer and insured, both parties must act in good faith.

Source: goodfaithinsure.com

Source: goodfaithinsure.com

This essay sample essay on utmost good faith offers an extensive list of facts and arguments related to it. An insurance contract requires utmost good faith from both parties in all circumstances. The principle or the doctrine of utmost good faith (uberrima fides) in relation to this principle, both the parties to the parties to the contract must disclose all facts material to the risk voluntarily to each other. Utmost good faith (uberrima fides) indicates both the parties to the insurance contract must disclose all facts material to the risk voluntarily to each other. As an insurance company, there is an obligation to deal honestly in the underwriting process.

Source: happyjamin.com

Source: happyjamin.com

It is commonly known that contracts of insurance are contracts of utmost good faith, requiring the parties to deal with each other fairly and in good faith. As an insurance company, there is an obligation to deal honestly in the underwriting process. Welcome to good faith agency. In the context of insurance, as each policy represents a contract between the insurer and insured, both parties must act in good faith. Neither party must conceal any relevant facts.

Source: iluvamericangirl.blogspot.com

Source: iluvamericangirl.blogspot.com

Utmost good faith (uberrima fides) indicates both the parties to the insurance contract must disclose all facts material to the risk voluntarily to each other. It means that both the policyholder and the insurer need to disclose all material and relevant information to each other before commencement of the contract. We have obtained the license from the ‘insurance regulatory and development authority’ (irda) of india on 20th june 2006, to operate as direct insurance broker for both life and general insurance. It means that both the proposer (who wishes to buy the. It requires honesty, sincerity, and integrity among the parties engaging in a contract, regardless of the outcomes of an action.

Source: walmart.com

Source: walmart.com

For the former, it means total disclosure about facts that may affect the purchase of the policy or the need for claims in the future. Good faith means that the (1). Because of this, it is important that you find the best possible rate for your auto and homeowners insurance policy. The principle or the doctrine of utmost good faith (uberrima fides) in relation to this principle, both the parties to the parties to the contract must disclose all facts material to the risk voluntarily to each other. Utmost good faith, uberrimae fedei in latin, refers to the principle of honesty expected from both the insured and the insurer when in the process of transacting a policy.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title good faith insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.