Your Get auto insurance score images are available in this site. Get auto insurance score are a topic that is being searched for and liked by netizens today. You can Download the Get auto insurance score files here. Download all royalty-free images.

If you’re searching for get auto insurance score images information related to the get auto insurance score interest, you have come to the right site. Our website frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

Get Auto Insurance Score. An insurance score is a score calculated from information on your credit report. Still, approximately 95% of auto insurers use an insurance credit score to determine car insurance rates, according to fico, so depending on where you live, you might have no choice. Each insurer has its own method for evaluating this credit information. Depending on the company that is issuing the insurance score, an insurance score range can go as low as 200 and as high as 997.

Get Auto Insurance Score Bad Driving History Car From eliteass.blogspot.com

Get Auto Insurance Score Bad Driving History Car From eliteass.blogspot.com

Typical insurance scores range from 200 to 997; Why are insurance scores important? What is a good fico® auto score? The higher your insurance score, the better an insurer will rate your level of risk in states where insurance scores are a rating factor. Credit information is very predictive of future accidents or insurance claims, which is why progressive, and most insurers, uses this information to help develop more accurate rates. Insurance companies may wish to use individuals’ credit scores when calculating auto rates because it can be an indicator of their likelihood to make a claim.

Temporary car insurance policies usually last between 1 day and 1 month.

For many people, the long list of factors influencing auto insurance rates is a mystery. Credit information can be very predictive of future accidents and claims which is why. Full coverage car insurance quotes by state below you can find some average auto insurance quotes for full coverage in every state in usa. If you have a score of 500 or less, you’re going to pay higher insurance rates. Why are insurance scores important? It’s mostly calculated from your claims history and your credit score, so it’s also referred to as a “credit insurance score.”.

Source: pinterest.com

Source: pinterest.com

If you have an insurance score of 770 or more, you’re considered to have a good insurance score, and so you’ll get lower rates. Credit information is very predictive of future accidents or insurance claims, which is why progressive, and most insurers, uses this information to help develop more accurate rates. The best ways to lower your car insurance premiums are to compare prices among insurers, take advantage of all the discounts you can, and adjust your coverage to fit your budget. Each insurer has its own method for evaluating this credit information. While having a higher score can lower the.

Source: eliteass.blogspot.com

Source: eliteass.blogspot.com

When you apply for insurance, your agent will send your data to their underwriters. Credit scores typically range between 300 and 900. According to progressive, insurance scores range from 200. The higher your insurance score, the better an insurer will rate your level of risk in states where insurance scores are a rating factor. An insurance score is a score calculated from information on your credit report.

Source: tipstico.com

Source: tipstico.com

Drivers can save an average of 64% by switching from full coverage to minimum coverage, for example. According to progressive, insurance scores range from 200. What is a good fico® auto score? Each insurer and rating agency calculates auto insurance scores differently, so you won�t have the same score at every company. Still, approximately 95% of auto insurers use an insurance credit score to determine car insurance rates, according to fico, so depending on where you live, you might have no choice.

Source: in.pinterest.com

Source: in.pinterest.com

Drivers who file fewer claims cost insurance companies less money and represent a lower insurance risk, so insurance companies use available data to determine which candidates have the. According to progressive, insurance scores range from 200. When you apply for insurance, your agent will send your data to their underwriters. Get the best car insurance with bad credit by knowing what to expect when shopping and how to find cheap insurance in your state. Typical insurance scores range from 200 to 997;

Source: valchoice.com

Source: valchoice.com

Temporary car insurance policies (and being a named driver) won�t affect your credit score. Even more than your driving record, studies have shown that drivers with the worst insurance scores are twice as likely to have an insurance claim as those with the best scores. Full coverage car insurance quotes by state below you can find some average auto insurance quotes for full coverage in every state in usa. Depending on the company that is issuing the insurance score, an insurance score range can go as low as 200 and as high as 997. If you have an excellent credit score you will receive cheaper car insurance quotes compared to the quotes a driver with bad credit score would get.

Source: ratingwalls.blogspot.com

Source: ratingwalls.blogspot.com

Temporary car insurance policies usually last between 1 day and 1 month. And if your insurance score goes down because of a late credit payment or a new loan on a car, the added points from your loyalty to say can help buffer the impact on your rate. Still, approximately 95% of auto insurers use an insurance credit score to determine car insurance rates, according to fico, so depending on where you live, you might have no choice. Depending on the company that is issuing the insurance score, an insurance score range can go as low as 200 and as high as 997. Car insurance rates are personalized for every individual based on a variety of factors that indicate how risky the driver is to insure.

Source: bankrate.com

Source: bankrate.com

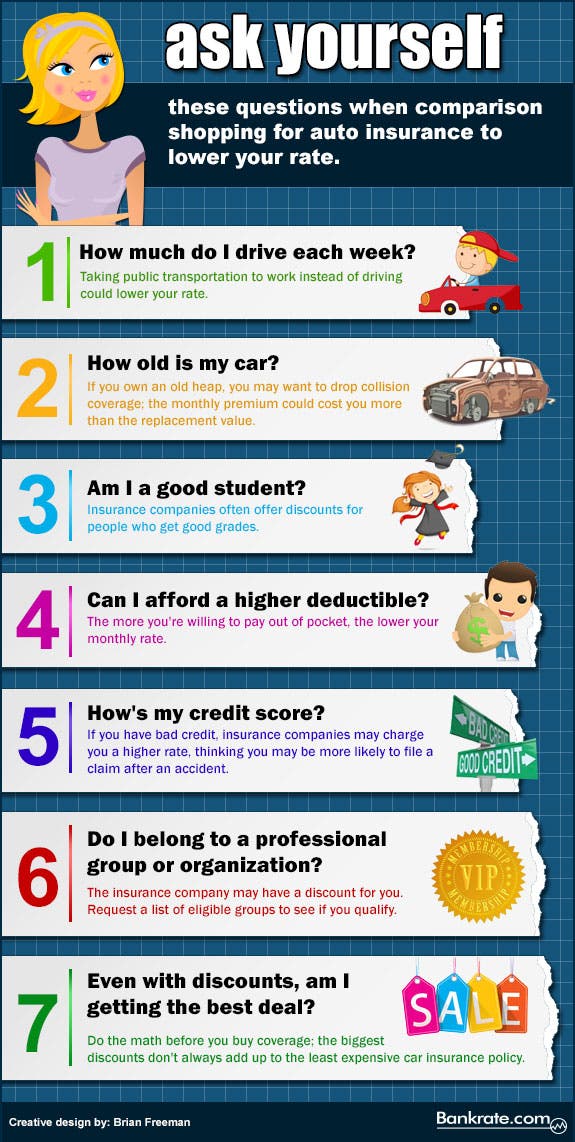

Your auto insurance scores might be directly affecting your insurance rate, though you may not even know they exist. They will also assess the many other factors at play to assign your risk level. The higher the score, the better your credit rating is. What is a good fico® auto score? 8 tips to help lower your car insurance costs.

Source: eliteass.blogspot.com

Source: eliteass.blogspot.com

When it comes to high scores versus low scores,. That way a devoted say customer with an average insurance score can get a rate just as good as a say newbie with an excellent score. The problem with using credit scores to determine a driver’s auto risk. An insurance score is a score calculated from information on your credit report. Temporary car insurance policies usually last between 1 day and 1 month.

Source: livegeneralnews.com

Source: livegeneralnews.com

That way a devoted say customer with an average insurance score can get a rate just as good as a say newbie with an excellent score. What is a good fico® auto score? That way a devoted say customer with an average insurance score can get a rate just as good as a say newbie with an excellent score. Drivers who file fewer claims cost insurance companies less money and represent a lower insurance risk, so insurance companies use available data to determine which candidates have the. If you have a score of 500 or less, you’re going to pay higher insurance rates.

Source: mylifewithcoffeestains.blogspot.com

Source: mylifewithcoffeestains.blogspot.com

When it comes to high scores versus low scores,. Even more than your driving record, studies have shown that drivers with the worst insurance scores are twice as likely to have an insurance claim as those with the best scores. Car insurance rates are personalized for every individual based on a variety of factors that indicate how risky the driver is to insure. Drivers who file fewer claims cost insurance companies less money and represent a lower insurance risk, so insurance companies use available data to determine which candidates have the. Credit scores typically range between 300 and 900.

Source: pinterest.com

Source: pinterest.com

The best ways to lower your car insurance premiums are to compare prices among insurers, take advantage of all the discounts you can, and adjust your coverage to fit your budget. Depending on the company that is issuing the insurance score, an insurance score range can go as low as 200 and as high as 997. When you apply for insurance, your agent will send your data to their underwriters. You probably realize that things like where you live, accidents and your prior claim history can affect your rates. Each insurer has its own method for evaluating this credit information.

Car insurance rates are personalized for every individual based on a variety of factors that indicate how risky the driver is to insure. The best ways to lower your car insurance premiums are to compare prices among insurers, take advantage of all the discounts you can, and adjust your coverage to fit your budget. And if your insurance score goes down because of a late credit payment or a new loan on a car, the added points from your loyalty to say can help buffer the impact on your rate. Drivers who file fewer claims cost insurance companies less money and represent a lower insurance risk, so insurance companies use available data to determine which candidates have the. Credit information can be very predictive of future accidents and claims which is why.

Source: pinterest.com

Source: pinterest.com

The higher the score, the better your credit rating is. If you have an excellent credit score you will receive cheaper car insurance quotes compared to the quotes a driver with bad credit score would get. Each insurer and rating agency calculates auto insurance scores differently, so you won�t have the same score at every company. An auto insurance score is a rating that insurance companies use to evaluate your risk. Each insurer has its own method for evaluating this credit information.

Auto insurance scores rely on the same information as traditional credit scores, but they reflect your risk of filing an insurance claim in the future. How good or bad your credit is factors into your insurance score. Still, approximately 95% of auto insurers use an insurance credit score to determine car insurance rates, according to fico, so depending on where you live, you might have no choice. The scoring system for auto insurance was established as a way to try and predict the likeliness of filing an insurance claim. The problem with using credit scores to determine a driver’s auto risk.

Source: dhhi.com

Source: dhhi.com

The best ways to lower your car insurance premiums are to compare prices among insurers, take advantage of all the discounts you can, and adjust your coverage to fit your budget. An auto insurance score is a rating that insurance companies use to evaluate your risk. Car insurance rates are typically set using a driver�s credit score to help determine their monthly premium. Credit scores typically range between 300 and 900. Drivers who file fewer claims cost insurance companies less money and represent a lower insurance risk, so insurance companies use available data to determine which candidates have the.

Credit information is very predictive of future accidents or insurance claims, which is why progressive, and most insurers, uses this information to help develop more accurate rates. When it comes to high scores versus low scores,. A numerical score is assigned to every driver based in part on their credit reports, and predicts how likely the driver is to have a claim. Full coverage car insurance quotes by state below you can find some average auto insurance quotes for full coverage in every state in usa. An insurance score is a way for insurers to calculate risk.

![Car Insurance for Bad Credit [Updated 2020] No Credit Car Insurance for Bad Credit [Updated 2020] No Credit](http://blog.insurify.com/wp-content/uploads/2019/03/CreditScore.jpg) Source: insurify.com

Source: insurify.com

If you have an excellent credit score you will receive cheaper car insurance quotes compared to the quotes a driver with bad credit score would get. Full coverage car insurance quotes by state below you can find some average auto insurance quotes for full coverage in every state in usa. Credit information can be very predictive of future accidents and claims which is why. Credit scores typically range between 300 and 900. What is a good fico® auto score?

Source: insurancenoon.com

Source: insurancenoon.com

Drivers who file fewer claims cost insurance companies less money and represent a lower insurance risk, so insurance companies use available data to determine which candidates have the. The higher the score, the better your credit rating is. The problem with using credit scores to determine a driver’s auto risk. Insurance companies may wish to use individuals’ credit scores when calculating auto rates because it can be an indicator of their likelihood to make a claim. The higher your insurance score, the better an insurer will rate your level of risk in states where insurance scores are a rating factor.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title get auto insurance score by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.