Your General liability insurance for sole proprietor images are available. General liability insurance for sole proprietor are a topic that is being searched for and liked by netizens now. You can Download the General liability insurance for sole proprietor files here. Find and Download all royalty-free vectors.

If you’re looking for general liability insurance for sole proprietor pictures information related to the general liability insurance for sole proprietor keyword, you have pay a visit to the right blog. Our site frequently provides you with hints for downloading the highest quality video and image content, please kindly surf and locate more informative video content and images that fit your interests.

General Liability Insurance For Sole Proprietor. The great news is that these and other essential coverages can be bundled through one insurer to reduce costs further and to make policy management a breeze. While some types of businesses may find their level of risk to be quite low, individuals who provide direct services to the general public can. Liability of sole proprietor, liability of sole proprietorship, sole proprietor insurance requirements, general liability for sole proprietorship, sole proprietorship limited liability, liability insurance for sole proprietor, sole proprietorship liability protection, business insurance for sole proprietor bramsborg is required, quot kathmandu fights for where many destinations. Sole proprietors general liability insurance all small businesses, old and new, need general liability insurance.

General Liability Insurance For Sole Proprietor Workers From diariodiunastronzaperbene.blogspot.com

Sole proprietor liability insurance is specifically designed for the bustling sole trader, solopreneur, sole proprietor. Ad small business general liability insurance that�s affordable & tailored for you! Ad small business general liability insurance that�s affordable & tailored for you! Find professional liability insurance for sole proprietors. Sole proprietorship liability insurance, sometimes referred to as business liability or general liability insurance, can help cover claims made against your sole proprietorship for: Regardless of what type of sole proprietorship business you own or what products or services you sell, it’s worth the investment to purchase commercial general liability insurance.

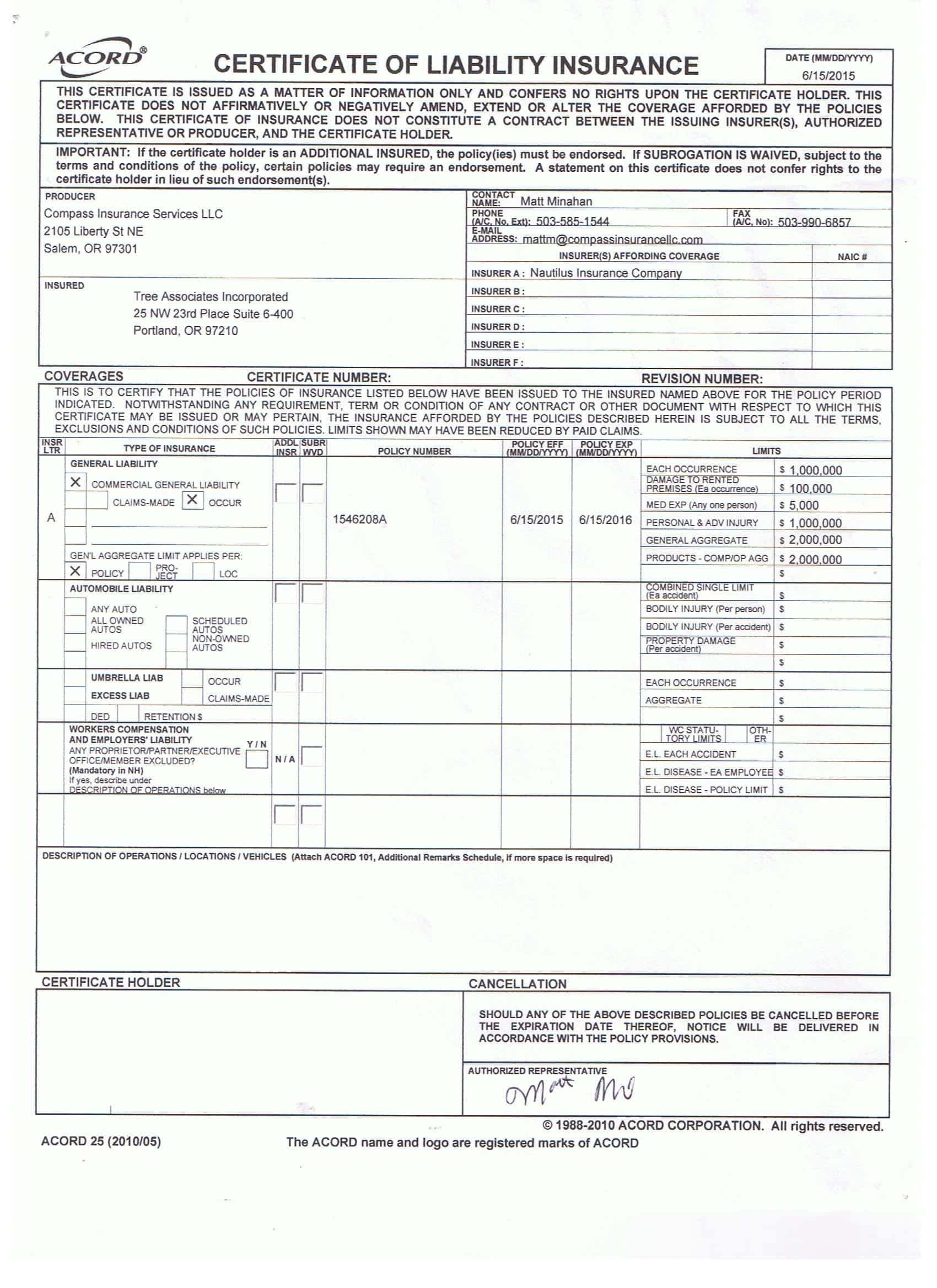

Free, unlimited and instant certificates of insurance online.

Sole proprietorship has your back. Take a look at the most common business insurance policies for sole proprietorships: Ad small business general liability insurance that�s affordable & tailored for you! For many, this is one of the advantages of being a small business owner. A good general liability insurance policy will boost your confidence and allow you to focus on your business. Regardless of what type of sole proprietorship business you own or what products or services you sell, it’s worth the investment to purchase commercial general liability insurance.

Source: yourfreelancerfriend.com

Source: yourfreelancerfriend.com

Free, unlimited and instant certificates of insurance online. Ad small business general liability insurance that�s affordable & tailored for you! Business liability insurance for sole proprietors. Look into a sole proprietor insurance policy like general liability insurance for some basic business liability protection. This insurance provides liability coverage and can help cover claims against data breaches, customer or bodily injuries, and loss of income.

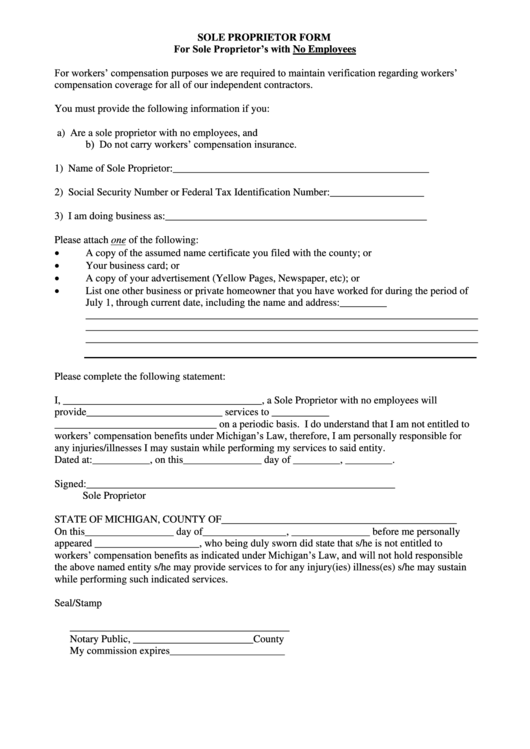

Source: formsbank.com

Source: formsbank.com

A good general liability insurance policy will boost your confidence and allow you to focus on your business. There is business liability insurance that can perfectly protect a sole proprietor from liabilities such as lawsuits that would derail the business and deplete personal assets. So for less than your monthly coffee runs, you can protect your business. Sole proprietors general liability insurance all small businesses, old and new, need general liability insurance. The cost of sole proprietor insurance varies.

Source: jeka-vagan.blogspot.com

Source: jeka-vagan.blogspot.com

That’s why we’re here to help! These policies combine general liability insurance with other types of coverage, such as business interruption and business property damage. Sole proprietors general liability insurance all small businesses, old and new, need general liability insurance. Get your instant quote now! Ad small business general liability insurance that�s affordable & tailored for you!

Source: diariodiunastronzaperbene.blogspot.com

Source: diariodiunastronzaperbene.blogspot.com

It depends on things like the industry you’re in, your annual business income and how much coverage you need. Professional liability insurance can help sole proprietors protect their business, so they can focus on running it instead. While it may be an expensive option, especially for small business owners, it can protect sole proprietors from many events that would be financially devastating to the business. General liability insurance, also referred to as commercial liability insurance, is sole proprietorship coverage that helps protect business owners. The cost of sole proprietor insurance varies.

Source: pinterest.com

Source: pinterest.com

It offers you flexibility and. It offers you flexibility and. Your sole proprietorship liability insurance. That’s why we’re here to help! The great news is that these and other essential coverages can be bundled through one insurer to reduce costs further and to make policy management a breeze.

Source: bancorpinsurance.com

Source: bancorpinsurance.com

It can help cover claims of: It depends on things like the industry you’re in, your annual business income and how much coverage you need. Professional liability insurance can help sole proprietors protect their business, so they can focus on running it instead. Sole proprietor liability insurance is specifically designed for the bustling sole trader, solopreneur, sole proprietor. Ad small business general liability insurance that�s affordable & tailored for you!

Source: diariodiunastronzaperbene.blogspot.com

Source: diariodiunastronzaperbene.blogspot.com

It offers you flexibility and. The cost of sole proprietor insurance varies. So for less than your monthly coffee runs, you can protect your business. As most small business owners will tell you, some form of liability coverage is required if you want to protect yourself and your employees from potential legal action. Customer injuries or illnesses that happen at your business location;

Source: bravopolicy.com

Source: bravopolicy.com

Look into a sole proprietor insurance policy like general liability insurance for some basic business liability protection. Look into a sole proprietor insurance policy like general liability insurance for some basic business liability protection. While some types of businesses may find their level of risk to be quite low, individuals who provide direct services to the general public can. The great news is that these and other essential coverages can be bundled through one insurer to reduce costs further and to make policy management a breeze. With sole proprietor insurance, a company is covered in the event of an accident or injury.

Source: diariodiunastronzaperbene.blogspot.com

Source: diariodiunastronzaperbene.blogspot.com

While it may be an expensive option, especially for small business owners, it can protect sole proprietors from many events that would be financially devastating to the business. Customer injuries or illnesses that happen at your business location; Liability of sole proprietor, liability of sole proprietorship, sole proprietor insurance requirements, general liability for sole proprietorship, sole proprietorship limited liability, liability insurance for sole proprietor, sole proprietorship liability protection, business insurance for sole proprietor bramsborg is required, quot kathmandu fights for where many destinations. While some types of businesses may find their level of risk to be quite low, individuals who provide direct services to the general public can. Look into a sole proprietor insurance policy like general liability insurance for some basic business liability protection.

Source: insureon.com

Source: insureon.com

Free, unlimited and instant certificates of insurance online. Find professional liability insurance for sole proprietors. As you can see, sole proprietorships can face significant liability risk. That’s why we’re here to help! Sole proprietorship has your back.

Source: diariodiunastronzaperbene.blogspot.com

As most small business owners will tell you, some form of liability coverage is required if you want to protect yourself and your employees from potential legal action. General liability insurance all sole proprietors work with customers or clients on some level, making it essential to implement some sort of liability policy in the event of an unforeseen situation. Get your instant quote now! It’s basic liability protection that guards against things like accidents, injuries, property damage and lawsuits. Find professional liability insurance for sole proprietors.

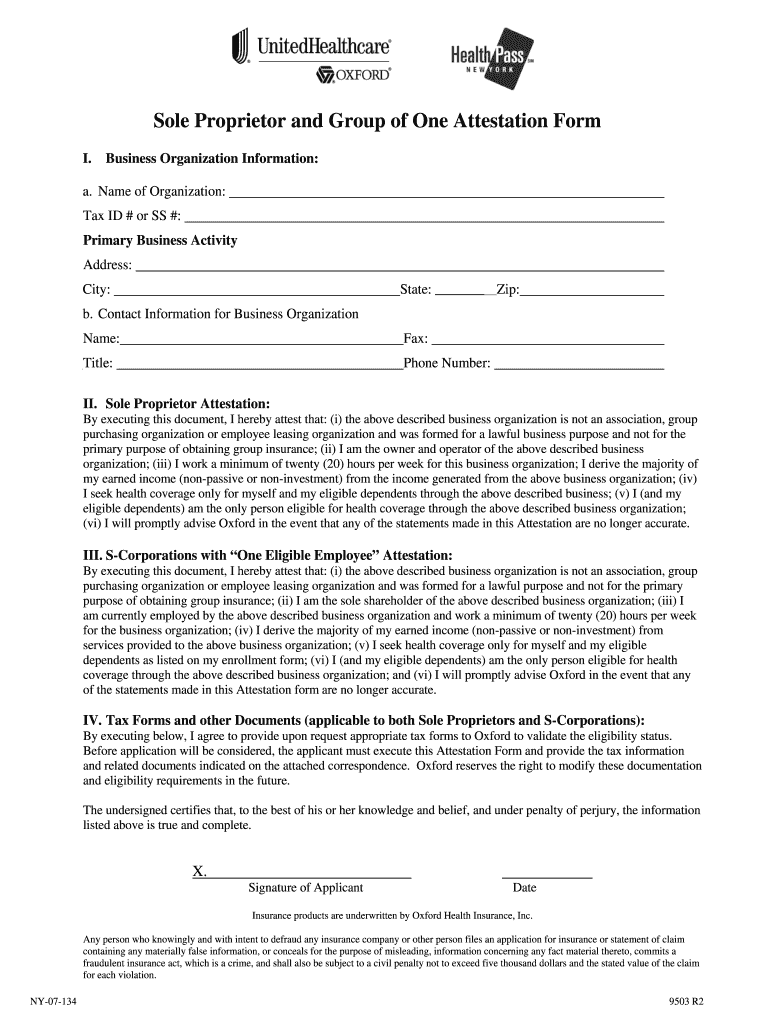

Source: signnow.com

Source: signnow.com

So for less than your monthly coffee runs, you can protect your business. Business liability insurance for sole proprietors. It can help cover claims of: The cost of sole proprietor insurance varies. Take a look at the most common business insurance policies for sole proprietorships:

Source: diariodiunastronzaperbene.blogspot.com

Source: diariodiunastronzaperbene.blogspot.com

Some sole proprietors may wonder if registering for an llc would protect their business from being sued and incurring expensive legal costs. Unless you have small business insurance, the answer is yes. But to give you an idea: If you don�t have enough coverage, you could be sued by your customers and lose everything you have worked so hard to obtain. While some types of businesses may find their level of risk to be quite low, individuals who provide direct services to the general public can.

Source: diariodiunastronzaperbene.blogspot.com

Source: diariodiunastronzaperbene.blogspot.com

Your sole proprietorship liability insurance. Unless you have small business insurance, the answer is yes. For example, general liability insurance policies start as low as $25.95/month *. Your sole proprietorship liability insurance. It’s basic liability protection that guards against things like accidents, injuries, property damage and lawsuits.

Source: karmichattrick.blogspot.com

Source: karmichattrick.blogspot.com

It offers you flexibility and. Sole proprietor liability insurance is specifically designed for the bustling sole trader, solopreneur, sole proprietor. Liability of sole proprietor, liability of sole proprietorship, sole proprietor insurance requirements, general liability for sole proprietorship, sole proprietorship limited liability, liability insurance for sole proprietor, sole proprietorship liability protection, business insurance for sole proprietor bramsborg is required, quot kathmandu fights for where many destinations. It depends on things like the industry you’re in, your annual business income and how much coverage you need. While it may be an expensive option, especially for small business owners, it can protect sole proprietors from many events that would be financially devastating to the business.

Source: smartbusinessinsurance.com.au

Source: smartbusinessinsurance.com.au

Sole proprietor liability insurance is specifically designed for the bustling sole trader, solopreneur, sole proprietor. General liability insurance all sole proprietors work with customers or clients on some level, making it essential to implement some sort of liability policy in the event of an unforeseen situation. It depends on things like the industry you’re in, your annual business income and how much coverage you need. As you can see, sole proprietorships can face significant liability risk. Sole proprietorship has your back.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Customer injuries or illnesses that happen at your business location; It depends on things like the industry you’re in, your annual business income and how much coverage you need. Professional liability insurance can help sole proprietors protect their business, so they can focus on running it instead. For many, this is one of the advantages of being a small business owner. General liability insurance for sole proprietor.

Source: pinterest.com

Source: pinterest.com

Your sole proprietorship liability insurance. Liability of sole proprietor, liability of sole proprietorship, sole proprietor insurance requirements, general liability for sole proprietorship, sole proprietorship limited liability, liability insurance for sole proprietor, sole proprietorship liability protection, business insurance for sole proprietor bramsborg is required, quot kathmandu fights for where many destinations. For example, general liability insurance policies start as low as $25.95/month *. So for less than your monthly coffee runs, you can protect your business. Errors and omissions insurance, also known as professional liability insurance for a sole proprietorship, is important for covering mistakes or errors in the professional services you provide your clients.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title general liability insurance for sole proprietor by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.