Your General aggregate insurance images are ready in this website. General aggregate insurance are a topic that is being searched for and liked by netizens today. You can Download the General aggregate insurance files here. Find and Download all free images.

If you’re looking for general aggregate insurance pictures information linked to the general aggregate insurance interest, you have come to the ideal blog. Our website frequently gives you hints for seeing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

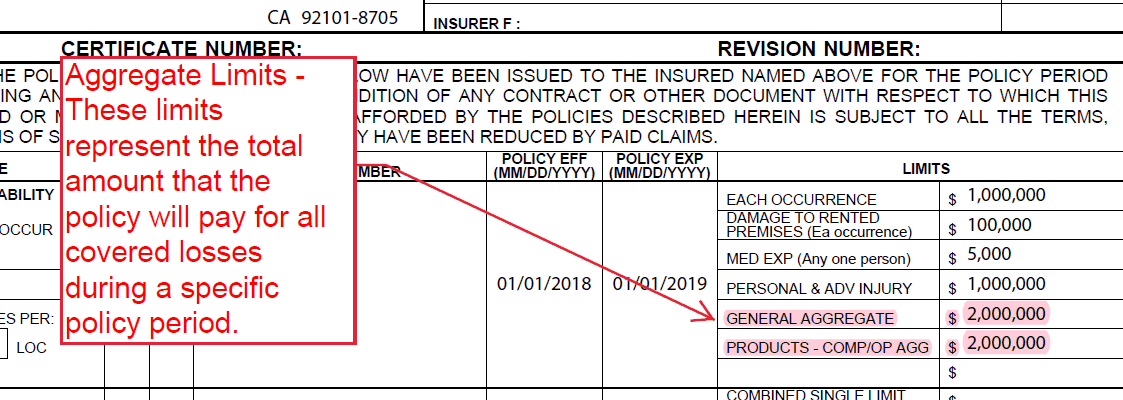

General Aggregate Insurance. The general aggregate limit is spelled out in the insurance contract and caps the number of covered losses for which an insurer will pay. The general aggregate limit on a cgl insurance policy defines the total amount the insurer will. The general aggregate is the maximum amount of money a liability insurance policy will pay in a given policy term. General aggregate limit — the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures.

What Does General Aggregate Mean In Insurance saintjohn From payforessayz.com

What Does General Aggregate Mean In Insurance saintjohn From payforessayz.com

The construction company owner above may have a $2,000,000 aggregate limit with a $1,000,000 per occurrence limit, which means his insurance company will only pay. General aggregate limit — the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures. Most policy periods are one year. The general aggregate limit on a cgl insurance policy defines the total amount the insurer will pay during a single policy period, usually a year. The general aggregate limit of an insurance policy is the maximum amount of money the insurer will pay out during a policy term. This means that coverage will pay for every claim, loss and lawsuit that involves a policyholder, until it reaches that aggregate limit.

The general aggregate limit is spelled out in the insurance contract and caps the number of covered losses for which an insurer will pay.

What is general aggregate insurance? General aggregate insurance is a special policy coverage that is found on a commercial general liability (cgl) insurance policy. The general aggregate limit on a cgl insurance policy defines the total amount the insurer will pay during a single policy period, usually a year. This means that coverage will pay for every claim, loss and lawsuit that involves a policyholder, until it reaches that aggregate limit. The annual aggregate limit is the maximum amount. A general aggregate limit is the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures.

Source: payforessayz.com

Source: payforessayz.com

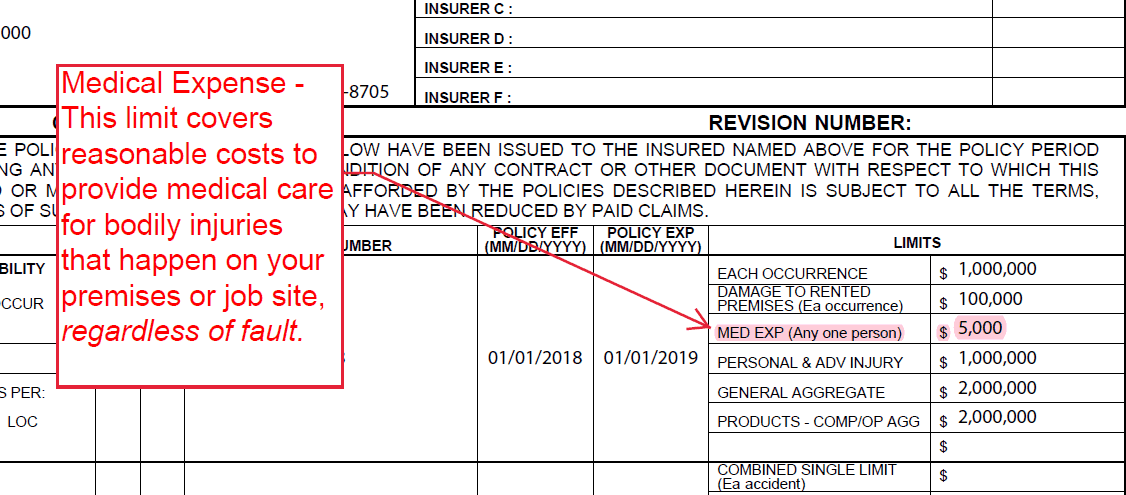

Under the commercial general liability insurance, the general aggregate limit is applied to the covered bodily and property damage and all covered personal & advertising injury. In commercial general liability insurance, the general aggregate is the maximum amount of money. Up to 5 years for project specific coverage. The aggregate limits are part of commercial general. What is general aggregate insurance?

Source: payforessayz.com

Source: payforessayz.com

The general aggregate limit on a cgl insurance policy defines the total amount the insurer will. Under the standard commercial general liability (cgl) policy, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for injury or. The policy contract defines your coverage limits, parameters, and policy period. The annual aggregate limit is the maximum amount. What is general aggregate insurance?

Source: softproductionafrica.com

Source: softproductionafrica.com

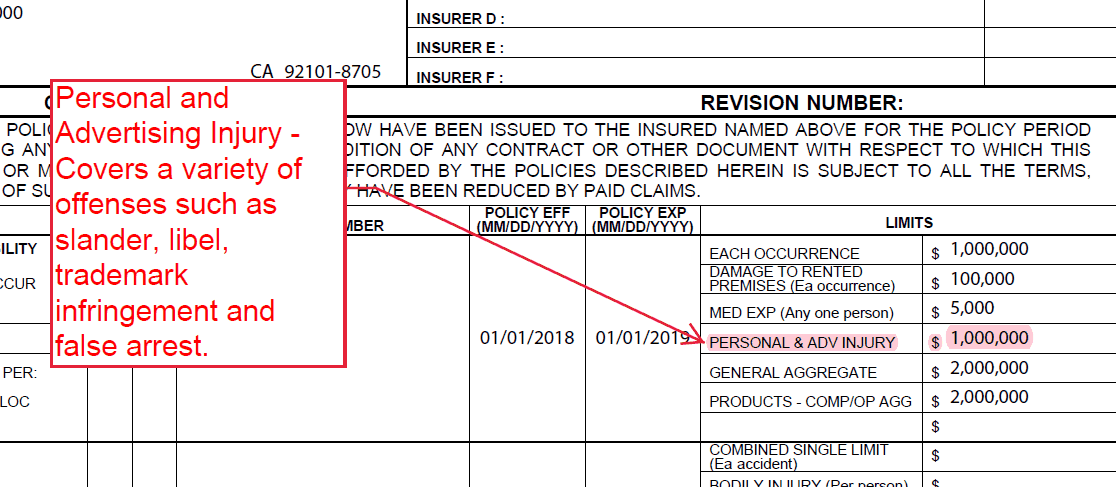

What does ‘general aggregate’ mean in an insurance policy? In insurance terms, aggregate refers to the limit a policy will pay during a specified timeframe. The term is also known as “general aggregate limit of liability,” which is the maximum amount of money an insurance company will pay for claims, losses, and lawsuits that happen during the active period of your policy (typically one. Aggregate also is referred to as an aggregate limit or general aggregate limit. The general aggregate limit places a ceiling on the insurer’s obligation to pay for property damage, bodily injury, medical expenses, lawsuit, etc.

Source: glquote.com

Source: glquote.com

A general aggregate is the maximum limit of coverage which applies to commercial general liability insurance policy. What does ‘general aggregate’ mean in an insurance policy? General aggregate insurance is a special policy coverage that is found on a commercial general liability (cgl) insurance policy. The general aggregate limit is spelled out in the insurance contract and caps the number of covered losses for which an insurer will pay. The term is also known as “general aggregate limit of liability,” which is the maximum amount of money an insurance company will pay for claims, losses, and lawsuits that happen during the active period of your policy (typically one.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

A general aggregate is a crucial term in commercial general liability insurance, which is necessary for all policyholders to understand. Under the standard commercial general liability (cgl) policy, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for injury or. In insurance terms, aggregate refers to the limit a policy will pay during a specified timeframe. In commercial general liability insurance, the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure. In commercial general liability insurance , the general aggregate is the maximum amount of money the insurer will pay out during a.

Source: weqmra.com

Source: weqmra.com

Most policy periods are one year. Up to 5 years for project specific coverage. A general aggregate limit of liability applies to all types of liability claims that the policy covers, such as property damage, bodily injury, personal, and advertising injury. Under some commercial general liability (cgl) policies, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for injury or. (iso), commercial general liability coverage form begins by making it clear that the limits shown in the declarations fix the most the insurer will pay regardless of the number of insureds, claims made, suits brought, or persons or.

Source: massageliabilityinsurancegroup.com

Source: massageliabilityinsurancegroup.com

Under the standard commercial general liability (cgl) policy, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for injury or. A general aggregate limit is the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures. (iso), commercial general liability coverage form begins by making it clear that the limits shown in the declarations fix the most the insurer will pay regardless of the number of insureds, claims made, suits brought, or persons or. What does ‘general aggregate’ mean in an insurance policy? The general aggregate limit on a cgl insurance policy defines the total amount the insurer will.

Source: npa1.org

Source: npa1.org

The general aggregate limit on a cgl insurance policy defines the total amount the insurer will pay during a single policy period, usually a year. In commercial general liability insurance, the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure. The general aggregate limit is spelled out in the insurance contract and caps the number of covered losses for which an insurer will pay. The general aggregate limit places a ceiling on the insurer’s obligation to pay for property damage, bodily injury, medical expenses, lawsuit, etc. Up to 5 years for project specific coverage.

Source: npa1.org

Source: npa1.org

What does ‘general aggregate’ mean in an insurance policy? Cgl insurance policies carry liability limits, which means that during the term of coverage, the insurance will pay only up to a certain amount.once the policy reaches those thresholds, its financial resources are exhausted. General aggregate limit — the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures. Learn more → insurance policies set a limit to how much they�ll pay when you file a claim, but they also limit the aggregate insurance coverage they pay out over time. Under some commercial general liability (cgl) policies, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for injury or.

Source: softproductionafrica.com

Source: softproductionafrica.com

The general aggregate limit places a ceiling on the insurer’s obligation to pay for property damage, bodily injury, medical expenses, lawsuit, etc. The annual aggregate limit is the maximum amount. The construction company owner above may have a $2,000,000 aggregate limit with a $1,000,000 per occurrence limit, which means his insurance company will only pay. In commercial general liability insurance, the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure. Cgl insurance policies carry liability limits, which means that during the term of coverage, the insurance will pay only up to a certain amount.once the policy reaches those thresholds, its financial resources are exhausted.

Source: softproductionafrica.com

Source: softproductionafrica.com

The general aggregate limit on a cgl insurance policy defines the total amount the insurer will. The aggregate limits are part of commercial general. The general aggregate limit is spelled out in the insurance contract and caps the number of covered losses for which an insurer will pay. The general aggregate limit on a cgl insurance policy defines the total amount the insurer will pay during a single policy period, usually a year. The policy contract defines your coverage limits, parameters, and policy period.

Source: npa1.org

Source: npa1.org

What is general aggregate insurance? A general aggregate is the maximum limit of coverage which applies to commercial general liability insurance policy. The general aggregate limit places a ceiling on the insurer’s obligation to pay for property damage, bodily injury, medical expenses, lawsuit, etc. General aggregate insurance is a special policy coverage that is found on a commercial general liability (cgl) insurance policy. The general aggregate limit on a cgl insurance policy defines the total amount the insurer will.

Source: tempusproservices.com

Source: tempusproservices.com

General aggregate insurance is a special policy coverage that is found on a commercial general liability (cgl) insurance policy. What is a general aggregate for insurance? In commercial general liability insurance , the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure. A general aggregate is a crucial term in commercial general liability insurance, which is necessary for all policyholders to understand. The policy contract defines your coverage limits, parameters, and policy period.

Source: verifiablee.com

Source: verifiablee.com

The general aggregate limit of an insurance policy is the maximum amount of money the insurer will pay out during a policy term. The general aggregate is the maximum amount of money a liability insurance policy will pay in a given policy term. Aggregate limit refers to the maximum amount up to which a liability insurance coverage extends for a. Learn more → insurance policies set a limit to how much they�ll pay when you file a claim, but they also limit the aggregate insurance coverage they pay out over time. A general aggregate limit of liability applies to all types of liability claims that the policy covers, such as property damage, bodily injury, personal, and advertising injury.

Source: verifiablee.com

Source: verifiablee.com

A general aggregate limit is the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures. A general aggregate is a crucial term in commercial general liability insurance, which is necessary for all policyholders to understand. Up to 5 years for project specific coverage. Under the commercial general liability insurance, the general aggregate limit is applied to the covered bodily and property damage and all covered personal & advertising injury. This means that coverage will pay for every claim, loss and lawsuit that involves a policyholder, until it reaches that aggregate limit.

Source: liabilityinsurancehikenshi.blogspot.com

Source: liabilityinsurancehikenshi.blogspot.com

In commercial general liability insurance , the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure. The policy contract defines your coverage limits, parameters, and policy period. Under the commercial general liability insurance, the general aggregate limit is applied to the covered bodily and property damage and all covered personal & advertising injury. A general aggregate limit of liability applies to all types of liability claims that the policy covers, such as property damage, bodily injury, personal, and advertising injury. The general aggregate limit on a cgl insurance policy defines the total amount the insurer will pay during a single policy period, usually a year.

Source: payforessayz.com

Source: payforessayz.com

Most policy periods are one year. Under some commercial general liability (cgl) policies, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for injury or. In commercial general liability insurance, the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure. The policy contract defines your coverage limits, parameters, and policy period. Aggregate limit refers to the maximum amount up to which a liability insurance coverage extends for a.

Source: payforessayz.com

Source: payforessayz.com

The construction company owner above may have a $2,000,000 aggregate limit with a $1,000,000 per occurrence limit, which means his insurance company will only pay. Learn more → insurance policies set a limit to how much they�ll pay when you file a claim, but they also limit the aggregate insurance coverage they pay out over time. The annual aggregate limit is the maximum amount. Most policy periods are one year. The general aggregate limit is spelled out in the insurance contract and caps the number of covered losses for which an insurer will pay.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title general aggregate insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.