Your Garage keepers liability insurance images are available in this site. Garage keepers liability insurance are a topic that is being searched for and liked by netizens now. You can Get the Garage keepers liability insurance files here. Find and Download all royalty-free photos.

If you’re looking for garage keepers liability insurance images information related to the garage keepers liability insurance keyword, you have pay a visit to the right site. Our site always provides you with suggestions for refferencing the highest quality video and image content, please kindly surf and locate more informative video content and images that fit your interests.

Garage Keepers Liability Insurance. This type of policy is different from a garage liability insurance policy , which covers property damage or bodily injuries resulting from an accident related to garage operations,. A garage keepers policy protects auto service businesses from damage to a customer�s vehicle including fire, theft, weather, and vandalism. It provides them with liability protection in the event that a customer’s car is damaged while in the garage’s possession for repairs, bodywork, or storage. Garage keepers liability insurance garage liability insurance covers claims of damage and injury to the property aside from the real vehicles possessed by customers or in the stock.

Garage Keepers Liability Insurance What Is It (& Why Do From mulleninsurance.com

Garage Keepers Liability Insurance What Is It (& Why Do From mulleninsurance.com

Garage keepers insurance falls under a garage policy held by auto dealers, body shops, and repair shops. This is the most common type of. While many may consider these policies to perform the same task, there is actually a. It provides them with liability protection in the event that a customer’s car is damaged while in the garage’s possession for repairs, bodywork, or storage. In states such as virginia or texas, it is. The first one is coverage for when negligence is found on the side of the garage.

Is a policy that covers bodily injury or property damage caused by an incident out of garage operations.

Business auto life home health renter disability commercial auto long term care annuity. As we said, garage keepers and garage keepers liability insurance policies go hand in hand. There are two types of garage liability insurance for tow truck operations and other similar industries. Garage keepers insurance, also called garage keepers liability coverage, protects you if a customer’s car is damaged while it’s at your auto repair shop or towing company. If a vehicle is damaged, stolen, or left unlocked and losses were incurred, this policy covers those. Garage keepers is a very specific liability insurance policy designed for businesses that work with vehicles or equipment in a garage setting.

Source: boomautomobile.com

Source: boomautomobile.com

Garagekeepers legal liability coverage is an optional coverage designed for business owners who offer towing services or operate service stations. Is a policy that covers bodily injury or property damage caused by an incident out of garage operations. Garage keepers insurance, also called garage keepers liability coverage, protects you if a customer’s car is damaged while it’s at your auto repair shop or towing company. Garage keepers liability insurance is a form of specialty coverage that shields the vehicles that clients leave with automotive companies for repairs or other services. Garage keepers liability insurance is vital for small businesses dealing with automotive services.

Source: businessinsurancelosangeles.com

Source: businessinsurancelosangeles.com

On average, garage keepers liability insurance cost is $96 per month, or $1,146 per year. Garagekeepers liability insurance provides you with financial protection if you accidentally damage a customer’s vehicle. What is garage keepers liability insurance? In states such as virginia or texas, it is. It’s important to understand it’s not a physical damage coverage so that it wouldn’t protect your vehicles, but it acts like a physical damage coverage safeguarding other people’s cars.

Source: prorevtech.com

Source: prorevtech.com

Garage keepers insurance, also called garage keepers liability coverage, protects you if a customer’s car is damaged while it’s at your auto repair shop or towing company. This type of coverage is needed due to an exclusion in the garage liability form for damage to a customer’s auto while in the “care, custody or control” of the garage. Garage keepers liability insurance is vital for small businesses dealing with automotive services. While many may consider these policies to perform the same task, there is actually a. Wondering how much is garage keepers insurance policy going to cost you?

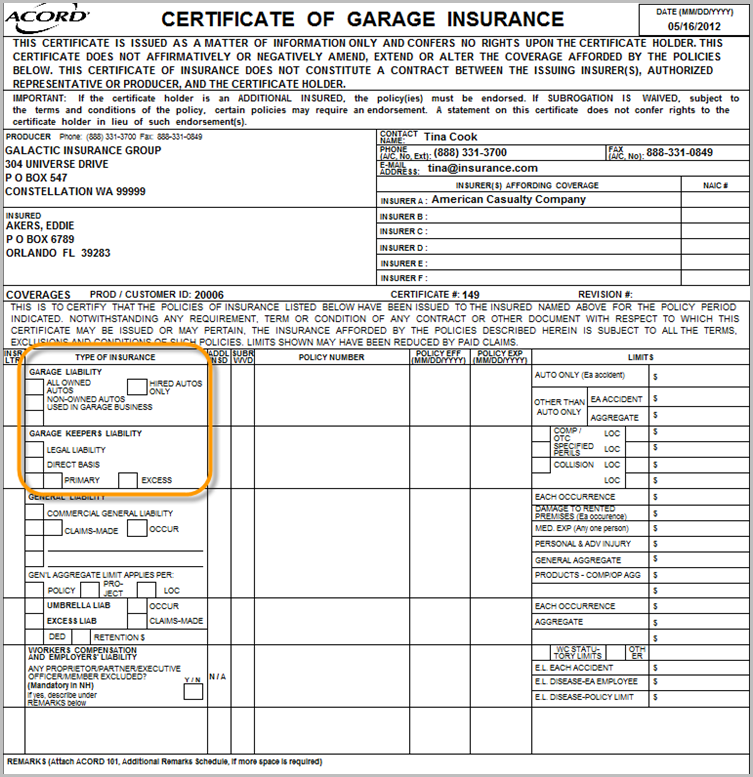

Source: simply-easier-acord-forms.blogspot.com

Source: simply-easier-acord-forms.blogspot.com

It provides them with liability protection in the event that a customer’s car is damaged while in the garage’s possession for repairs, bodywork, or storage. As we said, garage keepers and garage keepers liability insurance policies go hand in hand. Garage liability vs garagekeepers liability. A liability insurance covers or insures against any injury or accident and resulting damage that occurs out of garage business operations. The first one is coverage for when negligence is found on the side of the garage.

Source: rsgilmore.com

Source: rsgilmore.com

This type of policy offers insurance protection for your business from liability arising from damage claims caused by you or your employees while conducting your professional services. Garage keepers is a very specific liability insurance policy designed for businesses that work with vehicles or equipment in a garage setting. Garage keepers liability insurance 🟨 feb 2022. To help alleviate the intimidation, think of garagekeepers liability insurance as insurance that covers someone’s vehicle while it is being stored at an auto repair shop. There are two types of garage liability insurance for tow truck operations and other similar industries.

Source: insurancepm.com

Source: insurancepm.com

The policy refers to the ownership, maintenance or use of locations for garage business operations. Whether the car is being worked on or is being stored, this protection helps pay for covered damages if the car is left in your care. As we said, garage keepers and garage keepers liability insurance policies go hand in hand. Garage keepers liability insurance is a form of specialty coverage that shields the vehicles that clients leave with automotive companies for repairs or other services. Garagekeepers legal liability insurance provides protection in case a vehicle is damaged by fire, theft, vandalism or collision.

Source: neiltortorella.com

Source: neiltortorella.com

Depending on the policy, garage keepers’ insurance may cover several types of. The individual owner of the car would not carry a garagekeepers liability policy, but it would need to be purchased by the business owner who is in possession of the client’s car. To add to the confusion, it. Garage keepers insurance is a form of specialty insurance coverage designed to shield any business that owns and operates a garage, from losses tied to the customer vehicles it services. As we said, garage keepers and garage keepers liability insurance policies go hand in hand.

Source: laclassedemaitressemarie.blogspot.com

Source: laclassedemaitressemarie.blogspot.com

Garage keepers liability insurance is an optional coverage endorsement meant to protect only your customers’ vehicles or goods from damages while under your care, custody, control or possession. Garagekeepers legal liability coverage is an optional coverage designed for business owners who offer towing services or operate service stations. Is a policy that covers bodily injury or property damage caused by an incident out of garage operations. This type of coverage is needed due to an exclusion in the garage liability form for damage to a customer’s auto while in the “care, custody or control” of the garage. This type of policy is different from a garage liability insurance policy , which covers property damage or bodily injuries resulting from an accident related to garage operations,.

Source: dandkmotorsports.com

Source: dandkmotorsports.com

Depending on the policy, garage keepers’ insurance may cover several types of. It’s important to understand it’s not a physical damage coverage so that it wouldn’t protect your vehicles, but it acts like a physical damage coverage safeguarding other people’s cars. If you have a general liability policy , you may think you’re covered, as general liability covers third party property damage. Garage keepers liability insurance garage liability insurance covers claims of damage and injury to the property aside from the real vehicles possessed by customers or in the stock. If you’re just getting started, you’ll need garage.

Source: businessinsurancelosangeles.com

Source: businessinsurancelosangeles.com

The first one is coverage for when negligence is found on the side of the garage. Garagekeepers liability insurance provides you with financial protection if you accidentally damage a customer’s vehicle. Garagekeepers coverage — coverage provided under a garage policy for auto and trailer dealers, particularly those dealers that maintain a service department or body shop, for liability exposures with respect to damage to a customer�s auto or auto equipment that has been left in the dealer�s care for service or repair, for example. It provides them with liability protection in the event that a customer’s car is damaged while in the garage’s possession for repairs, bodywork, or storage. A liability insurance covers or insures against any injury or accident and resulting damage that occurs out of garage business operations.

![Garage Keepers Insurance [What you NEED to Know] Garage Keepers Insurance [What you NEED to Know]](https://d2ydlkypr5z8li.cloudfront.net/images/pages/VQajwXNhD0gHyJWf9hk6RmUGjYflC4wEFsu8KlmI.jpeg) Source: commercialinsurance.net

Source: commercialinsurance.net

Wondering how much is garage keepers insurance policy going to cost you? Garage keepers liability insurance is a specialty policy that auto businesses use to protect client’s vehicles (cars, trucks, vans, motorcycles) that have been entrusted to the garage for service or repair. The first is the legal liability, the second is direct primary, and the third is direct excess. This type of coverage is needed due to an exclusion in the garage liability form for damage to a customer’s auto while in the “care, custody or control” of the garage. If you’re just getting started, you’ll need garage.

Source: mulleninsurance.com

Source: mulleninsurance.com

Garagekeepers liability insurance provides you with financial protection if you accidentally damage a customer’s vehicle. Whether the car is being worked on or is being stored, this protection helps pay for covered damages if the car is left in your care. Garage keepers is a very specific liability insurance policy designed for businesses that work with vehicles or equipment in a garage setting. Garage liability vs garagekeepers liability. This type of policy offers insurance protection for your business from liability arising from damage claims caused by you or your employees while conducting your professional services.

Source: dandkmotorsports.com

Source: dandkmotorsports.com

The first is the legal liability, the second is direct primary, and the third is direct excess. This type of coverage is needed due to an exclusion in the garage liability form for damage to a customer’s auto while in the “care, custody or control” of the garage. If you have a general liability policy , you may think you’re covered, as general liability covers third party property damage. It’s important to understand it’s not a physical damage coverage so that it wouldn’t protect your vehicles, but it acts like a physical damage coverage safeguarding other people’s cars. Garage keepers liability insurance is a form of specialty coverage that shields the vehicles that clients leave with automotive companies for repairs or other services.

Source: miamihotnews.blogspot.com

Source: miamihotnews.blogspot.com

This type of policy offers insurance protection for your business from liability arising from damage claims caused by you or your employees while conducting your professional services. Garagekeepers coverage — coverage provided under a garage policy for auto and trailer dealers, particularly those dealers that maintain a service department or body shop, for liability exposures with respect to damage to a customer�s auto or auto equipment that has been left in the dealer�s care for service or repair, for example. The first is the legal liability, the second is direct primary, and the third is direct excess. This type of policy offers insurance protection for your business from liability arising from damage claims caused by you or your employees while conducting your professional services. Garagekeepers liability insurance provides you with financial protection if you accidentally damage a customer’s vehicle.

Source: harvardwestern.com

Source: harvardwestern.com

Garage keeper’s insurance has three options offered: The individual owner of the car would not carry a garagekeepers liability policy, but it would need to be purchased by the business owner who is in possession of the client’s car. To help alleviate the intimidation, think of garagekeepers liability insurance as insurance that covers someone’s vehicle while it is being stored at an auto repair shop. They are garage liability and garagekeepers liability. It provides them with liability protection in the event that a customer’s car is damaged while in the garage’s possession for repairs, bodywork, or storage.

Source: ericandarihyder.blogspot.com

Source: ericandarihyder.blogspot.com

The policy refers to the ownership, maintenance or use of locations for garage business operations. This type of policy offers insurance protection for your business from liability arising from damage claims caused by you or your employees while conducting your professional services. What is garage keepers liability insurance? They are garage liability and garagekeepers liability. Garage keepers insurance, also called garage keepers liability coverage, protects you if a customer’s car is damaged while it’s at your auto repair shop or towing company.

Source: uigusa.com

Source: uigusa.com

This is the most common type of. As we said, garage keepers and garage keepers liability insurance policies go hand in hand. Garage keepers liability insurance garage liability insurance covers claims of damage and injury to the property aside from the real vehicles possessed by customers or in the stock. Garage keeper’s liability insurance protects business owners against physical damage losses that occur to customers vehicles while in their care, custody, and control. Garagekeepers legal liability coverage is an optional coverage designed for business owners who offer towing services or operate service stations.

Source: youtube.com

Source: youtube.com

Garagekeepers coverage — coverage provided under a garage policy for auto and trailer dealers, particularly those dealers that maintain a service department or body shop, for liability exposures with respect to damage to a customer�s auto or auto equipment that has been left in the dealer�s care for service or repair, for example. The first one is coverage for when negligence is found on the side of the garage. Is a policy that covers bodily injury or property damage caused by an incident out of garage operations. On average, garage keepers liability insurance cost is $96 per month, or $1,146 per year. Garage keeper’s insurance has three options offered:

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title garage keepers liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.