Your Funeral insurance companies in california images are ready. Funeral insurance companies in california are a topic that is being searched for and liked by netizens now. You can Download the Funeral insurance companies in california files here. Get all free vectors.

If you’re searching for funeral insurance companies in california images information related to the funeral insurance companies in california keyword, you have visit the ideal site. Our website always provides you with hints for seeking the highest quality video and image content, please kindly hunt and find more informative video content and graphics that fit your interests.

Funeral Insurance Companies In California. Mutual of omaha offers smaller burial insurance policies, with coverage starting as low as $2,000 ($5,000 in washington state). The price of a funeral in canada can often be more than $10,000. Funeral insurance can be purchased in an amount to pay for services, merchandise, and cemetery costs. Life insurance for funeral expenses.

California Funeral Insurance 10 Valuable Questions Answered From willamettelifeinsurance.com

California Funeral Insurance 10 Valuable Questions Answered From willamettelifeinsurance.com

In those states that allow insurance, three or four insurance companies have designed policies specifically to. The annual accounts of ahorn ag show a slow but steady economic growth over the last five years, with a closing figure of 116.5 million dollars in turnover and a gross profit of 29.3 million dollars in. Like other burial insurance providers, gerber life insurance makes it easy to get a free quote online or over the phone. The funeral home you are working with will likely be able to sell you the insurance policy directly. It provides a quick cash payout typically within a few days to ensure your funeral costs don’t burden your family. Most funeral insurance policies range between $5000 and $25,000 in value and are available to persons up to age 85.

These policies are made to protect family and loved ones from the financial burden after one passes away.

Bbb start with trust ®. In those states that allow insurance, three or four insurance companies have designed policies specifically to. Independent agents represent various insurance companies, whereas exclusive or captive agents represent only one insurer. This funeral home company is a 100% subsidiary of the ideal beteiligungen ag group, which is a life, property and accident insurance company. Burial life insurance (sometimes called “funeral insurance”) is an excellent and affordable option for helping provide for your family after your passing, even though many americans see these policies as a waste of money. Most states allow for using life insurance for funeral plans and a large number of states allow it for burial plans.

Source: introfcsmind.blogspot.com

Source: introfcsmind.blogspot.com

How to set up a funeral insurance policy. If you pass unexpectedly without savings or a life insurance policy, your family may struggle to pay for your final arrangements and other expenses. The funeral home you are working with will likely be able to sell you the insurance policy directly. Funeral insurance protects your loved ones by covering the costs of the burial or cremation and service. Bbb directory of funeral insurance near holy city, ca.

Source: ezfuneralinsurance.com

Source: ezfuneralinsurance.com

How high are funeral insurance costs in canada. Companies are listed alphabetically rather than in. Then, upon your death, the insurer pays the policy’s death benefit to your estate or the policy’s designated beneficiary, and the money is then applied toward final expenses, such as any. Bbb start with trust ®. These are the costs that you loved ones have to.

Source: burialinsurance.com

Source: burialinsurance.com

Independent agents represent various insurance companies, whereas exclusive or captive agents represent only one insurer. Most life insurance companies and policies do not offer coverage for funerals, so if you don�t want to purchase the policy from the funeral home you will likely have to search for a smaller insurance. The state licenses and regulates fraternal and private cemeteries only. Bbb directory of funeral insurance near holy city, ca. If you pass unexpectedly without savings or a life insurance policy, your family may struggle to pay for your final arrangements and other expenses.

Source: pinterest.com

Source: pinterest.com

These are the costs that you loved ones have to. It provides a quick cash payout typically within a few days to ensure your funeral costs don’t burden your family. Burial insurance (aka final expense insurance) is a life insurance policy that provides a cash benefit that can be used to help pay for funeral and burial expenses, credit card debt, and other final expenses. Like other burial insurance providers, gerber life insurance makes it easy to get a free quote online or over the phone. These are the costs that you loved ones have to.

Source: thelifeinsuranceinsider.com

Source: thelifeinsuranceinsider.com

If the costs are guaranteed, the insurance should cover all the expenses. Then, upon your death, the insurer pays the policy’s death benefit to your estate or the policy’s designated beneficiary, and the money is then applied toward final expenses, such as any. One of the best things about funeral insurance plans is that they are affordable and accessible to everyone. “funeral insurance is a life insurance policy that is designed to cover funeral expenses. Funeral insurance can be purchased in an amount to pay for services, merchandise, and cemetery costs.

Source: choicemutual.com

Source: choicemutual.com

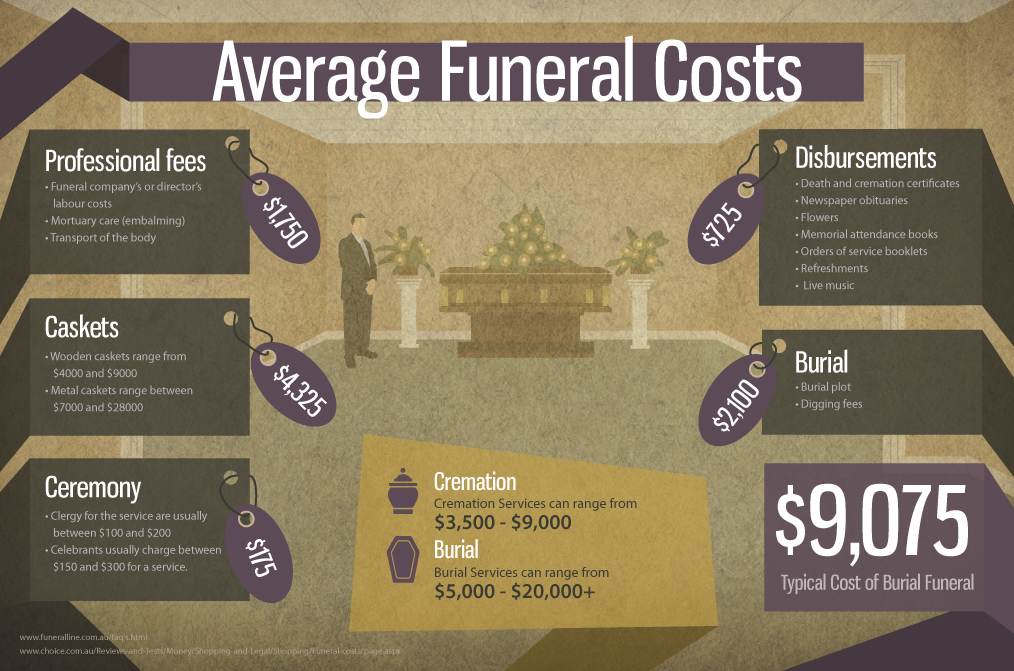

If you pass unexpectedly without savings or a life insurance policy, your family may struggle to pay for your final arrangements and other expenses. It provides a quick cash payout typically within a few days to ensure your funeral costs don’t burden your family. If you aren’t properly prepared, your funeral can be a large financial burden on your loved ones and a responsibility they don’t need during an already difficult time. As per chart below, cremation costs typically range between $1,500 and $4,500. The annual accounts of ahorn ag show a slow but steady economic growth over the last five years, with a closing figure of 116.5 million dollars in turnover and a gross profit of 29.3 million dollars in.

Source: lhlic.com

Source: lhlic.com

Many insurance companies also sell funeral insurance directly to consumers. Burial insurance policies are sold by dozens of large life insurance companies across the u.s. Bbb directory of funeral insurance near holy city, ca. Many insurance companies also sell funeral insurance directly to consumers. Most life insurance companies and policies do not offer coverage for funerals, so if you don�t want to purchase the policy from the funeral home you will likely have to search for a smaller insurance.

Source: cafda.org

Source: cafda.org

These policies are made to protect family and loved ones from the financial burden after one passes away. The funeral home you are working with will likely be able to sell you the insurance policy directly. This funeral home company is a 100% subsidiary of the ideal beteiligungen ag group, which is a life, property and accident insurance company. The annual accounts of ahorn ag show a slow but steady economic growth over the last five years, with a closing figure of 116.5 million dollars in turnover and a gross profit of 29.3 million dollars in. If you’re anticipating having a smaller funeral or opting for cremation, you may not need $50,000 or even $25,000 in burial insurance.

Source: willamettelifeinsurance.com

Source: willamettelifeinsurance.com

If you aren’t properly prepared, your funeral can be a large financial burden on your loved ones and a responsibility they don’t need during an already difficult time. Like other burial insurance providers, gerber life insurance makes it easy to get a free quote online or over the phone. Your guide to trusted bbb ratings, customer reviews and bbb accredited businesses. How to set up a funeral insurance policy. In those states that allow insurance, three or four insurance companies have designed policies specifically to.

Source: buyburialinsuranceonline.com

Source: buyburialinsuranceonline.com

Mutual of omaha offers smaller burial insurance policies, with coverage starting as low as $2,000 ($5,000 in washington state). The funeral home you are working with will likely be able to sell you the insurance policy directly. If the costs are guaranteed, the insurance should cover all the expenses. The price of a funeral in canada can often be more than $10,000. Before you purchase funeral insurance, you should be told in writing exactly how much you will pay and what will happen if you do not pay the insurance premiums.

Source: leavingtolivewithnature.blogspot.com

Source: leavingtolivewithnature.blogspot.com

This funeral home company is a 100% subsidiary of the ideal beteiligungen ag group, which is a life, property and accident insurance company. How to set up a funeral insurance policy. Most life insurance companies and policies do not offer coverage for funerals, so if you don�t want to purchase the policy from the funeral home you will likely have to search for a smaller insurance. Burial life insurance (sometimes called “funeral insurance”) is an excellent and affordable option for helping provide for your family after your passing, even though many americans see these policies as a waste of money. This funeral home company is a 100% subsidiary of the ideal beteiligungen ag group, which is a life, property and accident insurance company.

![Funeral & Burial Insurance in Texas [A Complete Guideline] Funeral & Burial Insurance in Texas [A Complete Guideline]](https://seniorslifeinsurancefinder.com/wp-content/uploads/2022/02/what-are-the-benefits-funeral-insurance-in-Texas.png) Source: seniorslifeinsurancefinder.com

Source: seniorslifeinsurancefinder.com

Then, upon your death, the insurer pays the policy’s death benefit to your estate or the policy’s designated beneficiary, and the money is then applied toward final expenses, such as any. These are the costs that you loved ones have to. In those states that allow insurance, three or four insurance companies have designed policies specifically to. These policies are made to protect family and loved ones from the financial burden after one passes away. It provides a quick cash payout typically within a few days to ensure your funeral costs don’t burden your family.

Source: choicemutual.com

Source: choicemutual.com

Mutual of omaha offers smaller burial insurance policies, with coverage starting as low as $2,000 ($5,000 in washington state). Mutual of omaha offers smaller burial insurance policies, with coverage starting as low as $2,000 ($5,000 in washington state). There are two major funeral alternatives in canada: Most life insurance companies and policies do not offer coverage for funerals, so if you don�t want to purchase the policy from the funeral home you will likely have to search for a smaller insurance. The state licenses and regulates fraternal and private cemeteries only.

Source: burialinsuranceplan.org

Source: burialinsuranceplan.org

Then, upon your death, the insurer pays the policy’s death benefit to your estate or the policy’s designated beneficiary, and the money is then applied toward final expenses, such as any. Best for smaller burial expense needs : Bbb start with trust ®. Your guide to trusted bbb ratings, customer reviews and bbb accredited businesses. “funeral insurance is a life insurance policy that is designed to cover funeral expenses.

Source: willamettelifeinsurance.com

Source: willamettelifeinsurance.com

In california, the cost of a full funeral ranges from $2,770 to $10,000 or more depending on the style of service, materials used, transportation, and location of service. In those states that allow insurance, three or four insurance companies have designed policies specifically to. How to set up a funeral insurance policy. The annual accounts of ahorn ag show a slow but steady economic growth over the last five years, with a closing figure of 116.5 million dollars in turnover and a gross profit of 29.3 million dollars in. Best for smaller burial expense needs :

Source: willamettelifeinsurance.com

Source: willamettelifeinsurance.com

Best for smaller burial expense needs : Before you purchase funeral insurance, you should be told in writing exactly how much you will pay and what will happen if you do not pay the insurance premiums. Companies are listed alphabetically rather than in. These are the costs that you loved ones have to. It provides a quick cash payout typically within a few days to ensure your funeral costs don’t burden your family.

Source: burialinsuranceplan.org

Source: burialinsuranceplan.org

If the costs are guaranteed, the insurance should cover all the expenses. Determine how much your funeral will cost: Funeral insurance protects your loved ones by covering the costs of the burial or cremation and service. Bbb directory of funeral insurance near holy city, ca. Most funeral insurance policies range between $5000 and $25,000 in value and are available to persons up to age 85.

Source: reduce.com

Source: reduce.com

The following insurance companies have shown themselves to be the best companies for final expense life insurance. The annual accounts of ahorn ag show a slow but steady economic growth over the last five years, with a closing figure of 116.5 million dollars in turnover and a gross profit of 29.3 million dollars in. Life insurance for funeral expenses. These are the costs that you loved ones have to. Many insurance companies also sell funeral insurance directly to consumers.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title funeral insurance companies in california by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.