Your Fronting insurance images are ready. Fronting insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Fronting insurance files here. Download all royalty-free photos.

If you’re searching for fronting insurance pictures information related to the fronting insurance keyword, you have pay a visit to the ideal site. Our website frequently gives you hints for viewing the maximum quality video and picture content, please kindly search and find more informative video content and graphics that fit your interests.

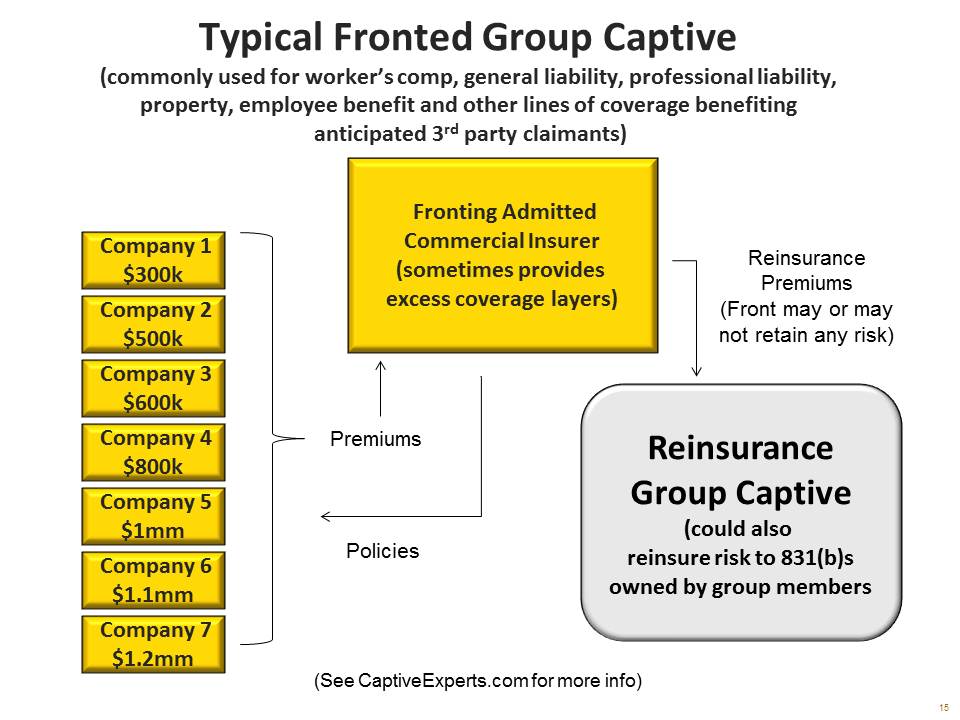

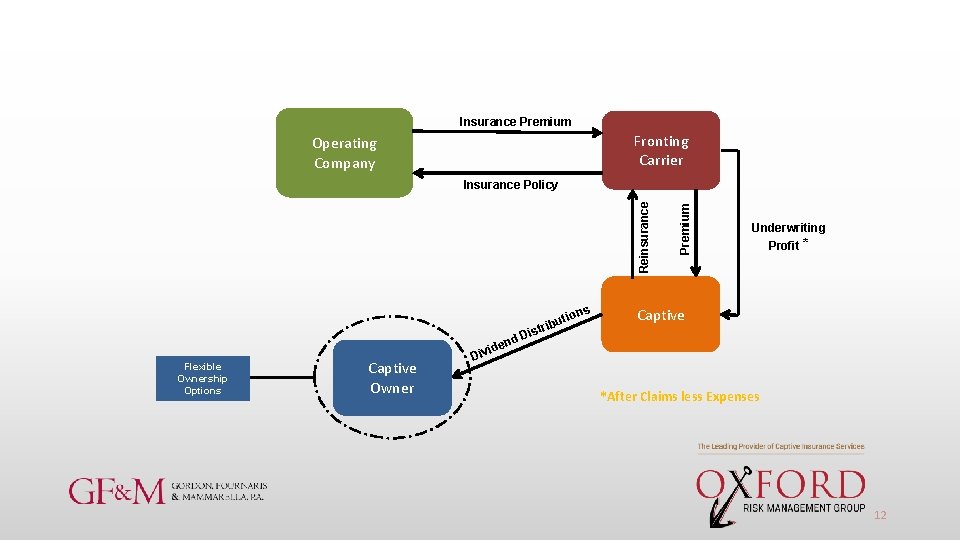

Fronting Insurance. Fronting arrangements typically suit companies located in countries with a sovereign rating of less than a. Fronting is most typically understood as when a ceding company (insurer) underwrites a policy and transfers the entire risk to a reinsurer. A procedure in which a primary insurer acts as the insurer of record by issuing a policy, but then passes the entire risk to a reinsurer in exchange for a commission. Fronting may provide a better solution for companies that are:

Fronting From aon.com

Fronting From aon.com

The insurance world is known for all sorts of complex and confusing terminology used to describe different relationships—commutation, per excess risk insurance, retrocession and dozens more. For a fee typically based on a percentage of premium, fronting allows wakefield to issue an insurance policy on your behalf with risk transferred from wakefield back to your captive with a reinsurance agreement. Our role as a fronting company is to issue an insurance policy to an insured and then, transfer some or all of this risk either to the insured’s captive or to the insured itself. Fronting can be tempting to cut the price of expensive car insurance for children, as main driver policies are more expensive for younger motorists. The company that underwrites the initial policy is the. Key things about car insurance fronting.

Fronting is most typically understood as when a ceding company (insurer) underwrites a policy and transfers the entire risk to a reinsurer.

This is illegal and could result in a criminal record. However, fronting is illegal, and if an older motorist is falsely naming themselves as the main driver of a car then the insurance policy can be invalidated and as a criminal offence, it can be. Should the insurer conclude that fronting has occurred, it may refuse to pay for any damage. Parents are usually fronting to make their children’s car insurance cheaper, but it’s a type of fraud and it�s. Fully collateralized by either letter of. Car insurance fronting is when someone pretends to be a named driver and not the main driver on an insurance policy.

Source: uscaptive.com

Source: uscaptive.com

Fronting is renting a product of an insurance company to another insurance entity for a fee. Fronting is a specialized form of reinsurance. An example of fronting would be a family where mum and dad have a car each and buy their newly qualified son a car, but take out the policy in one of their names. In such situations, the insurance company may find a local insurance. Car insurance fronting is when someone pretends to be a named driver and not the main driver on an insurance policy.

Source: saga.co.uk

Source: saga.co.uk

A fronting policy is a risk management technique in which an insurer underwrites a policy to cover a specific risk, but then cedes the risk to a reinsurer. Parents are usually fronting to make their children’s car insurance cheaper, but it’s a type of fraud and it�s. This is illegal and could result in a criminal record. White rock assists clients who need licensed insurance in the european economic area (eea) to access reinsurance markets or captives. This reliance on the insured to reimburse us for losses paid under the policy, creates a credit exposure for aig.

Source: uswitch.com

Source: uswitch.com

A commercial insurance company (fronting company) is licensed in the state (s) where a risk from the captive is located. The company that underwrites the initial policy is the. Fully collateralized by either letter of. Key things about car insurance fronting. A fronting policy is a risk management technique in which an insurer underwrites a policy to cover a specific risk, but then cedes the risk to a reinsurer.

Source: budgetdirect.com.sg

Source: budgetdirect.com.sg

For a fee typically based on a percentage of premium, fronting allows wakefield to issue an insurance policy on your behalf with risk transferred from wakefield back to your captive with a reinsurance agreement. In such situations, the insurance company may find a local insurance. Evaluating the possibility of retaining risk in order to benefit from positive loss experience requiring evidence of insurance for regulatory, disclosure, financing, marketing, trading, or counterparty needs However, fronting is illegal, and if an older motorist is falsely naming themselves as the main driver of a car then the insurance policy can be invalidated and as a criminal offence, it can be. A fronting company is a business entity that sells an insurance product but transfers the risk to another company.

Source: keyappdesign.blogspot.com

Source: keyappdesign.blogspot.com

In such situations, the insurance company may find a local insurance. The concept of fronting insurance is, for most people, one of those confusing ideas, and for good reason. A fronting policy is a risk management technique in which an insurer underwrites a policy to cover a specific risk, but then cedes the risk to a reinsurer. This is illegal and could result in a criminal record. Fronting is car insurance fraud, and it’s against the law.

Source: aon.com

Source: aon.com

A fronting policy is a risk management technique in which an insurer underwrites a policy to cover a specific risk, but then cedes the risk to a reinsurer. In addition, we need to allocate capital to support. For a fee typically based on a percentage of premium, fronting allows wakefield to issue an insurance policy on your behalf with risk transferred from wakefield back to your captive with a reinsurance agreement. Fronting is renting a product of an insurance company to another insurance entity for a fee. Fully collateralized by either letter of.

Source: keyappdesign.blogspot.com

A commercial insurance company (fronting company) is licensed in the state (s) where a risk from the captive is located. However, fronting is illegal, and if an older motorist is falsely naming themselves as the main driver of a car then the insurance policy can be invalidated and as a criminal offence, it can be. In such situations, the insurance company may find a local insurance. Fronting can be tempting to cut the price of expensive car insurance for children, as main driver policies are more expensive for younger motorists. Fronting will most likely be discovered when a claim is made.

Source: express.co.uk

Source: express.co.uk

A procedure in which a primary insurer acts as the insurer of record by issuing a policy, but then passes the entire risk to a reinsurer in exchange for a commission. Should the insurer conclude that fronting has occurred, it may refuse to pay for any damage. Fully collateralized by either letter of. Citadel reinsurance company limited can offer well capitalized companies the use of our am best rating on a fronting basis. The insurance world is known for all sorts of complex and confusing terminology used to describe different relationships—commutation, per excess risk insurance, retrocession and dozens more.

Source: bobatoo.co.uk

Source: bobatoo.co.uk

Parents are usually fronting to make their children’s car insurance cheaper, but it’s a type of fraud and it�s. The insurance world is known for all sorts of complex and confusing terminology used to describe different relationships—commutation, per excess risk insurance, retrocession and dozens more. A commercial insurance company (fronting company) is licensed in the state (s) where a risk from the captive is located. For companies that already have captives, wakefield provides fronting services for commercial real estate clients. For a fee typically based on a percentage of premium, fronting allows wakefield to issue an insurance policy on your behalf with risk transferred from wakefield back to your captive with a reinsurance agreement.

Source: express.co.uk

Source: express.co.uk

It is able to do so because the company that takes on the risk is not licensed to sell a similar product in that area. Fully collateralized by either letter of. A fronting policy is a risk management technique in which an insurer underwrites a policy to cover a specific risk, but then cedes the risk to a reinsurer. Parents are usually fronting to make their children’s car insurance cheaper, but it’s a type of fraud and it�s. Our role as a fronting company is to issue an insurance policy to an insured and then, transfer some or all of this risk either to the insured’s captive or to the insured itself.

Source: rac.co.uk

Source: rac.co.uk

Fully collateralized by either letter of. Evaluating the possibility of retaining risk in order to benefit from positive loss experience requiring evidence of insurance for regulatory, disclosure, financing, marketing, trading, or counterparty needs Parents are usually fronting to make their children’s car insurance cheaper, but it’s a type of fraud and it�s. Fronting is most typically understood as when a ceding company (insurer) underwrites a policy and transfers the entire risk to a reinsurer. Sometimes insurance companies wish to offer insurance in jurisdictions where they are not licensed:

Source: express.co.uk

Source: express.co.uk

Fronting is renting a product of an insurance company to another insurance entity for a fee. Fronting may provide a better solution for companies that are: Fronting is car insurance fraud, and it’s against the law. In such situations, the insurance company may find a local insurance. For a fee typically based on a percentage of premium, fronting allows wakefield to issue an insurance policy on your behalf with risk transferred from wakefield back to your captive with a reinsurance agreement.

Source: keyappdesign.blogspot.com

Source: keyappdesign.blogspot.com

Fully collateralized by either letter of. Fronting arrangements typically suit companies located in countries with a sovereign rating of less than a. Car insurance fronting is when someone pretends to be a named driver and not the main driver on an insurance policy. Fronting is car insurance fraud, and it’s against the law. In addition, we need to allocate capital to support.

Source: entertainmentandsporttickets.blogspot.com

Source: entertainmentandsporttickets.blogspot.com

The insurance world is known for all sorts of complex and confusing terminology used to describe different relationships—commutation, per excess risk insurance, retrocession and dozens more. Citadel reinsurance company limited can offer well capitalized companies the use of our am best rating on a fronting basis. This is illegal and could result in a criminal record. A commercial insurance company (fronting company) is licensed in the state (s) where a risk from the captive is located. Our role as a fronting company is to issue an insurance policy to an insured and then, transfer some or all of this risk either to the insured’s captive or to the insured itself.

Source: keyappdesign.blogspot.com

White rock assists clients who need licensed insurance in the european economic area (eea) to access reinsurance markets or captives. An example of fronting would be a family where mum and dad have a car each and buy their newly qualified son a car, but take out the policy in one of their names. Fronting is car insurance fraud, and it’s against the law. This is illegal and could result in a criminal record. Common features of a fronting arrangement include:

Source: firstcar.co.uk

Source: firstcar.co.uk

The insurance world is known for all sorts of complex and confusing terminology used to describe different relationships—commutation, per excess risk insurance, retrocession and dozens more. It is able to do so because the company that takes on the risk is not licensed to sell a similar product in that area. The insurance policy is issued on the paper from the fronting company, and then through contractual agreement (fronting agreement) the risk is transferred to the captive. Fronting is car insurance fraud, and it’s against the law. Fronting will most likely be discovered when a claim is made.

Source: hippo.co.za

Source: hippo.co.za

The insurance policy is issued on the paper from the fronting company, and then through contractual agreement (fronting agreement) the risk is transferred to the captive. If it is the named driver who is involved in a collision, for example, an insurance provider may launch an investigation. The insurance world is known for all sorts of complex and confusing terminology used to describe different relationships—commutation, per excess risk insurance, retrocession and dozens more. However, fronting is illegal, and if an older motorist is falsely naming themselves as the main driver of a car then the insurance policy can be invalidated and as a criminal offence, it can be. Fronting is car insurance fraud, and it’s against the law.

Source: keyappdesign.blogspot.com

Source: keyappdesign.blogspot.com

Fronting arrangements typically suit companies located in countries with a sovereign rating of less than a. Fronting is a specialized form of reinsurance. If it is the named driver who is involved in a collision, for example, an insurance provider may launch an investigation. A procedure in which a primary insurer acts as the insurer of record by issuing a policy, but then passes the entire risk to a reinsurer in exchange for a commission. Fronting may provide a better solution for companies that are:

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fronting insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.