Your Freelance liability insurance images are ready in this website. Freelance liability insurance are a topic that is being searched for and liked by netizens now. You can Download the Freelance liability insurance files here. Get all royalty-free photos.

If you’re looking for freelance liability insurance images information connected with to the freelance liability insurance keyword, you have come to the ideal blog. Our website always gives you suggestions for seeing the maximum quality video and picture content, please kindly search and find more enlightening video content and graphics that match your interests.

Freelance Liability Insurance. Freelance writer insurance starting at $24/month from prosight. Some common claims that would be covered under this type of insurance that you as a freelance writer might find helpful are negligence, misrepresentation, violation of good faith and fair dealing, and inaccurate advice. If a client is unhappy with your work, having this. Freelance business insurance costs vary.

Freelance Writer Insurance Liability Insurance From prosightdirect.com

Freelance Writer Insurance Liability Insurance From prosightdirect.com

Many freelancers can work remotely and likely work almost entirely from a laptop. As a freelance writer, this is the type of insurance you will most likely get if you decide to pick up a liability policy. Freelancer liability insurance from prosight starts at $24/month. If a client is unhappy with your work, having this. If you store or use client information in the course of your job, cyber liability insurance can protect you both. Business insurance for freelancers is definitely worth the investment.

Liability insurance is about the price of a cheap dinner for 2:

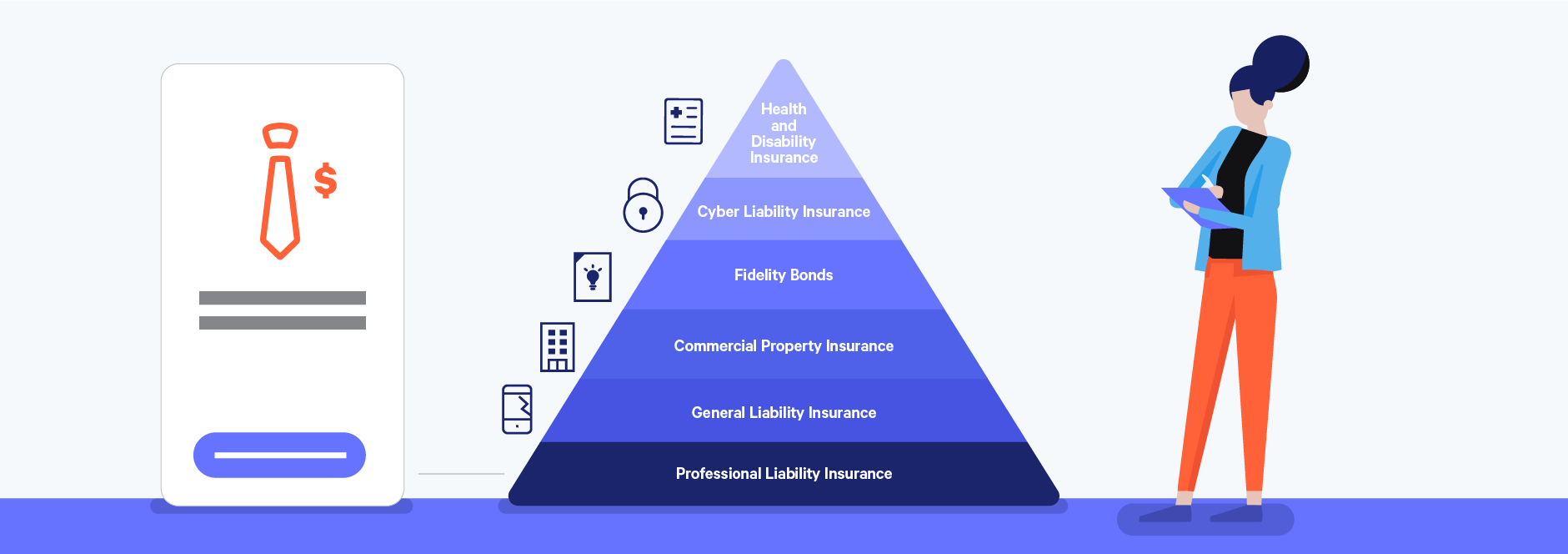

“media liability” policies are shields against the financial costs of litigation over libel, slander, defamation, invasion of privacy, plagiarism, copyright infringement and more. It protects you from lawsuits that can happen over your professional work: As a freelancer, it falls on you to identify and purchase the insurance you need to protect yourself and your business. From health to liability september 25, 2018 by michelle lovrine honeyager , updated november 15, 2021 all of our reviews and recommendations are completely impartial but some posts may include affiliate links that can earn us a commission. Freelancer liability insurance from prosight starts at $24/month. So do you need professional liability insurance?

Source: commerciallinesinsurance.net

Source: commerciallinesinsurance.net

Freelance insurance policies protect you from losses and lawsuits that can’t be covered by personal insurance. General liability insurance starts from $30 a month. To give you a rough idea: Ad get your contractor liability insurance quote & buy online with next insurance! Professional liability insurance (aka errors and omissions insurance) is the first policy most freelancers look into.

Source: pinterest.com

Source: pinterest.com

Sometimes known as errors and omissions, professional liability insurance policies exist to give freelancers watertight protection if any claims are made against them. This week we take a look at bunker’s specialty: Ad get your contractor liability insurance quote & buy online with next insurance! There are many factors that could cause a client to take legal action. General liability insurance arranged by thimble is designed to protect freelancers against accidents on the job that result in bodily injury, property damage, personal or advertising injury to a third party.

-min.jpg “Freelance Groom Liability Insurance the choice of”) Source: britishgrooms.org.uk

General liability insurance starts from $30 a month. Freelancer liability insurance from prosight starts at $24/month. Hiscox is a popular insurance provider that offers professional liability policies to. Professional liability insurance (aka errors and omissions insurance) is the first policy most freelancers look into. It protects you from lawsuits that can happen over your professional work:

Source: inspirelancer.com

Source: inspirelancer.com

In fact, it’s one of the. In fact, it’s one of the. “media liability” policies are shields against the financial costs of litigation over libel, slander, defamation, invasion of privacy, plagiarism, copyright infringement and more. Liability insurance is an important type of business insurance that protects freelancers from the various liabilities they may face. This week we take a look at bunker’s specialty:

Source: plusonesolutions.net

Source: plusonesolutions.net

Freelance insurance policies protect you from losses and lawsuits that can’t be covered by personal insurance. Professional liability insurance for freelance writers. Liability insurance is an important type of business insurance that protects freelancers from the various liabilities they may face. This form of liability insurance for freelancers is crucial for dealing with the legal side of your career. From health to liability september 25, 2018 by michelle lovrine honeyager , updated november 15, 2021 all of our reviews and recommendations are completely impartial but some posts may include affiliate links that can earn us a commission.

Source: embroker.com

Source: embroker.com

Professional liability policies cost from around $35 a month. Freelance insurance policies protect you from losses and lawsuits that can’t be covered by personal insurance. From tripping over your equipment to hot coffee spilled on a laptop, you’d be surprised how many freelance businesses need public liability insurance. Ad get your contractor liability insurance quote & buy online with next insurance! If you use a computer with internet access for your job, you open yourself up to the risk of data breaches.

![]() Source: prosightdirect.com

Source: prosightdirect.com

Freelancer liability insurance from prosight starts at $24/month. In fact, it’s one of the. Protection against slander, libel, defamation, copyright infringement, and errors & omissions claims for. As a freelancer, it falls on you to identify and purchase the insurance you need to protect yourself and your business. There are many types of liability insurance , and the purpose of all of them is to protect you from claims and lawsuits.

Source: theandrewagency.com

Source: theandrewagency.com

If a client is unhappy with your work, having this. This form of liability insurance for freelancers is crucial for dealing with the legal side of your career. Business insurance for freelancers is definitely worth the investment. Freelance writer insurance starting at $24/month from prosight. Protection against slander, libel, defamation, copyright infringement, and errors & omissions claims for.

Source: bramexplus.com

Source: bramexplus.com

From health to liability september 25, 2018 by michelle lovrine honeyager , updated november 15, 2021 all of our reviews and recommendations are completely impartial but some posts may include affiliate links that can earn us a commission. Freelancer liability insurance from prosight starts at $24/month. From health to liability september 25, 2018 by michelle lovrine honeyager , updated november 15, 2021 all of our reviews and recommendations are completely impartial but some posts may include affiliate links that can earn us a commission. It protects you from lawsuits that can happen over your professional work: So do you need professional liability insurance?

2.jpg “Freelance Groom Liability Insurance the choice of”) Source: britishgrooms.org.uk

Freelancers union’s plans through hiscox start at just $22.50/month. The price you’ll pay will depend on things like the industry you’re in, your annual income and the amount of coverage you need. To give you a rough idea: Liability insurance is an important type of business insurance that protects freelancers from the various liabilities they may face. Ad get your contractor liability insurance quote & buy online with next insurance!

Source: salongold.co.uk

Source: salongold.co.uk

As a freelancer, it falls on you to identify and purchase the insurance you need to protect yourself and your business. The price you’ll pay will depend on things like the industry you’re in, your annual income and the amount of coverage you need. As a freelancer, it falls on you to identify and purchase the insurance you need to protect yourself and your business. Freelance business insurance costs vary. Professional liability insurance (aka errors and omissions insurance) is the first policy most freelancers look into.

Source: salongold.co.uk

Source: salongold.co.uk

As a freelancer, it falls on you to identify and purchase the insurance you need to protect yourself and your business. Business insurance for freelancers is definitely worth the investment. Freelance investigative journalists should seriously consider having insurance to protect against the risk of being sued. To give you a rough idea: Freelance business insurance costs vary.

Source: prosightdirect.com

Source: prosightdirect.com

Freelancer liability insurance from prosight starts at $24/month. In fact, it’s one of the. Many freelancers can work remotely and likely work almost entirely from a laptop. So do you need professional liability insurance? If you need specific advice on what business insurance you need for your situation, talk to a licensed insurance agent in your area.

Source: britishgrooms.org.uk

As a freelancer, it falls on you to identify and purchase the insurance you need to protect yourself and your business. Many freelancers can work remotely and likely work almost entirely from a laptop. Freelance writers rely on us for better liability coverage with 24/7 access to a certificate of insurance. Freelance insurance policies protect you from losses and lawsuits that can’t be covered by personal insurance. There are many types of liability insurance , and the purpose of all of them is to protect you from claims and lawsuits.

Source: britishgrooms.org.uk

Freelance investigative journalists should seriously consider having insurance to protect against the risk of being sued. If you need specific advice on what business insurance you need for your situation, talk to a licensed insurance agent in your area. This form of liability insurance for freelancers is crucial for dealing with the legal side of your career. Freelancers union’s plans through hiscox start at just $22.50/month. It�s a lot to manage, but we�re here to help.

Source: createinsurance.co.uk

Source: createinsurance.co.uk

This week we take a look at bunker’s specialty: If you use a computer with internet access for your job, you open yourself up to the risk of data breaches. Many freelancers can work remotely and likely work almost entirely from a laptop. Stay tuned each week as we deep dive into freelance insurance, and help you figure out what you need, why, how much it will cost, and how to save. As a freelance writer, this is the type of insurance you will most likely get if you decide to pick up a liability policy.

Source: salongold.co.uk

Source: salongold.co.uk

In fact, it’s one of the. With new specialized insurance for freelance writers, you can get up to $100,000 of professional liability coverage that protects against all the risks above for less than $1 a day. Many freelancers can work remotely and likely work almost entirely from a laptop. General liability insurance starts from $30 a month. There are many factors that could cause a client to take legal action.

Source: freelancehairandbeautyinsurance.blogspot.com

Source: freelancehairandbeautyinsurance.blogspot.com

As a freelancer, it falls on you to identify and purchase the insurance you need to protect yourself and your business. Freelance writer insurance starting at $24/month from prosight. If you use a computer with internet access for your job, you open yourself up to the risk of data breaches. With new specialized insurance for freelance writers, you can get up to $100,000 of professional liability coverage that protects against all the risks above for less than $1 a day. Freelance investigative journalists should seriously consider having insurance to protect against the risk of being sued.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title freelance liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.