Your Free look period life insurance images are ready in this website. Free look period life insurance are a topic that is being searched for and liked by netizens now. You can Get the Free look period life insurance files here. Download all free images.

If you’re searching for free look period life insurance images information connected with to the free look period life insurance keyword, you have visit the ideal site. Our site always gives you hints for seeing the maximum quality video and picture content, please kindly surf and find more informative video content and graphics that fit your interests.

Free Look Period Life Insurance. The main benefit of a free look period is the additional time it provides to policyholders, thus enabling a policyholder to review each term and condition of the policy they bought. May 9, 2020 — the free look period allows a policy owner to review their contract after it is delivered, without having to make an unchangeable financial (7). A free look period is a time frame in which the owner of a life insurance policy can terminate the contract without surrender charges or other financial penalties. Depending on the insurance company and the state you reside in, the free look period can be 10 days or even longer.

Should You Apply for Life Insurance While Pregnant? SM From smartmoneymamas.com

Should You Apply for Life Insurance While Pregnant? SM From smartmoneymamas.com

(1) free look period is available for all life insurance policies. What is the free look period for life insurance? A free look period is a duration given to a new policy owner to check and review his policy document to confirm that his policy contains each and everything that was stated to him at the time of purchase. (2)the insured will be allowed a period of at least 15 days (30 days in case of electronic policies and policies sourced. Free look period life insurance philippines. The free look period shall be applicable at the inception of the policy and;

Depending on the insurance company and the state you reside in, the free look period can be 10 days or even longer.

Today, it is rare for a beneficiary to have a delayed or denied life insurance settlement because a death occurred during the free look period. What is the free look period for life insurance? Regulations vary from state to state, as does the required length of the free look period. May 9, 2020 — the free look period allows a policy owner to review their contract after it is delivered, without having to make an unchangeable financial (7). Even if a payment has been made, the insured will have a free look period to make the life insurance policy what they want. (2)the insured will be allowed a period of at least 15 days (30 days in case of electronic policies and policies sourced.

Source: fintrakk.com

Source: fintrakk.com

When you buy a life insurance policy, you generally have what is called a free look period. What is the free look period for life insurance? Additionally, your contract may include a free look provision longer than the minimum. A free look period is a duration given to a new policy owner to check and review his policy document to confirm that his policy contains each and everything that was stated to him at the time of purchase. If you do so, your insurer must return any premium.

Source: pinterest.com

Source: pinterest.com

For health policies a term of at least three years is a must. The length of the free look period varies depending on your state and your life insurance company. Depending on the insurance company and the state you reside in, the free look period can be 10 days or even longer. Depending on the insurance company and the state you reside in, the free look period can be 10 days or even longer. A free look period is a duration given to a new policy owner to check and review his policy document to confirm that his policy contains each and everything that was stated to him at the time of purchase.

Source: bhaskar.com

Source: bhaskar.com

Today, it is rare for a beneficiary to have a delayed or denied life insurance settlement because a death occurred during the free look period. There are various benefits of a free look period. During this time, you have the option of canceling your policy without penalty. If you do so, your insurer must return any premium. What is the free look period for life insurance?

Source: npa1.org

Source: npa1.org

A free look period is a window of time during which the owner of a life insurance policy can terminate the policy without incurring penalties. The free look period is a designated period of time during which a new life insurance policyholder may cancel the policy without incurring surrender charges or other penalties. (2)the insured will be allowed a period of at least 15 days (30 days in case of electronic policies and policies sourced. An unconditional refund for a period of at least 14 days once the life insurance contract is delivered. What is the free look period for life insurance?

Source: fr.slideshare.net

Source: fr.slideshare.net

Every state insurance department mandates a free look provision of at least 10 days in life insurance contracts, though many require an even longer period. The free look period protects the consumer against the predatory sales techniques that used to be common in the life insurance industry. For health policies a term of at least three years is a must. Depending on the insurance company and the state you reside in, the free look period can be 10 days or even longer. The length of the free look period varies depending on your state and your life insurance company.

Source: es.slideshare.net

Source: es.slideshare.net

(1) free look period is available for all life insurance policies. The insurance regulator mandates a free. May 9, 2020 — the free look period allows a policy owner to review their contract after it is delivered, without having to make an unchangeable financial (7). (2)the insured will be allowed a period of at least 15 days (30 days in case of electronic policies and policies sourced. The free look period is a designated period of time during which a new life insurance policyholder may cancel the policy without incurring surrender charges or other penalties.

Source: protective.com

Source: protective.com

A few of them include: The free look period is a required period of time, typically 10 days or more, in which a new life insurance policy owner can terminate the. A few of them include: Regulations vary from state to state, as does the required length of the free look period. During this time the policyholder has the right to return a life insurance policy for a full refund of all monies submitted for payment to the insurance company.

Source: quotesbae.com

Source: quotesbae.com

What is the free look period for life insurance? Additionally, your contract may include a free look provision longer than the minimum. (1) free look period is available for all life insurance policies. The insurance regulator mandates a free. During this time the policyholder has the right to return a life insurance policy for a full refund of all monies submitted for payment to the insurance company.

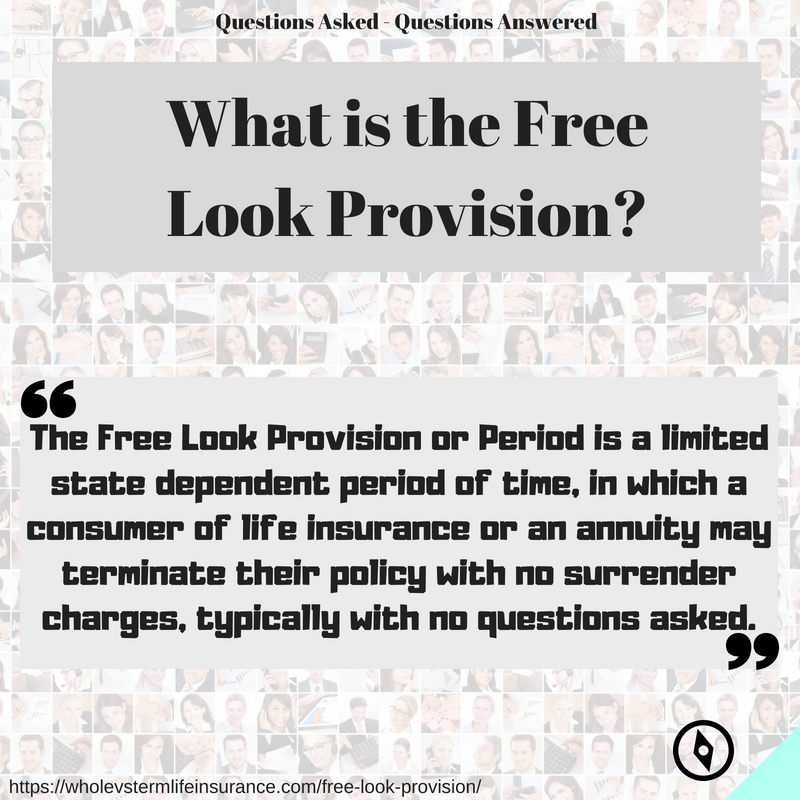

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

A free look period is a window of time during which the owner of a life insurance policy can terminate the policy without incurring penalties. The free look period is a required period of time, typically 10 days or more, in which a new life insurance policy owner can terminate the. May 9, 2020 — the free look period allows a policy owner to review their contract after it is delivered, without having to make an unchangeable financial (9). A free look period is a time frame in which the owner of a life insurance policy can terminate the contract without surrender charges or other financial penalties. (1) free look period is available for all life insurance policies.

![]() Source: beacon.co.in

Source: beacon.co.in

Additionally, your contract may include a free look provision longer than the minimum. During this time the policyholder has the right to return a life insurance policy for a full refund of all monies submitted for payment to the insurance company. Depending on the insurance company and the state you reside in, the free look period can be 10 days or even longer. If you do so, your insurer must return any premium. Free look period life insurance philippines.

Source: outlookindia.com

Source: outlookindia.com

If you do so, your insurer must return any premium. The free look period is a required period of time, typically 10 days or more, in which a new life insurance policy owner can terminate the. When you buy a life insurance policy, you generally have what is called a free look period. Every state in the us and the district of columbia requires life insurance policies to include a free look period. The insurance regulator mandates a free.

Source: smartmoneymamas.com

Source: smartmoneymamas.com

Every state in the us and the district of columbia requires life insurance policies to include a free look period. When you buy a life insurance policy, you generally have what is called a free look period. A free look period is loosely defined as a period of time in which us consumers have to cancel a life insurance or annuity product with virtually no reason given and receive a full refund. How long is the free look period? The free look period is a period of time during which you are able to call off your life insurance policy for which you do not get penalized and also receive a refund of any premiums you already paid.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

May 9, 2020 — the free look period allows a policy owner to review their contract after it is delivered, without having to make an unchangeable financial (9). When you buy a life insurance policy, you generally have what is called a free look period. A free look period is loosely defined as a period of time in which us consumers have to cancel a life insurance or annuity product with virtually no reason given and receive a full refund. During this time the policyholder has the right to return a life insurance policy for a full refund of all monies submitted for payment to the insurance company. If you do so, your insurer must return any premium.

Source: lifeant.com

Source: lifeant.com

May 9, 2020 — the free look period allows a policy owner to review their contract after it is delivered, without having to make an unchangeable financial (9). During this time, you have the option of canceling your policy without penalty. The free look period is a required period of time, typically 10 days or more, in which a new life insurance policy owner can terminate the. May 9, 2020 — the free look period allows a policy owner to review their contract after it is delivered, without having to make an unchangeable financial (7). Today, it is rare for a beneficiary to have a delayed or denied life insurance settlement because a death occurred during the free look period.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

Depending on the insurance company and the state you reside in, the free look period can be 10 days or even longer. The free look period is a required period of time, typically 10 days or more, in which a new life insurance policy owner can terminate the. During this time, you have the option of canceling your policy without penalty. A free look period is loosely defined as a period of time in which us consumers have to cancel a life insurance or annuity product with virtually no reason given and receive a full refund. When you buy a life insurance policy, you generally have what is called a free look period.

Source: livemint.com

Source: livemint.com

As long as the policy is cancelled within this timeframe, the purchaser receives a full refund of any premiums they’ve paid. A free look period is loosely defined as a period of time in which us consumers have to cancel a life insurance or annuity product with virtually no reason given and receive a full refund. The free look period is a required period of time, typically 10 days or more, in which a new life insurance policy owner can terminate the. As a buyer, you have the right to cancel a policy within a specified number of days for any reason. A few of them include:

Source: revisi.net

Source: revisi.net

(1) free look period is available for all life insurance policies. May 9, 2020 — the free look period allows a policy owner to review their contract after it is delivered, without having to make an unchangeable financial (7). What is the free look period for life insurance? How long is the free look period? A free look is the period of time beginning when a life insurance policy is delivered to the policy owner, and ending after the prescribed amount of time defined by law and or company guidelines.

Source: insurancesamadhan.com

Source: insurancesamadhan.com

Regulations vary from state to state, as does the required length of the free look period. The insurance regulator mandates a free. Depending on the insurance company and the state you reside in, the free look period can be 10 days or even longer. Today, it is rare for a beneficiary to have a delayed or denied life insurance settlement because a death occurred during the free look period. Additionally, your contract may include a free look provision longer than the minimum.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title free look period life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.