Your Fr44 insurance virginia images are ready. Fr44 insurance virginia are a topic that is being searched for and liked by netizens now. You can Find and Download the Fr44 insurance virginia files here. Download all free photos and vectors.

If you’re looking for fr44 insurance virginia images information related to the fr44 insurance virginia keyword, you have visit the right site. Our site always provides you with suggestions for refferencing the highest quality video and picture content, please kindly search and locate more informative video content and images that match your interests.

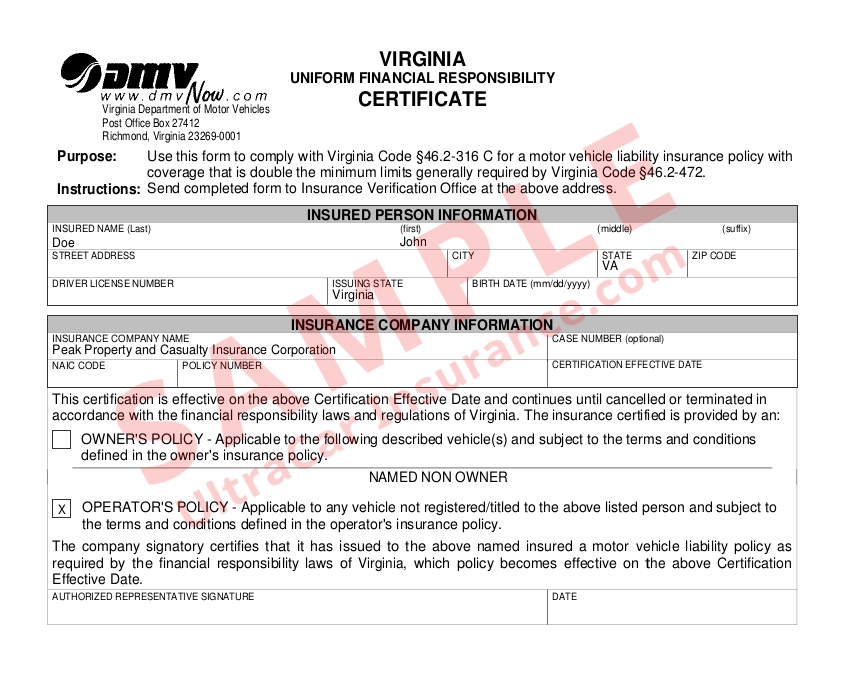

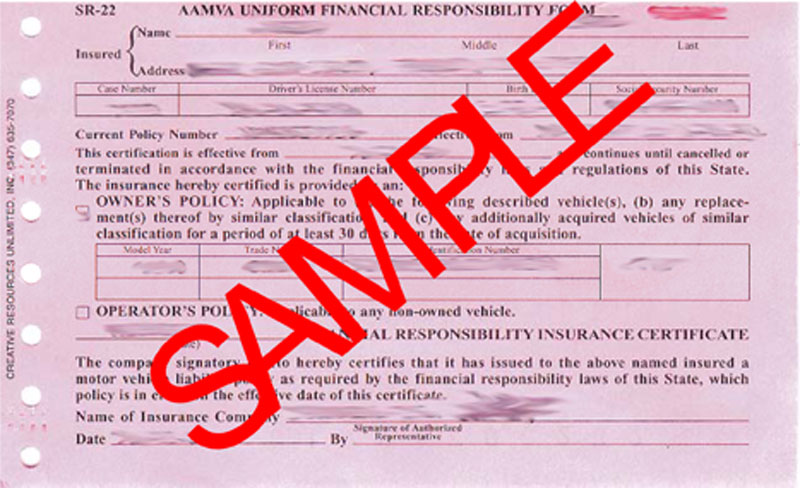

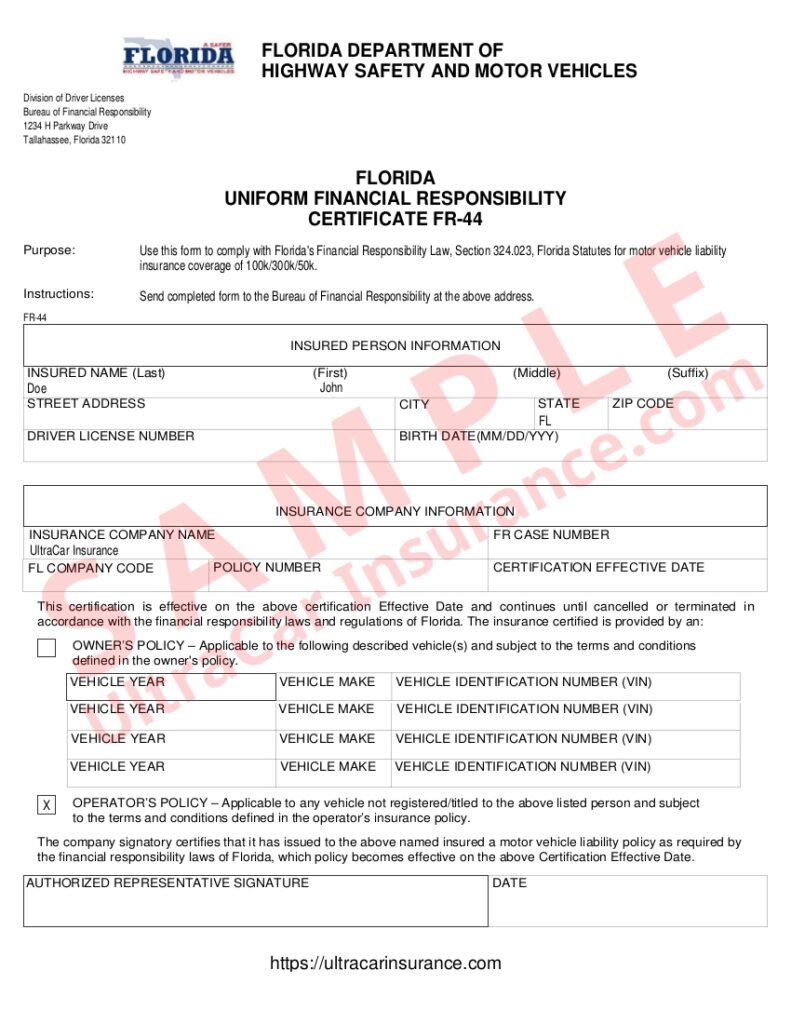

Fr44 Insurance Virginia. You must have auto insurance coverage to obtain an fr44. $40,000 of property damage liability. $50,000 bodily injury per person. Standard state minimum liability limits are only $25k per person for bodily injury and $50k per accident plus $20k for property damage.

Virginia DUI Fr 44 Insurance From fr44fast.com

Virginia DUI Fr 44 Insurance From fr44fast.com

How does virginia fr44 insurance work? An insurance provider endorses the fr44 certificate to an insurance policy, which is filed with. Standard state minimum liability limits are only $25k per person for bodily injury and $50k per accident plus $20k for property damage. If your insurance cancels, your fr44 will become invalid and your. The liability insurance requirements for fr44 coverage are 50/100/40: Fr44 insurance virginia state farm.

State farm does not offer fr44 insurance.

Indeed may be compensated by these employers, helping keep indeed free for jobseekers. $50,000 of bodily injury per person liability. This is a required field. $40,000 of property damage liability. State farm does not offer fr44 insurance. Due to the higher coverage the policy will be more expensive and the dui conviction will also keep.

Source: fr44fast.com

Source: fr44fast.com

Enter the customer number in the customer no field. As you can see below the requirements for fr44 insurance are much higher. Enter the customer number in the customer no field. Sending this form is crucial if you want to operate a vehicle legally in virginia. Indeed may be compensated by these employers, helping keep indeed free for jobseekers.

Source: keensinsuranceagency.com

Source: keensinsuranceagency.com

The fr44 insurance minimum in virginia is $25,000 for injury to one person, $50,000 for injury to two or more people, and $20,000 for property damage. Fr44 insurance must be kept current without lapse, in most cases, for three years. The fr44 insurance minimum in virginia is $25,000 for injury to one person, $50,000 for injury to two or more people, and $20,000 for property damage. Sending this form is crucial if you want to operate a vehicle legally in virginia. $50,000 bodily injury per accident.

Source: archibaldinsurance.com

Source: archibaldinsurance.com

To reinstate your license after a dui in florida or a dwi in virginia, you will need to file an fr44 certificate with the dmv. As you can see below the requirements for fr44 insurance are much higher. Get a free quote from state farm agent edgar jones in farmville, va virginia farm bureau is about more than just insurance. The liability insurance requirements for fr44 coverage are 50/100/40: $100,000 bodily injury per accident.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

Fr44 insurance must be kept current without lapse, in most cases, for three years. The liability insurance requirements for fr44 coverage are 50/100/40: An fr44 is not an insurance policy, but a form that ensures you have the proper car insurance when you are out there on the road. $40,000 of property damage liability. The cost of fr44 insurance is determined by your state’s minimum liability requirements.

Source: frasesdeumaluaneteapaxionada.blogspot.com

Source: frasesdeumaluaneteapaxionada.blogspot.com

An insurance provider endorses the fr44 certificate to an insurance policy, which is filed with. Enter the customer number in the customer no field. The cost of fr44 insurance is determined by your state’s minimum liability requirements. Fr44 coverage requirements are $50,000 bodily injury per person, $100,000 bodily injury per accident, and $40,000 property damage. Fr44 insurance virginia state farm.

Source: keensinsuranceagency.com

Source: keensinsuranceagency.com

Fr44 insurance must be kept current without lapse, in most cases, for three years. The cost of fr44 insurance is determined by your state’s minimum liability requirements. Fr44 coverage requirements are $50,000 bodily injury per person, $100,000 bodily injury per accident, and $40,000 property damage. This is a required field. Florida and virginia are only two states that use the fr44 form after a driver has been convicted of driving without insurance or convicted of a serious traffic violation.

Source: foxysletters.blogspot.com

As you can see below the requirements for fr44 insurance are much higher. A virginia fr44 insurance filing is similar to an sr22 filing, but fr44 insurance minimum coverage requirements for fr44 insurance is much higher than for standard liability insurance requirements. Car insurance companies issue the fr44 certificate. Virginia drivers who are not on fr44 insurance have to maintain auto insurance at minimum limits of $25,000 per person / $50,000 per accident in bodily injury coverage and $20,000 in property damage limits. Sending this form is crucial if you want to operate a vehicle legally in virginia.

Source: theandrewagency.com

Source: theandrewagency.com

State farm does not offer fr44 insurance. $50,000 of bodily injury per person liability. An fr44 is not an insurance policy, but a form that ensures you have the proper car insurance when you are out there on the road. $50,000 bodily injury per accident. There are coverage limitations with non owner fr44.

Source: selectsr22insurance.com

Source: selectsr22insurance.com

$50,000 bodily injury per accident. Also, you�re required to have the following minimum amounts of liability coverage in place on your car insurance: Florida & virginia require fr44. The requirements and premiums for high risk virginia fr44 insurance are set higher than those for sr22 insurance. $50,000 bodily injury per person.

Source: kenyachambermines.com

Source: kenyachambermines.com

Florida and virginia are only two states that use the fr44 form after a driver has been convicted of driving without insurance or convicted of a serious traffic violation. If your insurance cancels, your fr44 will become invalid and your. Florida & virginia require fr44. The liability insurance requirements for fr44 coverage are 50/100/40: To reinstate your license after a dui in florida or a dwi in virginia, you will need to file an fr44 certificate with the dmv.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

Due to the higher coverage the policy will be more expensive and the dui conviction will also keep. Florida & virginia require fr44. An insurance provider endorses the fr44 certificate to an insurance policy, which is filed with. Legion of honor qualifier ambassador. Fr44 insurance is a guarantee of future insurance coverage and proof of financial responsibility.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

$100,000 bodily injury liability for all injuries in an accident. Florida and virginia are only two states that use the fr44 form after a driver has been convicted of driving without insurance or convicted of a serious traffic violation. Virginia drivers who are not on fr44 insurance have to maintain auto insurance at minimum limits of $25,000 per person / $50,000 per accident in bodily injury coverage and $20,000 in property damage limits. $40,000 property damage per accident. This is a required field.

Source: kenyachambermines.com

Source: kenyachambermines.com

The cost of fr44 insurance is determined by your state’s minimum liability requirements. $50,000 of bodily injury per person liability. Fr44 insurance must be kept current without lapse, in most cases, for three years. A virginia fr44 insurance filing is similar to an sr22 filing, but fr44 insurance minimum coverage requirements for fr44 insurance is much higher than for standard liability insurance requirements. This is a required field.

Source: get-quotes.org

Source: get-quotes.org

This is a required field. You can see in virginia the fr44 limits are double those of a driver without the fr44 requirement. As you can see below the requirements for fr44 insurance are much higher. $100,000 bodily injury liability for all injuries in an accident. Due to the higher coverage the policy will be more expensive and the dui conviction will also keep.

Source: sr22va.myfirstoptioninsurance.com

Source: sr22va.myfirstoptioninsurance.com

$100,000 bodily injury liability for all injuries in an accident. An fr44 certificate is required by the court to verify you have double your state’s minimum liability requirements. Due to the higher coverage the policy will be more expensive and the dui conviction will also keep. The cost of fr44 insurance is determined by your state’s minimum liability requirements. $100,000 bodily injury per accident.

Source: mylovingstardoll.blogspot.com

Source: mylovingstardoll.blogspot.com

Virginia drivers who are not on fr44 insurance have to maintain auto insurance at minimum limits of $25,000 per person / $50,000 per accident in bodily injury coverage and $20,000 in property damage limits. You can see in virginia the fr44 limits are double those of a driver without the fr44 requirement. If your insurance cancels, your fr44 will become invalid and your. Fr44 coverage requirements are $50,000 bodily injury per person, $100,000 bodily injury per accident, and $40,000 property damage. Virginia’s financial responsibility law requires all drivers to maintain a minimum amount of liability insurance coverage of $25,000/$50,000/$20,000.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

Fr44 insurance virginia state farm. Enter the customer number in the customer no field. Florida and virginia are only two states that use the fr44 form after a driver has been convicted of driving without insurance or convicted of a serious traffic violation. These limits are $50,000 for bodily injury per person and $100,000 per incident, plus $40,000 for property damage. $50,000 bodily injury per person.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

Sending this form is crucial if you want to operate a vehicle legally in virginia. Fr44 coverage requirements are $50,000 bodily injury per person, $100,000 bodily injury per accident, and $40,000 property damage. Florida and virginia are only two states that use the fr44 form after a driver has been convicted of driving without insurance or convicted of a serious traffic violation. $40,000 of property damage liability. $100,000 bodily injury per accident.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fr44 insurance virginia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.