Your Fr44 insurance florida images are available. Fr44 insurance florida are a topic that is being searched for and liked by netizens now. You can Find and Download the Fr44 insurance florida files here. Find and Download all free vectors.

If you’re looking for fr44 insurance florida pictures information related to the fr44 insurance florida topic, you have come to the ideal blog. Our site frequently gives you hints for viewing the highest quality video and image content, please kindly hunt and locate more informative video articles and images that fit your interests.

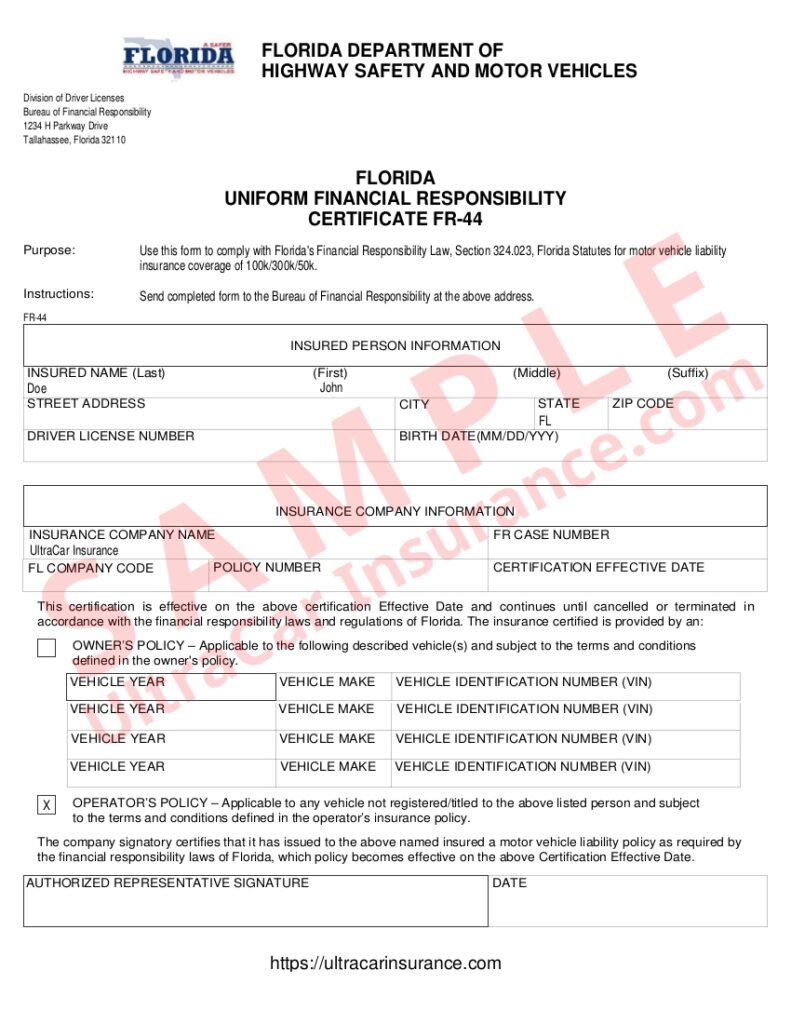

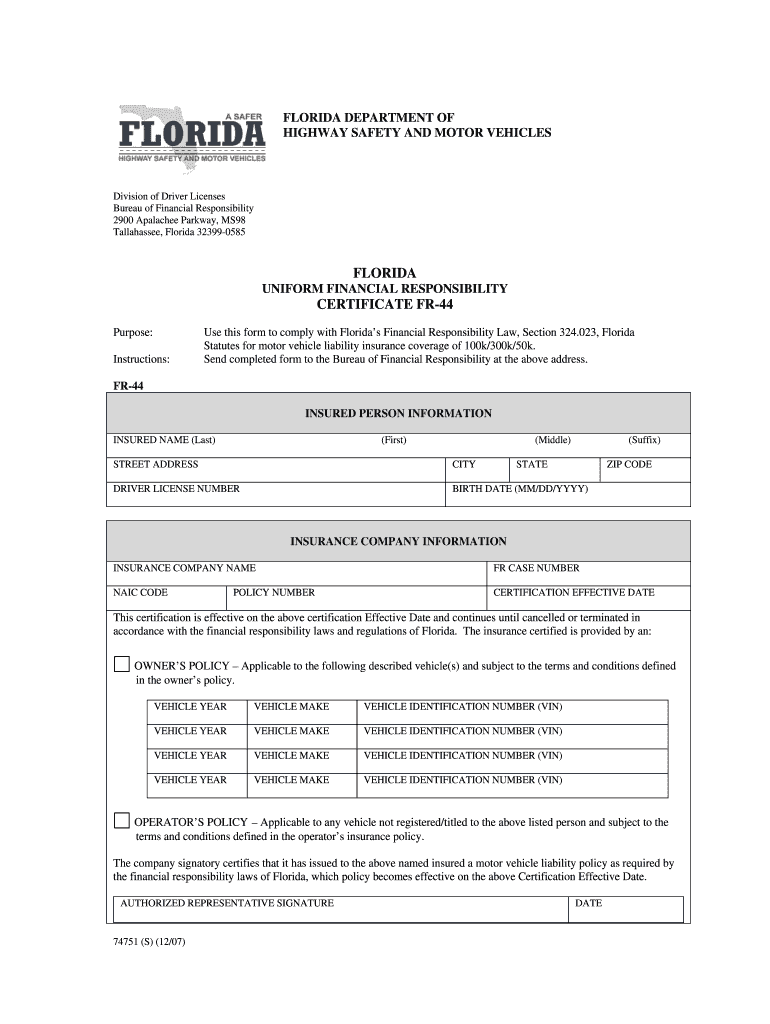

Fr44 Insurance Florida. This certification is similar to sr22 which is the regular requirement before. If you need fr44 florida insurance, we are the right company for you. While all florida fr44 insurance carries 100/300/50 coverage, a non owner fr44 takes the responsibility of covering a vehicle away from the insurance company. Fr44 demonstrates that you carry required liability insurance after being convicted of a dui.

About Us Florida NonOwner FR44 Insurance From floridanonownersfr44insurance.com

About Us Florida NonOwner FR44 Insurance From floridanonownersfr44insurance.com

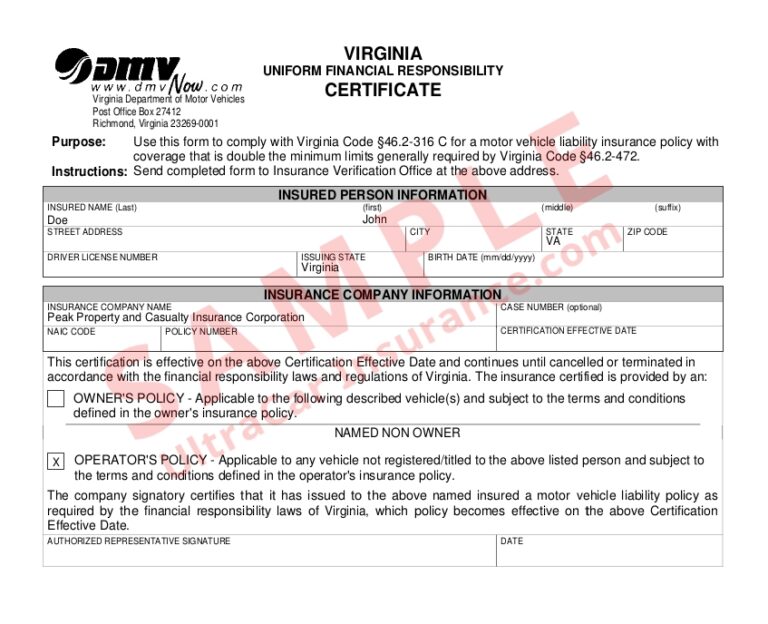

As we mentioned before, only florida and virginia currently use the fr44. While all florida fr44 insurance carries 100/300/50 coverage, a non owner fr44 takes the responsibility of covering a vehicle away from the insurance company. As of 1st october 2007, the state of florida needs at least 100/300/50 in property protection and bodily injury coverages for fr44 insurance. Insurance today has helped thousands of florida fr44 insurance clients find the lowest rates and the best insurance plans to reinstate their drivers licenses and follow state guidelines. Auto insurance companies issue the fr44, filed with the florida department of highway safety and motor vehicles (dmv), once your premium is paid in full. Fr44 demonstrates that you carry required liability insurance after being convicted of a dui.

However, fr44s require a higher limit of coverage to be maintained and require you to pay for 6 months of coverage upfront.

Florida introduced the fr44 insurance policy on february of 2008. $10,000 for injury to one person, $20,000 for injury to two or more people, and $10,000 for property damage. An fr44 insurance filing is similar to a sr22; If you don’t own a vehicle, you can qualify. This is a very important part of the process. When you’re looking for insurance, especially fr44 or sr22 insurance in florida, the last thing you want to do is to feel overwhelmed by too many options, too many questions or overpriced.

Source: youtube.com

Source: youtube.com

Some neighborhoods have higher losses than others. While all florida fr44 insurance carries 100/300/50 coverage, a non owner fr44 takes the responsibility of covering a vehicle away from the insurance company. The minimum liability requirements for florida non owner fr44 policies increase from 10/20/10 to 100/300/50. This is a very important part of the process. Because of the seriousness of impaired driving, the coverage and premiums for fr44 insurance are much higher.

Source: floridanonownersfr44insurance.com

Source: floridanonownersfr44insurance.com

Fr44 insurance florida is available within 5 minutes of. The cost of fr44 insurance is determined by your state’s minimum liability requirements. Fr44 insurance florida is available within 5 minutes of. Florida introduced the fr44 insurance policy on february of 2008. Either form verifies that convicted drivers are.

Source: mylovingstardoll.blogspot.com

Source: mylovingstardoll.blogspot.com

Our local team of experts boasts over a combined 30 years of experience and are standing by to answer your questions and get you back on the road. Sample florida fr44 auto insurance rates: That means that the insurer pays up to $100,000 per person injured and $300,000 per accident. Auto insurance companies issue the fr44, filed with the florida department of highway safety and motor vehicles (dmv), once your premium is paid in full. When you’re looking for insurance, especially fr44 or sr22 insurance in florida, the last thing you want to do is to feel overwhelmed by too many options, too many questions or overpriced.

Source: myfloridafr44.com

Source: myfloridafr44.com

Fr44 demonstrates that you carry required liability insurance after being convicted of a dui. $10,000 for injury to one person, $20,000 for injury to two or more people, and $10,000 for property damage. The cost of fr44 insurance is determined by your state’s minimum liability requirements. That means that the insurer pays up to $100,000 per person injured and $300,000 per accident. As an example, the required amount of fr44 insurance florida is $100,000/$300,000 worth of bodily injury liability and $50,000 of property damage liability insurance.

Source: frasesdeumaluaneteapaxionada.blogspot.com

Source: frasesdeumaluaneteapaxionada.blogspot.com

$300,000 bodily injury coverage per accident When it comes to getting florida fr44 insurance quotes, you have many options and shopping one by one could be tedious and frustrating so that’s why we’ve created an online comparative rater so that you can get multiple quotes with one simple form. In february 2008, the higher fr44 insurance coverage requirements went into effect Either form verifies that convicted drivers are. The cheapest type of fr44 insurance, by far, is the non owner policy.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

Coverage starting at midnight, care as soon as tomorrow. Fr44 demonstrates that you carry required liability insurance after being convicted of a dui. A fr44 insurance florida policy is required before the ignition interlock company will install the device. However, fr44s require a higher limit of coverage to be maintained and require you to pay for 6 months of coverage upfront. There are differences though with sr22 and fr44 which includes higher liability limits are required for the latter.

Source: floridafr44insuranceagency.com

Source: floridafr44insuranceagency.com

$100/300,000 bi liability $50,000 pd liability $500 deductible comp & collision on a 2005 toyota camry. Insurance today has helped thousands of florida fr44 insurance clients find the lowest rates and the best insurance plans to reinstate their drivers licenses and follow state guidelines. The other big difference is the amount of liability insurance that is required. Florida introduced the fr44 insurance policy on february of 2008. If you don’t own a vehicle, you can qualify.

Source: cheapfr44insurance.com

Source: cheapfr44insurance.com

Compared to the cost of upgrading an. Insurance today has helped thousands of florida fr44 insurance clients find the lowest rates and the best insurance plans to reinstate their drivers licenses and follow state guidelines. Fr44 insurance florida is available within 5 minutes of. A fr44 insurance florida policy is required before the ignition interlock company will install the device. Some neighborhoods have higher losses than others.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

When you’re looking for insurance, especially fr44 or sr22 insurance in florida, the last thing you want to do is to feel overwhelmed by too many options, too many questions or overpriced. When it comes to getting florida fr44 insurance quotes, you have many options and shopping one by one could be tedious and frustrating so that’s why we’ve created an online comparative rater so that you can get multiple quotes with one simple form. That means that the insurer pays up to $100,000 per person injured and $300,000 per accident. As we mentioned before, only florida and virginia currently use the fr44. Compared to the cost of upgrading an.

Source: selectsr22insurance.com

Source: selectsr22insurance.com

As an example, the required amount of fr44 insurance florida is $100,000/$300,000 worth of bodily injury liability and $50,000 of property damage liability insurance. $100,000 bodily injury coverage per person; Sample florida fr44 auto insurance rates: $100/300,000 bi liability $50,000 pd liability $500 deductible comp & collision on a 2005 toyota camry. We put customers first, we have been in business for over 10 years and specialize in florida fr44 insurance.

Source: cheap-florida-fr44.com

Source: cheap-florida-fr44.com

Florida introduced the fr44 insurance policy on february of 2008. The other big difference is the amount of liability insurance that is required. In just a couple of minutes, we’ll display the rates of some of the best carriers offering fr44. Our local team of experts boasts over a combined 30 years of experience and are standing by to answer your questions and get you back on the road. While all florida fr44 insurance carries 100/300/50 coverage, a non owner fr44 takes the responsibility of covering a vehicle away from the insurance company.

Source: signnow.com

Source: signnow.com

Insurance today has helped thousands of florida fr44 insurance clients find the lowest rates and the best insurance plans to reinstate their drivers licenses and follow state guidelines. When it comes to getting florida fr44 insurance quotes, you have many options and shopping one by one could be tedious and frustrating so that’s why we’ve created an online comparative rater so that you can get multiple quotes with one simple form. Fr44 demonstrates that you carry required liability insurance after being convicted of a dui. However, fr44s require a higher limit of coverage to be maintained and require you to pay for 6 months of coverage upfront. If there’s damage to personal property, the insurance company will cover them up to $50,000.

Source: fr44insuranceflorida.us

Source: fr44insuranceflorida.us

In just a couple of minutes, we’ll display the rates of some of the best carriers offering fr44. Your age, driving record, and demographics will play a large part in the pricing of your fr44 insurance florida policy. However, fr44s require a higher limit of coverage to be maintained and require you to pay for 6 months of coverage upfront. If you don’t own a vehicle, you can qualify. $100,000 bodily injury coverage per person;

Source: youtube.com

Source: youtube.com

When you’re looking for insurance, especially fr44 or sr22 insurance in florida, the last thing you want to do is to feel overwhelmed by too many options, too many questions or overpriced. The cheapest type of fr44 insurance, by far, is the non owner policy. Our local team of experts boasts over a combined 30 years of experience and are standing by to answer your questions and get you back on the road. If you need fr44 florida insurance, we are the right company for you. In february 2008, the higher fr44 insurance coverage requirements went into effect

Source: enrikesrcp.blogspot.com

Source: enrikesrcp.blogspot.com

An fr44 insurance filing is similar to a sr22; Insurance today has helped thousands of florida fr44 insurance clients find the lowest rates and the best insurance plans to reinstate their drivers licenses and follow state guidelines. In just a couple of minutes, we’ll display the rates of some of the best carriers offering fr44. That means that the insurer pays up to $100,000 per person injured and $300,000 per accident. Compared to the cost of upgrading an.

Source: carinsuranceguidebook.com

Source: carinsuranceguidebook.com

If you need fr44 florida insurance, we are the right company for you. There are differences though with sr22 and fr44 which includes higher liability limits are required for the latter. That means that the insurer pays up to $100,000 per person injured and $300,000 per accident. If there’s damage to personal property, the insurance company will cover them up to $50,000. The cost of fr44 insurance is determined by your state’s minimum liability requirements.

Source: insurancediaries.com

Source: insurancediaries.com

As we mentioned before, only florida and virginia currently use the fr44. If there’s damage to personal property, the insurance company will cover them up to $50,000. Compared to the cost of upgrading an. Coverage starting at midnight, care as soon as tomorrow. Our local team of experts boasts over a combined 30 years of experience and are standing by to answer your questions and get you back on the road.

Source: cheap-florida-fr44.com

Source: cheap-florida-fr44.com

Either form verifies that convicted drivers are. If you need fr44 florida insurance, we are the right company for you. Sample florida fr44 auto insurance rates: There are differences though with sr22 and fr44 which includes higher liability limits are required for the latter. When it comes to getting florida fr44 insurance quotes, you have many options and shopping one by one could be tedious and frustrating so that’s why we’ve created an online comparative rater so that you can get multiple quotes with one simple form.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fr44 insurance florida by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.