Your Fr 44 insurance virginia images are available in this site. Fr 44 insurance virginia are a topic that is being searched for and liked by netizens now. You can Get the Fr 44 insurance virginia files here. Get all royalty-free vectors.

If you’re searching for fr 44 insurance virginia images information linked to the fr 44 insurance virginia interest, you have visit the ideal site. Our site always gives you suggestions for seeking the maximum quality video and picture content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

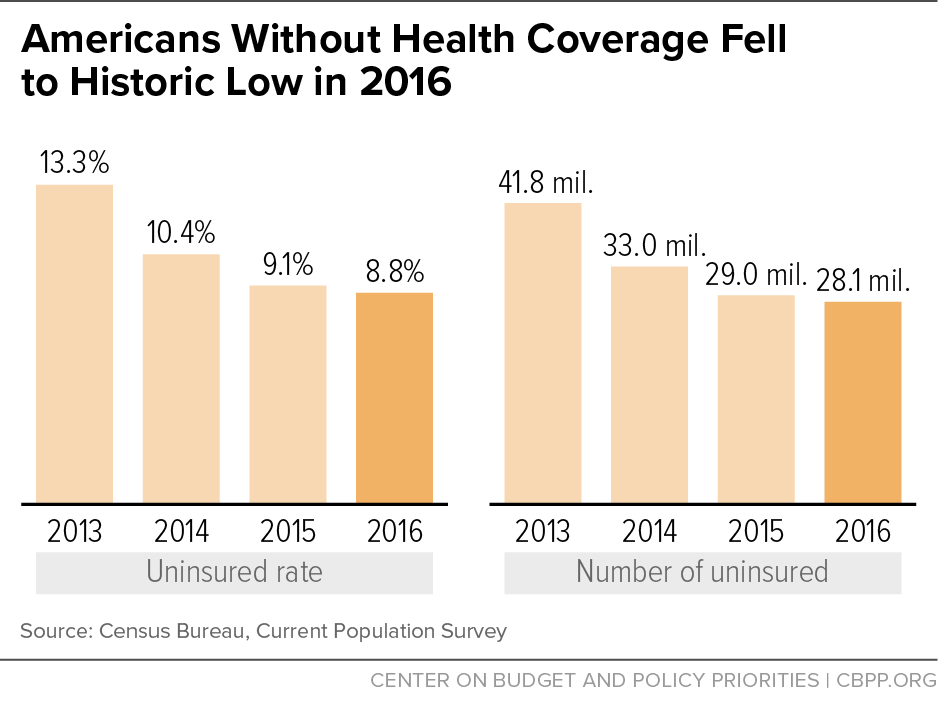

Fr 44 Insurance Virginia. In virginia, the dmv requires you to maintain sr22 insurance for three years in order to keep your driver. Sr22 / fr44 insurance low rates. $50,000 of bodily injury liability coverage per person, $100,000 of bodily injury liability coverage per accident and $40,000 of. Driving while under the influence of alcohol, drugs or intoxicants;

Nevada Insurance Licensing / Virginia SR22 FR44 Insurance From foxysletters.blogspot.com

If you need help ~ for sr22/fr44/sr26/fr46 insurance reporting data exchange questions call: With an fr44 your liability limits must be equal to or greater than $50,000 per person / $100,000 per accident / $40,000 property damage. Maiming someone in a car acci (6). Fr44 proves that you have the required liability insurance following a conviction for: $40,000required liability coverage, per person: $50,000 of bodily injury liability coverage per person, $100,000 of bodily injury liability coverage per accident and $40,000 of.

For general information regarding the sr22/fr44/sr26/fr46 insurance reporting data exchange process click the help feature in the top right hand corner of your screens.

Fr44 insurance is a guarantee of future insurance coverage and proof of financial responsibility. If your license is suspended, your state might require you to prove that you have car insurance before your license gets reinstated. Florida and virginia are only two states that use the fr44 form after a driver has been convicted of driving without insurance or convicted of a serious traffic violation. Those convicted, must carry higher liability limits on their auto or operator only insurance (5). For general information regarding the sr22/fr44/sr26/fr46 insurance reporting data exchange process click the help feature in the top right hand corner of your screens. You should be able to buy car insurance as you normally would.

Source: pdffiller.com

Source: pdffiller.com

What is fr44 insurance in virginia? Not all vehicles or drivers are eligible for discounts. Maiming someone in a car acci (6). Your policy has to stay current during a specific time (in most cases three years). Driving while under the influence of alcohol, drugs or intoxicants;

Source: keensinsuranceagency.com

Source: keensinsuranceagency.com

The fr 44 form is required by law for drivers convicted of a dui. With an fr44 your liability limits must be equal to or greater than $50,000 per person / $100,000 per accident / $40,000 property damage. Maiming someone in a car acci (6). Send completed form to insurance verification office at the above address. Maiming while under the influence

Source: sr22insurancequotes.org

Source: sr22insurancequotes.org

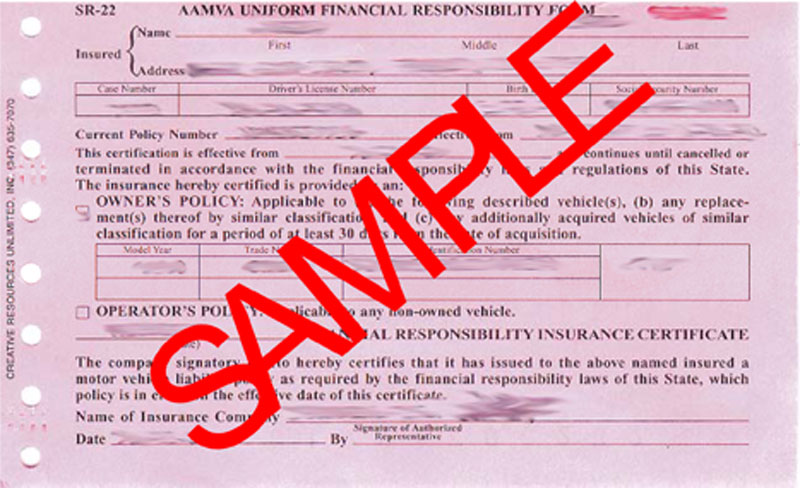

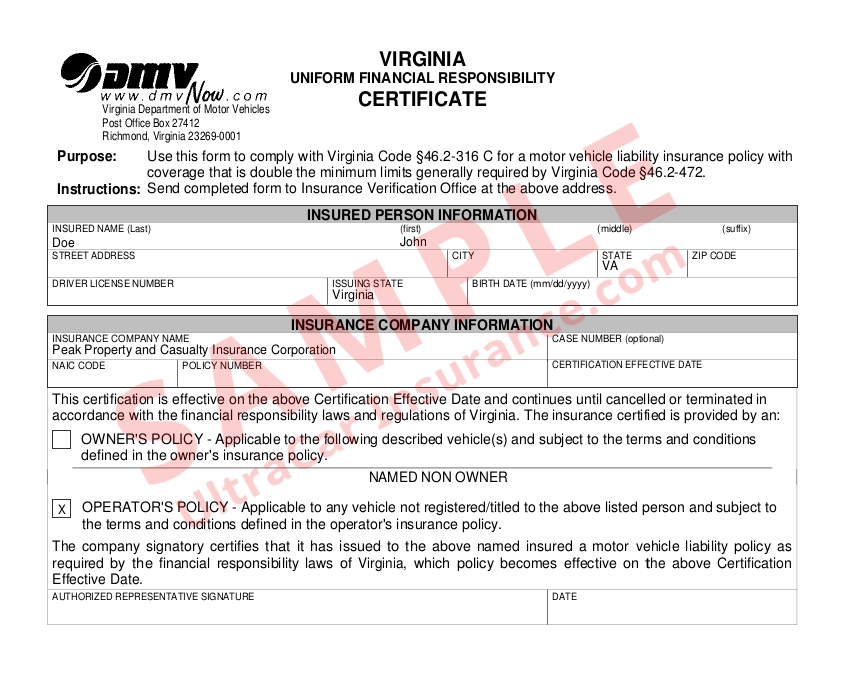

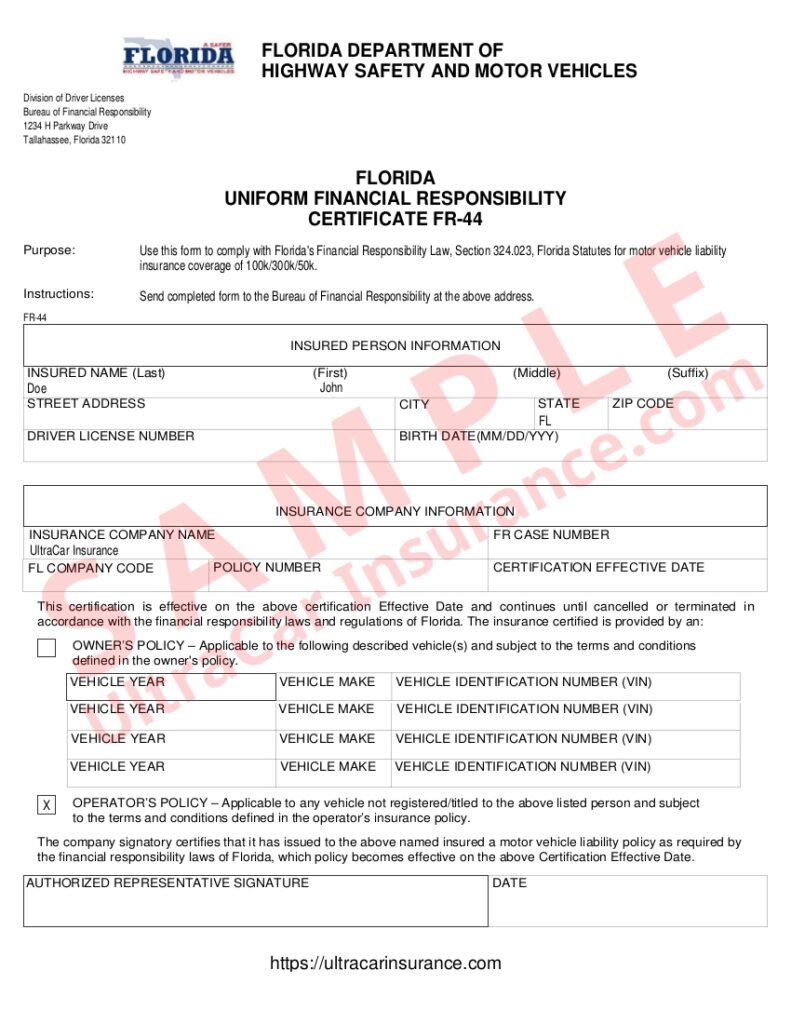

Fr 44 (01/01/2008) virginia uniform financial responsibility certificate insured name (last) (first) (middle) street address city state zip code driver license number issuing state birth date (mm/dd/yyyy) policy effective date naic code insurance. Serving auto insurance needs for all of virginia call our office for a free auto insurance quote! The state of virginia was the first state in the country to implement the fr44 filing system specifically for alcohol or drug related offenses. What is the difference between sr22 insurance and fr44 insurance?. Send completed form to insurance verification office at the above address.

Source: get-quotes.org

Source: get-quotes.org

Florida and virginia are only two states that use the fr44 form after a driver has been convicted of driving without insurance or convicted of a serious traffic violation. For general information regarding the sr22/fr44/sr26/fr46 insurance reporting data exchange process click the help feature in the top right hand corner of your screens. An fr44 is not an insurance policy, but a form that ensures you have the proper car insurance when you are out there on the road. The fr 44 form is required by law for drivers convicted of a dui. Maiming while under the influence

Source: foxysletters.blogspot.com

The fr 44 form is required by law for drivers convicted of a dui. Driving while under the influence of alcohol, drugs or intoxicants; An fr44 is not an insurance policy, but a form that ensures you have the proper car insurance when you are out there on the road. Florida and virginia are only two states that use the fr44 form after a driver has been convicted of driving without insurance or convicted of. A virginia fr44 insurance filing is similar to an sr22 filing, but fr44 insurance minimum coverage requirements for fr44 insurance is much higher than for standard liability insurance requirements.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

Fr44 insurance is a guarantee of future insurance coverage and proof of financial responsibility. Sr22 / fr44 insurance low rates. With an fr44 your liability limits must be equal to or greater than $50,000 per person / $100,000 per accident / $40,000 property damage. Your policy has to stay current during a specific time (in most cases three years). For general information regarding the sr22/fr44/sr26/fr46 insurance reporting data exchange process click the help feature in the top right hand corner of your screens.

Source: theandrewagency.com

Source: theandrewagency.com

Driving while under the influence of alcohol, drugs or intoxicants; Florida and virginia are only two states that use the fr44 form after a driver has been convicted of driving without insurance or convicted of a serious traffic violation. The fr 44 form is required by law for drivers convicted of a dui. You should be able to buy car insurance as you normally would. In virginia, the dmv requires you to maintain sr22 insurance for three years in order to keep your driver.

Source: sr22va.myfirstoptioninsurance.com

Source: sr22va.myfirstoptioninsurance.com

Not all vehicles or drivers are eligible for discounts. In virginia, the dmv requires you to maintain sr22 insurance for three years in order to keep your driver. For general information regarding the sr22/fr44/sr26/fr46 insurance reporting data exchange process click the help feature in the top right hand corner of your screens. Those convicted, must carry higher liability limits on their auto or operator only insurance (5). A virginia fr44 insurance filing is similar to an sr22 filing, but fr44 insurance minimum coverage requirements for fr44 insurance is much higher than for standard liability insurance requirements.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

If your license is suspended, your state might require you to prove that you have car insurance before your license gets reinstated. Fr44 proves that you have the required liability insurance following a conviction for: An insurance provider endorses the fr44 certificate to an insurance policy, which is filed with the virginia dmv by an insurance provider. If you need help ~ for sr22/fr44/sr26/fr46 insurance reporting data exchange questions call: Maiming someone in a car acci (6).

Source: sr22insurancequotes.org

Source: sr22insurancequotes.org

With an fr44 your liability limits must be equal to or greater than $50,000 per person / $100,000 per accident / $40,000 property damage. Maiming while under the influence Maiming someone in a car acci (6). You should be able to buy car insurance as you normally would. The fr 44 form is required by law for drivers convicted of a dui.

Fr 44 (01/01/2008) virginia uniform financial responsibility certificate insured name (last) (first) (middle) street address city state zip code driver license number issuing state birth date (mm/dd/yyyy) policy effective date naic code insurance. Not all vehicles or drivers are eligible for discounts. $50,000 of bodily injury liability coverage per person, $100,000 of bodily injury liability coverage per accident and $40,000 of. Fr44 proves that you have the required liability insurance following a conviction for: An fr44 is not an insurance policy, but a form that ensures you have the proper car insurance when you are out there on the road.

Source: fr44fast.com

Source: fr44fast.com

If the form is not submitted, you cannot legally drive in virginia. Your policy has to stay current during a specific time (in most cases three years). $40,000required liability coverage, per person: Those convicted, must carry higher liability limits on their auto or operator only insurance (5). Fr44 insurance is a guarantee of future insurance coverage and proof of financial responsibility.

Source: youtube.com

Source: youtube.com

$50,000 of bodily injury coverage per person For general information regarding the sr22/fr44/sr26/fr46 insurance reporting data exchange process click the help feature in the top right hand corner of your screens. “fr 44” simply refers to form fr 44. With an fr44 your liability limits must be equal to or greater than $50,000 per person / $100,000 per accident / $40,000 property damage. Fr44 insurance is a guarantee of future insurance coverage and proof of financial responsibility.

Source: kenyachambermines.com

Source: kenyachambermines.com

Not all vehicles or drivers are eligible for discounts. If you need help ~ for sr22/fr44/sr26/fr46 insurance reporting data exchange questions call: Florida and virginia are only two states that use the fr44 form after a driver has been convicted of driving without insurance or convicted of. An insurance provider endorses the fr44 certificate to an insurance policy, which is filed with the virginia dmv by an insurance provider. The state of virginia was the first state in the country to implement the fr44 filing system specifically for alcohol or drug related offenses.

Source: archibaldinsurance.com

Source: archibaldinsurance.com

An insurance provider endorses the fr44 certificate to an insurance policy, which is filed with the virginia dmv by an insurance provider. Not all vehicles or drivers are eligible for discounts. $40,000required liability coverage, per person: $50,000 of bodily injury coverage per person $50,000 of bodily injury liability coverage per person, $100,000 of bodily injury liability coverage per accident and $40,000 of.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

Serving auto insurance needs for all of virginia call our office for a free auto insurance quote! The fr 44 form is required by law for drivers convicted of a dui. Fr44 proves that you have the required liability insurance following a conviction for: $50,000 of bodily injury coverage per person The state of virginia was the first state in the country to implement the fr44 filing system specifically for alcohol or drug related offenses.

Source: youtube.com

Source: youtube.com

Fr 44 (01/01/2008) virginia uniform financial responsibility certificate insured name (last) (first) (middle) street address city state zip code driver license number issuing state birth date (mm/dd/yyyy) policy effective date naic code insurance. Florida and virginia are only two states that use the fr44 form after a driver has been convicted of driving without insurance or convicted of a serious traffic violation. $50,000 of bodily injury coverage per person You should be able to buy car insurance as you normally would. “fr 44” simply refers to form fr 44.

Source: ultracarinsurance.com

Source: ultracarinsurance.com

Sr22 / fr44 insurance low rates. The fr 44 form is required by law for drivers convicted of a dui. An insurance provider endorses the fr44 certificate to an insurance policy, which is filed with the virginia dmv by an insurance provider. The state of virginia was the first state in the country to implement the fr44 filing system specifically for alcohol or drug related offenses. If your license is suspended, your state might require you to prove that you have car insurance before your license gets reinstated.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fr 44 insurance virginia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.