Your Force placed insurance auto images are available. Force placed insurance auto are a topic that is being searched for and liked by netizens now. You can Get the Force placed insurance auto files here. Get all royalty-free images.

If you’re searching for force placed insurance auto images information connected with to the force placed insurance auto keyword, you have come to the right site. Our site always gives you hints for viewing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Force Placed Insurance Auto. You don�t have a homeowners� policy in place, either because you didn�t buy one or because the. Essentially, lenders require that borrowers maintain insurance on their homes and sometimes cars. Force placed insurance is the cheapest way to protect the lender’s interests by adding the cost of the insurance to the car payments. Force placed insurance is a term that most people are not familiar with.

What Does ForcePlaced Insurance Mean for Homeowners From labovick.com

What Does ForcePlaced Insurance Mean for Homeowners From labovick.com

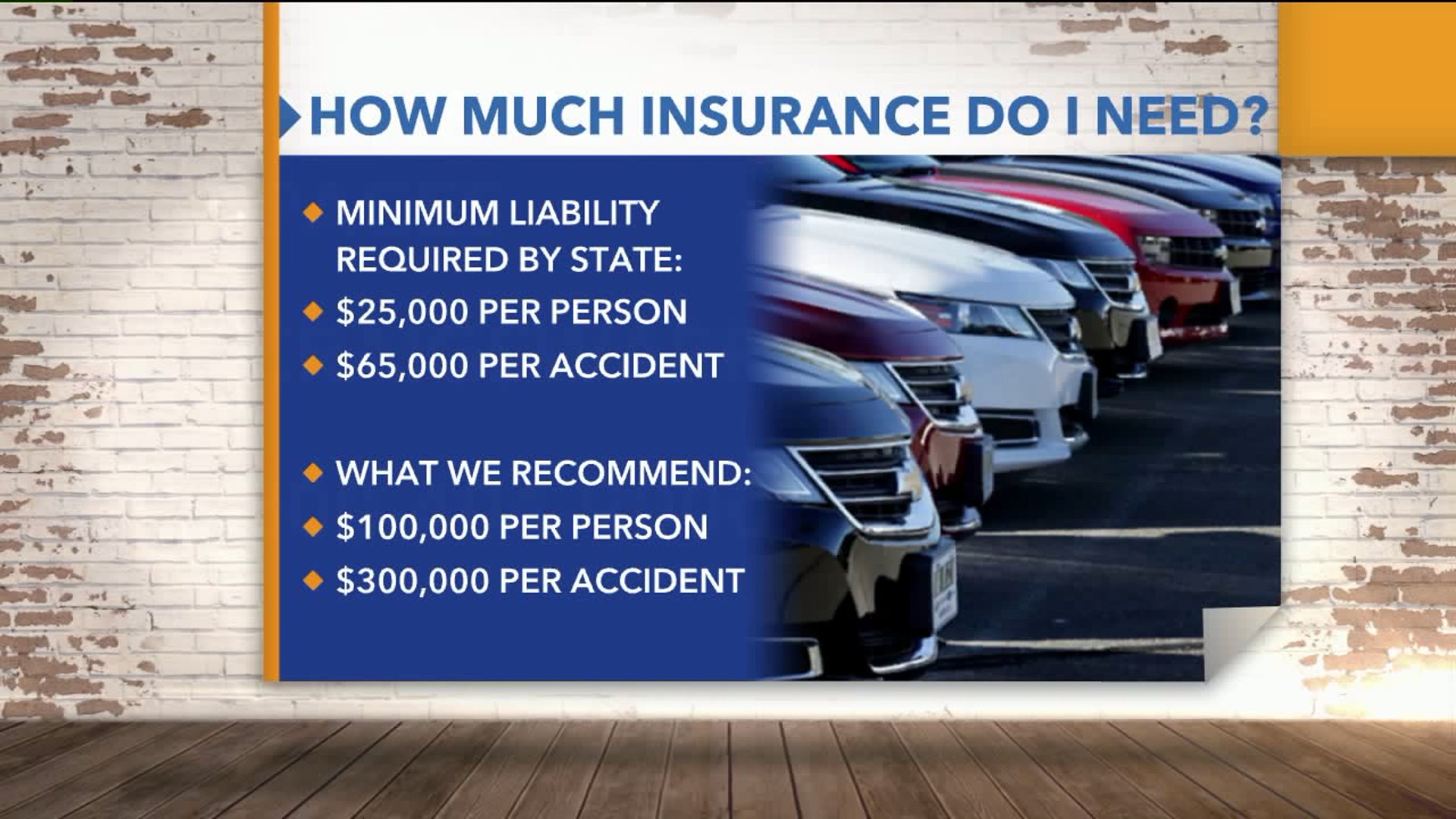

In order to get a loan to buy a vehicle, you must have insurance to cover the vehicle itself. The companies that provide force placed insurance describe it as a policy designed to protect both the lender and the borrower from loss. In most cases, you will have to buy the minimum liability insurance for your state. Forced placed auto insurance is very expensive, as well. Wednesday, january 9, 2013 3:06:01 pm. That’s partly but not completely true.

When it comes to car insurance, most people are familiar with their state’s minimum insurance requirements, as well as the insurance requirements of their lender.however, force placed insurance on a vehicle can mean excessive costs and.

It�s an insurance policy that’s put in place by a lender if your coverage lapses, doesn�t include enough protection for the vehicle, or you simply don�t get insurance as promised. Force placed insurance is a term that most people are not familiar with. This is far cheaper than the cost of civil litigation. You may be considered higher risk if you don’t have your own car insurance. �force placed� car insurance means higher premiums. If you have a car loan but not enough insurance, your lender can place you with a forced insurance policy to fulfill your contract.

Source: creditkarma.com

Source: creditkarma.com

�force placed� car insurance means higher premiums. This is far cheaper than the cost of civil litigation. In order to get a loan to buy a vehicle, you must have insurance to cover the vehicle itself. What they don’t know will come back to hurt them. In other words, if $3000 worth of damage is incurred on the car with a loan balance of $10,000, forced placed insurance will cover the cost of repairs.

Source: autocreditexpress.com

Source: autocreditexpress.com

In other words, if $3000 worth of damage is incurred on the car with a loan balance of $10,000, forced placed insurance will cover the cost of repairs. You may be considered higher risk if you don’t have your own car insurance. That’s partly but not completely true. But along with a car come costs like loan payments, fuel, parking, and car insurance. If you have a car loan but not enough insurance, your lender can place you with a forced insurance policy to fulfill your contract.

Source: audetlaw.com

Source: audetlaw.com

That’s partly but not completely true. You may be considered higher risk if you don’t have your own car insurance. If you have a car loan but not enough insurance, your lender can place you with a forced insurance policy to fulfill your contract. Force placed insurance is a term that most people are not familiar with. Why your lender will require it.

Source: wiseinsurancegroup.com

Source: wiseinsurancegroup.com

If you fail to obtain insurance or you let your insurance lapse, the contract usually gives the lender the right to get insurance to cover the vehicle. Forced place insurance is intended to ensure. If a borrower fails to maintain insurance, or if insurance premiums are included in the monthly payment and a borrower defaults, the lender or servicer will “force place” an insurance policy. In other words, if $3000 worth of damage is incurred on the car with a loan balance of $10,000, forced placed insurance will cover the cost of repairs. Essentially, lenders require that borrowers maintain insurance on their homes and sometimes cars.

Source: twitter.com

Source: twitter.com

It�s an insurance policy that’s put in place by a lender if your coverage lapses, doesn�t include enough protection for the vehicle, or you simply don�t get insurance as promised. But along with a car come costs like loan payments, fuel, parking, and car insurance. If the car is totaled, the policy will pay the bank the. Last updated on december 5, 2019. Why your lender will require it.

Source: miniter.com

Source: miniter.com

But it is a necessity for the lender, to protect its interests. Why your lender will require it. When it comes to car insurance, most people are familiar with their state’s minimum insurance requirements, as well as the insurance requirements of their lender.however, force placed insurance on a vehicle can mean excessive costs and. If you fail to obtain insurance or you let your insurance lapse, the contract usually gives the lender the right to get insurance to cover the vehicle. You don�t have a homeowners� policy in place, either because you didn�t buy one or because the.

The following are a few examples of when a servicer might place hazard insurance on your home: If you fail to obtain insurance or you let your insurance lapse, the contract usually gives the lender the right to get insurance to cover the vehicle. If you have a car loan but not enough insurance, your lender can place you with a forced insurance policy to fulfill your contract. Just as mortgage lenders can force homeowners to carry coverage against loss of a house, auto lenders can and do institute forced place insurance when borrowers fail to maintain insurance for a car financed by a loan. In the case of home, condo, flood and wind versions of force placed insurance:

Source: labovick.com

Source: labovick.com

The forced placed insurance policy will repair that damage or replace the vehicle up to the current value of what the bank loans you. Essentially, lenders require that borrowers maintain insurance on their homes and sometimes cars. It�s an insurance policy that’s put in place by a lender if your coverage lapses, doesn�t include enough protection for the vehicle, or you simply don�t get insurance as promised. If you have a car loan but not enough insurance, your lender can place you with a forced insurance policy to fulfill your contract. If the borrower refuses to pay the cost of insurance, the lender can make the full payment of the car.

Source: classaction.org

Source: classaction.org

You don�t have a homeowners� policy in place, either because you didn�t buy one or because the. Essentially, lenders require that borrowers maintain insurance on their homes and sometimes cars. When it comes to car insurance, most people are familiar with their state’s minimum insurance requirements, as well as the insurance requirements of their lender.however, force placed insurance on a vehicle can mean excessive costs and. It�s an insurance policy that’s put in place by a lender if your coverage lapses, doesn�t include enough protection for the vehicle, or you simply don�t get insurance as promised. In other words, if $3000 worth of damage is incurred on the car with a loan balance of $10,000, forced placed insurance will cover the cost of repairs.

Source: moneycrashers.com

Source: moneycrashers.com

Essentially, lenders require that borrowers maintain insurance on their homes and sometimes cars. Forced place insurance is intended to ensure. Why your lender will require it. Force placed insurance is a term that most people are not familiar with. The companies that provide force placed insurance describe it as a policy designed to protect both the lender and the borrower from loss.

Source: youtube.com

Source: youtube.com

It�s an insurance policy that’s put in place by a lender if your coverage lapses, doesn�t include enough protection for the vehicle, or you simply don�t get insurance as promised. You don�t have a homeowners� policy in place, either because you didn�t buy one or because the. If the car is totaled, the policy will pay the bank the. This is far cheaper than the cost of civil litigation. When it comes to car insurance, most people are familiar with their state’s minimum insurance requirements, as well as the insurance requirements of their lender.however, force placed insurance on a vehicle can mean excessive costs and.

Source: elliotwhittier.com

Source: elliotwhittier.com

But along with a car come costs like loan payments, fuel, parking, and car insurance. If the car is totaled, the policy will pay the bank the. Just as mortgage lenders can force homeowners to carry coverage against loss of a house, auto lenders can and do institute forced place insurance when borrowers fail to maintain insurance for a car financed by a loan. In the case of home, condo, flood and wind versions of force placed insurance: Forced placed auto insurance is very expensive, as well.

Source: onenewspage.com

Source: onenewspage.com

So if a car buyer is in the market for auto insurance, it behooves him or her to pay careful attention to what they’re buying. But along with a car come costs like loan payments, fuel, parking, and car insurance. If you have a car loan but not enough insurance, your lender can place you with a forced insurance policy to fulfill your contract. If the borrower refuses to pay the cost of insurance, the lender can make the full payment of the car. So if a car buyer is in the market for auto insurance, it behooves him or her to pay careful attention to what they’re buying.

Source: insurancetrust.us

Source: insurancetrust.us

If the borrower refuses to pay the cost of insurance, the lender can make the full payment of the car. If you have a car loan but not enough insurance, your lender can place you with a forced insurance policy to fulfill your contract. If the borrower refuses to pay the cost of insurance, the lender can make the full payment of the car. Force placed insurance is the cheapest way to protect the lender’s interests by adding the cost of the insurance to the car payments. Forced placed auto insurance is very expensive, as well.

Source: fox13now.com

Source: fox13now.com

This is far cheaper than the cost of civil litigation. If the car is totaled, the policy will pay the bank the. So if a car buyer is in the market for auto insurance, it behooves him or her to pay careful attention to what they’re buying. In most cases, you will have to buy the minimum liability insurance for your state. The forced placed insurance policy will repair that damage or replace the vehicle up to the current value of what the bank loans you.

Source: einsurance.com

Source: einsurance.com

Essentially, lenders require that borrowers maintain insurance on their homes and sometimes cars. You may be considered higher risk if you don’t have your own car insurance. But along with a car come costs like loan payments, fuel, parking, and car insurance. If the borrower refuses to pay the cost of insurance, the lender can make the full payment of the car. This is far cheaper than the cost of civil litigation.

Source: duaapaixonada.blogspot.com

Source: duaapaixonada.blogspot.com

Wednesday, january 9, 2013 3:06:01 pm. In order to get a loan to buy a vehicle, you must have insurance to cover the vehicle itself. The forced placed insurance policy will repair that damage or replace the vehicle up to the current value of what the bank loans you. If you have a car loan but not enough insurance, your lender can place you with a forced insurance policy to fulfill your contract. The monthly cost of having a car will go up.

Source: slideshare.net

Source: slideshare.net

The monthly cost of having a car will go up. If you have a car loan but not enough insurance, your lender can place you with a forced insurance policy to fulfill your contract. The forced placed insurance policy will repair that damage or replace the vehicle up to the current value of what the bank loans you. The monthly cost of having a car will go up. What they don’t know will come back to hurt them.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title force placed insurance auto by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.