Your Force placed flood insurance notice requirements images are ready. Force placed flood insurance notice requirements are a topic that is being searched for and liked by netizens now. You can Find and Download the Force placed flood insurance notice requirements files here. Get all royalty-free vectors.

If you’re searching for force placed flood insurance notice requirements pictures information linked to the force placed flood insurance notice requirements interest, you have pay a visit to the right site. Our site frequently gives you hints for viewing the highest quality video and picture content, please kindly surf and locate more enlightening video content and graphics that match your interests.

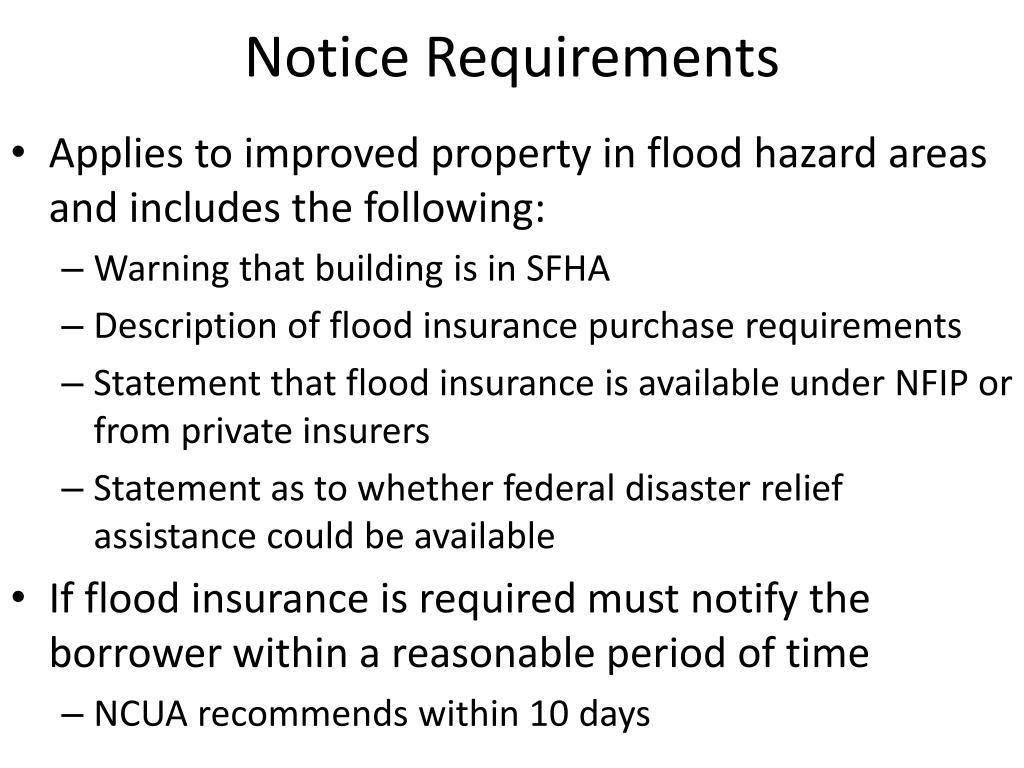

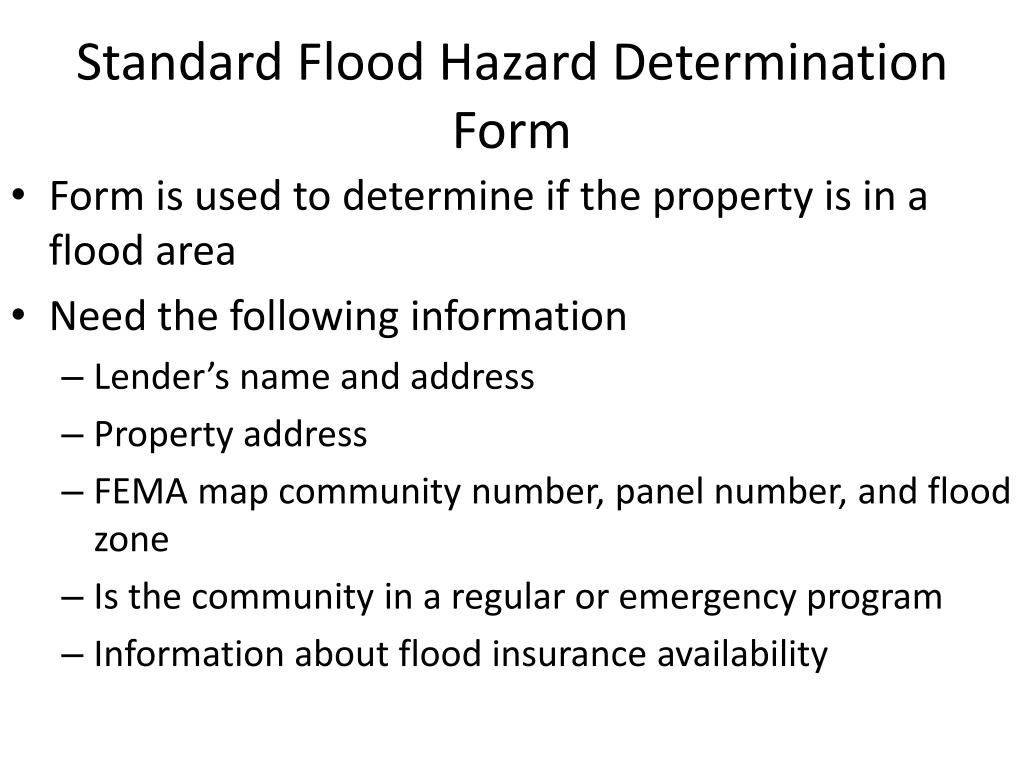

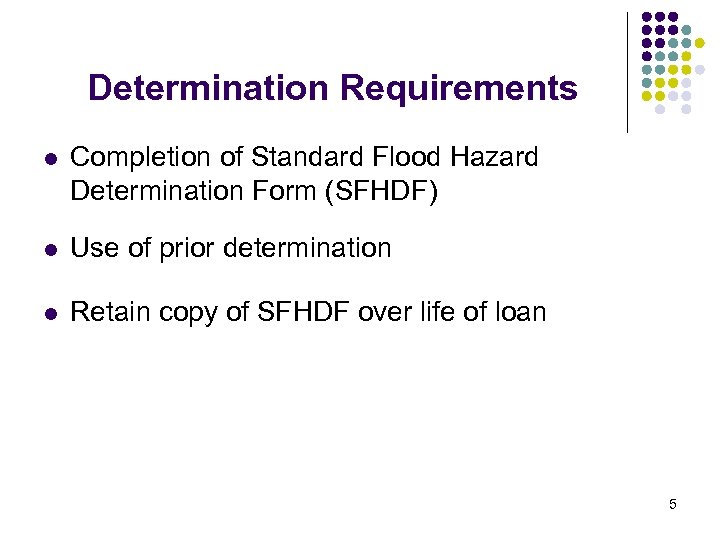

Force Placed Flood Insurance Notice Requirements. If a national bank or federal savings association, or a servicer acting on behalf of the bank or savings association, determines at any time during the term of a designated loan, that the building or mobile home and any personal property securing the designated loan is not covered by flood insurance or is covered by flood insurance in an amount less than the amount required under. Force placement 6 clarifies once a lender makes a determination that a designated loan has no or insufficient flood insurance coverage, the lender must notify the borrower and, if the borrower fails to obtain sufficient flood insurance coverage within 45 days after the original notice, the lender must purchase coverage on the borrower’s behalf and may not extend the. There is no flexibility in the flood insurance requirements. If the determination shows the improvements are in a special flood hazard area, flood insurance is required.

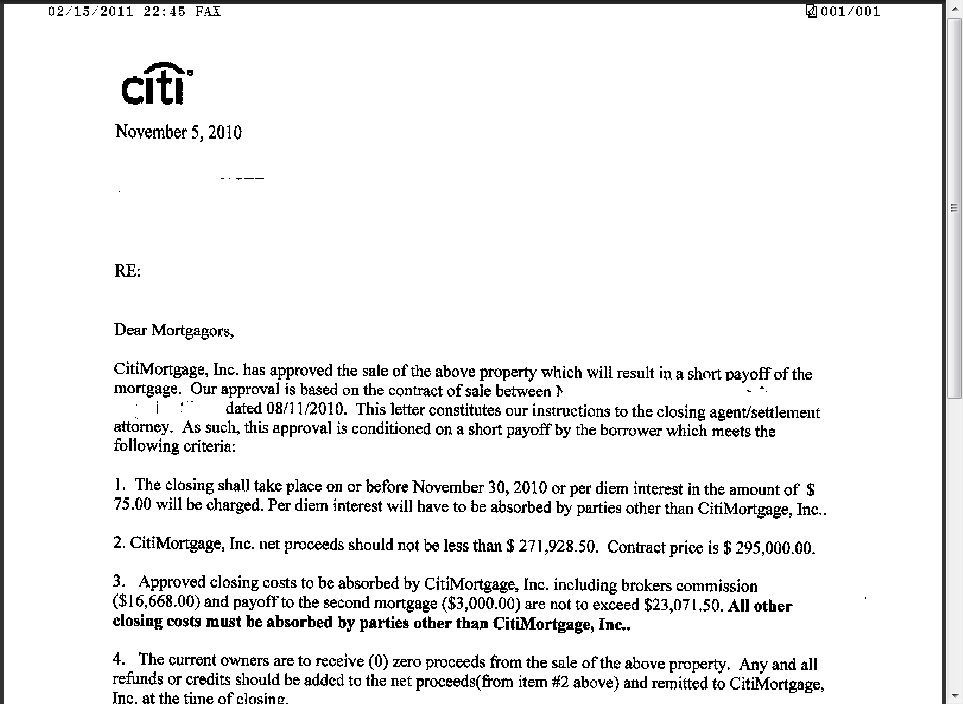

Option to Escrow for Flood Insurance Sample Letter From jackscomplianceresource.com

Option to Escrow for Flood Insurance Sample Letter From jackscomplianceresource.com

Flood insurance required by a servicer, but not required by the fdpa, falls within the scope of the new regulations. Force placement 6 clarifies once a lender makes a determination that a designated loan has no or insufficient flood insurance coverage, the lender must notify the borrower and, if the borrower fails to obtain sufficient flood insurance coverage within 45 days after the original notice, the lender must purchase coverage on the borrower’s behalf and may not extend the. To document that sufficient coverage exists, section 760.7(b)(2). The lender may send a notice prior to the expiration of “force placement authority is designed to be used if, over the term of the loan, the institution or its servicer determines that. When a lender determines the flood insurance has expired or is less than the amount required by law, the borrower must be notified to obtain adequate flood insurance within 45 days.

Us federal agencies have issued new regulations on flood insurance effective from 1 october 2015 addressing matters relating to force placed insurance, exemptions to the mandatory purchase requirement, escrow requirements and notice forms.

Force placement 6 clarifies once a lender makes a determination that a designated loan has no or insufficient flood insurance coverage, the lender must notify the borrower and, if the borrower fails to obtain sufficient flood insurance coverage within 45 days after the original notice, the lender must purchase coverage on the borrower’s behalf and may not extend the. (i) hazard insurance required by the flood disaster protection act of 1973. The lender may send a notice prior to the expiration of To document that sufficient coverage exists, section 760.7(b)(2). Us federal agencies have issued new regulations on flood insurance effective from 1 october 2015 addressing matters relating to force placed insurance, exemptions to the mandatory purchase requirement, escrow requirements and notice forms. Force placed flood insurance.force placed flood insurance lawsuits consumers may be eligible for a force placed flood insurance lawsuit if their bank or mortgage company forced or coerced them into:

Source: berkshirerealtors.net

Source: berkshirerealtors.net

(iii) hazard insurance obtained by a. • the borrower can pursue a letter of map amendment (loma) from fema. Force placement is not an option. (ii) hazard insurance obtained by a borrower but renewed by the borrower�s servicer as described in § 1024.17 (k) (1), (2), or (5). Second and final notice — please provide insurance information for [property address] dear [borrower’s name]:

Source: napavalleyaddress.com

Source: napavalleyaddress.com

If the borrower fails to obtain flood insurance within 45 days of this notice, then the credit union is required to obtain flood insurance on any properties securing a. (ii) hazard insurance obtained by a borrower but renewed by the borrower�s servicer as described in § 1024.17 (k) (1), (2), or (5). “force placement authority is designed to be used if, over the term of the loan, the institution or its servicer determines that. (a) notice and purchase of coverage. (iii) hazard insurance obtained by a.

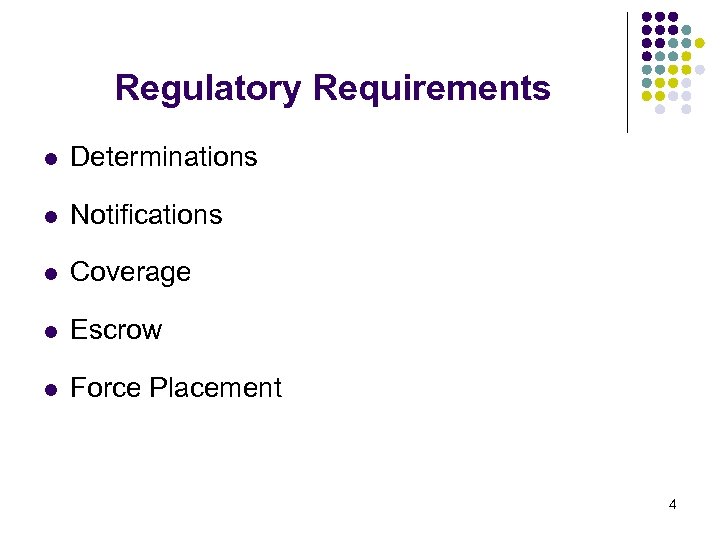

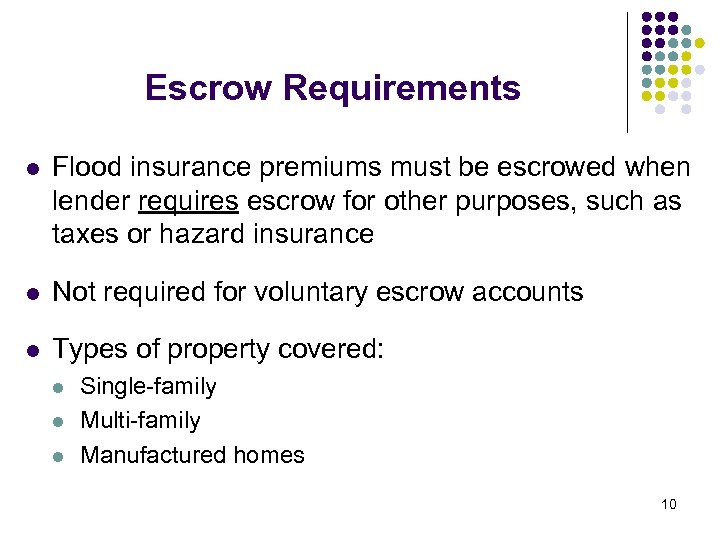

Source: slideserve.com

Source: slideserve.com

If the borrower fails to obtain flood insurance within 45 days of this notice, then the credit union is required to obtain flood insurance on any properties securing a. Avp at a bank ($17busa) when renewing a force placed flood insurance policy, is the renewal notification required to be sent 45 days prior to the expiration date of the existing. If the determination shows the improvements are in a special flood hazard area, flood insurance is required. If the borrower fails to obtain flood insurance within 45 days of this notice, then the credit union is required to obtain flood insurance on any properties securing a. “force placement authority is designed to be used if, over the term of the loan, the institution or its servicer determines that.

Source: everquote.com

Source: everquote.com

If the determination shows the improvements are in a special flood hazard area, flood insurance is required. Flood insurance required by a servicer, but not required by the fdpa, falls within the scope of the new regulations. If the determination shows the improvements are in a special flood hazard area, flood insurance is required. Force placement 6 clarifies once a lender makes a determination that a designated loan has no or insufficient flood insurance coverage, the lender must notify the borrower and, if the borrower fails to obtain sufficient flood insurance coverage within 45 days after the original notice, the lender must purchase coverage on the borrower’s behalf and may not extend the. See the answer to the previous question.

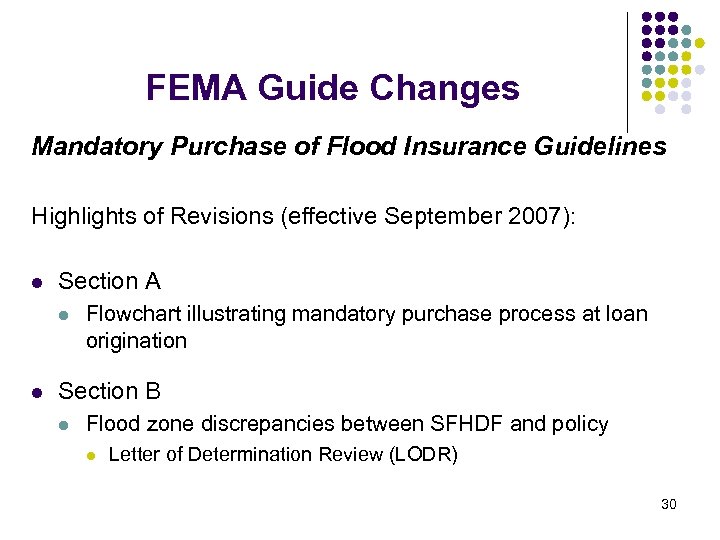

Source: slideserve.com

Source: slideserve.com

(iii) hazard insurance obtained by a. (ii) hazard insurance obtained by a borrower but renewed by the borrower�s servicer as described in § 1024.17 (k) (1), (2), or (5). “force placement authority is designed to be used if, over the term of the loan, the institution or its servicer determines that. Us federal agencies have issued new regulations on flood insurance effective from 1 october 2015 addressing matters relating to force placed insurance, exemptions to the mandatory purchase requirement, escrow requirements and notice forms. Avp at a bank ($17busa) when renewing a force placed flood insurance policy, is the renewal notification required to be sent 45 days prior to the expiration date of the existing.

Source: present5.com

Source: present5.com

See the answer to the previous question. Flood insurance required by a servicer, but not required by the fdpa, falls within the scope of the new regulations. See the answer to the previous question. There is no flexibility in the flood insurance requirements. Force placement 6 clarifies once a lender makes a determination that a designated loan has no or insufficient flood insurance coverage, the lender must notify the borrower and, if the borrower fails to obtain sufficient flood insurance coverage within 45 days after the original notice, the lender must purchase coverage on the borrower’s behalf and may not extend the.

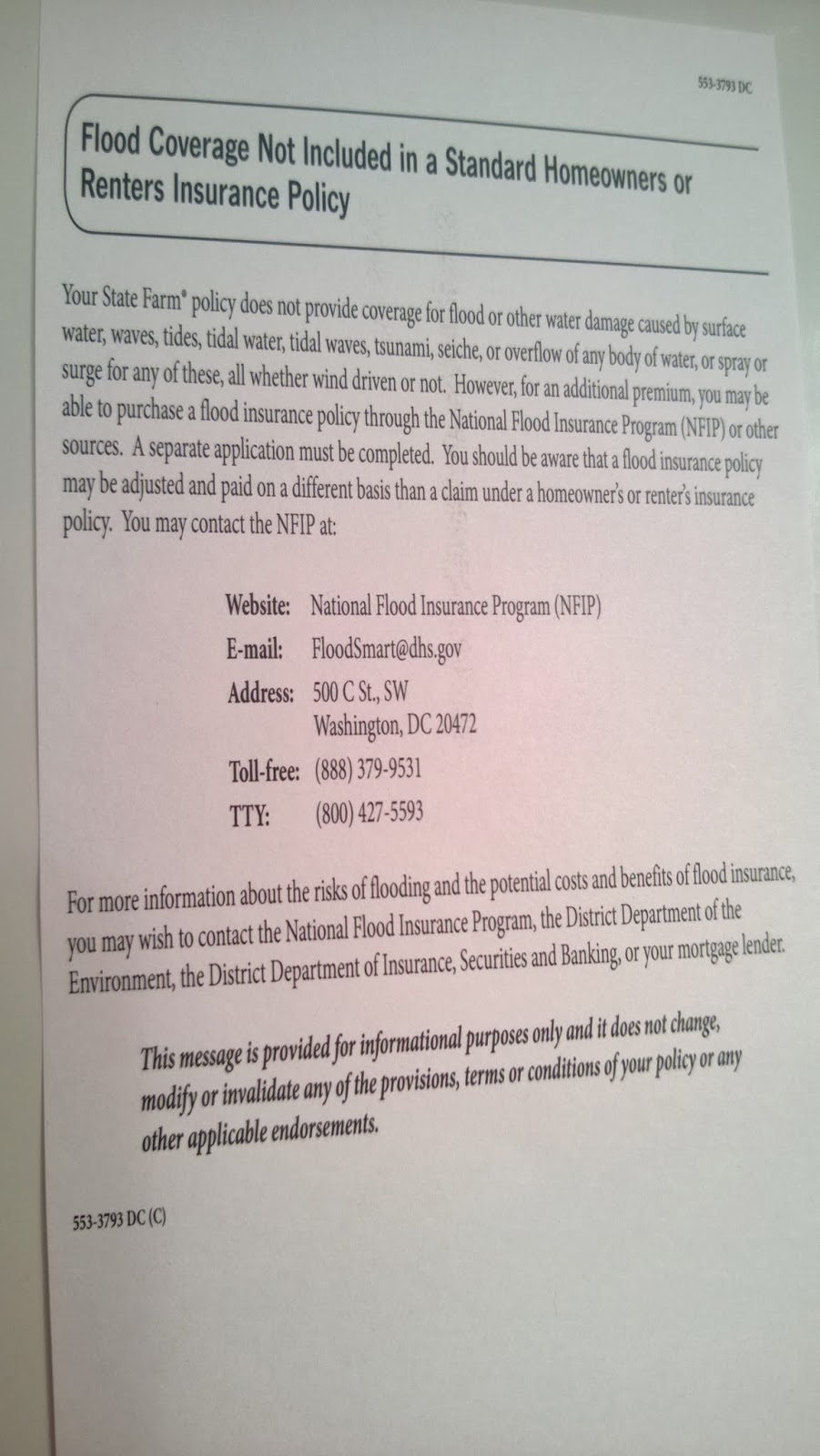

Source: bloomingdaleneighborhood.blogspot.com

Source: bloomingdaleneighborhood.blogspot.com

Force placed flood insurance.force placed flood insurance lawsuits consumers may be eligible for a force placed flood insurance lawsuit if their bank or mortgage company forced or coerced them into: Apparently, the agencies are moving toward not requiring notice, although the lender/servicer may need to communicate the fact that a premium is being added to the underlying loan obligation (or otherwise handled). To document that sufficient coverage exists, section 760.7(b)(2). Force placement 6 clarifies once a lender makes a determination that a designated loan has no or insufficient flood insurance coverage, the lender must notify the borrower and, if the borrower fails to obtain sufficient flood insurance coverage within 45 days after the original notice, the lender must purchase coverage on the borrower’s behalf and may not extend the. Us federal agencies have issued new regulations on flood insurance effective from 1 october 2015 addressing matters relating to force placed insurance, exemptions to the mandatory purchase requirement, escrow requirements and notice forms.

Source: present5.com

Source: present5.com

Us federal agencies have issued new regulations on flood insurance effective from 1 october 2015 addressing matters relating to force placed insurance, exemptions to the mandatory purchase requirement, escrow requirements and notice forms. There is no flexibility in the flood insurance requirements. • the borrower can pursue a letter of map amendment (loma) from fema. Apparently, the agencies are moving toward not requiring notice, although the lender/servicer may need to communicate the fact that a premium is being added to the underlying loan obligation (or otherwise handled). Flood insurance required by a servicer, but not required by the fdpa, falls within the scope of the new regulations.

Source: jackscomplianceresource.com

Source: jackscomplianceresource.com

(a) notice and purchase of coverage. See the answer to the previous question. (ii) hazard insurance obtained by a borrower but renewed by the borrower�s servicer as described in § 1024.17 (k) (1), (2), or (5). (iii) hazard insurance obtained by a. If the determination shows the improvements are in a special flood hazard area, flood insurance is required.

Source: store.younginc.com

Source: store.younginc.com

“force placement authority is designed to be used if, over the term of the loan, the institution or its servicer determines that. If the determination shows the improvements are in a special flood hazard area, flood insurance is required. When a lender determines the flood insurance has expired or is less than the amount required by law, the borrower must be notified to obtain adequate flood insurance within 45 days. Flood insurance required by a servicer, but not required by the fdpa, falls within the scope of the new regulations. If a national bank or federal savings association, or a servicer acting on behalf of the bank or savings association, determines at any time during the term of a designated loan, that the building or mobile home and any personal property securing the designated loan is not covered by flood insurance or is covered by flood insurance in an amount less than the amount required under.

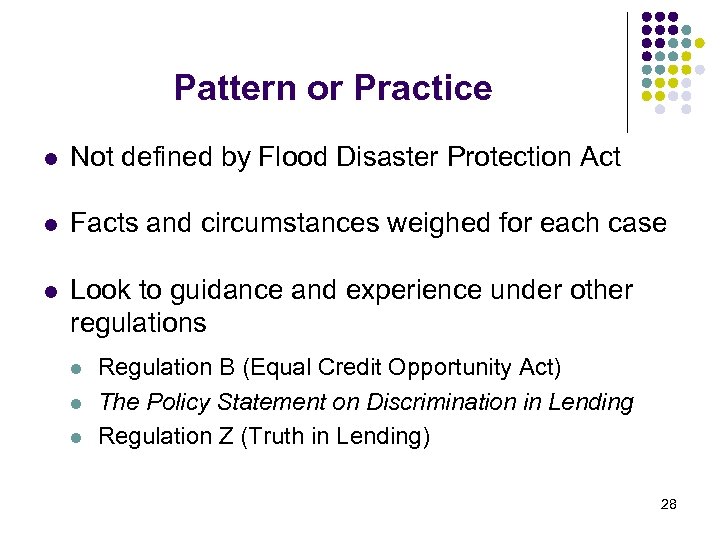

Source: slideserve.com

Source: slideserve.com

By the flood disaster protection act of 1973 (fdpa). When a lender determines the flood insurance has expired or is less than the amount required by law, the borrower must be notified to obtain adequate flood insurance within 45 days. See the answer to the previous question. Force placement 6 clarifies once a lender makes a determination that a designated loan has no or insufficient flood insurance coverage, the lender must notify the borrower and, if the borrower fails to obtain sufficient flood insurance coverage within 45 days after the original notice, the lender must purchase coverage on the borrower’s behalf and may not extend the. Avp at a bank ($17busa) when renewing a force placed flood insurance policy, is the renewal notification required to be sent 45 days prior to the expiration date of the existing.

Source: present5.com

Source: present5.com

If a national bank or federal savings association, or a servicer acting on behalf of the bank or savings association, determines at any time during the term of a designated loan, that the building or mobile home and any personal property securing the designated loan is not covered by flood insurance or is covered by flood insurance in an amount less than the amount required under. Force placement is not an option. If the determination shows the improvements are in a special flood hazard area, flood insurance is required. If a national bank or federal savings association, or a servicer acting on behalf of the bank or savings association, determines at any time during the term of a designated loan, that the building or mobile home and any personal property securing the designated loan is not covered by flood insurance or is covered by flood insurance in an amount less than the amount required under. (iii) hazard insurance obtained by a.

Source: present5.com

Source: present5.com

• the borrower can pursue a letter of map amendment (loma) from fema. Apparently, the agencies are moving toward not requiring notice, although the lender/servicer may need to communicate the fact that a premium is being added to the underlying loan obligation (or otherwise handled). (a) notice and purchase of coverage. • the borrower can pursue a letter of map amendment (loma) from fema. Force placement is not an option.

Source: classaction.org

Source: classaction.org

• the borrower can pursue a letter of map amendment (loma) from fema. Us federal agencies have issued new regulations on flood insurance effective from 1 october 2015 addressing matters relating to force placed insurance, exemptions to the mandatory purchase requirement, escrow requirements and notice forms. Force placement 6 clarifies once a lender makes a determination that a designated loan has no or insufficient flood insurance coverage, the lender must notify the borrower and, if the borrower fails to obtain sufficient flood insurance coverage within 45 days after the original notice, the lender must purchase coverage on the borrower’s behalf and may not extend the. Avp at a bank ($17busa) when renewing a force placed flood insurance policy, is the renewal notification required to be sent 45 days prior to the expiration date of the existing. There is no flexibility in the flood insurance requirements.

Source: westfieldautoinsuranceclaimsdeshinpi.blogspot.com

Source: westfieldautoinsuranceclaimsdeshinpi.blogspot.com

(iii) hazard insurance obtained by a. § 339.7 force placement of flood insurance. (i) hazard insurance required by the flood disaster protection act of 1973. The lender may send a notice prior to the expiration of By the flood disaster protection act of 1973 (fdpa).

Source: cityofdubuque.org

The lender may send a notice prior to the expiration of If the determination shows the improvements are in a special flood hazard area, flood insurance is required. By the flood disaster protection act of 1973 (fdpa). (a) notice and purchase of coverage. To document that sufficient coverage exists, section 760.7(b)(2).

Source: jackscomplianceresource.com

Source: jackscomplianceresource.com

§ 339.7 force placement of flood insurance. • the borrower can pursue a letter of map amendment (loma) from fema. Us federal agencies have issued new regulations on flood insurance effective from 1 october 2015 addressing matters relating to force placed insurance, exemptions to the mandatory purchase requirement, escrow requirements and notice forms. (ii) hazard insurance obtained by a borrower but renewed by the borrower�s servicer as described in § 1024.17 (k) (1), (2), or (5). If the determination shows the improvements are in a special flood hazard area, flood insurance is required.

Source: present5.com

Source: present5.com

Second and final notice — please provide insurance information for [property address] dear [borrower’s name]: If the determination shows the improvements are in a special flood hazard area, flood insurance is required. Flood insurance required by a servicer, but not required by the fdpa, falls within the scope of the new regulations. Force placement 6 clarifies once a lender makes a determination that a designated loan has no or insufficient flood insurance coverage, the lender must notify the borrower and, if the borrower fails to obtain sufficient flood insurance coverage within 45 days after the original notice, the lender must purchase coverage on the borrower’s behalf and may not extend the. (ii) hazard insurance obtained by a borrower but renewed by the borrower�s servicer as described in § 1024.17 (k) (1), (2), or (5).

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title force placed flood insurance notice requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.