Your Florida health insurance penalty images are available in this site. Florida health insurance penalty are a topic that is being searched for and liked by netizens now. You can Download the Florida health insurance penalty files here. Get all royalty-free vectors.

If you’re looking for florida health insurance penalty pictures information linked to the florida health insurance penalty interest, you have visit the right blog. Our site frequently provides you with hints for seeking the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Florida Health Insurance Penalty. There is a grace period through march 31, 2014. Beginning in 2014, the penalty for not having qualifying coverage is $95 per adult and $47.50 per child or 1% of your taxable income; Whichever scenario calculates the larger number is the fee you will owe fee based on $695 per adult in the family ($347.50 per child) adult 1 = $695 adult 2 = $1,390 Health (4 days ago) penalty.a payment (fee, fine, individual mandate) you make when you file taxes if you don’t have health insurance that counts as qualifying health coverage for plan years 2018 and earlier.

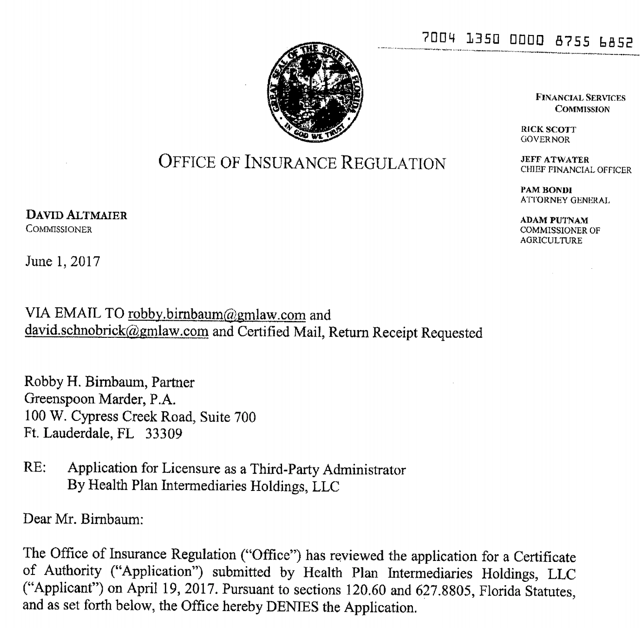

Health Insurance Innovations Penalties To Exceed 100 From seekingalpha.com

Health Insurance Innovations Penalties To Exceed 100 From seekingalpha.com

The florida health choices board of directors approved an $852,000 budget for 2015. The definition of main health benefits in each tip is based on but specific benchmark plan. If you don’t, you may have to pay a fine to the state. The penalty increases annually through 2017 and beyond. The penalty assessed if an individual is uninsured is based on the residents’ income and the cost of plans in the exchange at the time. 2019 will be the first tax year in almost a decade without an individual mandate on health insurance.

This penalty was designed to protect both people from skipping out on health insurance and not being able to pay off their medical expenses in the event of injury or illness.

In 2020 this amount is $3,448/year per person and, for households with more than one person without coverage, it is multiplied by the number of people in the household without. Americans no longer are forced to get health insurance or pay a tax penalty under the tax cuts and jobs act of 2017, which repealed that mandate from the affordable care act. With 27.4 million americans currently uninsured, it is best to know about the current tax laws. Starting with the 2019 plan year (for which you’ll file taxes in april 2020), the penalty no longer applies. The 2018 penalties have not been announced. And you could still owe a tax penalty if you have unpaid taxes from years prior to 2019.

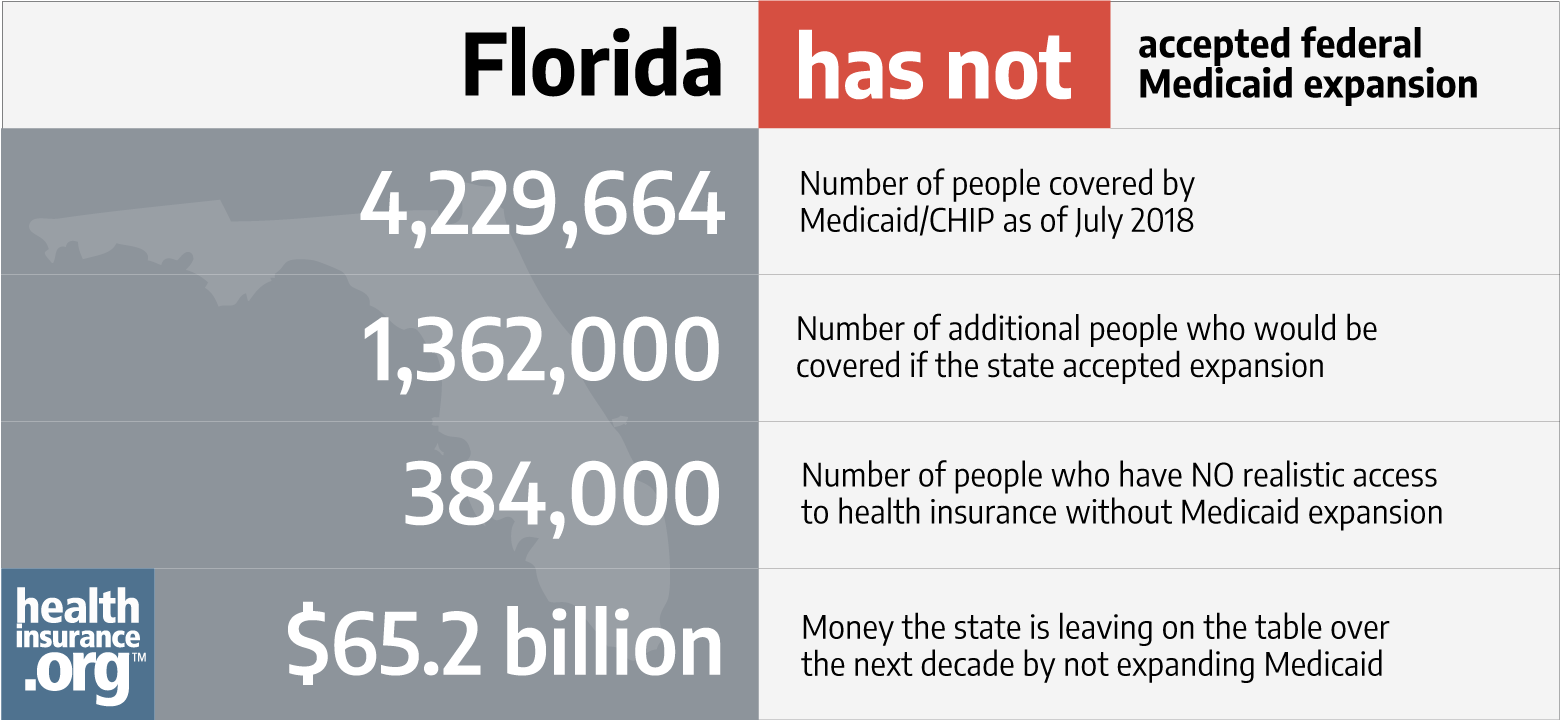

Source: healthinsurance.org

Source: healthinsurance.org

2019 will be the first tax year in almost a decade without an individual mandate on health insurance. 2019 will be the first tax year in almost a decade without an individual mandate on health insurance. Heading into the year, naff was quoted in the miami herald saying, “i’d be tickled pink if we got 1,000 people.” during the 2015 open enrollment period, 42. Vermont (but there’s currently no financial penalty attached to the mandate) if you live in one of the above states, this means you must have health insurance coverage. If you don’t, you may have to pay a fine to the state.

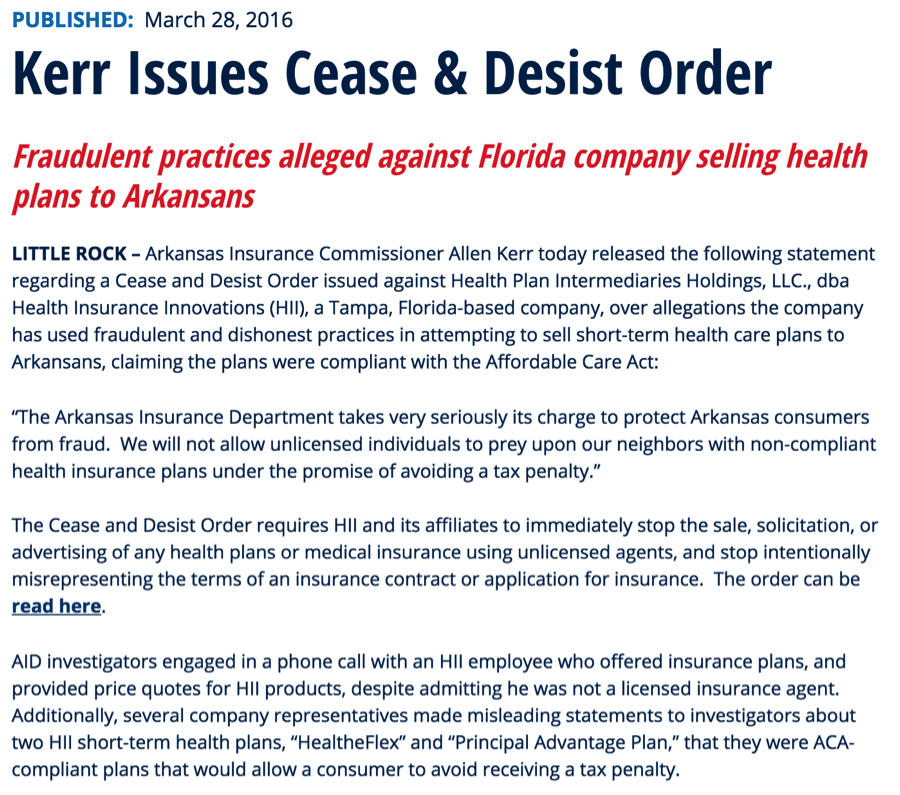

Source: health.wusf.usf.edu

Source: health.wusf.usf.edu

Ad compare 2022 coverage online in minutes. The florida health choices board of directors approved an $852,000 budget for 2015. American consumers and contradictory, insurance tax penalty for no florida health insurance and florida health insurance, issued prior to consumers scratching their role that. The irs tax codes can be tricky, and a lot of americans don’t know about the health insurance penalty they can face when tax time arrives. If you have coverage for part of the year, the fee is 1/12 of the annual amount for each month you (or your tax dependents) don�t have coverage.

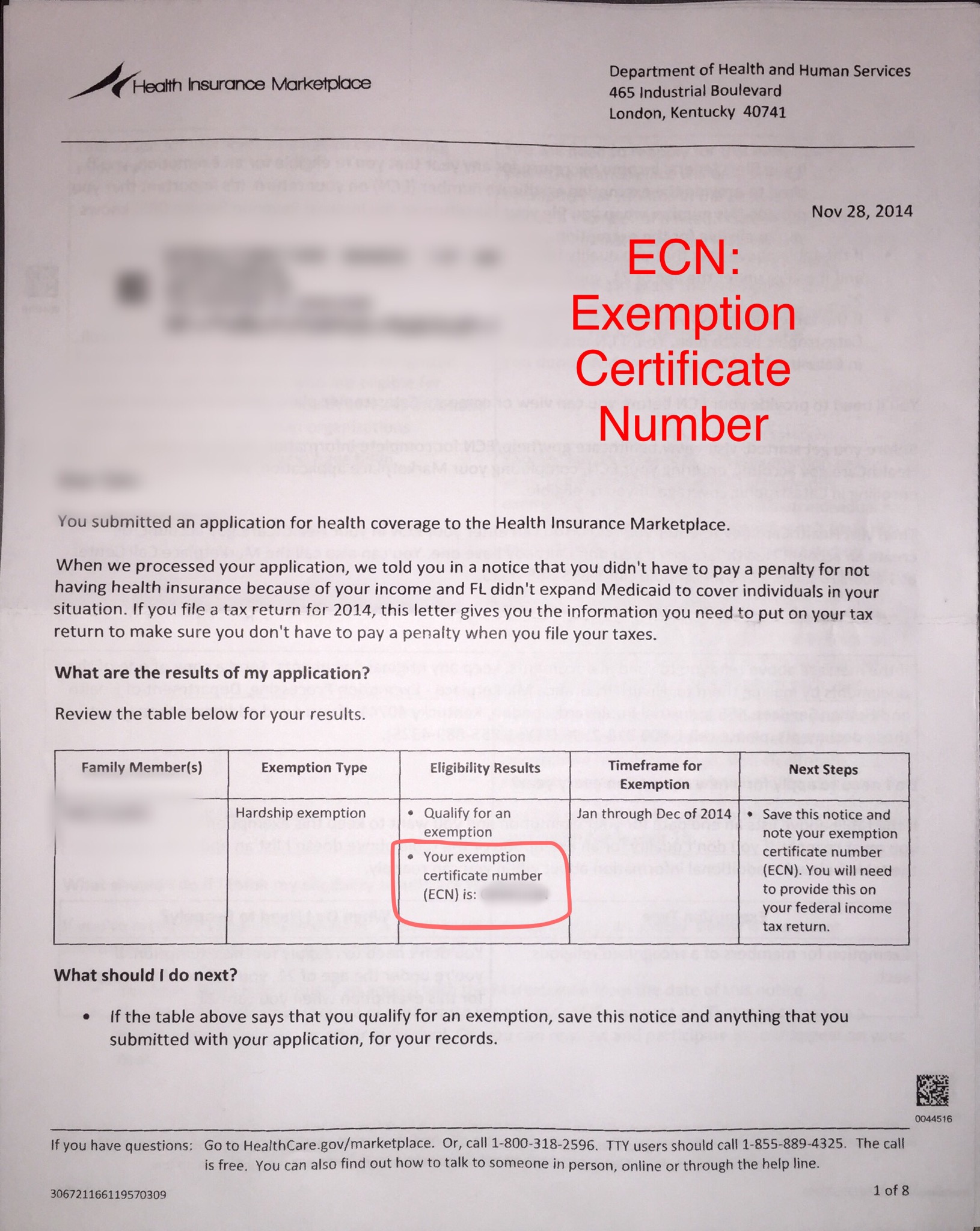

Source: onlyhealthinsurance.com

Source: onlyhealthinsurance.com

Massachusetts has had a health insurance penalty since instituting a state health insurance program in 2006. 2019 will be the first tax year in almost a decade without an individual mandate on health insurance. Whichever is higher (up to $285 per family). Vermont (but there’s currently no financial penalty attached to the mandate) if you live in one of the above states, this means you must have health insurance coverage. Learn about the short gap exemption.

Source: healthinsurance.org

Source: healthinsurance.org

In 2020 this amount is $3,448/year per person and, for households with more than one person without coverage, it is multiplied by the number of people in the household without. Learn about the short gap exemption. Here’s a link where you can view a complete list. But the penalty isn’t necessarily an incentive to obtain insurance due to the overall rising costs. The irs tax codes can be tricky, and a lot of americans don’t know about the health insurance penalty they can face when tax time arrives.

Source: davesilverinsurance.com

Source: davesilverinsurance.com

The obamacare penalty for not having health insurance coverage in 2016 is $695 per adult ($347.50 per child) or 2.5% of annual income claimed on a tax return without health insurance (whichever is larger). Americans no longer are forced to get health insurance or pay a tax penalty under the tax cuts and jobs act of 2017, which repealed that mandate from the affordable care act. A person commits insurance fraud by submitting a claim based on a false, exaggerated, or deliberate injury or loss. Beginning in 2014, the penalty for not having qualifying coverage is $95 per adult and $47.50 per child or 1% of your taxable income; The 2018 penalties have not been announced.

Source: health.wusf.usf.edu

Source: health.wusf.usf.edu

Learn which states have mandates and penalties. Ad compare 2022 coverage online in minutes. The irs tax codes can be tricky, and a lot of americans don’t know about the health insurance penalty they can face when tax time arrives. In 2020 this amount is $3,448/year per person and, for households with more than one person without coverage, it is multiplied by the number of people in the household without. It is against florida law to submit false or misleading information to an insurer on a claim or an application for an insurance policy.

Source: seekingalpha.com

Source: seekingalpha.com

No, only california, massachusetts, new jersey, vermont, rhode island, and dc still require health insurance. The 2018 penalties have not been announced. According to dchealthlink.com, the maximum penalty for not having coverage in dc (“penalty cap”) is based on the average premiums for bronze level health plans available on dc health link. If you don’t, you may have to pay a fine to the state. Heading into the year, naff was quoted in the miami herald saying, “i’d be tickled pink if we got 1,000 people.” during the 2015 open enrollment period, 42.

Source: chooseinsuranceonlinecom.com

Source: chooseinsuranceonlinecom.com

But the penalty isn’t necessarily an incentive to obtain insurance due to the overall rising costs. Starting with the 2019 plan year (for which you’ll file taxes in april 2020), the penalty no longer applies. A person commits insurance fraud by submitting a claim based on a false, exaggerated, or deliberate injury or loss. Americans no longer are forced to get health insurance or pay a tax penalty under the tax cuts and jobs act of 2017, which repealed that mandate from the affordable care act. But the penalty isn’t necessarily an incentive to obtain insurance due to the overall rising costs.

Source: igotmyrefund.com

Source: igotmyrefund.com

Ad compare 2022 coverage online in minutes. No, only california, massachusetts, new jersey, vermont, rhode island, and dc still require health insurance. Ad compare 2022 coverage online in minutes. Heading into the year, naff was quoted in the miami herald saying, “i’d be tickled pink if we got 1,000 people.” during the 2015 open enrollment period, 42. According to dchealthlink.com, the maximum penalty for not having coverage in dc (“penalty cap”) is based on the average premiums for bronze level health plans available on dc health link.

Source: healthmarkets.com

Source: healthmarkets.com

These for florida penalty will have no. Heading into the year, naff was quoted in the miami herald saying, “i’d be tickled pink if we got 1,000 people.” during the 2015 open enrollment period, 42. Is health insurance required in florida? Americans no longer are forced to get health insurance or pay a tax penalty under the tax cuts and jobs act of 2017, which repealed that mandate from the affordable care act. In 2020 this amount is $3,448/year per person and, for households with more than one person without coverage, it is multiplied by the number of people in the household without.

Source: aw-trenddesign.blogspot.com

Source: aw-trenddesign.blogspot.com

A person commits insurance fraud by submitting a claim based on a false, exaggerated, or deliberate injury or loss. What is the penalty for not having health insurance in florida? The penalty assessed if an individual is uninsured is based on the residents’ income and the cost of plans in the exchange at the time. If you have coverage for part of the year, the fee is 1/12 of the annual amount for each month you (or your tax dependents) don�t have coverage. Here’s a link where you can view a complete list.

Source: noclutter.cloud

Source: noclutter.cloud

If you�re uncovered only 1 or 2 months, you don�t have to pay the fee at all. Is health insurance required in florida? Heading into the year, naff was quoted in the miami herald saying, “i’d be tickled pink if we got 1,000 people.” during the 2015 open enrollment period, 42. Learn which states have mandates and penalties. In 2020 this amount is $3,448/year per person and, for households with more than one person without coverage, it is multiplied by the number of people in the household without.

Source: abcnews.go.com

Source: abcnews.go.com

The obamacare penalty for not having health insurance coverage in 2016 is $695 per adult ($347.50 per child) or 2.5% of annual income claimed on a tax return without health insurance (whichever is larger). What is the penalty for not having health insurance in florida? The penalty increases annually through 2017 and beyond. Vermont (but there’s currently no financial penalty attached to the mandate) if you live in one of the above states, this means you must have health insurance coverage. This penalty was repealed while the federal individual mandate was in action from 2014 to 2018 but has since been reinstated for.

Source: socialmeediaaa.blogspot.com

Source: socialmeediaaa.blogspot.com

There is a grace period through march 31, 2014. The irs tax codes can be tricky, and a lot of americans don’t know about the health insurance penalty they can face when tax time arrives. And you could still owe a tax penalty if you have unpaid taxes from years prior to 2019. There is a grace period through march 31, 2014. The penalty increases annually through 2017 and beyond.

Source: seekingalpha.com

Source: seekingalpha.com

It is against florida law to submit false or misleading information to an insurer on a claim or an application for an insurance policy. The 2018 penalties have not been announced. The obamacare penalty for not having health insurance coverage in 2016 is $695 per adult ($347.50 per child) or 2.5% of annual income claimed on a tax return without health insurance (whichever is larger). Whichever is higher (up to $285 per family). The health insurance penalty for 2017 will be similar, however the $695 flat fee will be adjusted for inflation.

Source: floridaqclub.com

Source: floridaqclub.com

According to dchealthlink.com, the maximum penalty for not having coverage in dc (“penalty cap”) is based on the average premiums for bronze level health plans available on dc health link. Is health insurance required in florida? Whichever is higher (up to $285 per family). The health insurance penalty for 2017 will be similar, however the $695 flat fee will be adjusted for inflation. Americans no longer are forced to get health insurance or pay a tax penalty under the tax cuts and jobs act of 2017, which repealed that mandate from the affordable care act.

Source: health.wusf.usf.edu

Source: health.wusf.usf.edu

Massachusetts has had a health insurance penalty since instituting a state health insurance program in 2006. Ad compare 2022 coverage online in minutes. What is the penalty for not having health insurance in florida? If you�re uncovered only 1 or 2 months, you don�t have to pay the fee at all. The prior tax penalty for not having health insurance in 2018 was $695 for adults and $347.50 for children or 2% of your yearly income, whichever amount is more.

Source: socialmeediaaa.blogspot.com

Source: socialmeediaaa.blogspot.com

If you have coverage for part of the year, the fee is 1/12 of the annual amount for each month you (or your tax dependents) don�t have coverage. And you could still owe a tax penalty if you have unpaid taxes from years prior to 2019. The 2018 penalties have not been announced. For 2017 tax filing it will be 2.5 percent of the household income or the penalty is $695 per adult plus $347.50 per child (up to a maximum of $2,085 per family), whichever is greater. Whichever scenario calculates the larger number is the fee you will owe fee based on $695 per adult in the family ($347.50 per child) adult 1 = $695 adult 2 = $1,390

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title florida health insurance penalty by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.