Your Flood insurance new orleans images are ready in this website. Flood insurance new orleans are a topic that is being searched for and liked by netizens now. You can Find and Download the Flood insurance new orleans files here. Get all royalty-free photos.

If you’re searching for flood insurance new orleans images information connected with to the flood insurance new orleans interest, you have pay a visit to the right site. Our site always gives you hints for viewing the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that match your interests.

Flood Insurance New Orleans. Building 100,000 contents 40,000 $399. It is not covered by homeowners insurance. You will also want to consider coverage for your personal property as well, such as furniture and clothing. Building 125,000 contents 50,000 $419.

New Orleans Flood Insurance Costs and Requirements From nolastyles.com

New Orleans Flood Insurance Costs and Requirements From nolastyles.com

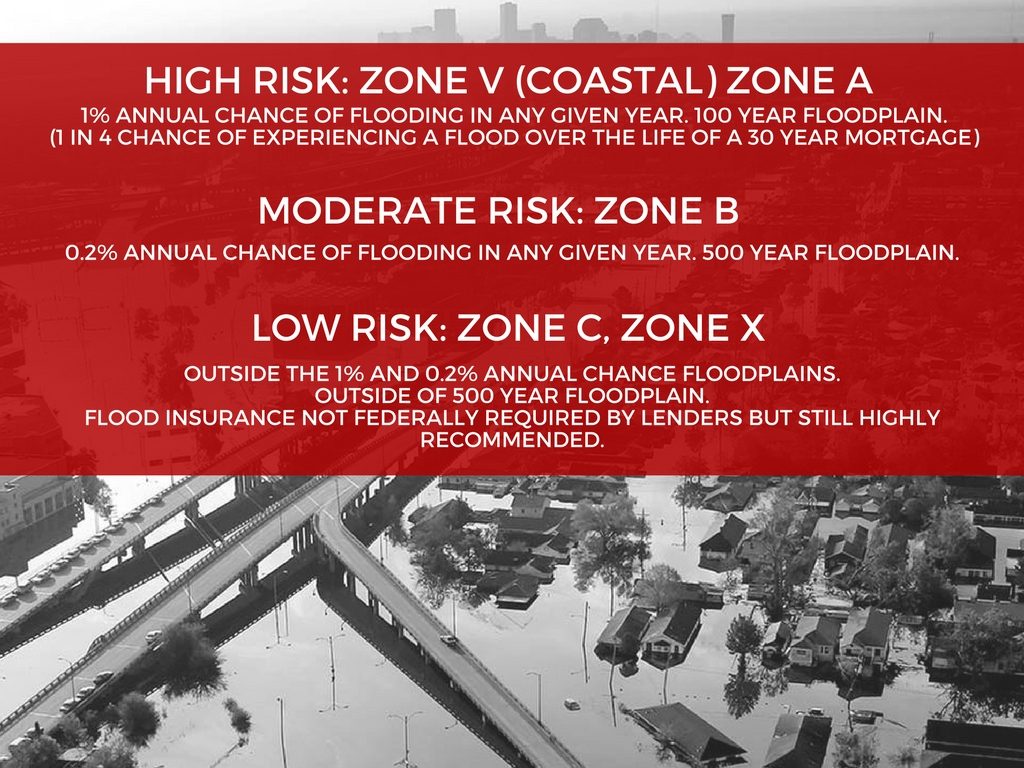

$250,000 per unit for multifamily residents, with a limit for contents on all residential buildings is $100,000, which is also available for renters. Fema says under the new flood insurance plan, 20% of louisiana residents could see reductions. However, 70% could see increases of up to $120 per year while 10% could see increases of up to $240. What flood zones will i find in new orleans? We are looking at homes in new orleans and can�t seem to get clear information on flood insurance rates. Flood insurance is usually cheaper than homeowner insurance guidelines;

Seems the information is not available until an offer on property is made, kind of like hidden costs.

Some louisiana homeowners are facing a $20 per month. The national flood insurance program (nfip) has been the main source of flood insurance policies since the program began in 1968. Building 100,000 contents 40,000 $399. In dealing with them yourself, they may lead you. The city of new orleans strongly recommends that you consider purchasing flood insurance. Building 125,000 contents 50,000 $419.

Source: bizneworleans.com

Source: bizneworleans.com

It is not covered by homeowners insurance. Flood facts from the national flood insurance program (nfip) floods are the nation’s most common and costly natural disaster and cause millions of dollars in damage every year. Louisiana consumers can purchase flood insurance through the national flood insurance program (nfip), private insurers and surplus lines insurers. When it comes to flood insurance, consumers now have more options than before. What flood zones will i find in new orleans?

Source: wafb.com

Source: wafb.com

Flood insurance policies also reimburse you for the work that you and other family members did to sandbag your homes, move furniture and remove debris. The city of new orleans strongly recommends that you consider purchasing flood insurance. It is best to consider the different sources of costs for flood insurance. If you’re a risk taker buying a property in a flood zone that lies below the flood line, if you’re paying all cash then you are not required to purchase flood insurance. New orleans flood damage claims serving the entire state of louisiana.

Source: awsinsurance.com

Source: awsinsurance.com

Some louisiana homeowners are facing a $20 per month. Building 100,000 contents 40,000 $399. The goal of the nfip is to reduce the impact of flooding on private and public homes and buildings while providing affordable flood insurance. Flood insurance is usually cheaper than homeowner insurance guidelines; However, 70% could see increases of up to $120 per year while 10% could see increases of up to $240.

Source: baptistmessage.com

Source: baptistmessage.com

Building 100,000 contents 40,000 $399. Flood facts from the national flood insurance program (nfip) floods are the nation’s most common and costly natural disaster and cause millions of dollars in damage every year. What are the costs for flood insurance? The goal of the nfip is to reduce the impact of flooding on private and public homes and buildings while providing affordable flood insurance. Anyone have any info on this.

Source: landecheinsurance.com

Source: landecheinsurance.com

You will also want to consider coverage for your personal property as well, such as furniture and clothing. Renters can also buy policies to protect their personnel property. Flood facts from the national flood insurance program (nfip) floods are the nation’s most common and costly natural disaster and cause millions of dollars in damage every year. When it comes to flood insurance, consumers now have more options than before. If you are having trouble getting wright national to pay the total value of your claim, new orleans legal, llc can help.

Source: theadvocate.com

Source: theadvocate.com

If the property is located in an preferred flood zone x in new orleans you will get set coverage amounts and pay the same rate. When it comes to flood insurance, consumers now have more options than before. Anyone have any info on this. The national flood insurance program (nfip) has been the main source of flood insurance policies since the program began in 1968. Flood insurance metairie & new orleans, la.

Source: global-mapss.blogspot.com

Source: global-mapss.blogspot.com

The average nfip premium in louisiana is $878 each year. Seems the information is not available until an offer on property is made, kind of like hidden costs. You will also want to consider coverage for your personal property as well, such as furniture and clothing. Flood insurance in new orleans posted by isabelle on 5/16/14 at 10:37 am. What are the costs for flood insurance?

Source: wwltv.com

Flood insurance policies also reimburse you for the work that you and other family members did to sandbag your homes, move furniture and remove debris. New orleans flood damage claims serving the entire state of louisiana. Flood insurance is usually cheaper than homeowner insurance guidelines; Flood insurance policies also reimburse you for the work that you and other family members did to sandbag your homes, move furniture and remove debris. Some louisiana homeowners are facing a $20 per month.

Source: carbon-based-ghg.blogspot.com

Source: carbon-based-ghg.blogspot.com

The city of new orleans strongly recommends that you consider purchasing flood insurance. Flood insurance in new orleans is only mandatory if you are using a mortgage to secure your property. The reason they are more desirable is you’re not required to have flood insurance, and it’s typically about $475/year for premium coverage. The moment you run into this problem, contact one of insurance claim hq�s qualified new orleans bad faith flood damage insurance attorneys. If you are having trouble getting wright national to pay the total value of your claim, new orleans legal, llc can help.

Source: gisnola.com

Source: gisnola.com

Wright national has extensive knowledge of flood insurance, as well as current nfip legislation. It is not covered by homeowners insurance. Louisiana consumers can purchase flood insurance through the national flood insurance program (nfip), private insurers and surplus lines insurers. Flood facts from the national flood insurance program (nfip) floods are the nation’s most common and costly natural disaster and cause millions of dollars in damage every year. The reason they are more desirable is you’re not required to have flood insurance, and it’s typically about $475/year for premium coverage.

Source: dbiagency.com

Source: dbiagency.com

Flood insurance is not legally mandated in louisiana. Flood facts from the national flood insurance program (nfip) floods are the nation’s most common and costly natural disaster and cause millions of dollars in damage every year. Building 125,000 contents 50,000 $419. You can also buy flood insurance for vacant homes, renovation and builder’s risk projects. It is best to consider the different sources of costs for flood insurance.

Source: nolastyles.com

Source: nolastyles.com

However, 70% could see increases of up to $120 per year while 10% could see increases of up to $240. However, 70% could see increases of up to $120 per year while 10% could see increases of up to $240. The national flood insurance program (nfip) has been the main source of flood insurance policies since the program began in 1968. In dealing with them yourself, they may lead you. What are the costs for flood insurance?

It is not covered by homeowners insurance. Flood insurance metairie & new orleans, la. There is little room for. Insurance agency, homeowners insurance, auto insurance. It is not covered by homeowners insurance.

Source: orleansappraisal.com

Source: orleansappraisal.com

Some louisiana homeowners are facing a $20 per month. Flood facts from the national flood insurance program (nfip) floods are the nation’s most common and costly natural disaster and cause millions of dollars in damage every year. Renters can also buy policies to protect their personnel property. Home, flood, auto, business and life 1615 poydras st ste 900, new orleans, la 70112.

Source: floodinsurancequotes.com

Source: floodinsurancequotes.com

Wright national has extensive knowledge of flood insurance, as well as current nfip legislation. Building 125,000 contents 50,000 $419. Anyone have any info on this. Flood insurance is usually cheaper than homeowner insurance guidelines; Building 150,000 contents 60,000 $446.

Source: lavislaw.com

Source: lavislaw.com

If you’re a risk taker buying a property in a flood zone that lies below the flood line, if you’re paying all cash then you are not required to purchase flood insurance. Flood insurance metairie & new orleans, la. If the property is located in an preferred flood zone x in new orleans you will get set coverage amounts and pay the same rate. What flood zones will i find in new orleans? Insurance agency, homeowners insurance, auto insurance.

Source: nytimes.com

Source: nytimes.com

The average nfip premium in louisiana is $878 each year. What flood zones will i find in new orleans? Out of these, the most desirable flood zones are b, c, & x. However, 70% could see increases of up to $120 per year while 10% could see increases of up to $240. Some louisiana homeowners are facing a $20 per month.

Source: sibleyrealtygroup.com

Source: sibleyrealtygroup.com

We are looking at homes in new orleans and can�t seem to get clear information on flood insurance rates. The reason they are more desirable is you’re not required to have flood insurance, and it’s typically about $475/year for premium coverage. Insurance companies are notorious for attempting to utilize loopholes to avoid paying out. Flood insurance is not legally mandated in louisiana. Louisiana consumers can purchase flood insurance through the national flood insurance program (nfip), private insurers and surplus lines insurers.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title flood insurance new orleans by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.