Your Flood insurance nc images are ready in this website. Flood insurance nc are a topic that is being searched for and liked by netizens today. You can Get the Flood insurance nc files here. Download all royalty-free vectors.

If you’re searching for flood insurance nc images information related to the flood insurance nc topic, you have visit the ideal site. Our site always gives you hints for refferencing the highest quality video and image content, please kindly search and locate more informative video content and images that fit your interests.

Flood Insurance Nc. The maximum amount of coverage for your home�s structure available from nfip flood insurance plans is $250,000 for the structure of your home and $100,000 for its contents. These efforts help mitigate the effects of flooding on new and improved structures. Under the changes, called risk 2.0, about a third of flood insurance policyholders will. In this article, we will talk about fema flood insurance.

Flood Facts North Carolina Flood Insurance From northcarolinafloodinsurance.org

Flood Facts North Carolina Flood Insurance From northcarolinafloodinsurance.org

Currently, about 140,000 people have flood insurance policies here in north carolina. A couple of factors that will affect the cost of your flood insurance policy include where you live and the extent of coverage you choose. The cost of a preferred risk policy starts as low as $129 a year. The nfip insures buildings, including mobile homes, with two types of coverage: The program is separate from the national flood insurance program and may provide greater flood coverage options. The national flood insurance program (nfip) is managed by the fema and is delivered to the public by a network of more than 50 insurance companies and the nfip direct.

For 5,793 flood insurance claims.

The national flood insurance program (nfip) provides federally backed flood insurance within communities that enact and enforce floodplain regulations. The cost of a preferred risk policy starts as low as $129 a year. We will also go through how to apply for your fema flood insurance policy. Nc program provides help for homeowners who’ve been victimized. Additionally, the north carolina department of insurance (nc doi) approved a statewide flood insurance program that participating companies can now offer to residents living anywhere in the state. The national flood insurance program (nfip) provides federally backed flood insurance within communities that enact and enforce floodplain regulations.

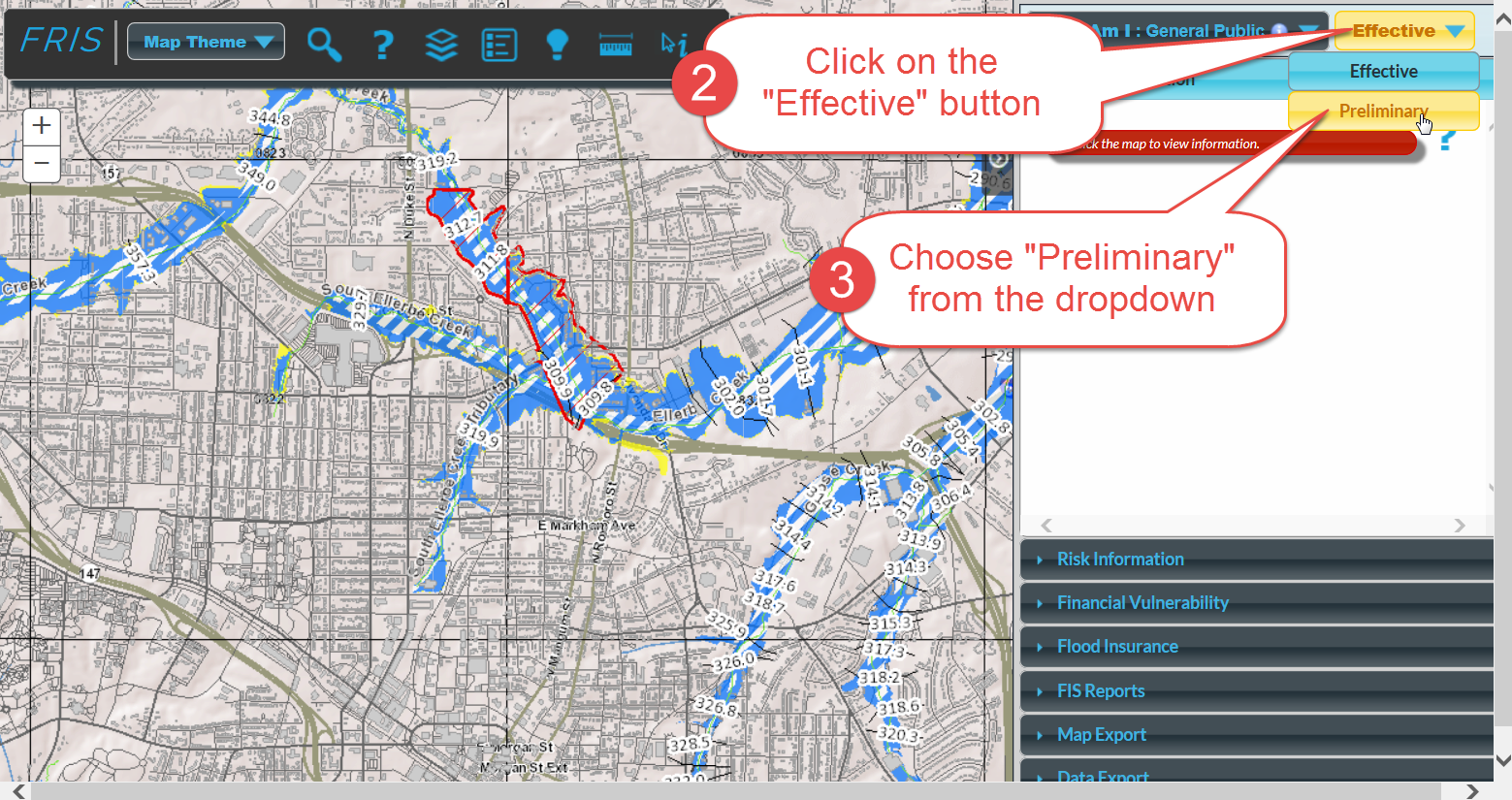

Source: flood.nc.gov

Source: flood.nc.gov

Waiting to take out a flood policy once a storm or hurricane is in motion will be too late. Additionally, the north carolina department of insurance (nc doi) approved a statewide flood insurance program that participating companies can now offer to residents living anywhere in the state. The cost of a preferred risk policy starts as low as $129 a year. $0m paid by national flood insurance program. Flood insurance coverage in north carolina.

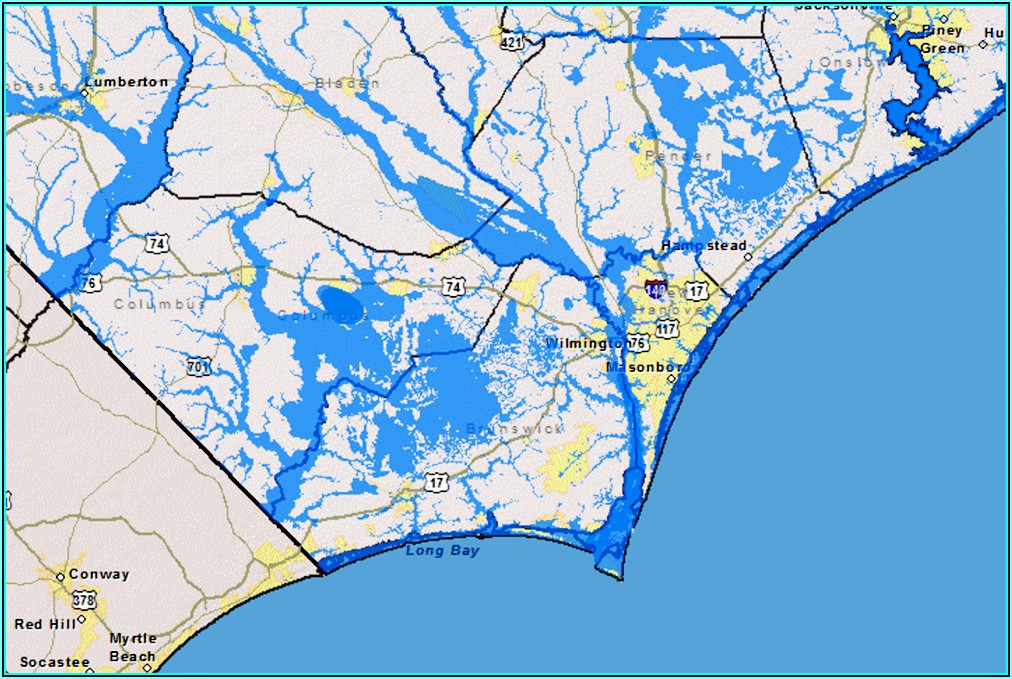

Source: ncseagrant.ncsu.edu

Source: ncseagrant.ncsu.edu

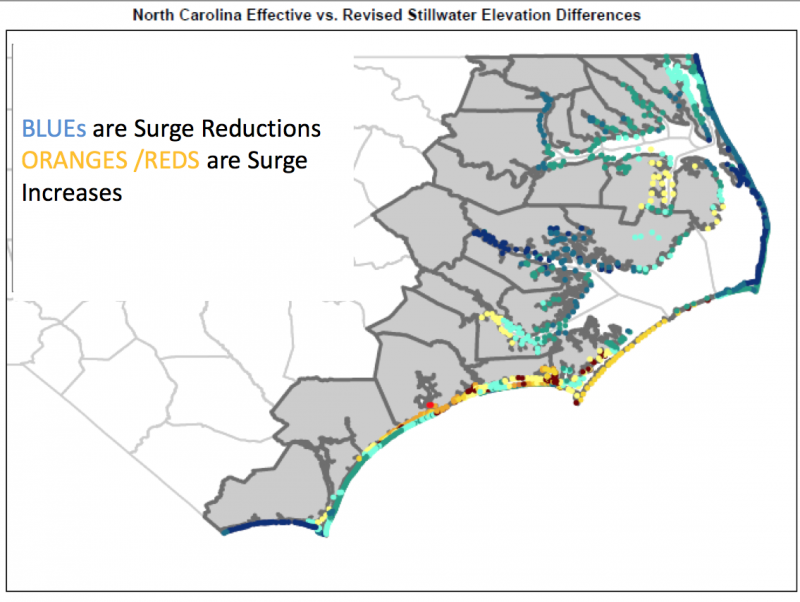

$0m paid by national flood insurance program. Flood insurance rate maps (firms) are the primary tool for state and local governments to mitigate areas of flooding. The national flood insurance program (nfip) is managed by the fema and is delivered to the public by a network of more than 50 insurance companies and the nfip direct. The national flood insurance program takes 30 days to take effect. For 5,793 flood insurance claims.

Source: contrapositionmagazine.com

Source: contrapositionmagazine.com

The national flood insurance program aims to reduce the impact of flooding on private and public structures. Waiting to take out a flood policy once a storm or hurricane is in motion will be too late. The program is separate from the national flood insurance program and may provide greater flood coverage options. Additionally, the north carolina department of insurance (nc doi) approved a statewide flood insurance program that participating companies can now offer to residents living anywhere in the state. Flood insurance covers direct loss caused by surface flooding, including a river flowing over its banks, a lake or ocean storm, and local drainage problems.

Source: northcarolinafloodinsurance.org

Source: northcarolinafloodinsurance.org

Flood insurance rate maps (firms) are the primary tool for state and local governments to mitigate areas of flooding. The cost of a preferred risk policy starts as low as $129 a year. Nc program provides help for homeowners who’ve been victimized. The national flood insurance program (nfip) provides federally backed flood insurance within communities that enact and enforce floodplain regulations. Since 1963, the fema national flood insurance program has provided coverage for flood damages.

Source: northcarolinafloodinsurance.org

Source: northcarolinafloodinsurance.org

The cost of a preferred risk policy starts as low as $129 a year. Assurant insurance is one of the more longstanding insurance companies. The facts are that the average premium for federally backed flood insurance through the nfip is only $550 a year. It does so by providing affordable insurance to property owners and by encouraging communities to adopt and enforce floodplain management regulations. Protect your home and belongings from devastating water damage with flood insurance.

Source: esri.com

Source: esri.com

{{filteroutmidnight(event.start_date) | date:�medium� }} {{event.title}} {{event.title}} see all > Nc program provides help for homeowners who’ve been victimized. In this article, we will talk about fema flood insurance. Just because there�s no longer a mortgage on a home does not nullify the need for homeowners� insurance. “think nc flood insurance is expensive?

Source: cbsnews.com

Source: cbsnews.com

The national flood insurance program (nfip) is managed by the fema and is delivered to the public by a network of more than 50 insurance companies and the nfip direct. Fema flood insurance has served as a financial buffer to those who have suffered from flood losses and home damage. Just because there�s no longer a mortgage on a home does not nullify the need for homeowners� insurance. Assurant insurance is one of the more longstanding insurance companies. Since its inception in 1968, the nfip has been very successful in helping flood victims get back on their feet.

Source: wusfnews.wusf.usf.edu

Source: wusfnews.wusf.usf.edu

“think nc flood insurance is expensive? Since its inception in 1968, the nfip has been very successful in helping flood victims get back on their feet. Since 1963, the fema national flood insurance program has provided coverage for flood damages. The $250,000 structure limit covers the cost to rebuild your home and is different from your home�s resale value. The national flood insurance program (nfip) is managed by the fema and is delivered to the public by a network of more than 50 insurance companies and the nfip direct.

Source: farahfatihah90.blogspot.com

Source: farahfatihah90.blogspot.com

Since 1963, the fema national flood insurance program has provided coverage for flood damages. Brief informational documents on commonly asked questions about the mapping program, insurance and mitigation. The facts are that the average premium for federally backed flood insurance through the nfip is only $550 a year. Flood insurance rate maps (firms) are the primary tool for state and local governments to mitigate areas of flooding. A couple of factors that will affect the cost of your flood insurance policy include where you live and the extent of coverage you choose.

Source: nytimes.com

Source: nytimes.com

The nfip insures buildings, including mobile homes, with two types of coverage: It opened its doors in 1892, starting with disability insurance. If you own or rent a home anywhere in the united states, you may be. Under the changes, called risk 2.0, about a third of flood insurance policyholders will. A couple of factors that will affect the cost of your flood insurance policy include where you live and the extent of coverage you choose.

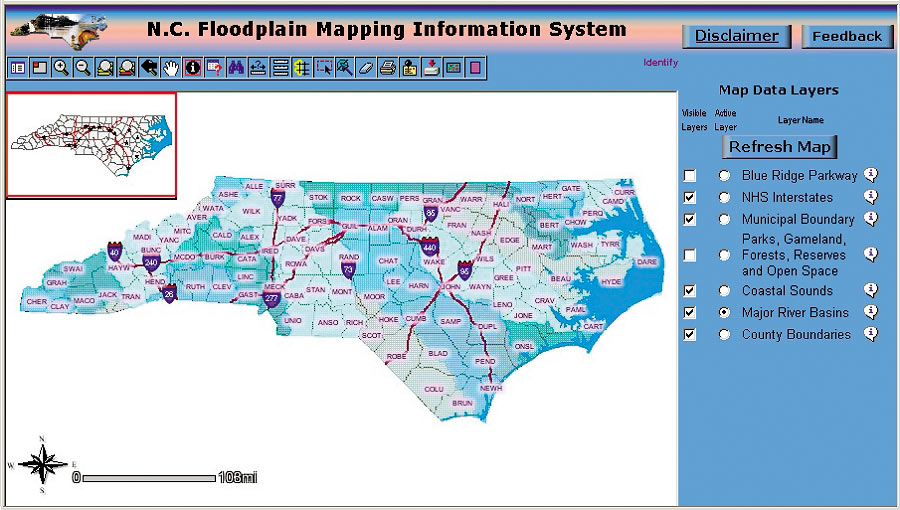

Source: espgis.com

Source: espgis.com

Under the changes, called risk 2.0, about a third of flood insurance policyholders will. The national flood insurance program (nfip) is managed by the fema and is delivered to the public by a network of more than 50 insurance companies and the nfip direct. In this article, we will talk about fema flood insurance. It does so by providing affordable insurance to property owners and by encouraging communities to adopt and enforce floodplain management regulations. $0m paid by national flood insurance program.

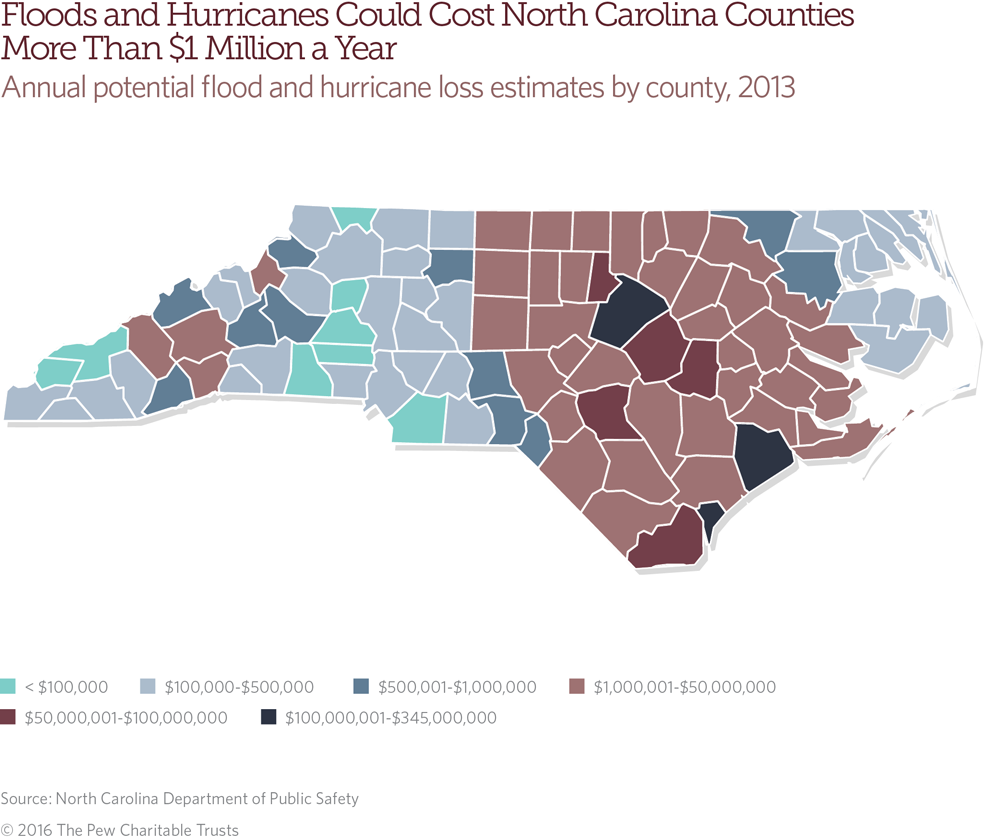

Source: pewtrusts.org

Source: pewtrusts.org

Brief informational documents on commonly asked questions about the mapping program, insurance and mitigation. The $250,000 structure limit covers the cost to rebuild your home and is different from your home�s resale value. The program is separate from the national flood insurance program and may provide greater flood coverage options. If you own or rent a home anywhere in the united states, you may be. The facts are that the average premium for federally backed flood insurance through the nfip is only $550 a year.

Source: beaufortnc.org

Source: beaufortnc.org

It does so by providing affordable insurance to property owners and by encouraging communities to adopt and enforce floodplain management regulations. Typically, the cost of flood insurance in north carolina can range from $700 to $800 per year. North carolina residents now have greater flood coverage options than ever before. The facts are that the average premium for federally backed flood insurance through the nfip is only $550 a year. It does so by providing affordable insurance to property owners and by encouraging communities to adopt and enforce floodplain management regulations.

Source: betterflood.com

Source: betterflood.com

Nc program provides help for homeowners who’ve been victimized. Typically, the cost of flood insurance in north carolina can range from $700 to $800 per year. Currently, about 140,000 people have flood insurance policies here in north carolina. The national flood insurance program (nfip) provides federally backed flood insurance within communities that enact and enforce floodplain regulations. It opened its doors in 1892, starting with disability insurance.

Source: pinterest.com

Source: pinterest.com

$0m paid by national flood insurance program. Flood insurance covers direct loss caused by surface flooding, including a river flowing over its banks, a lake or ocean storm, and local drainage problems. The program is separate from the national flood insurance program and may provide greater flood coverage options. Since its inception in 1968, the nfip has been very successful in helping flood victims get back on their feet. The nfip insures buildings, including mobile homes, with two types of coverage:

Source: insurancejournal.com

Source: insurancejournal.com

Additionally, the north carolina department of insurance (nc doi) approved a statewide flood insurance program that participating companies can now offer to residents living anywhere in the state. Since 1963, the fema national flood insurance program has provided coverage for flood damages. Flood insurance coverage in north carolina. It opened its doors in 1892, starting with disability insurance. If you own or rent a home anywhere in the united states, you may be.

Source: onlinemapdatabase.blogspot.com

Source: onlinemapdatabase.blogspot.com

These efforts help mitigate the effects of flooding on new and improved structures. Additionally, the north carolina department of insurance (nc doi) approved a statewide flood insurance program that participating companies can now offer to residents living anywhere in the state. Assurant insurance is one of the more longstanding insurance companies. Flood insurance rate maps (firms) are the primary tool for state and local governments to mitigate areas of flooding. For 5,793 flood insurance claims.

Source: wunc.org

Source: wunc.org

Nc program provides help for homeowners who’ve been victimized. Click on the what’s my risk box to see if you live in a flood zone. For 5,793 flood insurance claims. North carolina residents now have greater flood coverage options than ever before. The nfip insures buildings, including mobile homes, with two types of coverage:

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title flood insurance nc by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.