Your Flood insurance michigan images are ready in this website. Flood insurance michigan are a topic that is being searched for and liked by netizens now. You can Download the Flood insurance michigan files here. Find and Download all royalty-free images.

If you’re searching for flood insurance michigan images information connected with to the flood insurance michigan interest, you have visit the ideal blog. Our website always gives you hints for seeking the maximum quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

Flood Insurance Michigan. Most homeowners insurance does not cover flood damage. So michigan flood insurance can help to pay for repairs to your home and belongings if either is damaged or destroyed by a flood. As of may 2020, there were 20,500 flood insurance policies in the state, providing coverage in the amount of $4,074,845,000. This is a common misconception across the state that puts many homeowners at risk.

Do I Need Flood Insurance in Michigan? MasonMcBride Inc. From mason-mcbride.com

Do I Need Flood Insurance in Michigan? MasonMcBride Inc. From mason-mcbride.com

This is a common misconception across the state that puts many homeowners at risk. Typically, your flood insurance policy is dependent on your flood zone risk. This includes losses resulting from water from over flowing rivers or streams, rain, storm surge, snow melt, blocked storm drainage systems, broken dams or other like causes. The national flood insurance program (nfip) is managed by the fema and is delivered to the public by a network of more than 50 insurance companies and the nfip direct. Floods can happen anywhere — just one inch of floodwater can cause up to $25,000 in damage. Flood insurance is a type of property insurance that will cover you if your dwelling in the event of excessive water damage.

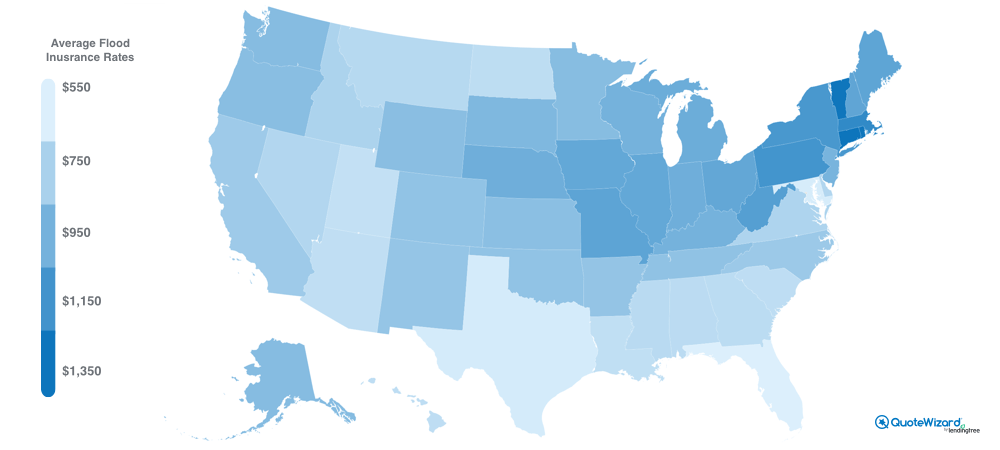

The average cost of flood insurance in michigan is $1,054 a year.

In 1968, congress instituted the national flood insurance program (nfip) to reduce the economic and social cost of flood losses. At michigan insurance and financial services, we work with carriers who have extensive flood insurance options for your individual needs. Flood insurance is a type of property insurance that will cover you if your dwelling in the event of excessive water damage. Having a flood insurance policy can save you from huge financial losses that are caused by floods. As of may 2020, there were 20,500 flood insurance policies in the state, providing coverage in the amount of $4,074,845,000. How much does flood insurance cost in michigan?

Source: miindependentagents.com

Source: miindependentagents.com

Your standard michigan flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas. You with flood insurance information, you can contact one of the numbers listed below. As of may 2020, there were 20,500 flood insurance policies in the state, providing coverage in the amount of $4,074,845,000. Best rated flood insurance in midland, michigan. The average cost of flood insurance in michigan is $1,054 a year.

Source: myryanagency.com

Source: myryanagency.com

Depending on where you live, this average could vary substantially! How much does flood insurance cost in michigan? State of michigan nfip coordinator. From mbs international airport (mbs) head east and keep right. It is not covered by your homeowners insurance policy.

Source: capitaltitle.net

Source: capitaltitle.net

If every property owner carried a policy, the average rate would be much lower. Michigan — risk rating 2.0 with the implementation of risk rating 2.0, fema delivers rates that more accurately reflect flood risk and ensure the national flood insurance program will be here for this generation and generations to come. Most homeowners insurance does not cover flood damage. How much is flood insurance in michigan? Insurance to cover floods must be written 30 days in advance of a flood in the state of michigan.

Source: detroit.cbslocal.com

Source: detroit.cbslocal.com

You with flood insurance information, you can contact one of the numbers listed below. The primary source of floodplain mapping information in michigan is the flood insurance rate maps (firms), which are developed by the federal emergency management agency (fema). Ieuter insurance group is located on 414 townsend st, midland. Your standard michigan flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas. Building, contents, replacement cost coverages

Source: mason-mcbride.com

Source: mason-mcbride.com

Compare michigan flood insurance quotes from multiple companies in minutes! Flood damage may differ from regular water damage. How much is flood insurance in michigan? The average cost of flood insurance in michigan is $1,054 a year. Flood insurance only covers the dwelling and personal belongings.

Source: thenorthcoastagency.com

Source: thenorthcoastagency.com

We have multiple options for your flood insurance in michigan: Compare michigan private market flood insurance quotes from multiple companies in minutes! Since 1978, michigan citizens with flood insurance have been paid $98,000,000 for flood losses. Ieuter insurance group is located on 414 townsend st, midland. At michigan insurance and financial services, we work with carriers who have extensive flood insurance options for your individual needs.

Source: laissega.blogspot.com

Source: laissega.blogspot.com

How much does flood insurance cost in michigan? How much is flood insurance in michigan? Compare michigan flood insurance quotes from multiple companies in minutes! Flood insurance in michigan takes 30 days after purchase to go into effect, so you’ll want to get a policy as soon as possible to ensure you’re protected from the snowmelt and subsequent rains that follow. Insurance to cover floods must be written 30 days in advance of a flood in the state of michigan.

Source: laissega.blogspot.com

Source: laissega.blogspot.com

Building, contents, replacement cost coverages Compare michigan private market flood insurance quotes from multiple companies in minutes! Typically, your flood insurance policy is dependent on your flood zone risk. The average cost per policy in michigan through the nfip is $863.39. The leading cause for disaster declarations by the governor or the president is flooding.

Source: betterflood.com

Source: betterflood.com

It is not covered by your homeowners insurance policy. So michigan flood insurance can help to pay for repairs to your home and belongings if either is damaged or destroyed by a flood. Michigan has seen significant growth in the number of individuals whose homes or businesses are protected by flood insurance. Private policies are often cheaper. Whether you live in detroit, grand rapids, warren, sterling heights, lansing or somewhere in between, insurox offers choices for flood insurance that could help you save hundreds of dollars a year.

Source: npa1.org

Source: npa1.org

Building, contents, replacement cost coverages Why spending 15 or even 7 ½ minutes online and receive only one. By dam failures, moving ground water, copioius amounts of rainwater, and large. This is a common misconception across the state that puts many homeowners at risk. Flood damage may differ from regular water damage.

Source: betterflood.com

Source: betterflood.com

This includes losses resulting from water from over flowing rivers or streams, rain, storm surge, snow melt, blocked storm drainage systems, broken dams or other like causes. Typically, your flood insurance policy is dependent on your flood zone risk. Whether you live in detroit, grand rapids, warren, sterling heights, lansing or somewhere in between, insurox offers choices for flood insurance that could help you save hundreds of dollars a year. Best rated flood insurance in midland, michigan. The mission of the michigan department of insurance and financial services is to ensure access to safe and secure insurance

Source: midv.net

Source: midv.net

Ieuter insurance group is located on 414 townsend st, midland. This is one reason why having flood insurance in michigan is so important! Flood insurance is a type of property insurance that will cover you if your dwelling in the event of excessive water damage. Floods can happen anywhere — just one inch of floodwater can cause up to $25,000 in damage. Compare michigan private market flood insurance quotes from multiple companies in minutes!

Source: floodinsuranceguru.com

Source: floodinsuranceguru.com

Of the 1776 communities (cities, villages, and townships) in michigan, currently about 1,004 communities have floodplain maps that have been developed by fema. We have multiple options for your flood insurance in michigan: By dam failures, moving ground water, copioius amounts of rainwater, and large. Whether you live in detroit, grand rapids, warren, sterling heights, lansing or somewhere in between, insurox offers choices for flood insurance that could help you save hundreds of dollars a year. It is not covered by homeowners insurance.

Source: npa1.org

Source: npa1.org

The average cost of flood insurance in michigan is $1,054 a year. Flood insurance only covers the dwelling and personal belongings. The leading cause for disaster declarations by the governor or the president is flooding. At michigan insurance and financial services, we work with carriers who have extensive flood insurance options for your individual needs. This includes losses resulting from water from over flowing rivers or streams, rain, storm surge, snow melt, blocked storm drainage systems, broken dams or other like causes.

Source: brouwersagency.com

Source: brouwersagency.com

Generally mi commercial flood insurance covers damage to your building and contents caused by flood. As of may 2020, there were 20,500 flood insurance policies in the state, providing coverage in the amount of $4,074,845,000. At compass insurance agency, we will make sure that you know the difference between water damage covered on your homeowner’s insurance plan and water damage covered on your flood insurance policy. Your standard michigan flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas. Since 1978, michigan citizens with flood insurance have been paid $98,000,000 for flood losses.

Source: floodinsuranceyukeise.blogspot.com

Source: floodinsuranceyukeise.blogspot.com

The average cost of flood insurance in michigan is $1,054 a year. Flood insurance in michigan takes 30 days after purchase to go into effect, so you’ll want to get a policy as soon as possible to ensure you’re protected from the snowmelt and subsequent rains that follow. This is one reason why having flood insurance in michigan is so important! Flood damage may differ from regular water damage. By dam failures, moving ground water, copioius amounts of rainwater, and large.

Source: greatlakesinsuranceagency.net

Source: greatlakesinsuranceagency.net

In 1968, congress instituted the national flood insurance program (nfip) to reduce the economic and social cost of flood losses. State of michigan nfip coordinator. We have multiple options for your flood insurance in michigan: If every property owner carried a policy, the average rate would be much lower. The average cost of flood insurance in michigan is $1,054 a year.

Source: insurancejournal.com

Source: insurancejournal.com

This is one reason why having flood insurance in michigan is so important! Building, contents, replacement cost coverages Flood insurance in michigan takes 30 days after purchase to go into effect, so you’ll want to get a policy as soon as possible to ensure you’re protected from the snowmelt and subsequent rains that follow. Whether you live in detroit, grand rapids, warren, sterling heights, lansing or somewhere in between, insurox offers choices for private market flood insurance that could help you save hundreds of dollars a year. Flood insurance policies also reimburse you for the work that you and other family members did to sandbag your homes, move furniture and remove debris.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title flood insurance michigan by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.