Your Flood insurance indiana images are ready in this website. Flood insurance indiana are a topic that is being searched for and liked by netizens today. You can Get the Flood insurance indiana files here. Download all free vectors.

If you’re looking for flood insurance indiana images information related to the flood insurance indiana interest, you have visit the ideal blog. Our site always provides you with suggestions for seeking the maximum quality video and picture content, please kindly surf and find more enlightening video content and graphics that match your interests.

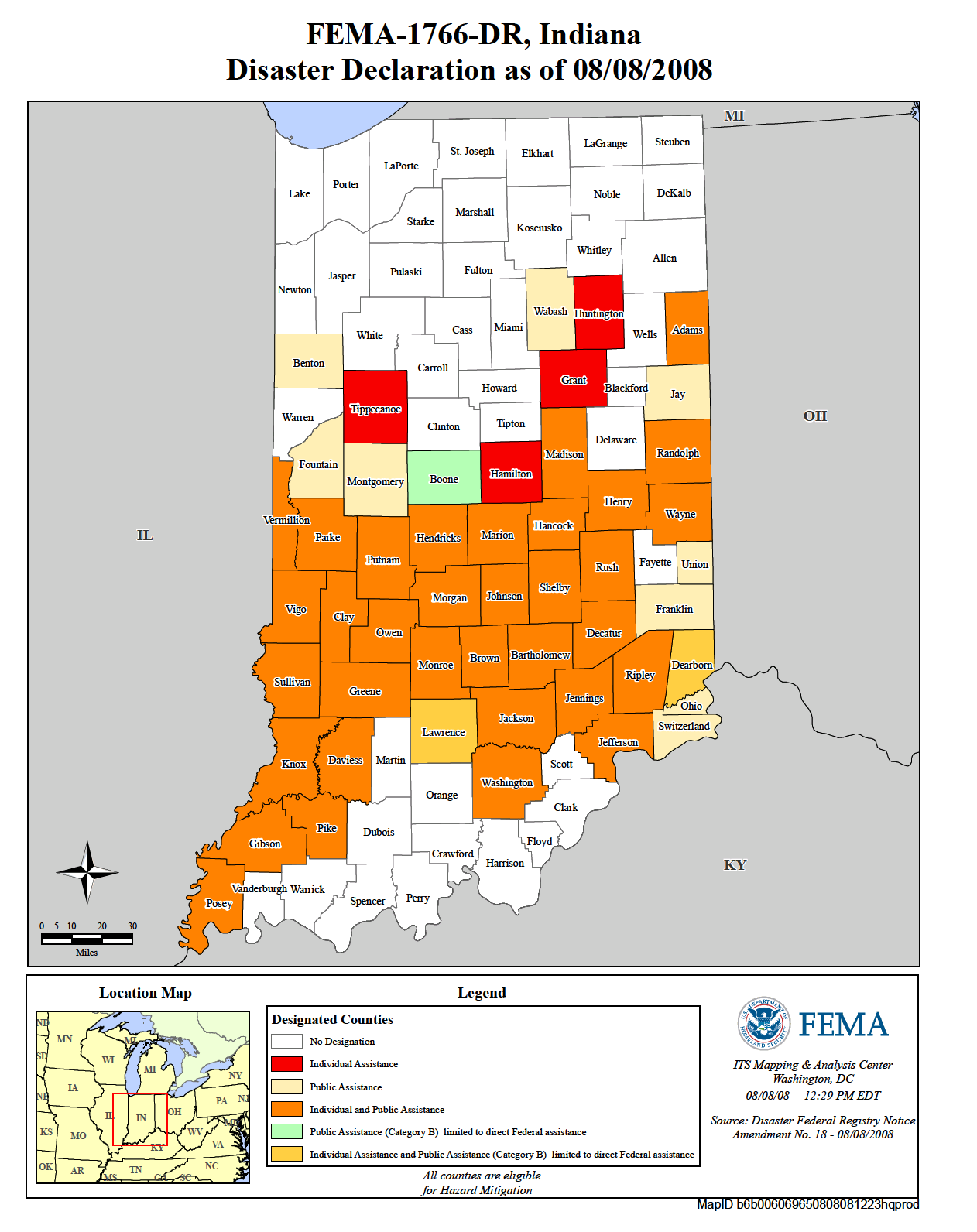

Flood Insurance Indiana. Building, contents, replacement cost coverages; It offers building coverage up to $250,000 on residential buildings and $100,000 in contents coverage. In 1968, congress created the national flood insurance program (nfip) to help provide a means for property owners to financially protect themselves. The average cost of flood insurance is $958 per year, or $80 a month, through the national flood insurance program (nfip).

DHS National Flood Insurance Program From in.gov

DHS National Flood Insurance Program From in.gov

Flooding is one of the most common natural disasters that occur in the united states, and indiana experienced 103 flooding or heavy rain events in 2021 alone. There are currently about 32,500 active flood insurance policies in indiana; Private flood insurance in the franklin indiana area has had a lot of changes over the last 10 years. Building coverage is designed to protect the structure of your home or business and cover appliances and other property items that are considered part of your property including air conditioners, dishwashers and cabinets. Your standard indiana flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas. · premiums for flood insurance will vary depending upon your risk level for a flood loss, the amount of coverage you choose,the type of coverage you need and your deductible.

Since standard home insurance doesn�t cover flooding, it�s important to have protection from floods associated with hurricanes, tropical storms, heavy rains and other conditions that impact the u.s.

How much is flood insurance in indiana? Compare indiana flood insurance quotes from multiple companies in minutes! Home insurance policies do not cover floods, which means you�ll need a separate flood policy to be fully protected. If you have a government loan like fha or va this might be the only option for flood insurance. Your standard indiana flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas. There are currently about 32,500 active flood insurance policies in indiana;

Source: nationalfloodservices.com

Source: nationalfloodservices.com

· premiums for flood insurance will vary depending upon your risk level for a flood loss, the amount of coverage you choose,the type of coverage you need and your deductible. No matter how much you pay, buying flood insurance is a worthwhile investment. Home insurance policies do not cover floods, which means you�ll need a separate flood policy to be fully protected. “flood waters just show up at your door. Building, contents, replacement cost coverages;

Source: libraries.indiana.edu

You will also want to consider coverage for your personal property as well. Flood insurance in indiana costs about $700 per year, but depending on where you live on the flood insurance rate map in indiana, you could pay significantly less or slightly more. If you have a government loan like fha or va this might be the only option for flood insurance. Typically, your flood insurance policy is dependent on your flood zone risk. Typically, your flood insurance policy is dependent on your flood zone risk.

Source: global-mapss.blogspot.com

Whether you live in indianapolis , fort wayne , evansville , south bend , carmel or somewhere in between, insurox offers choices for private market flood insurance that could help you save hundreds of dollars a year. The actual amount that will be covered depends on the value of the property and the extent of the loss. Building, contents, replacement cost coverages; We have multiple options for your flood insurance in indiana: Now let�s look at private flood insurance.

Source: global-mapss.blogspot.com

Building, contents, replacement cost coverages Your standard indiana flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas. Whether you live in indianapolis , fort wayne , evansville , south bend , carmel or somewhere in between, insurox offers choices for flood insurance that could help you save hundreds of dollars a year. Your standard indiana flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas. It offers building coverage up to $250,000 on residential buildings and $100,000 in contents coverage.

Source: global-mapss.blogspot.com

Home insurance policies do not cover floods, which means you�ll need a separate flood policy to be fully protected. Typically, your flood insurance policy is dependent on your flood zone risk. Indiana residents should be aware that the nfip was established by the federal government to help communities who “voluntarily participate in the nfip by adopting and enforcing. The average cost per policy in indiana through the nfip is $845.18. Building, contents, replacement cost coverages

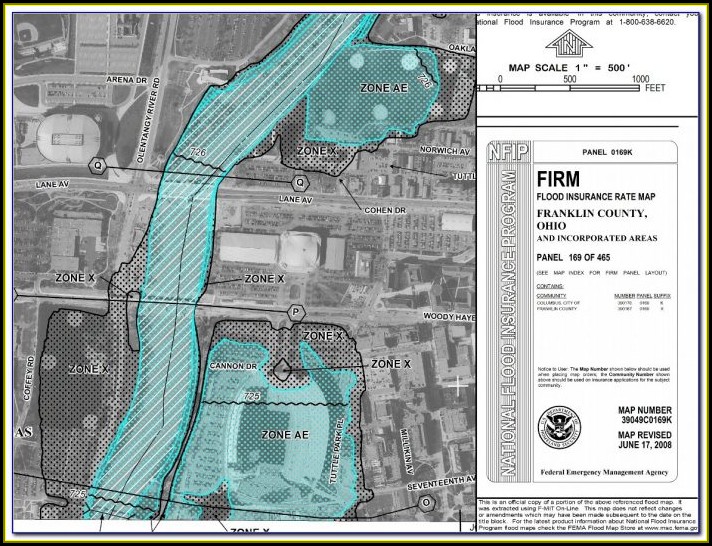

Source: fema.gov

Source: fema.gov

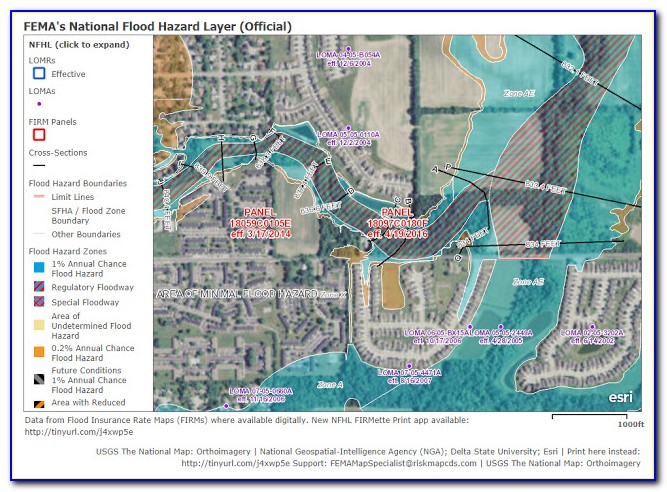

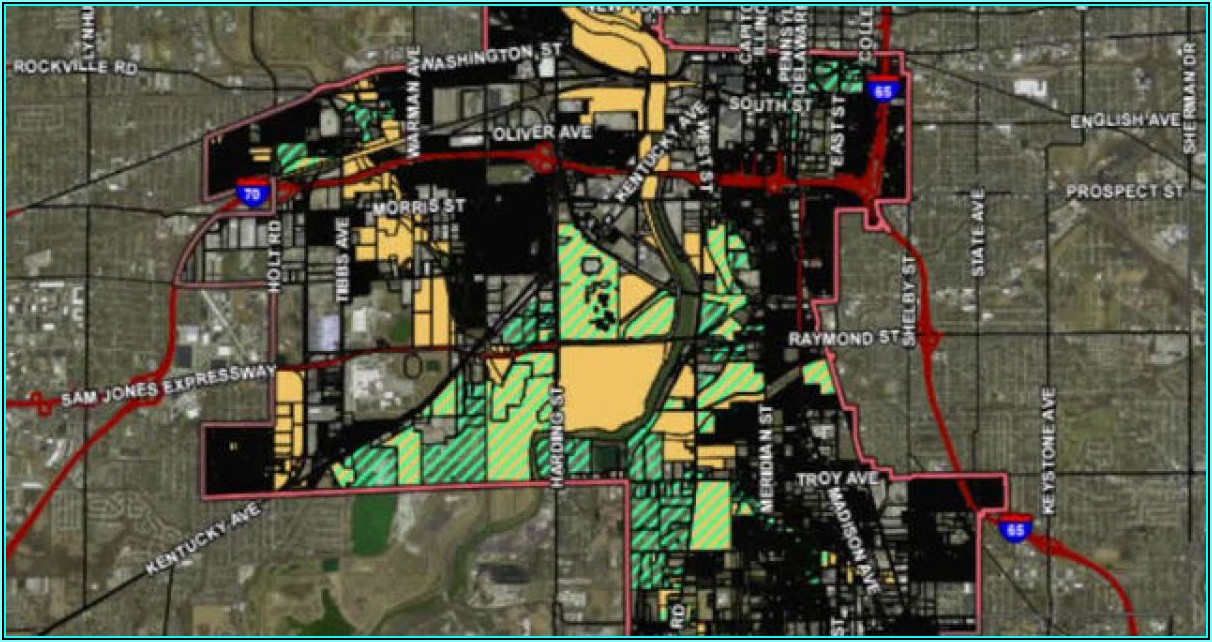

There are currently about 32,500 active flood insurance policies in indiana; Flood insurance rates increasing in indiana under new fema rating system. Fema’s national flood insurance program (nfip) and all federally backed lenders rely on these indiana flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. Building, contents, replacement cost coverages Typically, your flood insurance policy is dependent on your flood zone risk.

Source: wvpe.org

Source: wvpe.org

Typically, your flood insurance policy is dependent on your flood zone risk. Costs vary by state, and can be as cheap as $550 a year. Home insurance policies do not cover floods, which means you�ll need a separate flood policy to be fully protected. Your standard indiana flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas. The actual amount that will be covered depends on the value of the property and the extent of the loss.

Source: lawson-fisher.com

Source: lawson-fisher.com

If you have a government loan like fha or va this might be the only option for flood insurance. If you live in a community that participates in the national flood insurance program (nfip), your building and its contents can be covered by standard flood insurance. Costs vary by state, and can be as cheap as $550 a year. Indiana residents should be aware that the nfip was established by the federal government to help communities who “voluntarily participate in the nfip by adopting and enforcing. Your standard indiana flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas.

Source: global-mapss.blogspot.com

Source: global-mapss.blogspot.com

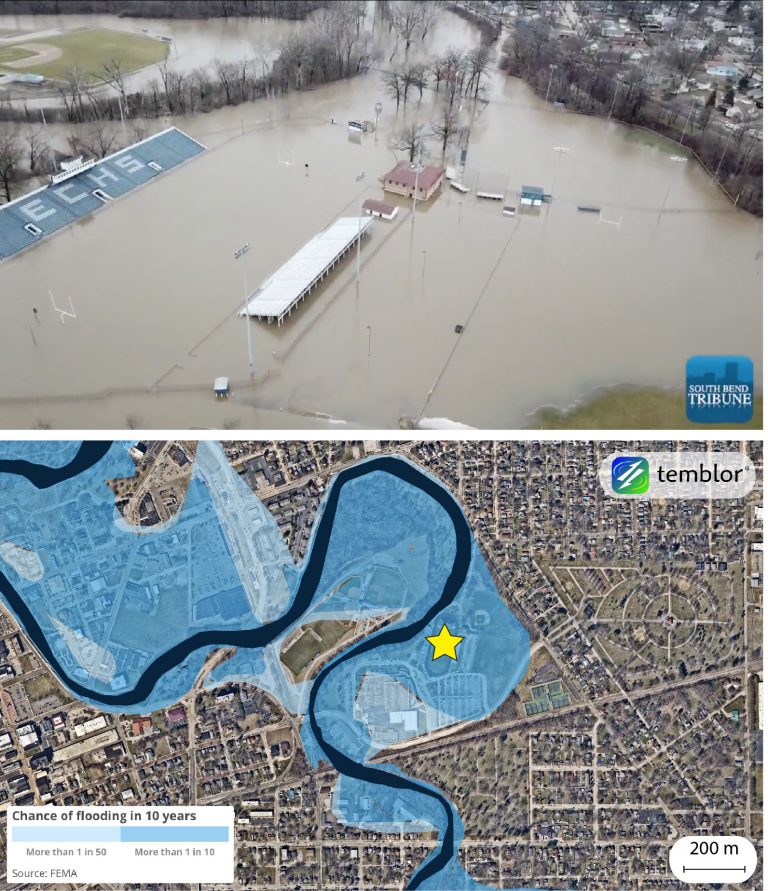

Flooding is one of the most common natural disasters that occur in the united states, and indiana experienced 103 flooding or heavy rain events in 2021 alone. Fewer than 2% of indiana’s households are covered by flood insurance; Whether you live in indianapolis , fort wayne , evansville , south bend , carmel or somewhere in between, insurox offers choices for private market flood insurance that could help you save hundreds of dollars a year. Your standard indiana flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas. Flooding is one of the most common natural disasters that occur in the united states, and indiana experienced 103 flooding or heavy rain events in 2021 alone.

Source: global-mapss.blogspot.com

If you have a government loan like fha or va this might be the only option for flood insurance. Typically, your flood insurance policy is dependent on your flood zone risk. Since standard home insurance doesn�t cover flooding, it�s important to have protection from floods associated with hurricanes, tropical storms, heavy rains and other conditions that impact the u.s. Compare indiana flood insurance quotes from multiple companies in minutes! Typically, your flood insurance policy is dependent on your flood zone risk.

Source: viralcovert.com

Source: viralcovert.com

Typically, your flood insurance policy is dependent on your flood zone risk. Building coverage is designed to protect the structure of your home or business and cover appliances and other property items that are considered part of your property including air conditioners, dishwashers and cabinets. Typically, your flood insurance policy is dependent on your flood zone risk. We have multiple options for your flood insurance in indiana: Flood insurance rates increasing in indiana under new fema rating system.

Source: wfyi.org

Source: wfyi.org

Whether you live in indianapolis , fort wayne , evansville , south bend , carmel or somewhere in between, insurox offers choices for flood insurance that could help you save hundreds of dollars a year. · according to federal emergency management agency (fema), the average homeowners flood insurance premium is a little more than $500 a year. You will also want to consider coverage for your personal property as well. Flood insurance pricing is complex and you need to speak with an agent to get an accurate quote. The average cost of flood insurance is $958 per year, or $80 a month, through the national flood insurance program (nfip).

Source: contrapositionmagazine.com

Source: contrapositionmagazine.com

Building, contents, replacement cost coverages Costs vary by state, and can be as cheap as $550 a year. Flood coverage insurance in fishers, indiana. Your standard indiana flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas. The importance of purchasing flood insurance in indiana.

Source: contrapositionmagazine.com

Source: contrapositionmagazine.com

Flood coverage insurance in fishers, indiana. In 1968, congress created the national flood insurance program (nfip) to help provide a means for property owners to financially protect themselves. Flood coverage insurance in indianapolis, indiana building coverage is designed to protect the structure of your home or business and cover appliances and other property items that are considered part of your property including air conditioners, dishwashers and cabinets. They don’t know there’s this imaginary line stating ‘i’m not in the flood zone,’ so the water needs to. The firm are the basis for floodplain management, mitigation, and insurance activities for the national flood insurance program (nfip).

Source: global-mapss.blogspot.com

Source: global-mapss.blogspot.com

Since standard home insurance doesn�t cover flooding, it�s important to have protection from floods associated with hurricanes, tropical storms, heavy rains and other conditions that impact the u.s. Flood insurance rates increasing in indiana under new fema rating system. The importance of purchasing flood insurance in indiana. We have multiple options for your flood insurance in indiana: Typically, your flood insurance policy is dependent on your flood zone risk.

Source: temblor.net

Source: temblor.net

Your standard indiana flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas. Costs vary by state, and can be as cheap as $550 a year. Typically, your flood insurance policy is dependent on your flood zone risk. In 1968, congress created the national flood insurance program (nfip) to help provide a means for property owners to financially protect themselves. We have multiple options for your flood insurance in indiana:

Source: duboiscountyherald.com

Source: duboiscountyherald.com

In 1968, congress created the national flood insurance program (nfip) to help provide a means for property owners to financially protect themselves. Flood insurance rates increasing in indiana under new fema rating system. Flood insurance in indiana costs about $700 per year, but depending on where you live on the flood insurance rate map in indiana, you could pay significantly less or slightly more. Fema’s national flood insurance program (nfip) and all federally backed lenders rely on these indiana flood insurance maps to assess risk, set premiums, and determine who is required to purchase flood insurance. Whether you live in indianapolis , fort wayne , evansville , south bend , carmel or somewhere in between, insurox offers choices for private market flood insurance that could help you save hundreds of dollars a year.

Source: in.gov

Source: in.gov

Costs vary by state, and can be as cheap as $550 a year. Indiana residents should be aware that the nfip was established by the federal government to help communities who “voluntarily participate in the nfip by adopting and enforcing. Now let�s look at private flood insurance. Your standard indiana flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas. According to the federal emergency management agency (fema), $282.46 million of fema.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title flood insurance indiana by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.