Your Flood insurance in utah images are ready in this website. Flood insurance in utah are a topic that is being searched for and liked by netizens now. You can Download the Flood insurance in utah files here. Find and Download all free vectors.

If you’re searching for flood insurance in utah pictures information related to the flood insurance in utah topic, you have come to the right site. Our website frequently gives you hints for seeing the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

Flood Insurance In Utah. Inx insurance services, llc is the parent company of flood insurance agency floodprice.com. It covers floods due to excessive rain storms, melting snow, or inadequate or overloaded drainage systems. It is not covered by homeowners insurance. If you live in a flood hazard area, depending on the amount of coverage you get, flood insurance costs around $425 a year or $35 a month.

Weather service issues new flood watch; Southern Utah From stgeorgeutah.com

Weather service issues new flood watch; Southern Utah From stgeorgeutah.com

If you live in utah and you�re looking for affordable flood insurance with broader coverage options than the nfip, get a quote here today. It regulates buildings allowed in the floodplain to reside safety and again not cause floodplain shifts that can impact adjacent properties. Press release | february 23, 2022 Whether you live in salt lake city, west valley city, provo, west jordan, orem or somewhere in between, insurox offers choices for flood insurance that could help you save hundreds of dollars a year. Central to our mission is reducing price for consumers through increased marketplace competition. We realize that getting flood insurance can be confusing, and we are here to help you with that at.

Provides a flood risk rating system to equitably determine insurance rates based on the persons chosen or situation of flood risk.

We realize that getting flood insurance can be confusing, and we are here to help you with that at. The cheapest states for flood insurance. Typically, your flood insurance policy is dependent on your flood zone risk. It covers floods due to excessive rain storms, melting snow, or inadequate or overloaded drainage systems. Whether you live in salt lake city, west valley city, provo, west jordan, orem or somewhere in between, insurox offers choices for flood insurance that could help you save hundreds of dollars a year. Your standard utah flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas.

Source: hazards.utah.gov

Source: hazards.utah.gov

Flood insurance policies also reimburse you for the work that you and other family members did to sandbag your homes, move furniture and remove debris. Flood insurance policies also reimburse you for the work that you and other family members did to sandbag your homes, move furniture and remove. The cheapest states for flood insurance. With our catalogue of 50+ insurance providers throughout utah, g&g independent insurance is committed to helping you find the best coverage at a price that works for you. Your standard utah flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas.

Source: stgeorgeutah.com

Source: stgeorgeutah.com

We have multiple options for your flood insurance in utah: With our catalogue of 50+ insurance providers throughout utah, g&g independent insurance is committed to helping you find the best coverage at a price that works for you. Rounding out the top five are the states of oklahoma, utah, and arizona. Our system is quick, easy, and allows you to instantly compare rates that cover your needs. The increase for those impacted will be a small one however when you�re paying for a relatively expensive flood insurance with fema, this can make or break you if you�re not ready for these changes.

Source: cinsuregroup.com

Source: cinsuregroup.com

Central to our mission is reducing price for consumers through increased marketplace competition. The cheapest states for flood insurance. The increase for those impacted will be a small one however when you�re paying for a relatively expensive flood insurance with fema, this can make or break you if you�re not ready for these changes. If you live in certain flood zones, your mortgage company may require that you purchase a flood insurance policy. Provides a flood risk rating system to equitably determine insurance rates based on the persons chosen or situation of flood risk.

Source: utahfloodfireandmoldcleanup.blogspot.com

Source: utahfloodfireandmoldcleanup.blogspot.com

It is not covered by homeowners insurance. The increase for those impacted will be a small one however when you�re paying for a relatively expensive flood insurance with fema, this can make or break you if you�re not ready for these changes. Flood insurance policies also reimburse you for the work that you and other family members did to sandbag your homes, move furniture and remove. Flood insurance policies also reimburse you for the work that you and other family members did to sandbag your homes, move furniture and remove debris. 97% of utahns don’t have proper flood coverage flood insurance policies typically take 30 days to go into effect.

Source: dem.utah.gov

Source: dem.utah.gov

Homeowners insurance does not cover flood damage. The cheapest states for flood insurance. Flood insurance policies also reimburse you for the work that you and other family members did to sandbag your homes, move furniture and remove debris. Typically, your flood insurance policy is dependent on your flood zone risk. It is not covered by homeowners insurance.

Source: saratogaspringscity.com

Homeowners insurance does not cover losses due to flooding. It is not covered by homeowners insurance. If you live in utah and are trying to learn more about. Floodplains represents the mapped areas in utah that are prone to flooding. The firm is the basis for floodplain management, mitigation, and insurance activities for the national flood.

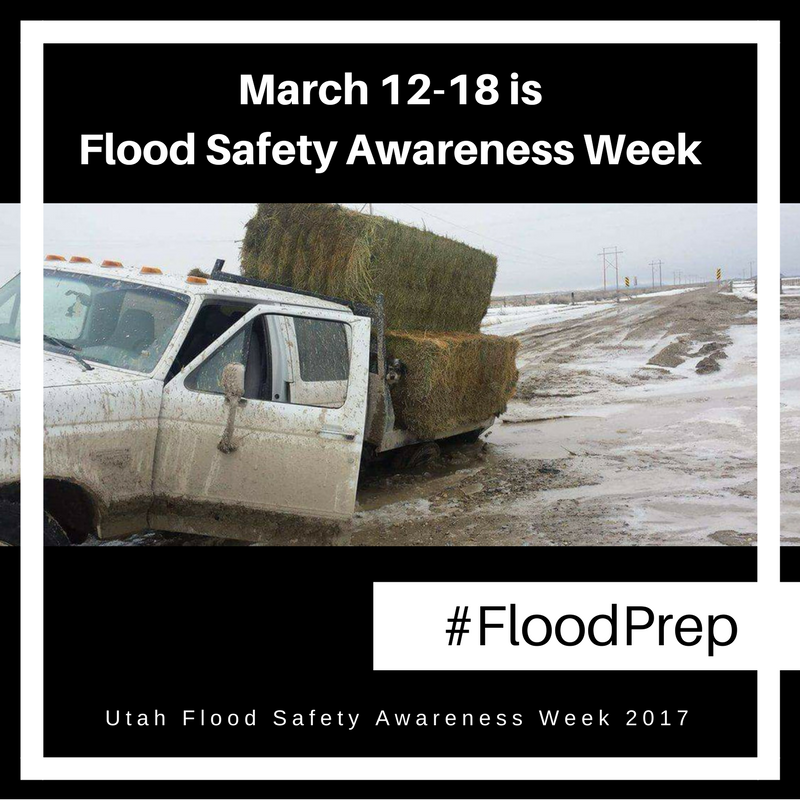

Source: dpsnews.utah.gov

Source: dpsnews.utah.gov

Provides a flood risk rating system to equitably determine insurance rates based on the persons chosen or situation of flood risk. Compare utah flood insurance quotes from multiple companies in minutes! 97% of utahns don’t have proper flood coverage flood insurance policies typically take 30 days to go into effect. If you’re looking for flood insurance, you’ve come to the right place. With our catalogue of 50+ insurance providers throughout utah, g&g independent insurance is committed to helping you find the best coverage at a price that works for you.

Source: dem.utah.gov

Source: dem.utah.gov

Factors that determine flood insurance cost Your standard utah flood insurance policy would apply to homes, condos, mobile homes, businesses and rentals that are in flood zone areas. It is not covered by homeowners insurance. Our system is quick, easy, and allows you to instantly compare rates that cover your needs. If you’re looking for flood insurance, you’ve come to the right place.

Source: webercountyutah.gov

Source: webercountyutah.gov

If you wait to purchase a policy until after a flood event threatens or occurs, your property won’t be protected from the damage caused by that flood event. Our system is quick, easy, and allows you to instantly compare rates that cover your needs. Rounding out the top five are the states of oklahoma, utah, and arizona. Whether you live in salt lake city, west valley city, provo, west jordan, orem or somewhere in between, insurox offers choices for flood insurance that could help you save hundreds of dollars a year. Fema flood coverage will not cover items in a basement and the definition of a flood is when three consecutive properties are inundated with three inches or more of water, not something we see often here in utah.

Source: disasterprofessionals.com

Source: disasterprofessionals.com

97% of utahns don’t have proper flood coverage flood insurance policies typically take 30 days to go into effect. Flood insurance policies are available through the national flood insurance program (nfip). The firm is the basis for floodplain management, mitigation, and insurance activities for the national flood. Rounding out the top five are the states of oklahoma, utah, and arizona. Homeowners insurance does not cover flood damage.

Source: dpsnews.utah.gov

Source: dpsnews.utah.gov

Utah is a desert state, with low yearly rainfall amounts. Utah is a desert state, with low yearly rainfall amounts. The increase for those impacted will be a small one however when you�re paying for a relatively expensive flood insurance with fema, this can make or break you if you�re not ready for these changes. Texas and louisiana — two states with arguably the highest flood risk — also happen to be the cheapest for nfip flood insurance. With our catalogue of 50+ insurance providers throughout utah, g&g independent insurance is committed to helping you find the best coverage at a price that works for you.

Source: youtube.com

Source: youtube.com

The company is a pioneer in using technology to improve the delivery of insurance products and services to consumers. If you wait to purchase a policy until after a flood event threatens or occurs, your property won’t be protected from the damage caused by that flood event. We realize that getting flood insurance can be confusing, and we are here to help you with that at. It is not covered by homeowners insurance. Floodplains represents the mapped areas in utah that are prone to flooding.

Source: livesouthdowns.com

Source: livesouthdowns.com

Homeowners insurance does not cover flood damage. The firm is the basis for floodplain management, mitigation, and insurance activities for the national flood. Utah is a desert state, with low yearly rainfall amounts. Building, contents, replacement cost coverages This layer was creating using criteria as defined by the flood insurance rate maps (firm) and produced by the federal emergency management agency (fema).

Source: bluffdale.com

Utah is a desert state, with low yearly rainfall amounts. It is not covered by homeowners insurance. Flood insurance policies also reimburse you for the work that you and other family members did to sandbag your homes, move furniture and remove. With our catalogue of 50+ insurance providers throughout utah, g&g independent insurance is committed to helping you find the best coverage at a price that works for you. It covers floods due to excessive rain storms, melting snow, or inadequate or overloaded drainage systems.

Source: insuremoab.com

Source: insuremoab.com

Building, contents, replacement cost coverages If you live in certain flood zones, your mortgage company may require that you purchase a flood insurance policy. Flood insurance policies also reimburse you for the work that you and other family members did to sandbag your homes, move furniture and remove. It covers floods due to excessive rain storms, melting snow, or inadequate or overloaded drainage systems. Flood insurance is relatively inexpensive, especially if you do not live in an identified flood hazard area.

Source: dem.utah.gov

Source: dem.utah.gov

Compare utah flood insurance quotes from multiple companies in minutes! Typically, your flood insurance policy is dependent on your flood zone risk. The firm is the basis for floodplain management, mitigation, and insurance activities for the national flood. Homeowners insurance does not cover losses due to flooding. Utah is a desert state, with low yearly rainfall amounts.

Source: stgeorgeutah.com

Source: stgeorgeutah.com

If you’re looking for flood insurance, you’ve come to the right place. It is not covered by homeowners insurance. Building, contents, replacement cost coverages We realize that getting flood insurance can be confusing, and we are here to help you with that at. Homeowners insurance does not cover flood damage.

Source: dem.utah.gov

Source: dem.utah.gov

Building, contents, replacement cost coverages The increase for those impacted will be a small one however when you�re paying for a relatively expensive flood insurance with fema, this can make or break you if you�re not ready for these changes. We have multiple options for your flood insurance in utah: Whether you live in salt lake city, west valley city, provo, west jordan, orem or somewhere in between, insurox offers choices for flood insurance that could help you save hundreds of dollars a year. We realize that getting flood insurance can be confusing, and we are here to help you with that at.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title flood insurance in utah by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.