Your Flexible premium adjustable life insurance images are ready in this website. Flexible premium adjustable life insurance are a topic that is being searched for and liked by netizens today. You can Download the Flexible premium adjustable life insurance files here. Find and Download all free photos.

If you’re looking for flexible premium adjustable life insurance images information connected with to the flexible premium adjustable life insurance interest, you have pay a visit to the ideal blog. Our website always gives you hints for seeking the highest quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

Flexible Premium Adjustable Life Insurance. This policy also features a. Adjustable life insurance is often thought of as a hybrid of term life insurance and whole life insurance. Flexible premium life insurance 👪 feb 2022. Life auto home health business renter disability commercial auto long term care annuity.

Flexible Premium Adjustable Life Insurance / LOGO EVERY From alexandra-artnstuff.blogspot.com

Flexible Premium Adjustable Life Insurance / LOGO EVERY From alexandra-artnstuff.blogspot.com

These plans also come with a flexible cash value component. Adjustable life insurance is often thought of as a hybrid of term life insurance and whole life insurance. As the name implies, flexible premium, or adjustable life insurance allows the customer to choose higher or lower premiums at numerous points throughout the policy’s life. Life auto home health business renter disability commercial auto long term care annuity. These premiums vary based on external factors such as. It has three moving parts:

As the name implies, flexible premium, or adjustable life insurance allows the customer to choose higher or lower premiums at numerous points throughout the policy’s life.these plans also come with a flexible cash value component.

As the name implies, flexible premium, or adjustable life insurance allows the customer to choose higher or lower premiums at numerous points throughout the policy’s life. Policyowners may choose the amount and frequency of their premium payments and, if the accumulated value in the policy is sufficient to cover the monthly policy charges, insurance coverage is provided until the death of the insured. How does adjustable complife insurance work? Life auto home health business renter disability commercial auto long term care annuity. Adjustable premiums are fluctuating monthly payments made to the provider of an adjustable, variable, or flexible life insurance policy. Individual flexible premium adjustable life products filed with the interstate insurance product regulation commission (“iiprc”).

Source: sec.gov

Source: sec.gov

As the name implies, flexible premium, or adjustable life insurance allows the customer to choose higher or lower premiums at numerous points throughout the policy’s life. Individual flexible premium adjustable life products filed with the interstate insurance product regulation commission (“iiprc”). As the name implies, flexible premium, or adjustable life insurance allows the customer to choose higher or lower premiums at numerous points throughout the policy’s life.these plans also come with a flexible cash value component. Pros and cons of flexible premiums. You can opt for higher premiums and use them to increase the policy’s cash value.

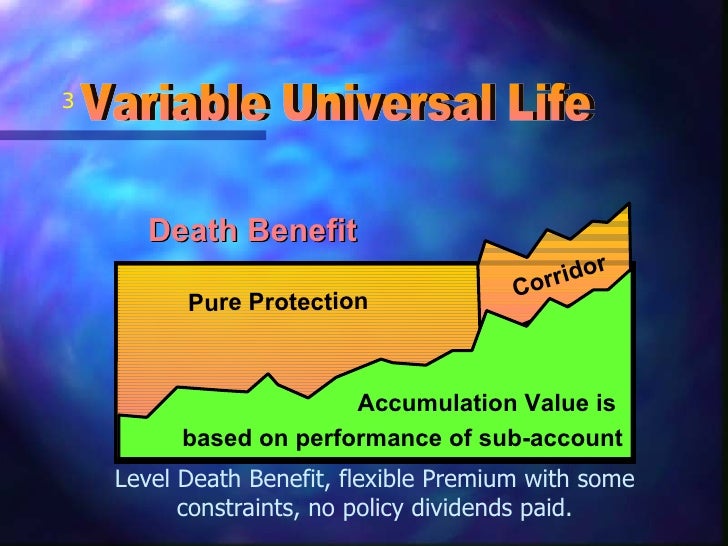

These plans also come with a flexible cash value component. The premium, the death benefit and the crediting method (interest rates, indices or separate sub accounts using equities and bonds.) They can also affect your life insurance policy. As the name implies, flexible premium, or adjustable life insurance allows the customer to choose higher or lower premiums at numerous points throughout the policy’s life.these plans also come with a flexible cash value component. Adjustable life insurance is a hybrid policy that combines characteristics from term life and whole life insurance.

Source: slideshare.net

Source: slideshare.net

Adjustable life insurance goes by a few different names. Any information found on website is for education purposes and is not tailored to the investment needs of any specific investor. Adjustable life insurance is a “flexible premium” “adjustable death benefit” type of permanent cash value insurance. An adjustable life policy is a form of permanent insurance, which is designed to last your entire life as long as premiums are paid into the plan. Flexible premium life insurance 👪 feb 2022.

Source: insurancenewsmag.com

Source: insurancenewsmag.com

These plans also come with a flexible cash value component. A flexible premium adjustable life insurance policy is generally a current assumption universal life contract. The premium, the death benefit and the crediting method (interest rates, indices or separate sub accounts using equities and bonds.) You can adjust your policy’s coverage amount, premiums, and premium payment period. Adjustable life insurance is a “flexible premium” “adjustable death benefit” type of permanent cash value insurance.

Source: insurancelibrary.com

As the name implies, flexible premium, or adjustable life insurance allows the customer to choose higher or lower premiums at numerous points throughout the policy’s life.these plans also come with a flexible cash value component. Indexed universal life insurance is a permanent life plan that has flexible premium payment and death benefit options. It is essentially a hybrid combination of. You can adjust your policy’s coverage amount, premiums, and premium payment period. Adjustable life insurance goes by a few different names.

Source: budgeting.thenest.com

Source: budgeting.thenest.com

Flexible premium adjustable life insurance 👪 feb 2022. Life auto home health business renter disability commercial auto long term care annuity. Adjustable premiums are fluctuating monthly payments made to the provider of an adjustable, variable, or flexible life insurance policy. These terms mean the same thing in almost all cases. Individual flexible premium adjustable life products filed with the interstate insurance product regulation commission (“iiprc”).

Source: thismybrightside.blogspot.com

Source: thismybrightside.blogspot.com

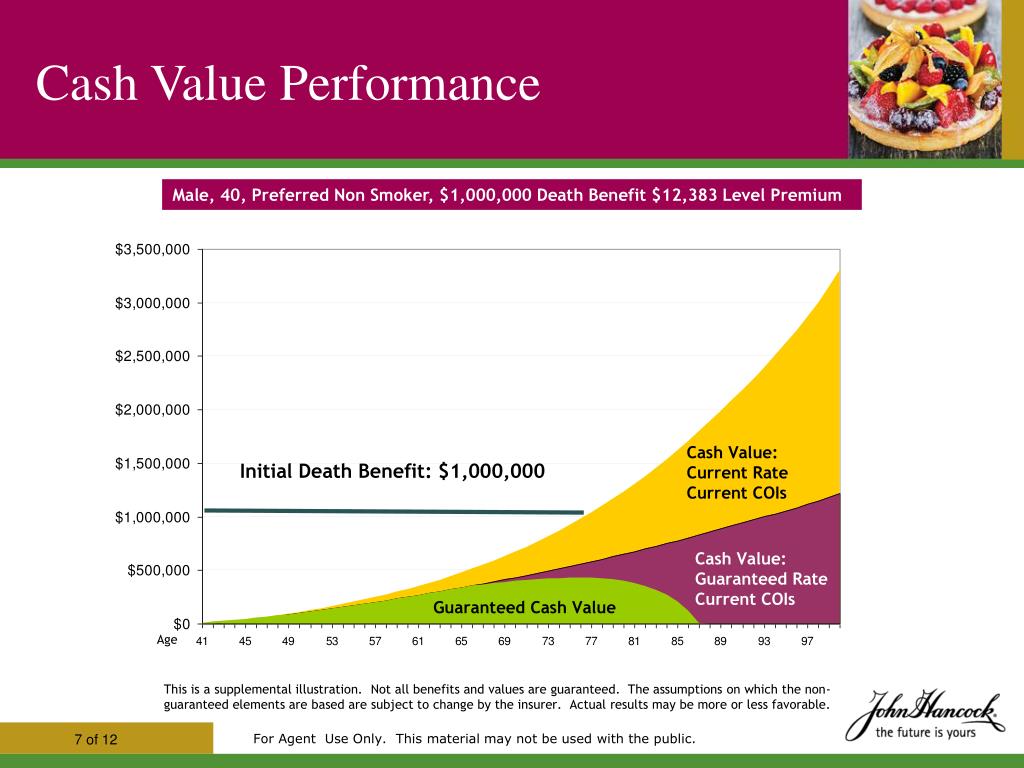

Flexible premium adjustable life insurance is a type of whole life insurance policy that offers individuals the greatest amount of flexibility in terms of their investment choice and monthly premiums. You can opt for higher premiums and use them to increase the policy’s cash value. Adjustable premiums are fluctuating monthly payments made to the provider of an adjustable, variable, or flexible life insurance policy. Adjustable life insurance is a “flexible premium” “adjustable death benefit” type of permanent cash value insurance. Investing involves risk, including risk of loss.

Source: wisegeek.com

Source: wisegeek.com

These plans also come with a flexible cash value component. As the name implies, flexible premium, or adjustable life insurance allows the customer to choose higher or lower premiums at numerous points throughout the policy’s life. Flexible premium life insurance 👪 feb 2022. This policy also features a. These premiums vary based on external factors such as.

Source: slideserve.com

Source: slideserve.com

Individual flexible premium adjustable life products filed with the interstate insurance product regulation commission (“iiprc”). You can opt for higher premiums and use them to increase the policy’s cash value. Flexible premium adjustable life insurance 👪 feb 2022. Life auto home health business renter disability commercial auto long term care annuity. It has three moving parts:

Source: paradigmlife.net

Source: paradigmlife.net

Also known as flexible premium adjustable life insurance, the policy has a cash value component that grows with the. Flexible premium adjustable life insurance *disclaimer: Adjustable life insurance is a “flexible premium” “adjustable death benefit” type of permanent cash value insurance. It provides both a death benefit and an investment vehicle. Adjustable life insurance is a hybrid policy that combines characteristics from term life and whole life insurance.

Source: sec.gov

Source: sec.gov

An adjustable life policy is a form of permanent insurance, which is designed to last your entire life as long as premiums are paid into the plan. Indexed universal life insurance is a permanent life plan that has flexible premium payment and death benefit options. How does adjustable complife insurance work? Adjustable life insurance goes by a few different names. Policyowners may choose the amount and frequency of their premium payments and, if the accumulated value in the policy is sufficient to cover the monthly policy charges, insurance coverage is provided until the death of the insured.

Source: wisegeek.com

Source: wisegeek.com

As the name implies, flexible premium, or adjustable life insurance allows the customer to choose higher or lower premiums at numerous points throughout the policy’s life. Flexible premium adjustable life insurance 👪 feb 2022. Adjustable life insurance is often thought of as a hybrid of term life insurance and whole life insurance. A flexible premium adjustable life policy allows the owner to vary the amount and/or timing of premium payments and may allow the owner to adjust the amount of insurance. This policy also features a.

Source: sec.gov

Source: sec.gov

An adjustable life policy is a form of permanent insurance, which is designed to last your entire life as long as premiums are paid into the plan. Life auto home health business renter disability commercial auto long term care annuity. Flexible premium adjustable life insurance is a type of whole life insurance policy that offers individuals the greatest amount of flexibility in terms of their investment choice and monthly premiums. Flexible premium life insurance 👪 feb 2022. It provides both a death benefit and an investment vehicle.

Source: slideserve.com

Source: slideserve.com

Flexible premium adjustable life insurance is a type of whole life insurance policy that offers individuals the greatest amount of flexibility in terms of their investment choice and monthly premiums. It provides both a death benefit and an investment vehicle. You can opt for higher premiums and use them to increase the policy’s cash value. An adjustable life policy is a form of permanent insurance, which is designed to last your entire life as long as premiums are paid into the plan. Flexible premium life insurance 👪 feb 2022.

Source: ancsakonyhaja.blogspot.com

Source: ancsakonyhaja.blogspot.com

It is essentially a hybrid combination of. Investing involves risk, including risk of loss. Adjustable life insurance goes by a few different names. Adjustable premiums are fluctuating monthly payments made to the provider of an adjustable, variable, or flexible life insurance policy. It provides both a death benefit and an investment vehicle.

Source: superpages.com

Source: superpages.com

Adjustable premiums are fluctuating monthly payments made to the provider of an adjustable, variable, or flexible life insurance policy. As the name implies, flexible premium, or adjustable life insurance allows the customer to choose higher or lower premiums at numerous points throughout the policy’s life. Adjustable life insurance, like any life insurance, has some advantages and disadvantages. Individual flexible premium adjustable life products filed with the interstate insurance product regulation commission (“iiprc”). Adjustable life insurance is often thought of as a hybrid of term life insurance and whole life insurance.

Source: alexandra-artnstuff.blogspot.com

Source: alexandra-artnstuff.blogspot.com

An adjustable life policy is a form of permanent insurance, which is designed to last your entire life as long as premiums are paid into the plan. These plans also come with a flexible cash value component. These terms mean the same thing in almost all cases. As the name implies, flexible premium, or adjustable life insurance allows the customer to choose higher or lower premiums at numerous points throughout the policy’s life.these plans also come with a flexible cash value component. Adjustable premiums are fluctuating monthly payments made to the provider of an adjustable, variable, or flexible life insurance policy.

Source: thismybrightside.blogspot.com

Source: thismybrightside.blogspot.com

Adjustable life insurance, also known as universal life insurance or flexible premium adjustable life insurance, is a type of permanent life insurance that has some of the features of a term life insurance policy. Also known as flexible premium adjustable life insurance, the policy has a cash value component that grows with the. Adjustable life insurance goes by a few different names. You can opt for higher premiums and use them to increase the policy’s cash value. It is essentially a hybrid combination of universal life and ordinary level premium participating life insurance.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title flexible premium adjustable life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.